Get instant access to this case solution for only $19

Lisco Acquisition of a Minority Interest in Orion Case Solution

LISCO is a privately owned wealth management company that is starting to emerge as the rising star in Chile’s market. The company has grown by leaps and bounds and is now ready to take the next step in its growth evolution. Ben Gar, the cofounder of the company, has recently gained sole ownership and is now looking to expand business operations. For this purpose, Ben Gar is looking to invest in a growing company catering to different clientele, in a market abroad. Orion, based in Colombia, presents itself as just what Ben Gar is looking for. However, first LISCO needs to determine whether or not Orion has a feasible fair value, and whether its stock can be readily traded. It also needs to determine the financial impact of the investment and what risks does it carry with it.

Following questions are answered in this case study solution

-

Introduction

-

Valuation of LISCO

-

Valuation of Orion

-

Risks Involved and Recommendations

Case Analysis for Lisco Acquisition of a Minority Interest in Orion

Valuation of LISCO

On the books, the company’s net worth is $US 18.9 million, which is calculated as the net of total assets and total liabilities. The fair value, however, will depend on the business’s ability to generate cash flows. In order to determine those, certain assumptions need to be made regarding future revenue and cost growths and changes in working capital.

The primary sources of income for LISCO are earnings from brokerage activities for private clients and earnings on advisory mandates to pension funds. The costs are mainly variable with respect to business activity and revenue. Therefore, the valuation model has been based on the net of the two or the earnings before interest and tax. Since the company is currently still in the growth stage of its life cycle, its earnings before interest and tax have been assumed to continue to grow at their current growth rate in the short run, i.e. 5 years. The current growth rate was obtained via a regression analysis of historical EBIT. After a short term period of the next 5 years, the company is expected to reach its mature stage, in which it will grow at the economy’s growth rate (5.6%).

The average corporate tax rate has been assumed to remain the same in the future with payments of tax due to be made within the period they fall due. Interest income from investments is expected to remain constant (on average), as well. Since no information has been provided in this regard, the purchase and sale of stocks and bonds are expected to remain constant in the future, i.e. no changes will be experienced by this item in the balance sheet. Working capital changes (accounts payable etc.) are expected to remain constant at the most recent change inactivity. That is for cash flow purposes; the average of the latest changes will be applied in the future.

The cost of capital will remain 15% as determined by the management since it represents the business’ inherent risk, which is not expected to change in the future. Using the growth rate in the company’s mature stage and the cost of capital, the company’s terminal value of $US63.2 million is attained, which is to be discounted along with the company’s cash flows in the growth stage to reach its fair value. The fair value turns out to be $US44.12 million.

Valuation of Orion

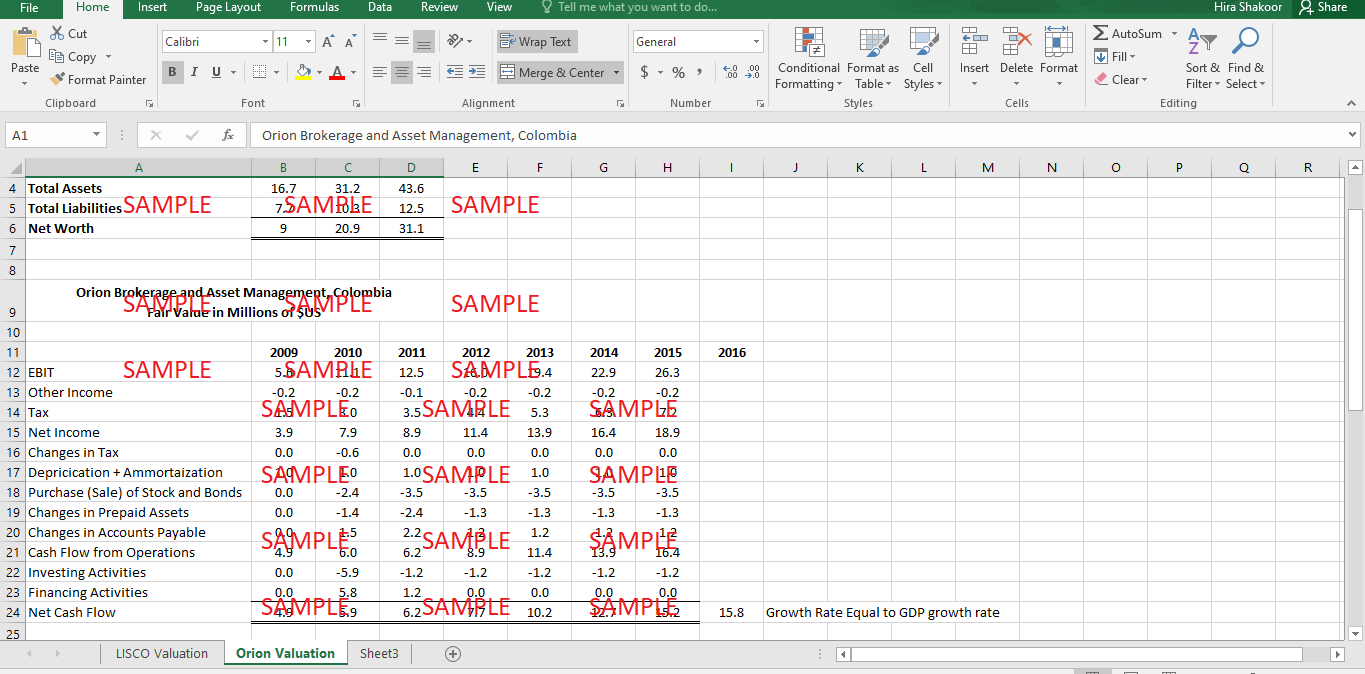

Orion is valued at $US31.1 million on its books, which is the net of its total assets and total liabilities. The company’s fair value, however, will be based on the same determinants as that of LISCO.

Orion’s primary sources of revenue are earnings from trading, earnings on advisory mandates to pension funds, earnings on Orion’s own regulatory capital, and special advisory mandate. The costs are expected, mainly, to vary with the revenues, the same as being the case with LISCO. Therefore, the projections using growth have been made on the net of the two, i.e. EBIT. The firm has been assumed to be in its growth stage and is expected to maintain its current growth in the short term that is the next 5 years. Once again this growth rate has been calculated using regression analysis on historical EBIT. After five years, when the company reaches its mature stage, the growth will slow down to them over the economic growth rate of 4%.

Taxation is expected to continue at the same rate as in the past, and payments are expected to be made within the period they fall due. Purchase, and sale, of “on the balance sheet stocks and bonds” is expected to continue at the same level as the most recent activity. Similarly, cash flows from investing activities are expected to remain at the most current level of activity. This is because the last activity is most likely to be representative of what is expected to happen in the future in regards to these line items. Changes in net working capital (prepaid assets, accounts payable, etc.) are expected to increase at the average of historical trends while financing activities are expected to become nil because they would become unnecessary once internal cash flows become strong enough to sustain the growth.

Cost of capital for the firm has been estimated by the management at 7%. This is extremely low, to say the least. The owner of the company Julian Salzar is comparing the internal risk of his firm with that of a fixed-rate loan in the international market. First of all, loans and other liabilities have a primary lien on the company’s assets in case of default, and secondly, their investors do not face the downside potential of the business. This is why the company must reevaluate its cost of capital upwards to cater better to its operational and financial risks.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Lisco Acquisition of a Minority Interest of Orion Case Solution

- Lockheed Martins Acquisition of NationScape Inc Case Solution

- Logoplaste Global Growing Challenges Case Solution

- Long Term Capital Management L.P (A) Case Solution

- Make Green Delicious Sustainability at Jamie Kennedy kitchens Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.