Get instant access to this case solution for only $19

Lockheed Martins Acquisition of NationScape Inc Case Solution

Lockheed Martin has always used acquisitions as a means of expanding their business. In their most current endeavor, they are looking into the benefits of acquiring Nations cape Inc. The management at Lockheed Martin is not only interested in valuing NSI as a potential addition to their portfolio of subsidiaries, but also look into the benefits of integrating the business into their own network of operations. Lockheed Martin’s management is concerned about the changing business landscape and is hopeful that NSI has the capability to mitigate some of the risks that are presented as a result of it.

The analysis of NSI’s business operations must not, therefore, only be limited to their financial aspect. It needs to include the operational as well as strategic value additions that NSI can make. The analysis must also not be standalone, but include the current situation in the picture.

Following questions are answered in this case study solution

-

Is NSI an attractive company compared to its competitors?

-

Is NSI a good strategic fit for Lockheed Martin? What are the potential synergies from the acquisition?

-

How would you characterize the strategic goal of such an acquisition: consolidation, market expansion, adding volume/scale, or as an R&D play?

-

If NSI is acquired, how should it be integrated into Lockheed Martin? Should NSI continue as a standalone company with little to no integration into Lockheed Martin’s operations? Or should it be fully integrated into Lockheed Martin?

-

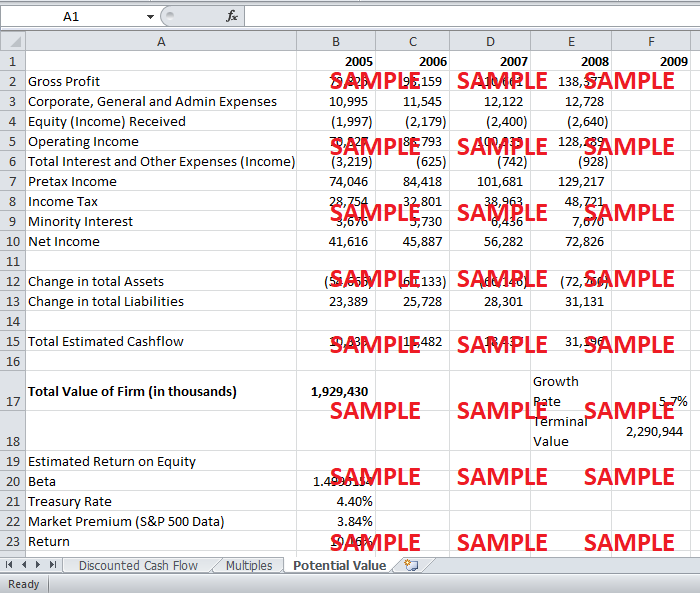

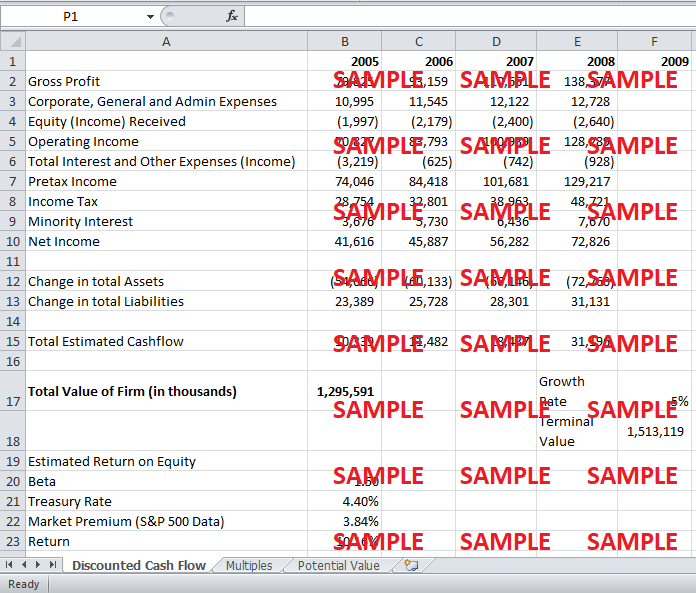

What is the value of NSI based on a discounted cash flow valuation, including the calculation of an appropriate weighted average cost of capital?

-

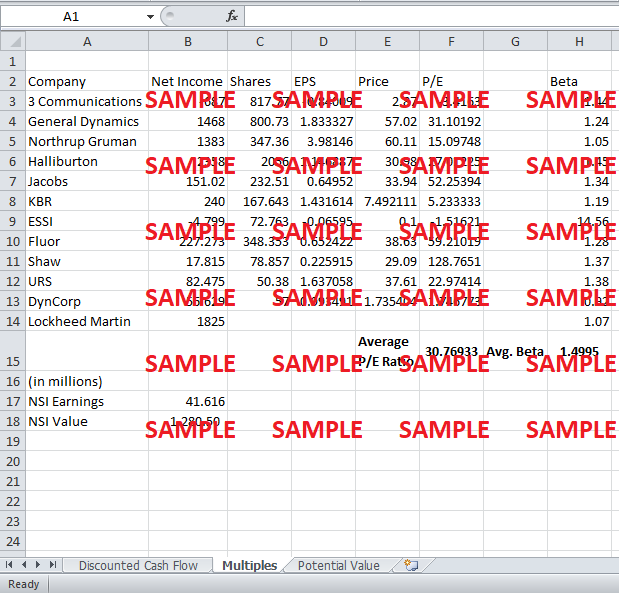

What is the value of NSI using a multiples valuation?

-

What price should Lockheed Martin offer for NSI if it decides to proceed with the acquisition?

-

What is the value of the potential synergies that could result from the acquisition?

Case Analysis for Lockheed Martins Acquisition of NationScape Inc

1. Is NSI an attractive company compared its competitors?

NationScape Inc. has many advantages over its competitors. The foremost is its financial prowess. Compared to its competitors, NSI has one of the largest revenue turnovers standing at more than half a billion dollars. The company’s growth rate is also very impressive. Unlike its larger competitors, who have reached their mature stage, NSI is still in its growth stage. The company is projected to grow at 10% for the foreseeable future (which in this case is assumed to be up till 2008).

Financial strengths aside, the company’s management practices and organizational structure make NSI a jewel that cannot be ignored. The highly versatile management practices and flat organizational structure make the organization extremely quick to react to changing customer needs. This speedy reaction is something that sets NSI apart from the rest, and is an advantage that could give Lockheed Martin a considerable edge over its competition in the industry. Combined with its portfolio of services, the speed of delivery will be an invaluable asset.

NationScape Inc. also possesses a wide range of available services for its customers. Unlike other companies, NIS does not have a limited scope of operations. The company has the ability to cater to both military and non-military customers. This means that NSI is not exposed to the risk of shrinking business faced by military contractors due to shrinking military funding and expenditure. As a result, the company provides Lockheed Martin with a unique opportunity to expand its current business portfolio to diversify its business risk, and start exploring non-military options. Given the high dependence that Lockheed Martin has on local military contract, this change will certainly be something that will give the company much needed financial stability.

2. Is NSI a good strategic fit for Lockheed Martin? What are potential synergies from the acquisition?

There are two aspects that need to be looked at in order to decide whether NationScape Inc. is good strategic fit for Lockheed Martin or not. The first is the target company’s organizational and operational policies and structures. If these policies and structures are a match, then the two companies possess the capability to work as a single unit. Looking over the organizational structure of NSI it is clear that the company operates with a flat hierarchy, which is what makes the organization so adaptive. Lockheed Martin, on the other hand, has a very traditional, tall hierarchical structure. Also, NSI employees operate under a considerable amount of autonomy, while Lockheed Martin has well defined policies and procedures that govern decision making. The two companies may seem a stark contrast of each other in this regard, but these very different features of NSI are what give the company its high level of adaptability and dynamism. It is, therefore, for these very reasons that NSI is capable of adapting to Lockheed’s organizational environment. Lockheed too will have to undergo certain paradigm shifts, such as allowing more autonomy to its employees; however, there are no changes so significant that will make joint operations for the two companies impossible.

Other than that, most of NSI’s policies and mission statements are in line with those of Lockheed Martin. For example, one of Lockheed Martin’s values was to “perform with excellence” and to “strive to excel in every aspect of business and approach every challenge with a determination to succeed. In line with these values, NSI too had proven track record of meeting its customer set goals with excellent results. Both companies valued corporate social responsibility greatly, and considered it one of the cornerstones of their business strategies. For example, Lockheed Martin believed in the principles of “do what’s right” and “committed to the highest standards of ethical conduct”; whereas, NSI as the family business had instilled a culture of ownership, where employees cared for the achievements and accomplishments of the firm as much as a monetary benefit.

Also, view on leadership was very similar in the two companies. Just as NSI had created a foundation of strong leadership in NSI through familial entrepreneurship, Lockheed Martin believed in creating “full spectrum leadership to shape the future, build effective relationships, energize the team, deliver results and model personal excellence, integrity and accountability.

The two firms were also eye to eye on the benefits of employee training and vision alignment. Both Lockheed Martin and NSI believed that in order to run a successful operation the employees must be aware of the company’s ultimate objectives and work towards it.

Similarly, quality of products and services provided was also of utmost importance to both the firms. Both Lockheed Martin and NSI had developed reputation in the market for providing highest standards in quality to its customers. NSI had a history of retaining contracts and had never defaulted on a contract in over fifty years of its business.

All of the mentioned goals, objective, policies and strategies adopted by the two firms show that they are compatible enough with each other to be able to run joint operations. This leads to the second aspect of determining whether the two are a strategic fit, and that is the scope of business operations and future expansions. In other words, what does the new firm have to offer in terms of the acquiring firm’s future?

In this case, Lockheed Martin is looking to expand not only the scale of its operations but also its scope. NSI has customers in both the military spectrum as well as the non-military. This means that the company can help Lockheed Martin increase the scale of its operations by selling existing Lockheed Martin services and products to NSI customers and increase the scope of its operations by pursuing clientele in the non-military sector, as well. Other than the client base, NSI also offers a wide variety of services that are not military-specific and are not offered by Lockheed Martin. This gives Lockheed Martin the unique opportunity to diversify its services portfolio to mitigate some of the risks of high dependence on the Department of Defense and its shrinking budget allocation. Such diversification is something that Lockheed Martin has been looking into for quite some time, but did not have the expertise to accomplish on its own. Therefore, NSI provides an extremely valuable strategic platform for a change in business operations that Lockheed Martin has been trying to achieve.

Also, NSI has presence and operational setups in many countries Lockheed Martin does not. The logistical framework in place and the expertise of NSI employees can prove to be invaluable to Lockheed Martin in its global operations. They also represent an opportunity for Lockheed Martin to increase its international business thereby reducing local market risks. This is another thing that has been on the table of Lockheed Martin executives; therefore, NSI fits right into their international expansion strategies.

All in all, NSI has the ability to fit right into Lockheed Martin’s strategic requirements and enable the company to achieve many of the goals that it will find very difficult to achieve on its own.

3. How would you characterize the strategic goal of such an acquisition: consolidation, market expansion, adding volume/scale, or as an R&D play?

It is difficult to categorize the goal of this acquisition in any single category because the end results of the acquisition are of many different categories. NSI offers a vertical, as well as horizontal, consolidation of services, expansion in current as well as new markets, increasing both the scope and scale of operations and new technology that is not yet available to Lockheed Martin.

The larger strategic goal, however, can be summed up into increasing shareholder value through expansion. The main reason behind the acquisition of NSI and all previous acquisitions is for Lockheed Martin to expand into new markets, both geographically and products and service wise. Such an expansion takes into account all of the major benefits that Lockheed Martin plans on gaining from the acquisition, which include reduction of business risk, reduction in dependence on a single form of contract, enhanced services portfolio and improved logistics network. Therefore, in the overall sense, the acquisition can be categorized as a bid for market expansion.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Logoplaste Global Growing Challenges Case Solution

- Long Term Capital Management L.P (A) Case Solution

- Make Green Delicious Sustainability at Jamie Kennedy kitchens Case Solution

- Making RFID Work The Worlds Largest University Library RFID Implementation Case Solution

- Managing Innovation at Nypro Inc (A) Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.