Get instant access to this case solution for only $19

Long Term Capital Management L.P (A) Case Solution

LTCM employed complex mathematical models to capitalize on the convergence trades. The essential strategy of LTCM to make the profit rounded around the fact that it took a long position in ‘off the run’ or cheaper bonds and shorted in the expensive ‘on the run’ bonds. When one approaches the starting date, the small differences in their value will tend to generate some profits. The differences in the value of bonds (long and short combination) were largely minute (especially for the convergence trades); therefore, LTCM has to take highly leveraged positions in order to secure a large profit figure. The first problem for this type of scenario corresponds to the information asymmetries in the market. The second biggest issue is a moral hazard.

Following questions are answered in this case study solution

-

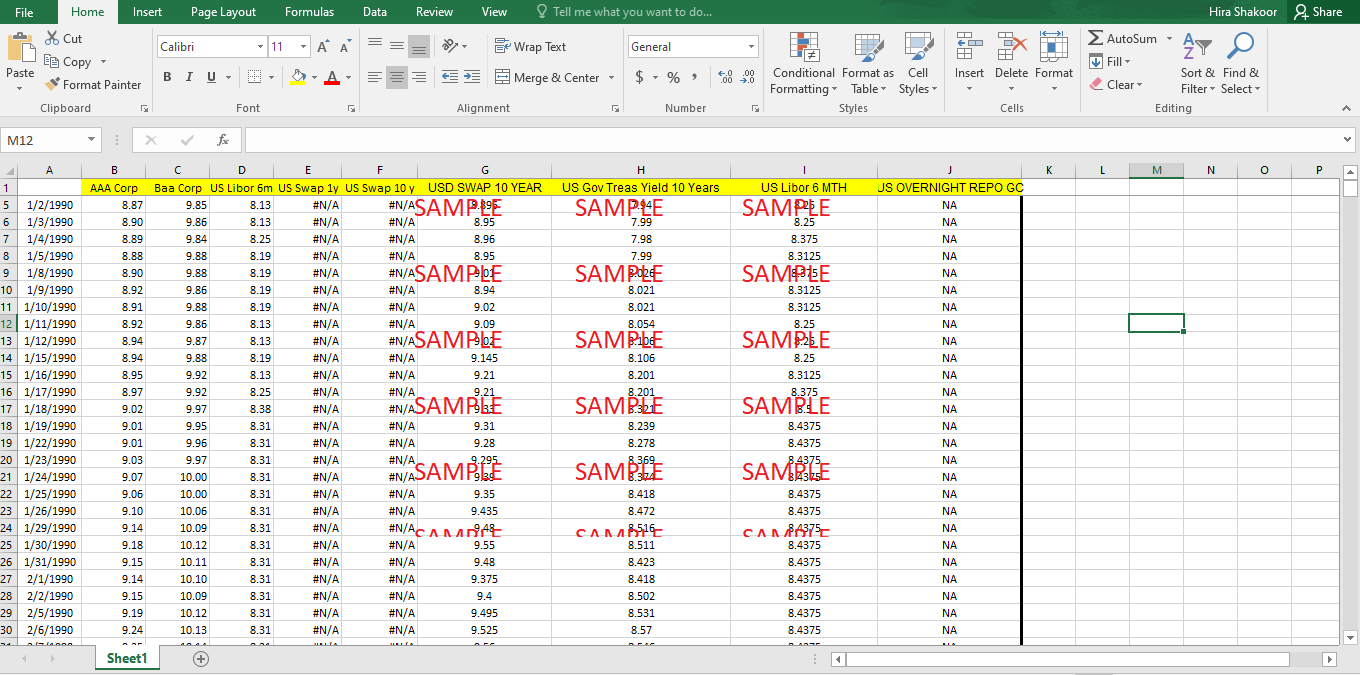

What would have been the implication for arbitrage strategies such as the one discussed in the case? Consider, for instance, shorting the 10-year bond and going long the swap betting that the spread, Δ1(t), would decrease. Imagine implementing it at the beginning of 2008. What would have been the risks of this trade? What would have happened to the annualized net financing/carry costs in basis points in summer and fall 2008?

Case Analysis for Long Term Capital Management L.P (A)

1. What would have been the implication for arbitrage strategies such as the one discussed in the case? Consider, for instance, shorting the 10year bond and going long the swap betting that the spread, Δ1(t), would decrease. Imagine implementing it at the beginning of 2008. What would have been the risks of this trade? What would have happened to the annualized net financing/carry costs in basis points in summer and fall 2008?

The case of LTCM is closely related to the downfall of markets in the financial crises of 2008. The arbitrage strategies put LTCM into such a position where the ‘divergence’ in the value of some bonds and equities will cause huge losses to the company, and its equity might experience a drastic decrease. The arbitrage strategies of LTCM were based on the principle of convergence and divergence. The problem with these strategies is that if the market shows even small deviations from the projected path, the concerned party will maintain huge losses.

Moreover, if this scenario is faced in conjunction with moral hazard and information asymmetry than the losses of the company might increase.

The financial crises started to make its way to the market in fall 2008. Let’s assume that a company implements the same strategy of ‘convergence trade’ at the beginning of 2008. Convergence trade is essentially synthetic and leveraged trades, and they involve short position. The biggest risk with this strategy would have been the realization of temporary or permanent divergence in the value of constituent stocks/bonds.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Make Green Delicious Sustainability at Jamie Kennedy kitchens Case Solution

- Making RFID Work The Worlds Largest University Library RFID Implementation Case Solution

- Managing Innovation at Nypro Inc (A) Case Solution

- Mandic BBS An Entrepreneurial Harvesting Decision Case Solution

- Maple Leaf Consumer Foods Fixing Hot Dogs A Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.