Get instant access to this case solution for only $19

Lighting The Way At The Manor House Hotel Case Solution

Andre and Melisa Barmore have recently acquired financing from a real estate investment trust (REIT) for the purchase and refurbishing of the newly named Manor House Hotel. The hotel was located in Chicago and had 100-rooms with state-of-the-art and classic design elements. Both Andrea and Melisa wanted to reposition the hotel with major changes in outlook so that they can able to target high-end clientele. However, in order to achieve this objective, the hotel building required major remodeling of rooms, common areas, and hallways. The plan was to complete the remodeling project by a holiday in order for it to be opened during that period.

Following questions are answered in this case study solution

-

Describe the business project and the investment choice to be made. a. Selecting which lighting fixtures to install for the hotel’s refurbishment b. Determine which lighting figures offered lowest cost in PV terms at the hotel’s quality level

-

What factors have the Barmores considered regarding the project’s cash flows? a. Initial investment cost b. Rated lifetime of a bulb c. Replacement labor cost d. Electricity cost per kWh, and potential changes in rates e. Inflation

-

What is the opportunity cost of capital? How was it determined? a. Ten-percent (10%) b. Advised by a REIT who explained that “its base of broadly diversified investors was currently requiring 10% for investments with similar risks and a similar time horizon…”

-

What investment criteria will the Barmores use to choose among the lighting options? a. Best choice would be “the alternative which offered the lowest cost in present value terms without compromising the hotel’s quality standards.”

-

Briefly explain how you would solve this investment problem. a. Determine cash flows b. Determine opportunity cost of capital c. Select time horizon d. Find PV of cash flows e. Compare to find lowest across alternatives, but keep in mind the hotel’s quality level

Case Analysis for Lighting The Way At The Manor House Hotel

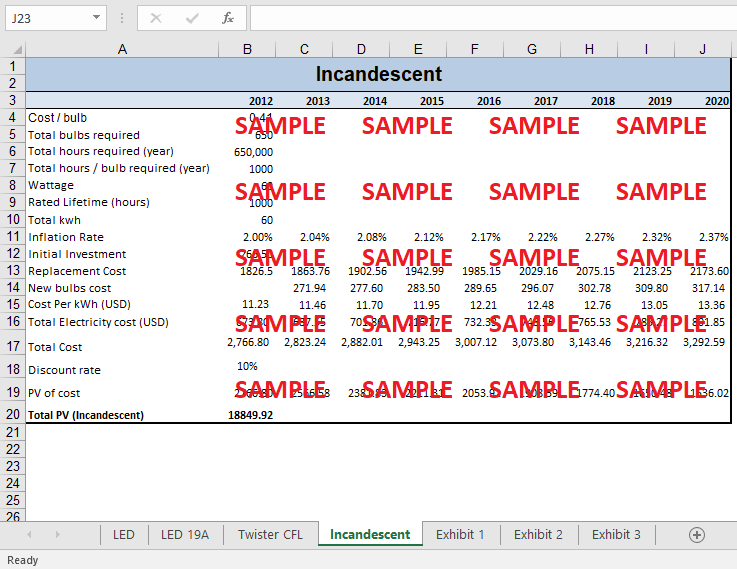

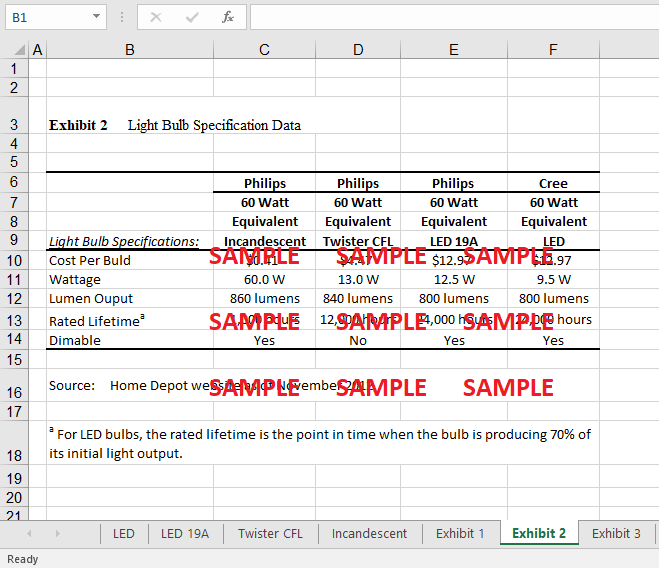

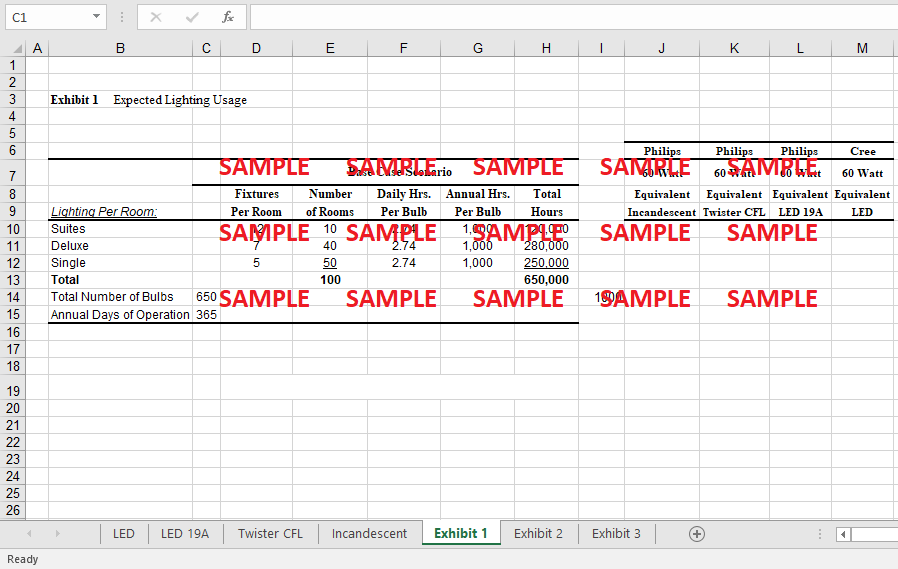

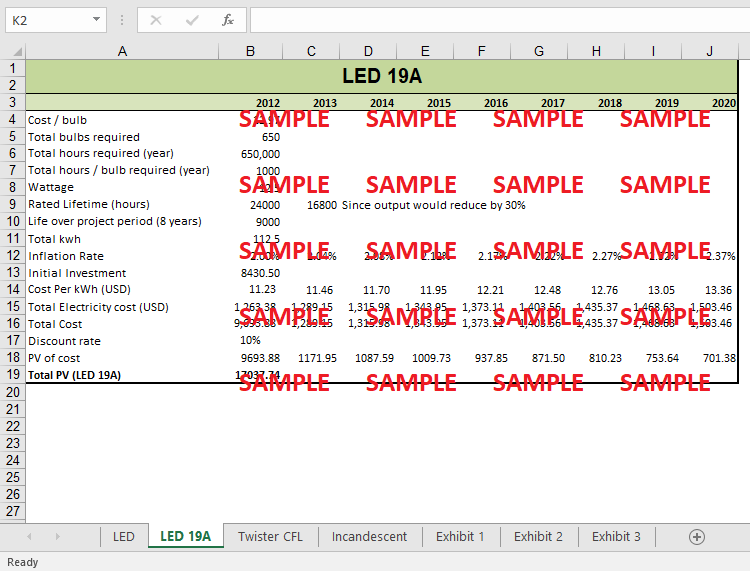

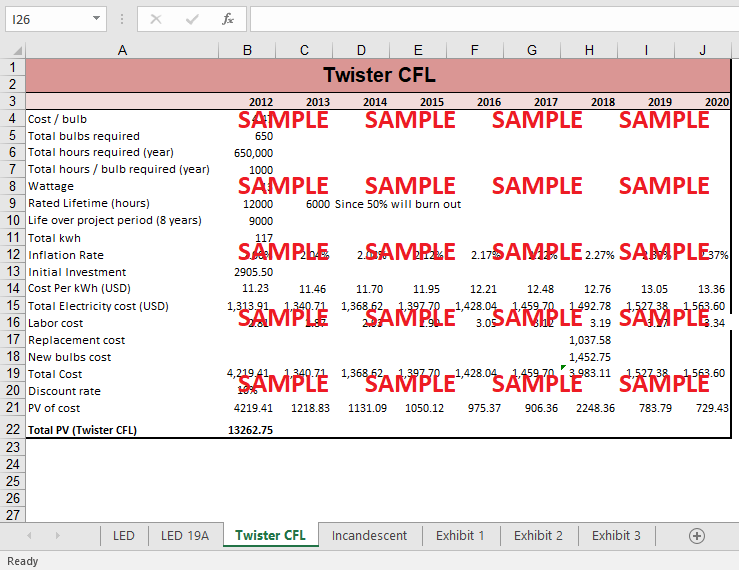

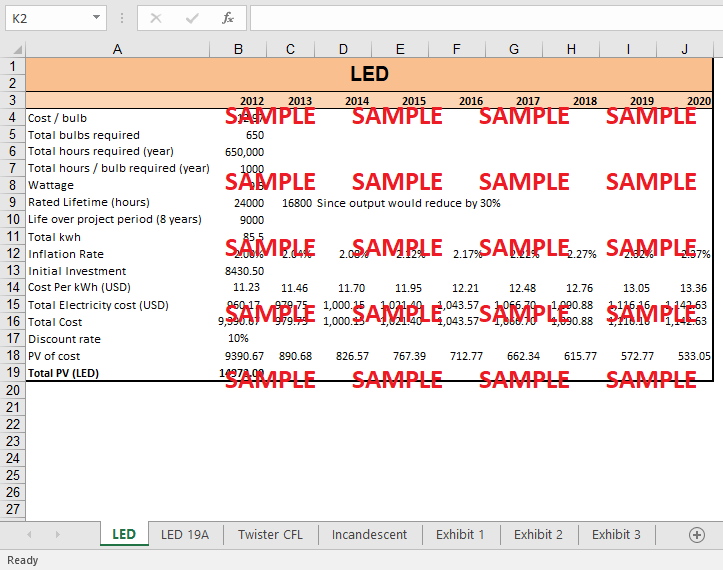

The new owners were wrestling with the question of installation of appropriate lighting in the hotel which not only cost minimum but also complies with the hotel’s quality standards. They intend to expense the cost of the lighting project immediately in case the amount is less $20,000. However, the owners realized that there are various factors that may affect their decision to choose specific lighting. Currently, there are mainly three technologies through which commercial bulbs are being operated. They include Incandescent light bulbs, compact fluorescent bulbs (CFLs), and Light Emitting Diode bulbs (LEDs). Three types of bulbs differ in specification with regards, to technology, cost per bulb, wattage, lumen output, rated lifetime, and dimmable. Based on different specifications, the per kWh cost across each type differs since the wattage of each bulb is different.

The decision of choosing a specific type of bulb pertains to guestroom lighting which seems trivial however the owners want to take a systematic approach for the decision thereby setting an example of the new business straight. For evaluating different alternatives, the optimum tool for making a decision is to compute the net present value for the cost related to each alternative. The cost would not only include the initial investment for each category but also the electricity, labor replacement cost, and new bulb cost in the years to follow.

2. What factors have the Barmores considered regarding the project’s cash flows? a. Initial investment cost b. Rated lifetime of a bulb c. Replacement labor cost d. Electricity cost per kWh, and potential changes in rates e. Inflation

There are various factors that the Barmores considered pertaining to the project’s cash flows. Primarily, starting with the initial investment under each category. The per-unit cost of each bulb varies across different types. The cost starts from $0.41in the case of an Incandescent bulb and goes up to $12.97 per bulb in the case of LEDs. The wattage is also another factor to consider while projecting the cash flows. The higher the wattage, the higher will be the per kWh cost of electricity. The wattage of Incandescent bulbs is highest followed by twister CFLs and LEDs respectively.

Lumen output does not directly correlate with the cash flows since there is no requirement of the quantity of light to be installed at the hotel. There fix a number of fitting in the hotel across suites, deluxe, and single rooms for which the total requirement for bulbs has been determined to be 650 bulbs. The total number of required bulbs thus produce 650,000 hours of light at a daily rate of 2.74 hours per day. Therefore, the requirement for a total number of bulbs would suffice to determine the initial investment without using the lumen output. Additionally, labor cost for replacement of bulbs in later years and cost of bulbs being replaced has also been considered for the cash flows.

3. What is the opportunity cost of capital? How was it determined? a. Ten-percent (10%) b. Advised by a REIT who explained that “its base of broadly diversified investors was currently requiring 10% for investments with similar risks and a similar time horizon…”

The opportunity cost of capital is the additional return that a business forgoes when it decides to utilize the available funds for an internal project rather than investing in a marketable security. For example, if a business is considering a tradeoff between two alternates. Firstly, the business can invest the available funds in a marketable security i.e. treasury bonds with a reasonable annual return of 10%. Secondly, the business has this business opportunity to replace the existing machinery which will improve the production capacity and reduce the bottleneck thereby increasing efficiency and reducing cost. The business has estimated that the total benefit brought by the replacement of old machines in form of cost reductions and incremental sales. The company has determined an internal rate of return of this investment to be 8%. In this case, the opportunity cost is the incremental return that the business could have earned if it would have invested in treasury bonds. The incremental return is the difference between the return on treasury bonds and the internal rate of return on the replacement project.

In case of Manor House Hotel, the opportunity cost of capital for REIT is the difference in the required rate of return (10%) which they demanded from the hotel and rate of return on any marketable security. The required rate of return was derived by the risks and time horizon of investment in hotel development. To calculate the opportunity cost of capital for the hotel, internal rate of return on investment in lighting project to be compared by the required return by REIT (10%). The lighting project to be viable, it should generate sufficient cost reduction for the business so that the return it would guarantee exceeds the required return by REIT. On the contrary, if the required return on REIT is higher than the cost savings brought by the of project. The hotel would have higher opportunity cost of capital.

4. What investment criteria will the Barmores use to choose among the lighting options? a. Best choice would be “the alternative which offered the lowest cost in present value terms without compromising the hotel’s quality standards.”

The appropriate investment criteria for evaluating the different types of lighting projects is the net present value. The NP method would tell the Barmores exact cost associated with each lighting project in absolute terms thereby allowing the company to make reasonable decisions that are economically beneficial for the company. In this regard, the cash flows associated with cost/expenses to be projected under each category of lighting bulb with reference to respective specifications. The present value of these cash flows to be calculated by discount the cash flows at a discount rate of 10%. The total present value will be the sum of all the cash flows for subsequent years. The lighting project with the lowest net present value should be selected. This is different from the investment project whereby the project with the highest net present value is selected. Since the said appraisal method is in terms of cost, thereby the lowest net present value will generate maximum value for the hotel.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Massachusetts General Hospitals Pre Admission Testing Area PATA Case Solution

- Pacific Drilling The Preferred Offshore Driller Case Solution

- Zaras Supply Chain Management Practices Case Solution

- TD Canada Trust B Linking the Service Model to the P and L Case Solution

- Quality Furniture Company Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.