Get instant access to this case solution for only $19

Liston Mechanics Corporation Case Solution

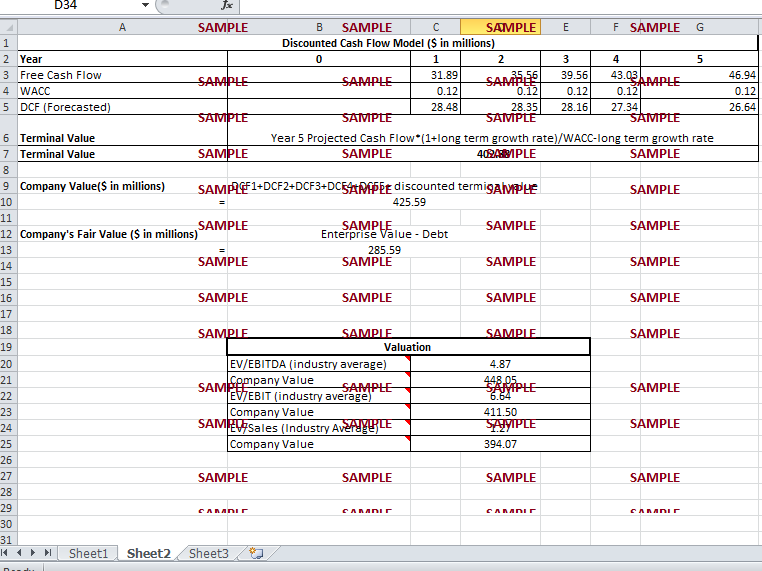

Multiples approach is another technique used to calculate the value of an enterprise. This technique focuses market valuation multiples. These multiples are calculated using the data of a similar company in the industry or by using industry average. For this case study, the data provided for NEC is used to compute multiples. A total of three multiples have been used to calculate company value (EBIT, EBITDA and Sales). Detailed calculations are shown in the spreadsheet; the estimated values using multiples approach are $448, $411 and $394 (in millions) for EBITDA, EBIT and Sales respectively.

Following questions are answered in this case study solution

-

Prepare a five-year forecast of the Free Cash Flows for LMC.

-

Use DCF to value the company based on your five-year forecasts plus terminal value.

-

Compare your DCF value to two or more multiples approach based on such multiples as earnings, EBIT, EBITDA, Sales, etc.

Case Analysis for Liston Mechanics Corporation

1. Prepare a five-year forecast of the Free Cash Flows for LMC.

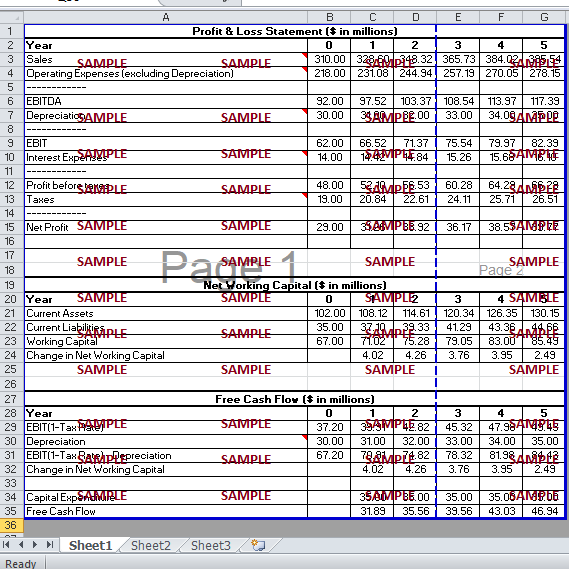

Liston Mechanics Corporation is an established corporation operating in industrial mechanics industry. It is rated as a high growth perspective company in terms of both, revenue and profit. Financial analysts believe that the company is not being managed properly; with proper management and utilization of resources, the company has high potential for growth and improvement in operating margin. The five year Free Cash Flows for Liston Mechanics Corporation have been generated using the financial information provided in the exhibits. The results depict that the Free Cash Flows for the company will continue to increase steadily in the next five years. The detailed calculations of FCF (included in the spreadsheet) use the balance sheet to calculate the net working capital, while depreciation, earnings before interest and taxes and capital expenditures are taken from profit and loss statement. The free cash flow stream forecasted for the business depicts that this corporation has high investment value. The major factor being analyzed is stability. If, the free cash flows maintain stable levels then not only is the company likely to generate cash flows but it can also finance its operations in the future.

2. Use DCF to value the company based on your five-year forecasts plus terminal value.

The basic principle behind DCF valuation is that the company’s value today is the sum of all future cash flows it generates discounted using a suitable discount rate. This means that the sum of all discounted cash flows that the company is expected to generate is the present value of the company. There are many methods of using DCF approach for valuation of an enterprise. In this case study, free cash flow to equity approach has been applied. The present value for Free Cash Flow forecast has been calculated by using a discount rate of 12% (WACC). The discounted cash flows have then been summed with discounted terminal value and hence, enterprise value of $425.59 million has been calculated for Liston Mechanics Corporation using the DCF valuation method. Terminal value has been calculated using the projected cash flow for year 5, long-term growth rate and WACC. Terminal value is the estimated worth of the company in the future. The estimated worth of Liston Mechanics Corporation after five years has been calculated to be $402.88 million. This terminal value has been used to calculate Company’s net worth today i.e. the enterprise value. Furthermore, fair value has also been obtained for this company. This value depicts the value of the shares of Liston Mechanics Corporation alone. As equity investors, it is important to calculate this value so that negotiations and offer are made on the fair value. The fair value has been calculated by subtracting company’s debt from its value. For Liston Mechanics Corporation, this value comes out to be $ 285.59 million.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Starbucks and the Spotlight Effect: Corporate Social Responsibility and Reputation Risk Case Solution

- Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value Case Solution

- Microsoft- Financial Reporting Strategy Case Solution

- Microsoft's Financial Reporting Strategy Case Solution

- An Investigation into the Challenges of Tourism Growth in Oman Consumer Perspective Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.