Get instant access to this case solution for only $9

Netflix Case Solution

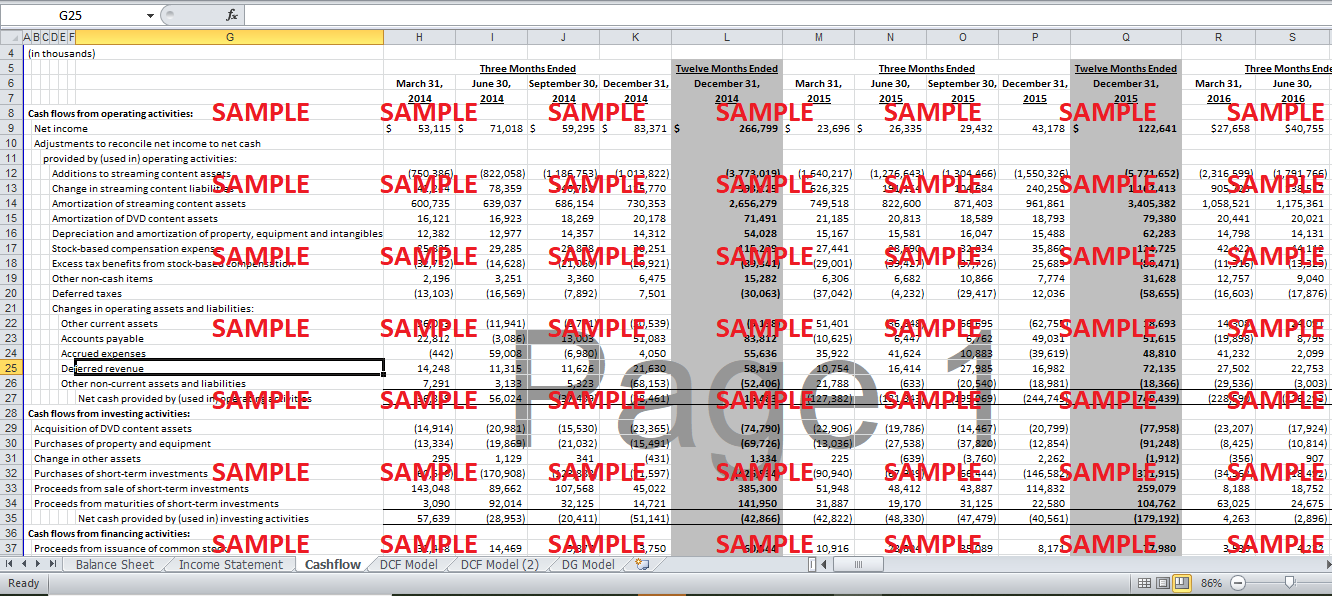

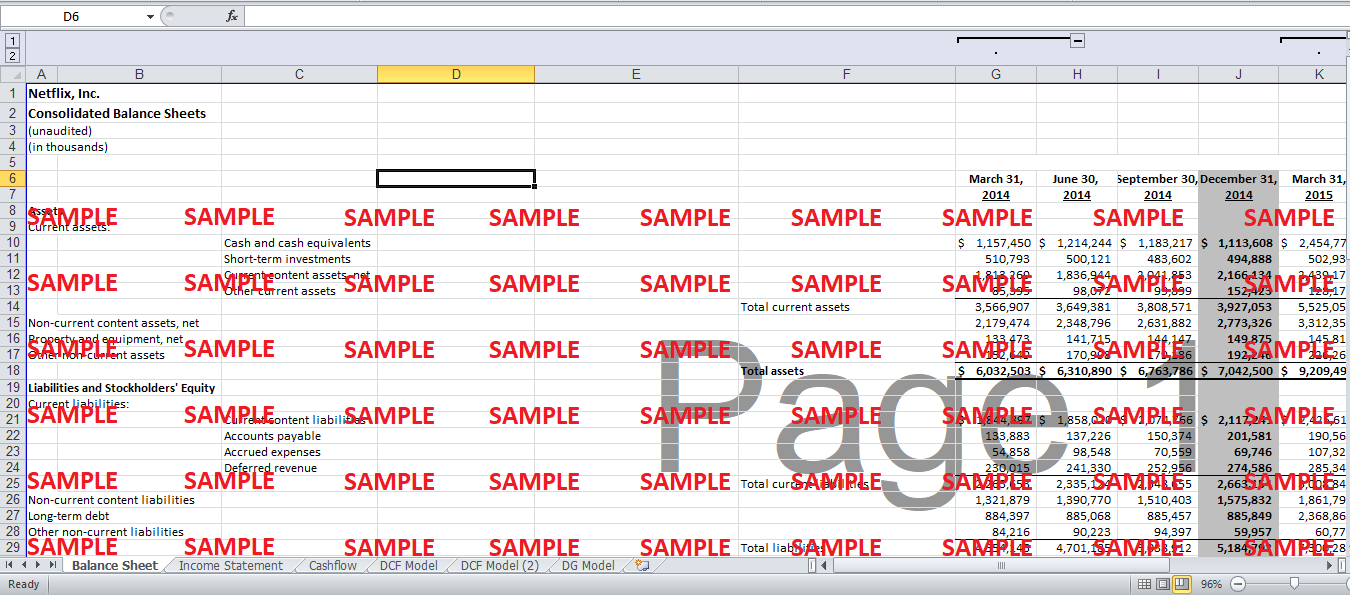

Netflix common stock price has been calculated using different valuation methods. Discounted Cash Flow Analysis has been carried out using both the enterprise valuation approach and value of common equity approach. For a more detailed analysis, Dividend Discount Model has also been used to value the common stock of Netflix.

Following questions are answered in this case study solution

-

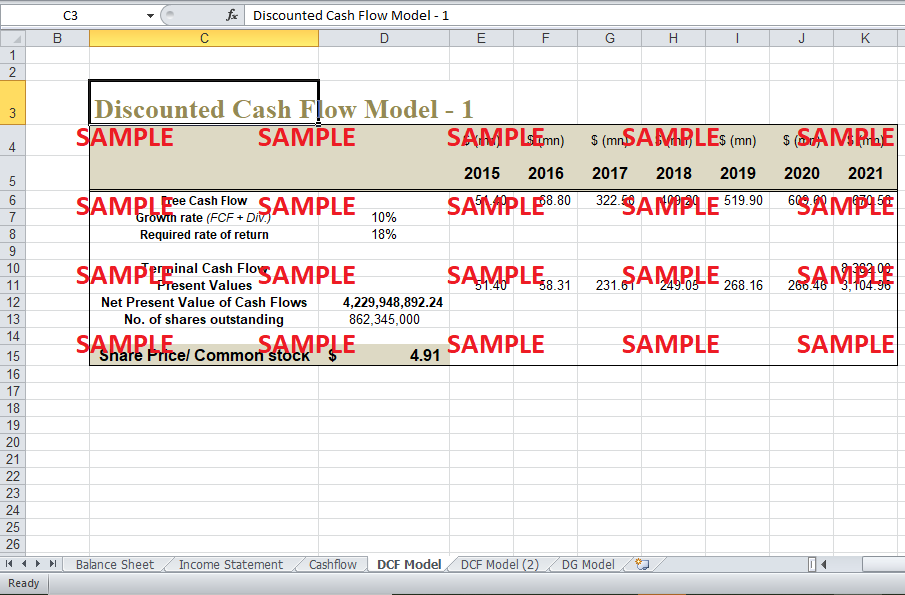

Discounted Cash Flow to Equity Analysis

-

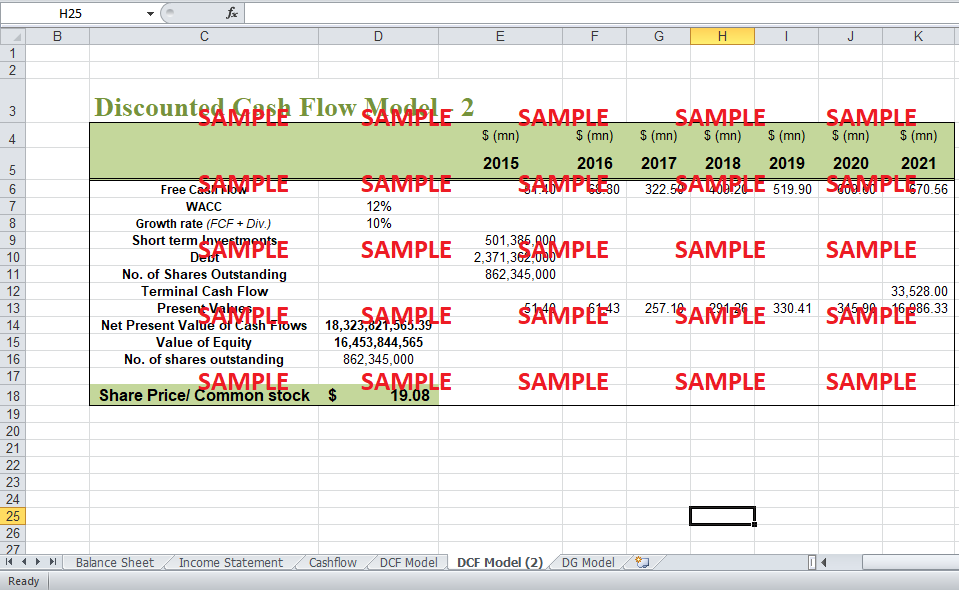

Discounted Cash Flow Analysis

-

Dividend Growth Model Analysis

-

Comparison

Case Analysis for Netflix

1. Discounted Cash Flow to Equity Analysis

The first sheet in the Excel file uses the free cash flows method to calculate enterprise value. In this particular approach, the required rate of return i.e. 18 percent has been used because this analysis assumes that the enterprise value of Netflix comprises entirely of equity value with no debt. This is why Weighted Average Cost of Capital (WACC) has not been used. This is also the primary reason why the share price per common stock of Netflix in this scenario is lowest i.e. $4.91 as it considers no leverage.

2. Discounted Cash Flow Analysis

The next sheet calculates the enterprise value using the free cash flow valuation method just like in the case of the first scenario, but here the actual short term investments and market value of debt have been incorporated. These two values have been extracted from the actual figures given in the balance sheet for the year ended 2015. Once an overall enterprise value has been estimated, the value of equity is separated from the overall enterprise value. Share price per common stock of Netflix has thus been calculated using the value of equity. Moreover, WACC has been used in this scenario for discounting purposes because here both debt and equity were involved. The share price is, thus, higher - in fact, highest for this approach i.e. $19.08.

Get instant access to this case solution for only $9

Get Instant Access to This Case Solution for Only $9

Standard Price

$25

Save $16 on your purchase

-$16

Amount to Pay

$9

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.