Get instant access to this case solution for only $19

Phuket Beach Hotel Valuing Mutually Exclusive Capital Projects Case Solution

Phuket Beach Hotel (PBH) had an un-used space on the second floor of the main building. Plant Karaoke Pub (PKP) offered to sign a four year lease on this floor with PBH with a proposed rent of 170,000 baht per month. Mike Campbell, the manager of PBH, considered another alternative of opening Beach Karaoke Pub (BKP), a pub owned by PBH itself, for six years on the un-used floor. Hence, the two projects are mutually exclusive. The projects involve different initial capital expenditures and result in different operating cash flows. An assessment of the different costs and benefits is required to determine the financial and economic viability of the project. For this purpose, the projects are evaluated and ranked using various analyzing tools such as payback period, internal rate of return, net present value, profitability index, and equivalent annual annuity.

Following questions are answered in this case study solution:

-

Please assess the economic benefits and costs associated with each of the capital projects. What are relevant incremental cash flows for the build and lease options? (For the calculation of incremental cash flows, create two spreadsheets – one for build option and the other for the lease option).

-

What is the appropriate discount rate for discounting the incremental cash flows?

-

Calculate and rank the projects according to payback, internal rate of return, net present value, profitability index, and equivalent annual annuity.

-

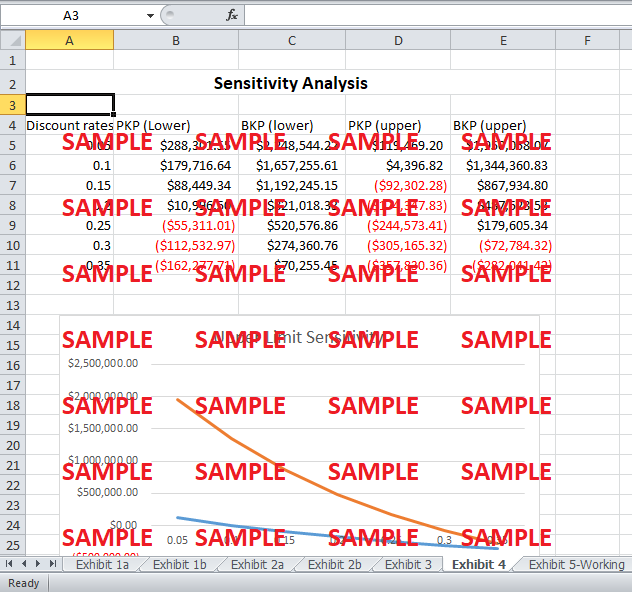

How sensitive is your ranking to changes in the discount rate? Create a net present value profile graph with NPV on the vertical axis and cost of capital on the horizontal axis.

-

Which project should the hotel undertake?

Phuket Beach Hotel Valuing Mutually Exclusive Capital Projects Case Analysis

1. Please assess the economic benefits and costs associated with each of the capital projects. What are relevant incremental cash flows for the build and lease options? (For the calculation of incremental cash flows, create two spreadsheets – one for build option and the other for the lease option).

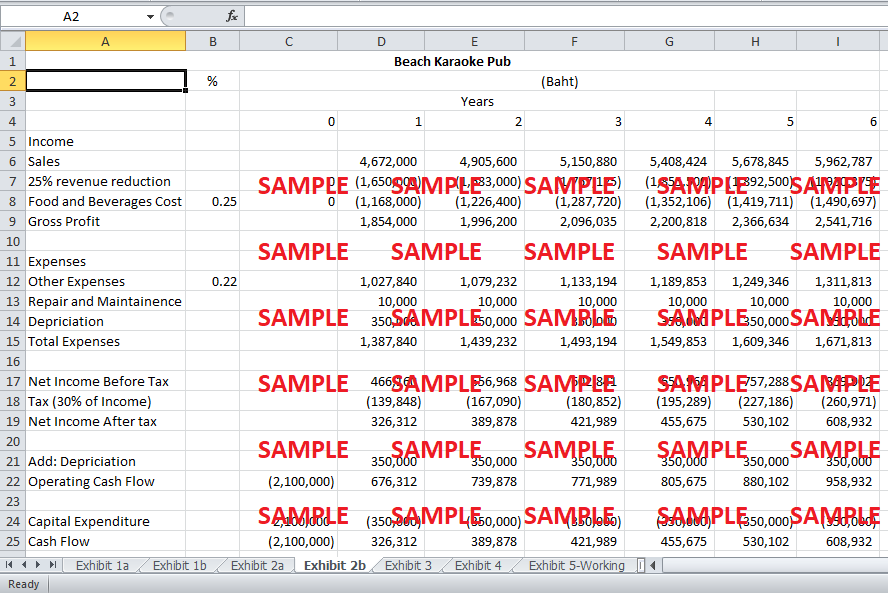

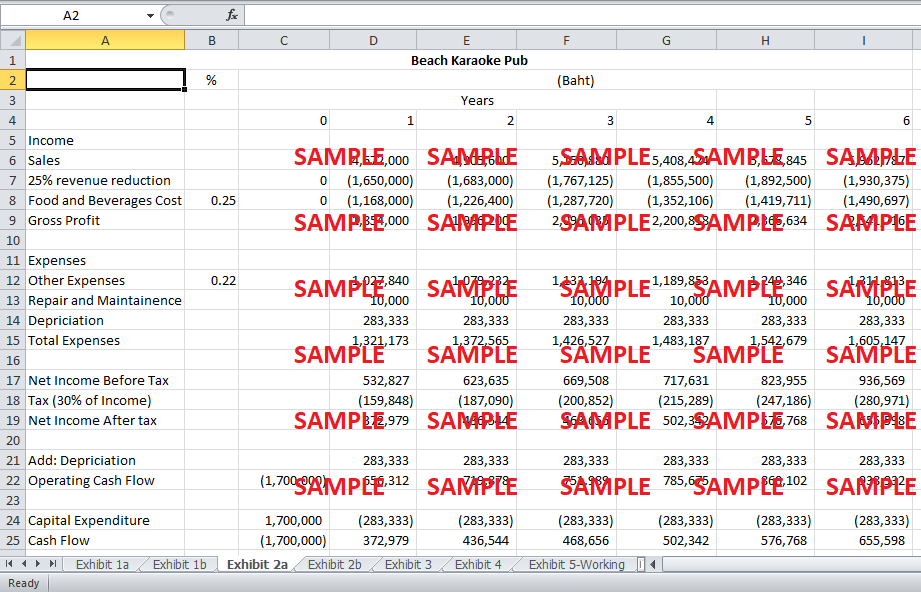

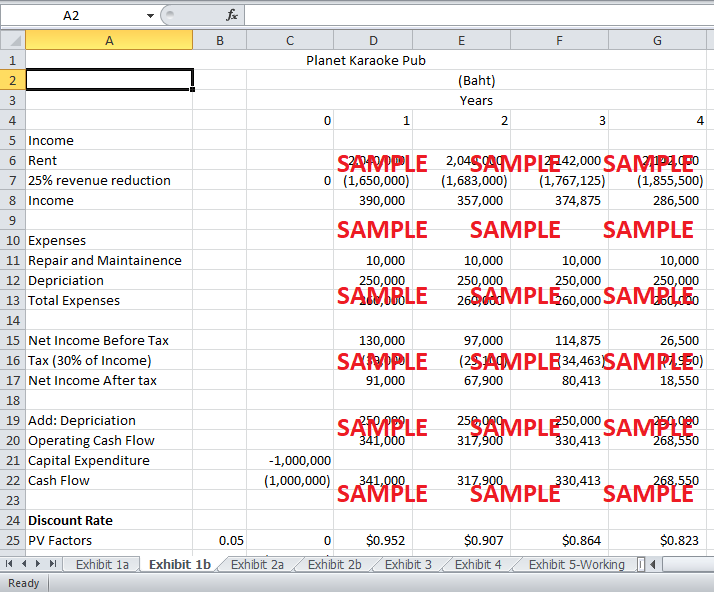

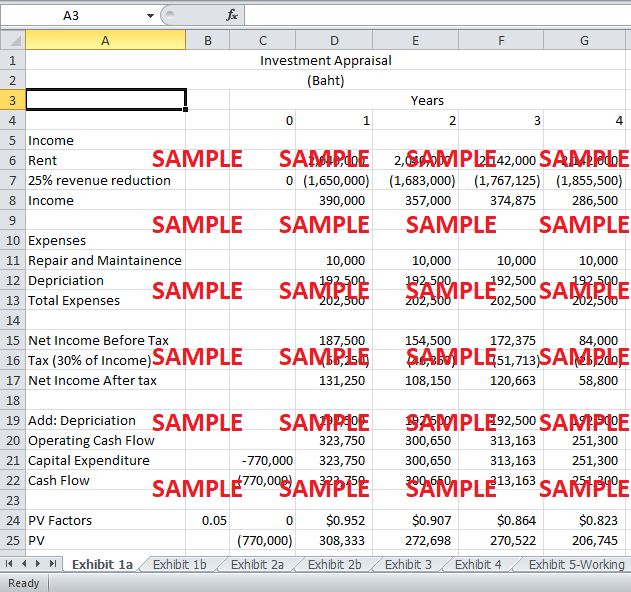

Planet Karaoke Pub offered a four year lease. The rent of 170,000 baht, which would increase by 5% after the first two years. If PBH accepted this offer, it would have to invest between 770,000 to 1,000,000 baht in renovation of the floor. Beach Karaoke pub was expected to earn an initial revenue of 4,672,000 baht that was forecasted to increase by 5% per year. BKP required an initial investment in this project, ranging from 800,000 and 1,200,000, and an additional investment in equipment of 900,000 baht.

PBH, for both projects, will have to bear the repair and maintenance costs of 10,000 baht per year. Similarly, the opening of the pub will increase the security problem for the firm and lead to negative publicity for tourists travelling with children. Hence, this will result in loss of total patronage of the firm. This loss is difficult to quantify. However, it is estimated that the loss of approximately 25% of room revenue earned from hotel guests.

2. What is the appropriate discount rate for discounting the incremental cash flows?

Kornkrit Manming, PBH’s financial controller, suggested to Wanida, his assistant, to use a discount rate of 5% in analyzing the project. This was the interest rate earned on the time deposit at Saim Commercial Bank. However, as capital budgeting system was not reviewed for many years, a discount rate of 5% is too low for evaluating the projects.

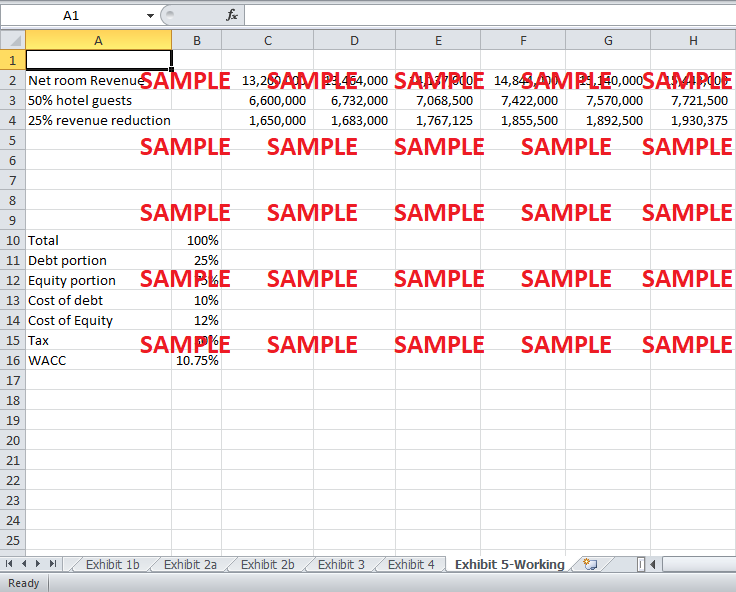

Therefore, for the analysis, the weighted average cost of capital (WACC) is used as the discount rate. PBH has the capital structure of 75% equity and 25% debt. The owner cost of capital is 12%, and the cost of debt is 10%. Using a tax rate of 30%, the WACC is calculated to be 10.75%.

3. Calculate and rank the projects according to payback, internal rate of return, net present value, profitability index, and equivalent annual annuity.

Exhibit 1 shows the analysis of Planet Karaoke Pub’s cash flows. As mentioned earlier, the initial investment is expected to range from 770,000 to 1000,000 baht. Hence, two scenarios are created. For the upper limit of cash flows, the initial expenditure of 1000,000 baht is assumed. Similarly, for the lower limit of cash flows, the initial investment is assumed to be 770,000 baht. The higher the initial investment, the higher is the depreciation. Higher depreciation results into lower income and lower taxes paid. Lower taxes paid causes higher cash flows. Thus, the higher the initial cash outlay the higher the operating cash flows. The Net present value for upper and lower limit, using WACC as the discount rate, are 165, 017 baht and (11,179) baht.

Exhibit 2 shows the analysis of Beach Karaoke Pub’s cash flows. The initial investment for this project ranges from 1700,000 to 2100,000 baht. Again two scenarios are created where 1700,000 baht investment is assumed for the upper limit (UL) of cash flows and 770,000 baht investment for the lower limit (LL). The Net Present Value (NPV) for upper and lower limit, using WACC as the discount rate, is 1,580,378 and 1,265,602 baht, respectively. This clearly shows that when compared the NPV of BKP in both the upper and lower limit of cash flow are considerably higher than that of PKP. Also for PKP, in the UL scenario the NPV becomes negative which shows that PBH will not even be able to recover its initial investment if it spent 1000,000 baht for leasing.

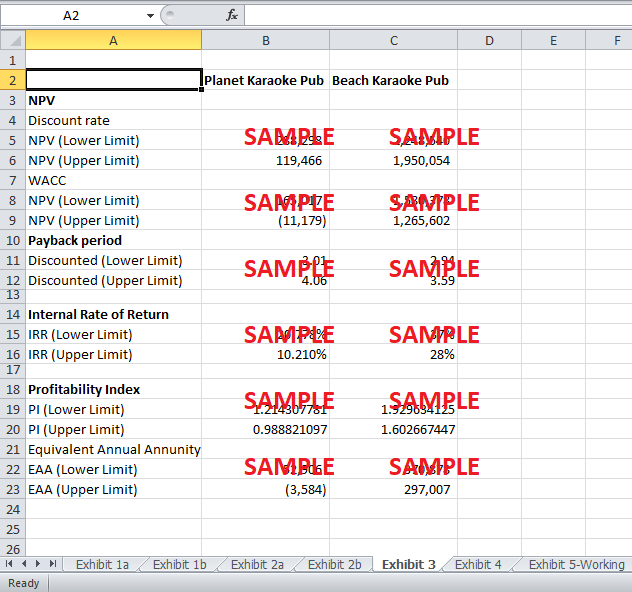

Exhibit 3 shows the results of other analysis tools. The payback period determines in time in which the firm will be able to recover its initial investment given the discounted annual cash flows. Considering the two scenarios, the discounted payback period of BKP is lower than that of BKP. For BKP, for the LL and UL scenarios the payback periods are 2.94 and 3.59 years, respectively. However, PKP is able to payback the investment in 3.01 years when the outlay is less, it will not be able to payback if the outlay is higher. Hence, the discounted payback period will rank BKP higher than PKP.

The internal rate of return (IRR) determines the discount rate at which the investment break-evens i.e. the NPV equals zero; the higher the IRR the less risky the project. A high IRR shows that unless the discount rates are that high the firm will make a profit. The IRRs of BKP for both UL and LL scenarios are very high. This shows that BKP will generate profit until the discount rate is below 28%. IRR for KPK LL scenario is also high at 20.778%. However, the IRR for UL scenario is below the WACC calculated. Therefore, BKP is a safer and more profitable investment.

The profitability index (PI) determines the ratio of the payoffs to initial expenditure of a project. It is the amount of value generated for every unit of investment. If the PI of a project is higher than 1, it should be accepted; otherwise, it should be rejected. The PI of UL scenario of PKP project is below 1. The PIs of BPK are higher than one and closer to 2. Therefore, BPK should be ranked higher than PKP as it generates higher value per unit of investment.

Equivalent annual annuity (EAA) is another approach used in capital budgeting to compare mutually exclusive projects with unequal lives. It calculates the equal annual cash flow, like an annuity, generated by an investment project over its operating period. The project with a higher EAA is more profitable. Exhibit 3 shows that BPK in both scenarios have significantly higher EAA than KPK. Hence, according to EAA approach, building BPK is a preferable investment for the firm.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.