Get instant access to this case solution for only $19

PlanetTran Case Solution

PlanetTran offers a livery service to its customers, which may either be individual consumers or business organisations. The service is provided with the aid of PlanetTran's fleet of hybrid autos, which assist carry out the operation. Seth Riney is now faced with the question of whether it would be profitable for him to take a large financial investment for the business to develop, both for himself and for his investors, after meeting with several local venture capital (VC) companies. This is a question that he is faced with after meeting with several local VC companies. This is a question that he has to respond to in order to decide whether or not making such an investment would be advantageous for him. It is imperative that he come to a decision on this prospect to deliver the maximum potential return on investment for all parties involved in the scenario.

Following questions are answered in this case study solution

-

Both Seth Riney, founder of PlanetTran, and the VC agree that it only makes sense to expand to one of the cities.

-

Assume that the change in net working capital is 1% of the change in sales.

-

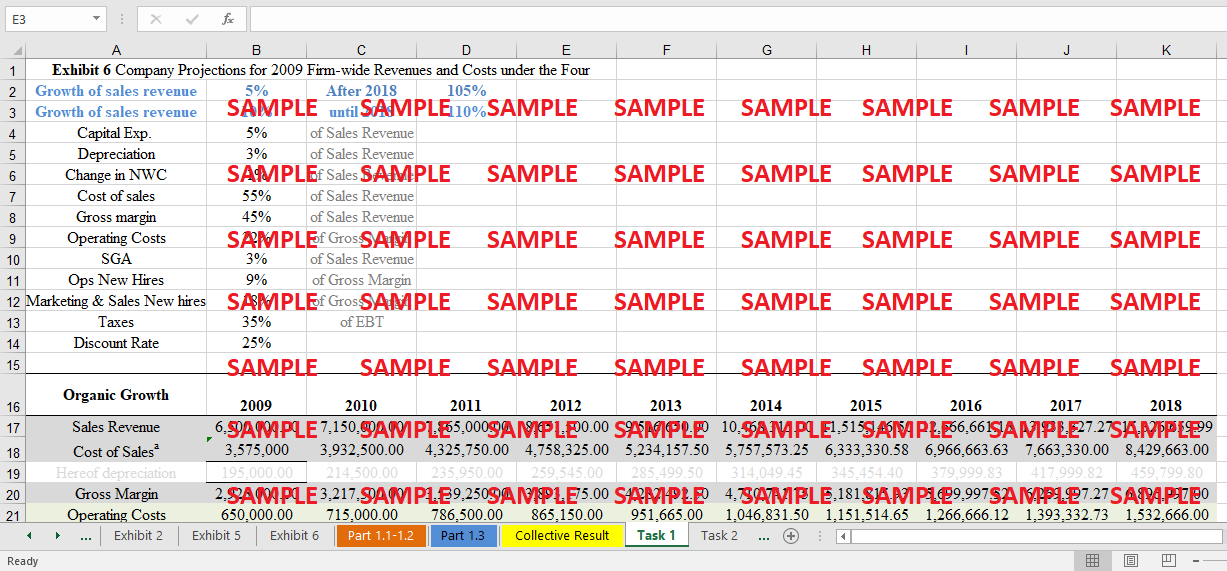

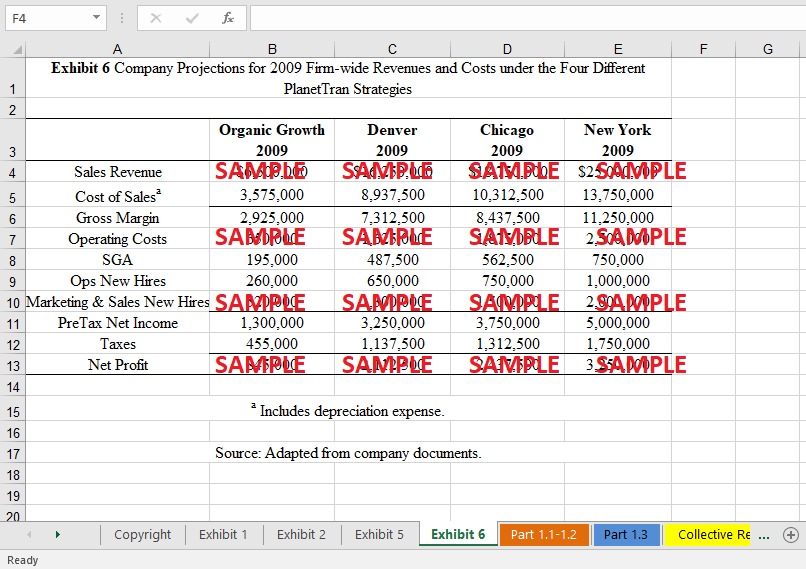

Exhibit 6 presents Seth's forecasted cash flows for 2009 for the three potential expansion city strategies: Denver, Chicago, or New York, as well as an organic growth (i.e., no funding) strategy. Seth projects a growth rate of sales of 10% per year following 2009 for each strategy until the end of 2018, followed by 5% thereafter in perpetuity. He assumes all line items will grow at their historical proportions with sales. Assume Seth has a discount rate of 25% and owns 100% of the company. From his perspective, which single strategy is best for the company?

-

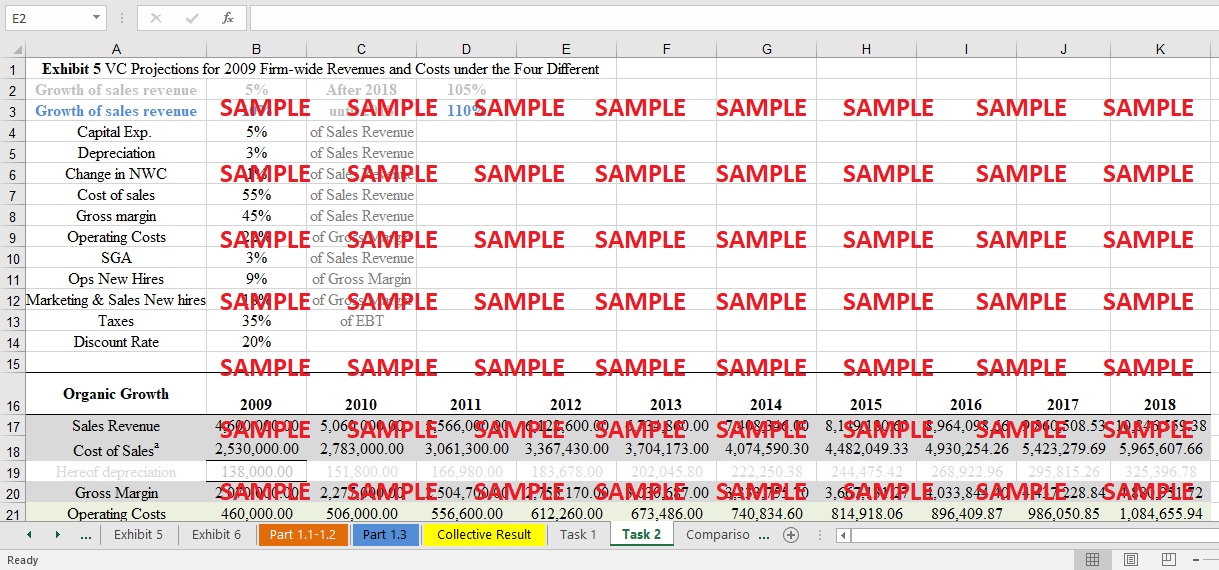

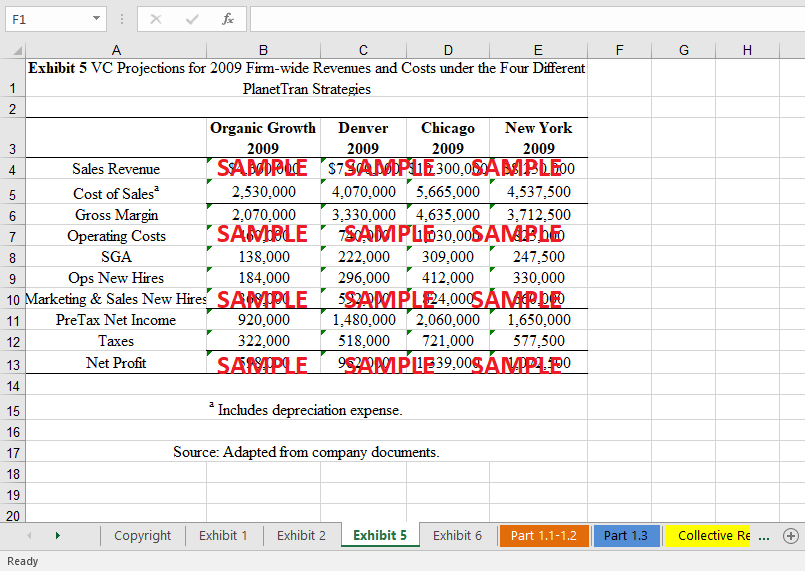

Exhibit 5 presents the VC's forecasted cash flows for 2009 for the three potential expansion city strategies: Denver, Chicago, or New York, as well as an organic growth (i.e., no funding) strategy. The VC projects a growth rate of sales of 5% per year following 2009 for each strategy, in perpetuity. The VC assumes all line items grow at their historical proportions with sales. Assume the VC has a discount rate of 20%. From the VC’s perspective, which single strategy is best for the company?

-

Which strategy do you think PlanetTran will adopt?

-

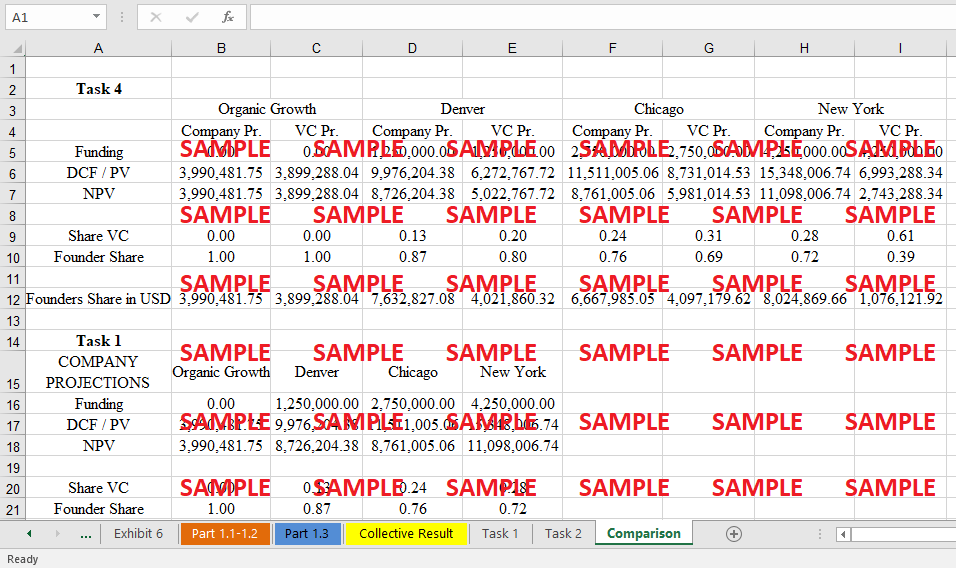

Assume the role of the venture capitalist. Prepare an offer for the founder. An offer consists of the following. For each of the three expansion strategies (Chicago, Denver, and New York), what fraction of the equity are you – the VC – willing to accept in exchange for the required investment?

Case Analysis for PlanetTran

1. Both Seth Riney, founder of PlanetTran, and the VC agree that it only makes sense to expand to one of the cities.

There are only two ways that businesses such as Planet Tran may produce value for their customers in exchange for the goods and services they provide. by means not just of natural growth but also of investment in new economic ventures and the people who start them. this may be accomplished in several ways. If a company or organization is unable to achieve financial success, whatever money that has been invested in that company or organization will be lost with no possibility of a return. Although venture investors often have a pessimistic outlook on the future, some businesses, such as PlanetTran, exhibit a high degree of optimism. Therefore, there is a tension that exists between the viewpoints that each group of individuals has on the future. When there are so many different options, it may be difficult for even a fledgling endeavor that has a lot of promise and some actual quality to come to terms with how to proceed. This is due to the intricate nature of the tradeoffs being considered. In order to ascertain whether or not an investment will result in a profit, the value of future cash flows that will be generated by the investment is brought forward in time and compared to the value of the investment at the present moment. This is done in order to ascertain whether or not the investment will end up yielding a return for the investor. When compared to the use of a greater discount rate, adopting a lower one leads in the accomplishment of a bigger present value. This is because of the exponential growth of the discount rate. Riney is in more need of financial assistance right now as compared to in the foreseeable future as a direct result of the lower discount rate that was anticipated for Riney.

2. Assume that the change in net working capital is 1% of the change in sales.

Even if it does not include the distribution of a significant number of the company's shares, a strong strategy will still be able to generate a positive net present value (NPV) for the firm. This is because of the way that it calculates the worth of the company's future cash flows. This is due to the manner that powerful strategies perform their functions. This is because the company will be in a position to enjoy the benefits of a positive cash flow as a direct consequence of it, which is the primary reason for this. The information that is given in the table that is displayed below was developed by companies using their very own estimations, which can be found in the footnotes of this article. The information that is provided in the table that is displayed below can be found below. Nevertheless, despite the fact that the value of the company would be significantly increased with a 72 percent ownership stake in the PlanetTran, the expansion in Denver will still provide a return for Riney despite the fact that it will require the least amount of money and the largest stake in the PlanetTran. This is because the expansion in Denver will require the least amount of money and the largest stake in the PlanetTran. This is due to the fact that if Riney were to acquire a majority position in PlanetTran, the value of the firm would skyrocket as a direct result of the ensuing rise in its market value. The reason for this is because of the fact that the city will continue to expand. This is due to the fact that the expansion in Denver will need the least amount of money and will allow the firm the opportunity to acquire the greatest degree of ownership in the PlanetTran.

3. Exhibit 6 presents Seth's forecasted cash flows for 2009 for the three potential expansion city strategies: Denver, Chicago, or New York, as well as an organic growth (i.e., no funding) strategy. Seth projects a growth rate of sales of 10% per year following 2009 for each strategy until the end of 2018, followed by 5% thereafter in perpetuity. He assumes all line items will grow at their historical proportions with sales. Assume Seth has a discount rate of 25% and owns 100% of the company. From his perspective, which single strategy is best for the company?

|

Exhibit 6 Company Projections for 2009 Firm-wide Revenues and Costs under the Four Different PlanetTran Strategies |

|

||||

|

|

|

||||

|

|

Organic Growth |

Denver |

Chicago |

New York |

|

|

Sales Revenue |

$6,500,000 |

$16,250,000 |

$18,750,000 |

$25,000,000 |

|

|

Cost of Salesa |

3,575,000 |

8,937,500 |

10,312,500 |

13,750,000 |

|

|

Gross Margin |

2,925,000 |

7,312,500 |

8,437,500 |

11,250,000 |

|

|

Operating Costs |

650,000 |

1,625,000 |

1,875,000 |

2,500,000 |

|

|

SGA |

195,000 |

487,500 |

562,500 |

750,000 |

|

|

Ops New Hires |

260,000 |

650,000 |

750,000 |

1,000,000 |

|

|

Marketing & Sales New Hires |

520,000 |

1,300,000 |

1,500,000 |

2,000,000 |

|

|

PreTax Net Income |

1,300,000 |

3,250,000 |

3,750,000 |

5,000,000 |

|

|

Taxes |

455,000 |

1,137,500 |

1,312,500 |

1,750,000 |

|

|

Net Profit |

845,000 |

2,112,500 |

2,437,500 |

3,250,000 |

|

|

|

|

|

|

|

|

|

a Includes depreciation expense. |

|

||||

|

|

|

|

|

|

|

|

Source: Adapted from company documents. |

|

||||

|

|

|

|

|

|

|

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.