Get instant access to this case solution for only $19

RD&I Inc Portfolio Risk And Return Case Solution

The case states that several individuals serve on all three committees which is to be beneficial because it increases interaction. However, it also might bring in problems specific to areas of conflict and the like. It is important to understand that for the protection of long term interests of shareholders, majority of the board shall comprise of independent members and also the board must meet regularly outside the presence of the management.

Following questions are answered in this case study solution

-

Executive Summary

-

Modern Portfolio Analysis

-

Recommendations

-

Conclusion

Case Analysis for RD&I Inc Portfolio Risk And Return

1. Executive Summary

“RD&I” is one of the largest investment counselling firms in the country with over $30 billion under management. The firm’s principle source of income is the fees paid by the clients for portfolio management services. This annual fee is a small percentage with respect to the market value of the client’s portfolio. The company’s stated objective for equity portfolio is to achieve a 14-16% annual rate of return with a limited standard error of deviation around 5-6%.

There are three committees: Investment Policy Committee (IPC) that develops economic forecasts; Equity Selection Committee (ESC) that uses IPC recommendation to analyse companies; and Securities List Review Committee (SLRC) that monitors the recommendations made by IPC and ESC. The SLRC can make amendments to the portfolios based on current developments. The committee receives computer reports, automatically generated for any client’s portfolio that shows significant deviation from the specified risk-return objective.

Henry Stones is a new employee at “RD&I” as a portfolio manager and has previously been working at a bank as a trust officer. Upon his arrival, his impression is of both excitement and dismay. He is excited and impressed with respect to the performance of portfolios, and his dismay is relative to operational procedures that allow portfolio managers a high degree of flexibility stemming from lack of formal guidelines and procedures dealing with formulating and revising a client’s portfolio.

The various methodologies adopted by the portfolio managers varied in terms of their approach; some used a more traditional approach where they emphasized on diversification in different industries so as to eliminate the non-systematic risk. The more modern approaches were inclined towards betas of individual securities and the resulting betas of the portfolio. These approaches basically attempt to maximize returns and minimize risk, but the addition of elements such as risk-free securities can have varied impact on the returns of a portfolio.

Thus, Henry is determined to decide between Markowitz variance covariance technique and Sharpe “simplified” procedure.

2. Modern Portfolio Analysis

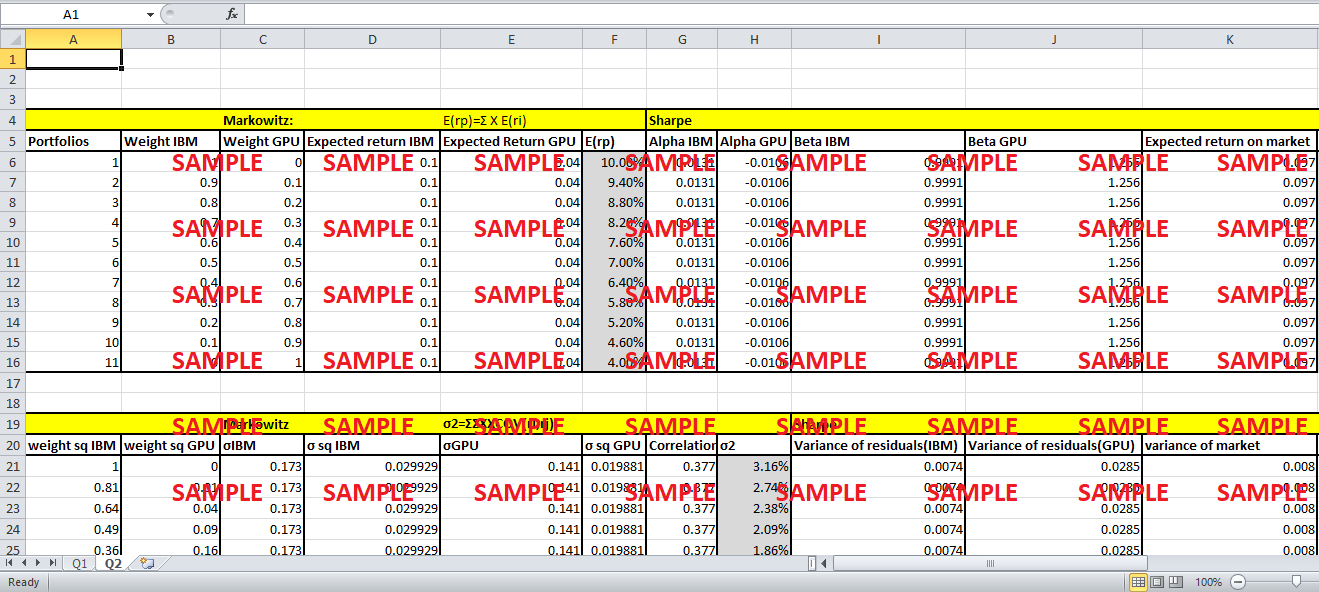

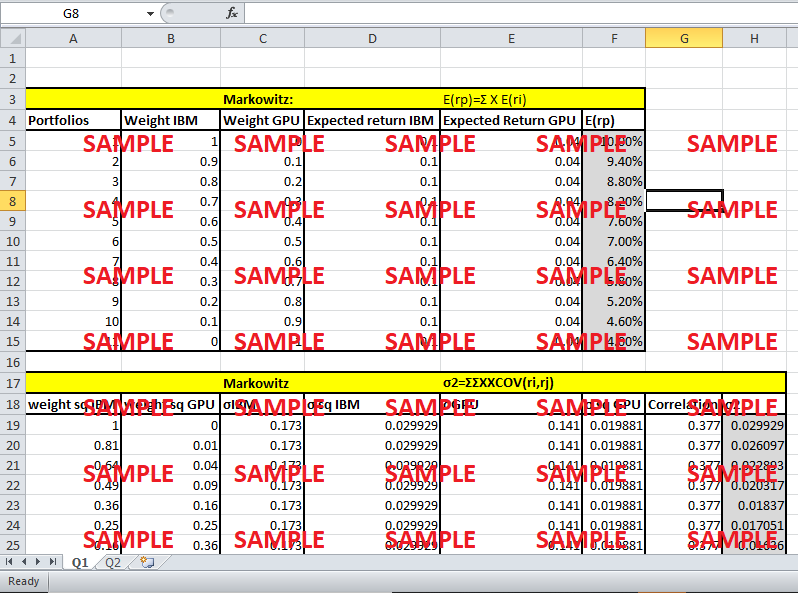

“RD&I” portfolio with only two stocks IBM and GPU depict a decreasing return as the weightage of IBM stock is dropped to zero; the reason is rather logical because the expected return of IBM stock is greater but as quantity of the stock is decreased, it adversely impacts the portfolio returns. This is the reaction on analysis towards Markowitz Modern portfolio theory.

An efficient portfolio offers the highest expected return for a specified risk. This risk level is calculated by variance or standard deviation of return. Furthermore, risk tolerance concept basically uses standard deviation to find a portfolio that will enhance returns for the standard deviation of return in line with risk tolerance.

In order to find the efficient portfolio, there is need to first find the portfolio with minimum variance for each given level of expected returns. To do this we create 11 portfolios, with 0.1 increments in weights, in the opposite direction, in each stock. There is need to calculate the expected returns based on the formula Rp = ∑ XiRi, where X represent the weights and R represent returns on individual stocks. The maximum return that was calculated was around 10% whilst, the lowest was around 4%. GPU stock has an extremely high beta which depicts its excessive riskiness as compared to the market. It might be a better idea for Henry to decrease or eliminate GPU stock from the portfolio and combine IBM stock with a certain risk-free asset that would allow more flexibility and lower cost lending at that specific rate.

With respect to the graph in sheet 2 (Q2) of excel file, the relative bulge depicts the diversification benefit of having invested in two different stocks, the peak of the bulge at 5.80% onwards to 10% is an attractive area considering portfolio construction; this is primarily due to the reason that from this point onwards as the risk increases, so does the returns. However, it must be noted that 5.8% return might as well be the optimal return with respect to variance of 1.54%.

As stated previously, the traditional portfolio theory that was being utilized by certain portfolio managers with respect to diversification across assets that are not perfectly correlated results in the portfolios risk to be lower than the weighted sum of the variances of the individual securities in the portfolio. So with respect to the theory, once you get to 30 or so securities in a portfolio, the standard deviation remains constant. The remaining risk is systematic or non-diversifiable risk. The reason to discuss this traditional theory is to emphasise that conventional portfolio theories has a certain level of strategic importance that if incorporated in our portfolio can increase our portfolio performance.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.