Get instant access to this case solution for only $19

Rosetree Mortgage Opportunity Fund (A) Case Solution

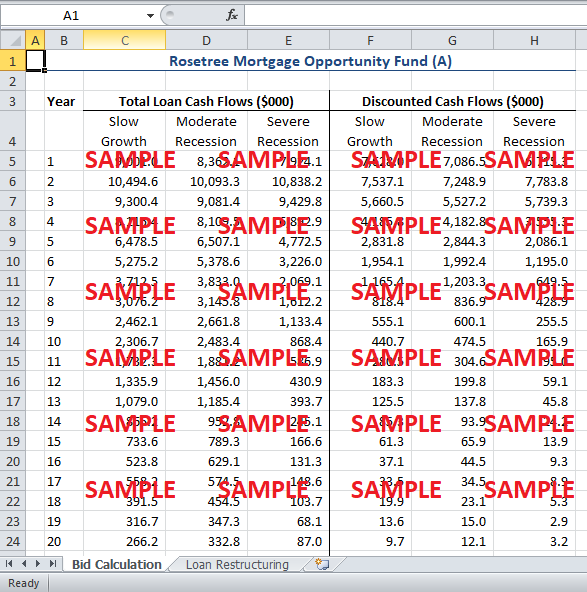

The expected cash flows from the loan differ under the possible economic scenarios. Three economic scenarios have been outlined in the case study: slow growth, moderate recession, and severe recession. It is assumed that the probability of each of these economic scenarios is equal – that one-third likelihood of each scenario. The cash flows associated with each of the scenarios are already provided. We can discount these cash flows at the required rate of return and multiply the discounted cash flow by the probability of each economic scenario to arrive at the appropriate bid. The attached spreadsheet details these calculations.

Following questions are answered in this case study solution:

-

Come up with a bid for Rosetree, explain how you got to that bid, and justify it."

-

a. What are the key risks that you have identified in your bid?

b. Which loans do you view as most risky? How will you manage the portfolio upon purchase?

c. How would the sale of modified and restructured loans increase or decrease your return?

-

Assume that you are working for the GSE's. Your objective is to create a program that will support the restructuring of troubled mortgages to help assist people stay in their houses and continue to make housing affordable:

a. What are the objectives of a program that you would create? What types of loans and borrowers should be eligible?

b. Would you provide incentives to the purchaser of this mortgage portfolio to obtain these goals? If Yes, how and what kind? If No, why not?

c. There have been several attempts at loan modification programs to assist distressed homeowners: what are the key principles of these programs, the lessons learned from them and issues raised that help to guide the establishment of a new program for borrowers in portfolios like Rosetree.

-

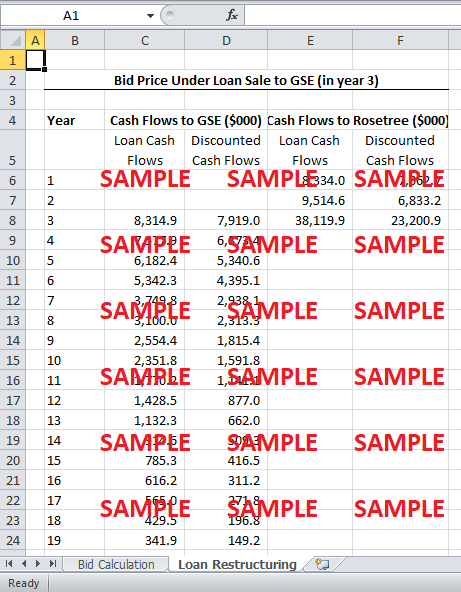

Could you estimate the impact of loan sales if loans could be made to conform to a new GSE program to purchase loans upon restructuring? How would you adjust your bid?

Rosetree Mortgage Opportunity Fund A Case Analysis

1. Come up with a bid for Rosetree, explain how you got to that bid, and justify it.

Rosetree expected to be able to purchase the mortgage loans at an internal rate of return between 15% and 20%. The average of this range is 17.5%. Therefore, we have used a discount rate of 18% to arrive at a bid. The cash flows from each of the three economic scenarios are discounted at 18% to arrive at the discounted cash flow under each scenario. The total of the discounted cash flow under each scenario is added together to arrive at the total value, under each scenario, that is expected to generate an 18% return. The total cash flow is then multiplied by the probabilities of each of the economic scenarios to arrive at the bid price that is expected to generate an 18% return. Using this methodology, the bid price should be $31.8 million.

It should be noted that it is not guaranteed that such a bid price would generate a return of 18%. Even if we assume that the cash flows generated under each scenario are very accurate, there are some inherent limitations of the methodology used to make the calculations. The 18% discount rate assumes that the cash flows generated from the loans are expected to be reinvested at the same rate. Data about the current treasury yield reveals that it is over-optimistic to assume that the cash flows can be invested at such a rate. Rosetree may only be able to reinvest the loan receipts at their own cost of capital, which may be lower than 18%. Under such a case, the actual return from the mortgage may be lower than 18%. However, there is no reason to suggest that the fund’s investor require an 18% return. They may be satisfied with an even lower return. More importantly, if the company is able to buy the loan portfolio, the company may be able to generate a higher return by renegotiating the loan terms with the mortgage holders. Therefore, the company can expect to realize an attractive return by bidding around $31.8 million for the loan portfolio.

2. (a) What are the key risks that you have identified in your bid?

There might be some uncertainty associated with the calculation of cash flows. It is practically impossible to accurately calculate the effect of each economic scenario on the cash flows associated with the loans. For instance, it may be difficult to predict the decline in housing prices and the resulting foreclosures in a severe economic recession. Furthermore, it may be difficult to predict the state of the economy. The resulting cash flows vary in accordance with the state of the economy. Therefore, the return on the loan portfolio may decrease if the economy goes into recession. However, it is difficult to predict the likelihood and the extent of such an economic recession. Nevertheless, the cash flows do not vary largely under the different economic scenarios. Under the worst-case scenario, the bid price should be only $3million lower than the current bid price. This is not a big difference when considering the magnitude of the investment.

2. (b) Which loans do you view as most risky? How will you manage the portfolio upon purchase?

An important indicator of the riskiness of loans is the loan-to-value (LTV) ratio. If the LTV increases beyond 100%, it does not make any economic sense for the borrower to repay his loan. Under such a scenario, the borrower is effectively paying more than the value of his home after accounting for time value of money. The borrower would have an incentive to default on his loan, and possibly obtain a new mortgage loan for a new house. Therefore, it is important to address the concerns of such a borrower. An effective approach might entail that the loans are restructured to decrease the loan-to-value ratio to a level below 100%. The FICO measure is also an important indicator, but it seems to be above 650 for all categories of the loans. Therefore, it may not be effective in pointing out the troubled loans.

2. (c) How would the sale of modified and restructured loans increase or decrease your return?

The loans should be restructured for borrowers who are expected to default on their loans. The restructure loans might prevent the borrowers from defaulting on their loans. If a borrower defaults, the lender will not realize any return from the value of the loan. A restructured loan may seek to reduce the obligations of the distressed borrowers. This could prevent borrowers from defaulting on their loans. For instance, if a borrower defaults, a company may realize a bigger amount of loss – such as 40% of the loan value. On the other hand, a restructured loan may be able to generate payments equal to 80% of the loan value, limiting the loss to 20%. However, the restructuring of loans should only be undertaken only for distressed borrowers. If a loan is restructure for a borrower who was willing to pay the original amount of the loan, the lender may effectively reduce the potential profit.

3. Assume that you are working for the GSE's. Your objective is to create a program that will support the restructuring of troubled mortgages to help assist people stay in their houses and continue to make housing affordable:

a. What are the objectives of a program that you would create? What types of loans and borrowers should be eligible?

The aim of the program should be to ensure that the struggling homeowners are not deprived of their homes. The primary goal is to ensure that the mortgage paid by homeowners remain affordable and attractive. The targeted borrowers can fall into two categories. One category is composed of people who are not able to afford their mortgages because their family income is too low. They may be characterized as the sub-prime borrowers, who can be identified with a low FICO score. The second category is comprised of people whose homes are worth less than the present value of their mortgage payments. They may be able to afford their mortgage payments, but such payments are no longer attractive because they are paying more than the fair value of their loans. Such borrowers can be identified with a loan-to-value ratio of greater than 100%. A borrower can fall into both these categories as well. GSE should initiate separate programs for both these categories, where the objective should be to make the loan payments affordable or attractive.

b. Would you provide incentives to the purchaser of this mortgage portfolio to obtain these goals? If Yes, how and what kind? If No, why not?

The program initiated by the GSE should be separate from the purchaser of the mortgage portfolios. If a fund purchases a portfolio, the purchaser already has an incentive to restructure the loans in order to prevent foreclosures. Such purchasers would implement the restructuring program if the need arises. Although GSE could facilitate the purchaser, but it could better utilize its resources by concentrating on portfolios that the mortgage funds like Rosetree are not eager to purchase. Some funds may not be attractive because of the high probability of foreclosures. GSE could restructure such funds to attract the attention of funds like Rosetree. In this way, GSE would be able to utilize its resources in a more efficient way and provide a more equitable solution to the homeowners who are trapped in less attractive loan portfolios.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.