Get instant access to this case solution for only $19

Rosetree Mortgage Opportunity Fund (B) Case Solution

Following the financial crises, Investors have been overly cautious as far mortgages are concerned. As the case illustrates, investors have not been willing to invest their money is mortgages. This is in sharp contrast to the circumstances before the financial crisis when there was a huge demand for mortgage-backed securities. This huge demand for the securities was the prime reason behind inflated home prices and over-inflated securities. In other words, the excess demand for mortgages led to over-valued investments in mortgages. The situation has completely reversed after the crisis: the demand for mortgage loan portfolio is less than optimum demand. Therefore, the mortgage loan portfolios, such as the one considered by Rosetree may be underpriced. Most of the institutions that own such portfolios are highly leverage and want to de-lever their balance sheets. Therefore, they might be willing to sell their portfolio at price below their fair market value. Moreover, investors are cautious about mortgages after the crisis and the portfolios holders are short of potential buyers. Rosetree, on the other hand, has accumulated $1.2 billion for investment in such potentially undervalued investment. The company also has the expertise to renegotiate the loans with individual borrowers and minimize the foreclosures. These reasons make the $65 million an attractive investment for companies like Rosetree.

Following questions are answered in this case study solution

-

Why is the $65 million loan portfolio a potentially interesting investment?

-

Using information provided in the case on portfolio cash flows under alternative scenarios and the Treasury yield curve, what it the portfolio’s fair market value? Feel free to undertake some sensitivity analysis at different discount rates. What should Rosetree pay for the portfolio and why?

-

What do we learn from this case about the cost and difficulty of ameliorating the housing crisis?

Case Analysis for Rosetree Mortgage Opportunity Fund (B)

2. Using information provided in the case on portfolio cash flows under alternative scenarios and the Treasury yield curve, what it the portfolio’s fair market value? Feel free to undertake some sensitivity analysis at different discount rates. What should Rosetree pay for the portfolio and why?

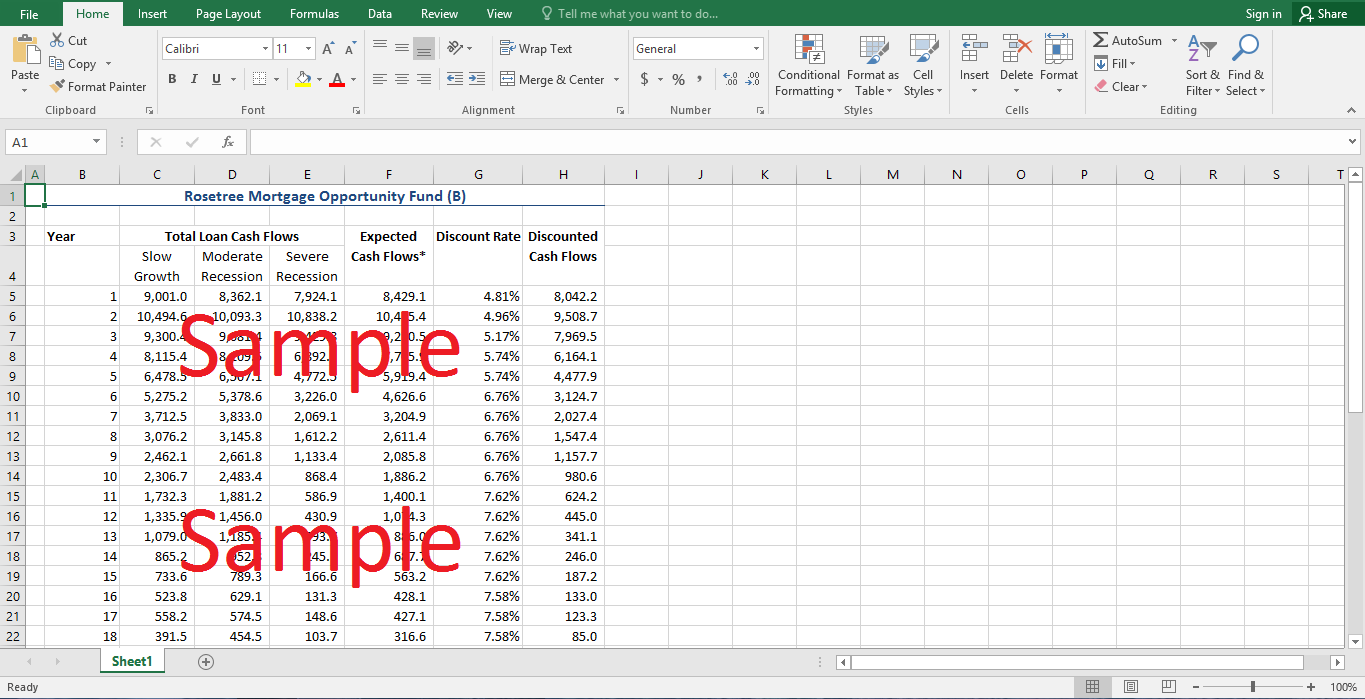

The cash flows under the alternative scenarios have been provided in exhibit 5 and 6 of the case study. There are three possible scenarios under consideration: slow growth, moderate recession, and severe recession. The company has also provided cash flows under a possible loan restructuring under the severe recession scenario. However, it is believed that only Rosetree has the ability to successfully restructure these loans and obtain the resulting cash flows. Therefore, the increased cash flows after restructuring should not be included in the calculation of fair market value of the portfolio. The calculation of the fair market value of the loan portfolio is described in the attached spreadsheet. The expected cash flows are calculated by averaging the yearly cash flows across the three scenarios. The assumption is that all three scenarios are equally likely to occur.

The discount rate is chosen by adding a default spread to the treasury rates. The discount rate caries across the cash flows horizon in accordance with the changes in the treasury yield curve. It is assumed that the default spread will remain constant. It is difficult to come up with a reasonable estimate of the default spread. As a base case, the default spread is assumed to be 4%. However, a sensitivity analysis is also constructed that demonstrate the change in market value of the portfolio if default spread is altered. The sum of the present value of the expected cash flows provides us with an estimate of the market value of the loan portfolio. Under the base-case default spread of 4%, the fair value of the $65 million loan portfolio is $47.4 million. This value decreases to $43.9 million if the default spread is increased to 6%, and increases to $51.4 million if the default spread decreases to 2%. The loan can be sold at a discount of 79% if the default spread is as low as 2%. Alternatively, the loan will carry a discount of 59% if the default spread is 10%. It is evident that the fair value of the portfolio is highly dependent on the default spread. Therefore, it is important to calculate an appropriate default spread. The spread is likely to be on the lower side as the cash flows already consider some possible foreclosures. Therefore, the fair market value of the portfolio is expected to be closer to the base-case value of $47.4 million. However, Rosetree can expect to obtain the portfolio at a lower price because it is expected to be undervalued. The scarcity of competitive bidders and the levered position of the seller might enable Rosetree to buy the portfolio at a lower price. Moreover, Rosetree is an investment fund that is expected to realize a certain rate of return on the investment. Therefore, it should bid around $35 million for the loan portfolio.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.