Get instant access to this case solution for only $19

Rushway Brothers Lumber and Building Supplies Case Solution

Established in 1992, RLBS was first in the lumber business only. During 1945 and 1951, the company expanded into a variety of products. A construction business was also started as a part of the company’s core business. In 1959, the owner died resulting in reorganization of the company. Finally in 1988, the company hired managers for its retail and operations business from where the problems started. The financial statements of the company started to strain, risking credit relations and reputation of the business. These will be discussed in detail further on in the report. Charlotte was assigned the task of taking over the operations and credit side of the Rushway Brothers Lumber and Building Supplies Ltd., at the end of 1989. She handled various business departments, became the president and the CEO of the company and participated as a sole shareholder during her three years tenure. When she started working in the company, the financials were bad: inventories were overstated, debts and interest costs high and shareholder profits too low. The company did not have a good working relationship with its creditors, and the general management of the business was misshaped.

Following questions are answered in this case study solution

-

Introduction

-

Background

-

Analysis

-

Decision and Plan of Action

Case Analysis for Rushway Brothers Lumber and Building Supplies

Charlotte worked to generate positive cash flows for the business, developed staff and managed to run the company fairly better than the competitors. After successfully managing the company and removing almost all its major problems, she is considering selling the business now in 1992. In this report, we discuss the alternatives available to Charlotte and reach a conclusion about the best choice. Facts and exhibits will be provided to support each argument.

2. Background

RLBS was into two related businesses: merchandising and construction. The merchandising side included a lumber yard and a retail store where home building and repair products were sold. This had two types of customers: the home owners and retail customers, and the contractors. Quite naturally, the contractors brought more than 50% of the company’s businesses. The construction side involved bulk purchases for building or repairing homes. The assets of the business principally were “the receivables, the inventory, and the land buildings and equipment.” The company reported a book value of $ 265,000 at the end of the fiscal year 1991. The sole bank extending cash to the business was Metropolitan, and the company had a good working relationship with the bank.

3. Analysis

For analyzing the problem at hand and coming up with the most suitable solution, different alternatives available to Charlotte should be considered. Each alternative would then be analyzed in the light of available qualitative and quantitative data, and a decision would be reached.

• Alternatives

RLBS is well-established and has been in operation for more than 70 years. Since the business is currently generating profits, closing the business is not a good option. It is also operating with complete compliance with the existing country laws, which makes it a very attractive opportunity.

However, Charlotte has reached the epitome of her career: she has run different departments of the business singlehandedly, been the president as well as the CEO. She is now more inclined towards getting a job than running an organization.

She now has the options of:

-

Transferring ownership of the business to another family member or close friend.

-

Hiring an outside experienced professional to run the family business.

-

Selling the business while it is still generating profits.

• Criteria

The factors to be taken into consideration to evaluate the feasibility of each alternative would be which one of these is the least time taking, cost-effective and most valuable. It is evident from the case that the company maintains its financial statements with cash flows forecasts on a monthly basis, has an up-to-date business plan in place, has sufficient systems to support budget and costs controls, and has a good working relationship with lending agencies. All this makes the three alternatives meeting the relevant criteria of adoption.

Undertaking the first alternative involves the transfer of all legal documents and ownership titles to the new owner. This also means reassigning any copyrights and patents to the new business owner.

Hiring an outside experienced professional to run the family business is the second option, which has been tested before. The former experience of the company and its management with Jack Fairlee and Paul Gaudet makes it clear that this option is bound to fire back to the company in the shape of increased debt and decreasing profit figures.

When deciding to sell the business, the current market conditions should be taken into account, and industry analysis should be performed. This would reveal the true value of the company, and whether selling is a profitable option or not.

• Qualitative Analysis

Transferring ownership of the business would involve a lot of legal bodies for Charlotte. She would first have to cancel her Business Number, notify the relevant Taxation Authorities about the change, cancel tax registrations from under her name, pay outstanding bills and transfer all business documents and domain names to the new owner. Each step has costs attached to it, which will be underlined in the quantitative section of the report. Hiring outside personnel to manage the business has lots of risks attached. The company has had a former bad experience in the case of Jack Fairlee and Paul Gaudet. After they had been hired as construction operation’s manager and retail and wholesale products business’s manager, respectively, the company had a strain on its financial statements. Inventories were overstated, and the corresponding bank loans, and interest costs were high. Profits to shareholders were at an all-time low. Hence, the natural wariness for avoiding bad outcomes makes this an unfeasible option.

Lastly, there is the option of selling the business. We should consider market trends before selling the business. Is the business idea still valuable in the current markets or is it likely to become more valuable in the future? Should Charlotte wait some more or sell right away? These questions are answered in the quantitative section. For Charlotte to sell the company, she should have the following documents prepared and ready, in case the buyer wants to value the company individually:

-

Financial statements

-

Legal documents including registration papers and licensing agreements (if any)

-

Business history

-

Market conditions

-

Business plan

-

Employee, supplier and customer details

• Quantitative Analysis

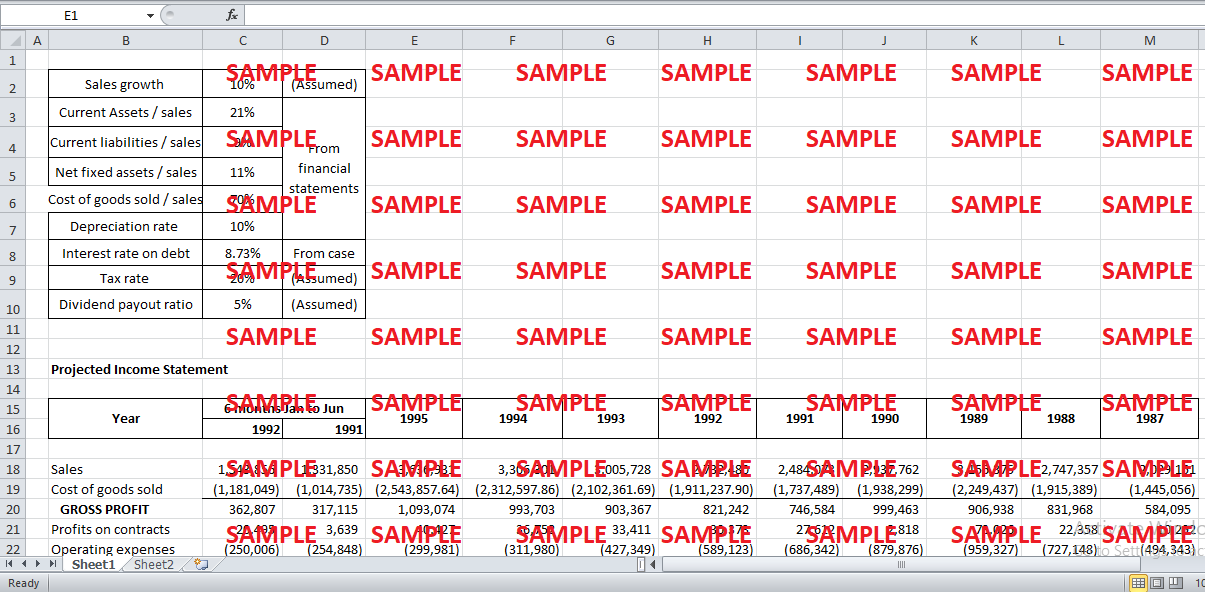

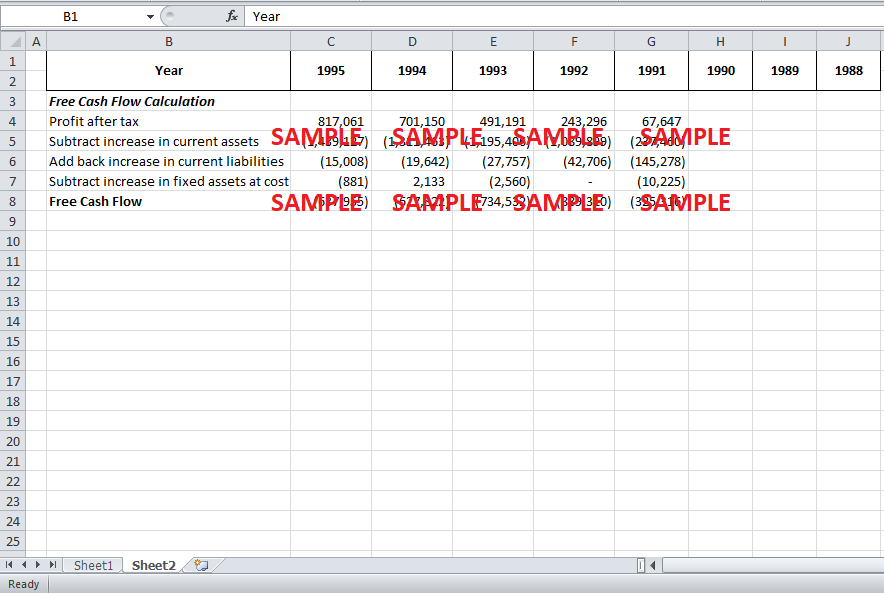

Let’s analyze the financial statements of the business to see whether or not this is a viable business. Consider Appendix: Exhibit 3 for this:

-

The projected financial statements show positive cash flows, sales and net income figures for the next five years.

-

Gross margin of the company is positive and more than 10% of the sales. There is no evident declining trend in gross margin as a percentage of sales. Same is true for EBITDA and net assets and liability position.

-

The current and quick ratio of the company is more than 1 and 0.5 respectively, which means the current assets of the business exceed the current liabilities. (Appendix: Exhibit 2)

-

It has an average monthly cash flows of $ 10,200

-

Gross margin has been between 29% – 34% and EBITDA stood at 4% as a percentage of sales, in the past three FY.

• Evaluation of the Alternatives

Close evaluation of all the alternatives from the above quantitative and qualitative analysis shows that the best choice for Charlotte here is to sell the business.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.