Get instant access to this case solution for only $19

Siemens Electric Motor Works (A) Process-Oriented Costing Case Solution

In order to calculate the total cost of all order types for the old costing system, one needs to add the overhead costs of support related activities to the base costs of the motor and special components. On contrast, for the new costing technique, two additional cost centers need to be established. The overhead rate for the order processing and specialty components are computed to be $210.29 and $60 respectively. The unit cost of all order types remains the same for the number of units demanded. The new costing system shows that the unit cost decrease as the number of demanded units increases. The new costing method is very efficient in allowing management to improve decision making.

Following questions are answered in this case study solution

-

Calculate the cost of the five orders in Exhibit 4 under the traditional and new cost systems.

-

Calculate traditional and revised costs for each order if 1 unit, 10 units, 20 units, or 100 units are ordered. Graph the total product cost (for orders of 1, 10, 20, and 100) against volume ordered, and then repeat for product cost per unit.

-

Does the new cost system support the strategy of the firm in ways that the traditional system cannot? Is Karl-Heinz Lottes overestimating the value of the new cost system? Discuss.

Case Analysis for Siemens Electric Motor Works (A) Process-Oriented Costing

1. Calculate the cost of the five orders in Exhibit 4 under the traditional and new cost systems.

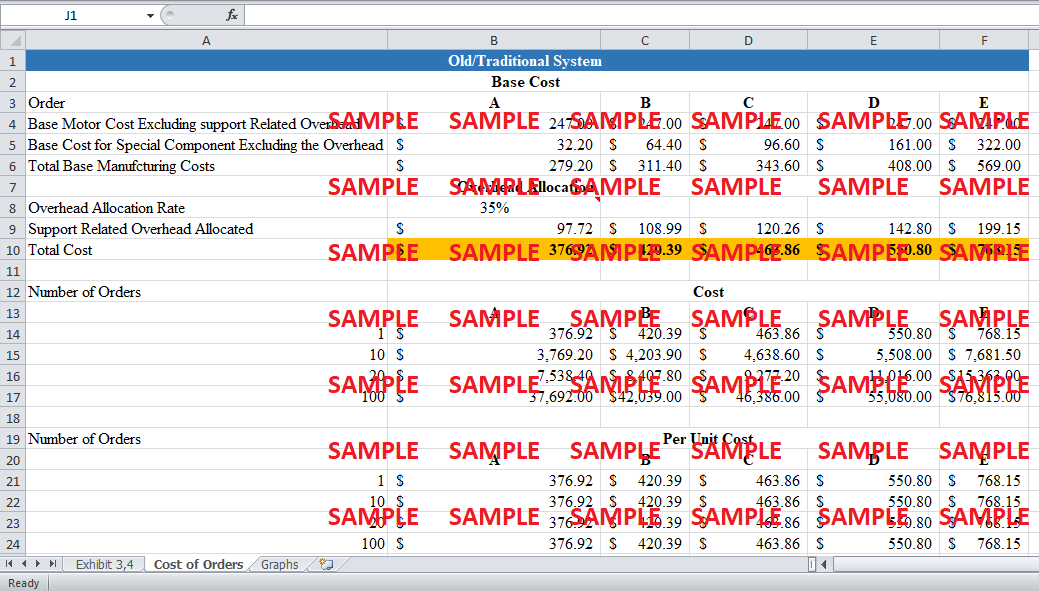

In order to strengthen the decision-making process, Siemens Electric introduced a new costing system and this is essential that the cost centers, overhead allocations and the unit costs of both the previous and the new costing systems are gauged. The prevalent costing system allocates costs to the motors by introducing a number of overhead items. In the calculations of the unit cost for the traditional system, the base cost already includes the manufacturing overhead items. These items include labor overhead, material overhead and a variety of costs. However, if one wants to compute the unit price, then the support related overhead also needs to be allocated. The traditional costing system provides a burden rate of 35% (35% of the other manufacturing costs) for the support related overheads. The total base cost for a traditional costing system is equal to the sum of the base costs of motors and special components. This amount needs to be adjusted for the incremental 35% of the support-related overhead. As the number of different types of special components varies across different order types, the base cost of the special component changes through every order type. However, the base cost of the motor remains unchanged at $247. This is the prime reason why the allocated overhead for the support activities and the total cost of every type of order increases as the number of specialty components increases across every order type. The following table shows the five given orders in relation to the old costing system:

|

Order Type |

A |

B |

C |

D |

E |

|

Cost |

$ 376.92 |

$ 420.39 |

$ 463.86 |

$ 550.80 |

$ 768.15 |

For the new costing system, the computations for the unit cost are largely different from the traditional method. Two additional activities, named as order processing and special component costs are also included in the overhead. Theoretically, the overhead from these two activities will be added to the unit manufacturing costs of every order. However, before doing this step, one needs to establish the cost centers and the overhead rates for these two activities. For order processing activity, it is evident that the relevant measure of the activity is the total number of orders. In the year 1987, a total of 62625 orders were processed. At the same time, the cost details show that the total amount of $13,800,000 was spent on these orders. This implies that the overhead rate per product would be $210.29. In the case of special component activity, the relevant cost driver is the ‘number of times the special components are processed’. This is equal to 325000. By dividing the total cost of the special components with this number, the overhead rate for this overhead center comes out to be $60. However, this is an overhead that should be allocated for one special component. As the number of special component increase, the allocated overhead will also increase.

|

Order Type |

A |

B |

C |

D |

E |

|

Cost |

$ 613.89 |

$ 713.49 |

$ 813.09 |

$ 1,012.29 |

$ 1,510.29 |

2. Calculate traditional and revised costs for each order if 1 unit, 10 units, 20 units, or 100 units are ordered. Graph the total product cost (for orders of 1, 10, 20, and 100) against volume ordered, and then repeat for product cost per unit.

In the case of the traditional costing system, the overhead is allocated on the basis of 35%. For every order type and for any level of units demanded, the overhead allocation will be the same. Therefore, the total cost of all order types will remain the same regardless of the total amount of units demanded. This also implies that the unit cost across all the order types will also remain the same. The following formula can be used to compute the total cost:

Total Cost for Order Type = (Base cost of Motor and Special Components + Overhead) * Number of Orders

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.