Get instant access to this case solution for only $19

Songy 2011 Restructuring To Survive Or Surviving To Restructure Case Solution

The recession was beyond David’s control so it wasn’t his or his partners’ fault if things went worst. But few errors done by Songy were that they didn’t evaluate the riskiness of partners with whom they conducted business i.e. Omni turned out to be the worst partner and Songy had to bear the payment which was supposed to be paid by Omni.

Following questions are answered in this case study solution

-

Which of David’s predicaments are attributable to unique outside forces versus human error? What could he have done differently?

-

What are the “critical assets” worth?

a. Dallas Garden Inn; should he make the $2 mm paydown?

b. Westheimer; how would the negotiation be different if there were two separate loans instead of one cross-collateralized loan?

c. Carpenter; how does the Songy corporate guarantee impact his strategy?

-

What are David’s obligations to his limited partners?

Case Analysis for Songy 2011 Restructuring To Survive Or Surviving To Restructure Case Solution

Additionally, Songy appeared quite overconfident while dealing with banks during its good days. Such high-interest rate exposure and allowing the bank to seek further amounts in guarantee if loans went bad were not a good strategy for Songy’s. even the banks they took a loan from were not well-developed well-regulated ones. This bank ultimately defaulted and their acquirers which were already giants were quite strict in terms of their regulations. This made the negotiating part worst for Songy.

2. What are the “critical assets” worth?

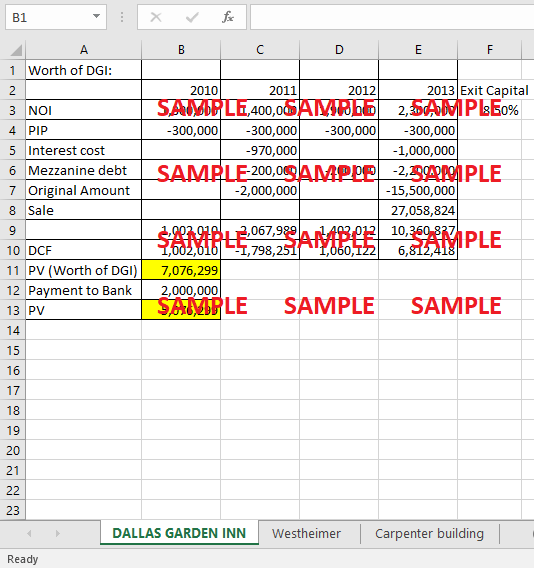

Dallas Garden = 7.1 million dollars (excluding 2 mn of bank paydown) (refer below table for calculations).

Westheimer = 12.4 million dollars. If things work out as planned.

|

2010 |

2011 |

2012 |

2013 |

|

|

|

Office NOI |

200,000 |

400,000 |

600,000 |

800,000 |

7.5% |

|

Hotel NOI |

1,800,000 |

2,000,000 |

2,200,000 |

2,900,000 |

8.00% |

|

Total NOI |

2,002,010 |

2,402,011 |

2,802,012 |

3,702,013 |

|

|

CAPEX |

|

|

-2,500,000 |

-2,500,000 |

|

|

Cost of Debt |

|

-1,100,000 |

-1,100,000 |

-1,100,000 |

|

|

Principal |

|

|

|

-32,000,000 |

|

|

Sale |

|

|

|

46,916,667 |

|

|

Value |

2,002,010 |

1,302,011 |

-797,988 |

15,018,680 |

|

|

DPV |

2,002,010 |

1,132,183 |

-603,394 |

9,875,026 |

|

|

PV |

12,405,826 |

|

|

|

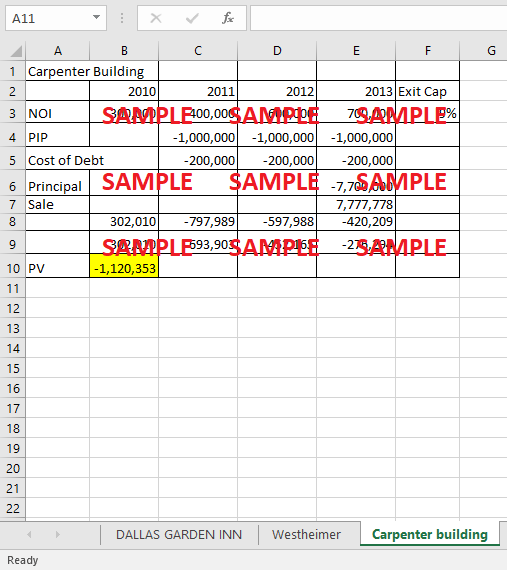

Carpenter buildimg = -1.1 mn dollars. (refer table below).

a. Dallas Garden Inn; should he make the $2 mm paydown?

|

Worth of DGI: |

|

|

|

|

|

|

|

2010 |

2011 |

2012 |

2013 |

Exit Capital |

|

NOI |

1,300,000 |

1,400,000 |

1,900,000 |

2,300,000 |

8.50% |

|

PIP |

-300,000 |

-300,000 |

-300,000 |

-300,000 |

|

|

Interest cost |

|

-970,000 |

|

-1,000,000 |

|

|

Mezzanine debt |

|

-200,000 |

-200,000 |

-2,200,000 |

|

|

Original Amount |

|

-2,000,000 |

|

-15,500,000 |

|

|

Sale |

|

|

|

27,058,824 |

|

|

|

1,002,010 |

-2,067,989 |

1,402,012 |

10,360,837 |

|

|

DCF |

1,002,010 |

-1,798,251 |

1,060,122 |

6,812,418 |

|

|

PV (Worth of DGI) |

7,076,299 |

|

|

|

|

|

Payment to Bank |

2,000,000 |

|

|

|

|

|

PV |

5,076,299 |

|

|

|

Songy should pay 2 million dollars to the bank and reap the benefit of 5.1 million dollars in the future.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.