Get instant access to this case solution for only $19

Stone Creek Vineyards 2000 Case Solution

Stone Creek vineyard was purchased by the parents of stone sisters in early 1950’s. Initially, these vineyards were not used for commercial purposes. To reduce the overall tax liability, the parents of the stone sisters gradually transferred the ownership of the vineyard to their daughters. In early 1990s, both the daughters took control of the vineyard and built the infrastructure necessary to expand the business on a large scale. Internally generated funds were by no means sufficient to support this expansion program. So, huge amounts of debts were borrowed to meet the capital needs to sustain the expansion program. However, even after a decade, the company could not become financially independent and was still dependent on external financing. The stone sisters were running out to of options for external financing. Mr. Arthur Malone made an offer to make a loan to the company, and at the same time allow both the sisters to remain as managers for next ten years.

Following questions are answered in this case study solution

-

What are the unique characteristics of this industry and the company that result in the financial challenges being faced by the Stone sisters? Make certain to mention the firm’s current goals, objectives and strategies.

-

Evaluate the operating and financial performance of Stone Creek over the last 5 years. Why has the firm required the extensive use of external financing the last 5 years when profits have been positive and margins have expanded?

-

How have the Stone sisters met their financing needs over the 5 years? Examine all sources and uses of funds and comment on management’s decisions as far as effectiveness. Has Stone Creek’s financial strength increased with its apparent success in the marketplace?

-

Create pro forma Income Statement and Balance Sheets for the next 2 years using.

-

If you were Mr. Serrano would you make the loan?

-

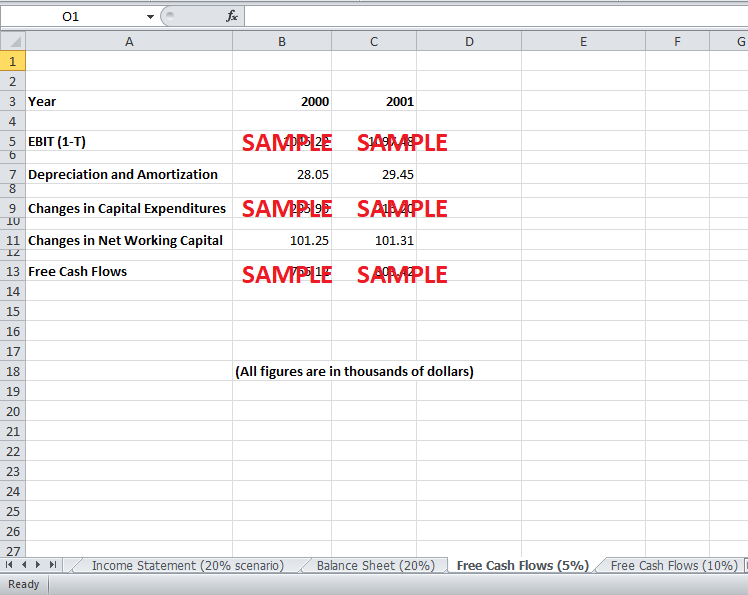

Evaluate the valuation provided by calculating the Free Cash Flow of Stone Creek for years 1996 to 1999 by using the free cash flow computed in question 5.

-

Is the 11 million dollar offer reasonable?

-

How should the Stone sisters resolve their dilemma? (I.e. pick a growth rate and financing method that maximizes value.

Case Analysis for Stone Creek Vineyards 2000

1. What are the unique characteristics of this industry and the company that result in the financial challenges being faced by the Stone sisters? Make certain to mention the firm’s current goals, objectives and strategies.

The vine industry is highly capital intensive and is marked with the competition. Although the number of players in the industry is very high, only the large companies have the resources that can meet the requirements of the market. That is why, most of the small family owned businesses were acquired by larger businesses to expand their size and take advantage of the economies of scale. The reason why small business like stone creek find it very difficult to become independent financially is that the nature of the business. The resources are piled up for a long time before they can be converted to sales. Although stone sisters were successful in implementing the business strategy, they could not control most of the fixed costs like capital expenditures, interest costs etc. That is why profit margins were not sufficient to make the firm financially independent.

i. Perform a SWOT analysis.

Strength

The main strength of the business is the consistency of financial and operational performance despite dismal market conditions. The company has earned a strong brand name and strengthened the distribution network continuously.

Weaknesses

The main weakness that has stopped the company from achieving its true potential is the lack of long term capital investment in the business. The increased borrowing to meet the capital needs have been depriving the firm of profits due to very high interest costs associated with borrowing.

Opportunities

The company has the opportunity to expand sales of its premium products on the internet. If stone sisters succeed in exploiting this opportunity, their company will have a significant competitive advantage over other firms.

Threat

Although every year, new players came in the wine industry, the threat of new entrants was not significant for Stone Creek Vineyard. This is because the industry was highly capital intensive. Huge investments were required to buy crushing facilities, fermentation tanks and vineyards and barrels. This is the reason why most of the family owned businesses were acquired by the large players most of the times.

2. Evaluate the operating and financial performance of Stone Creek over the last 5 years. Why has the firm required the extensive use of external financing the last 5 years when profits have been positive and margins have expanded?

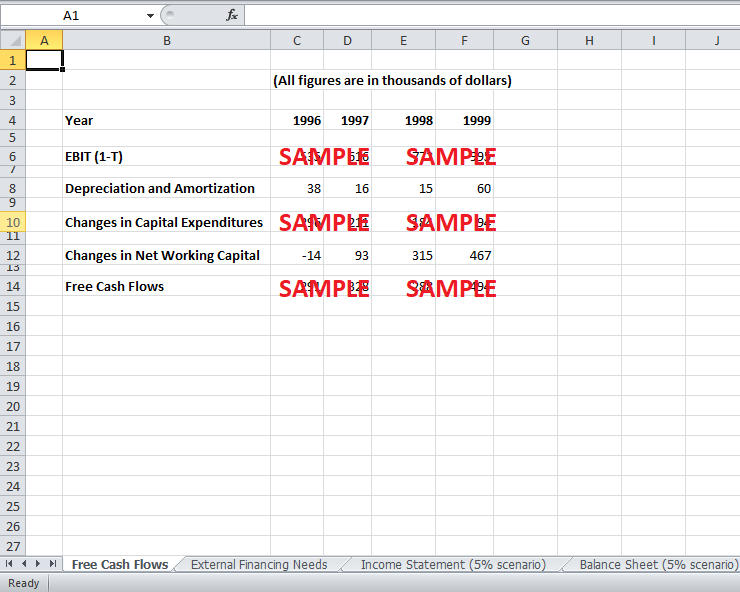

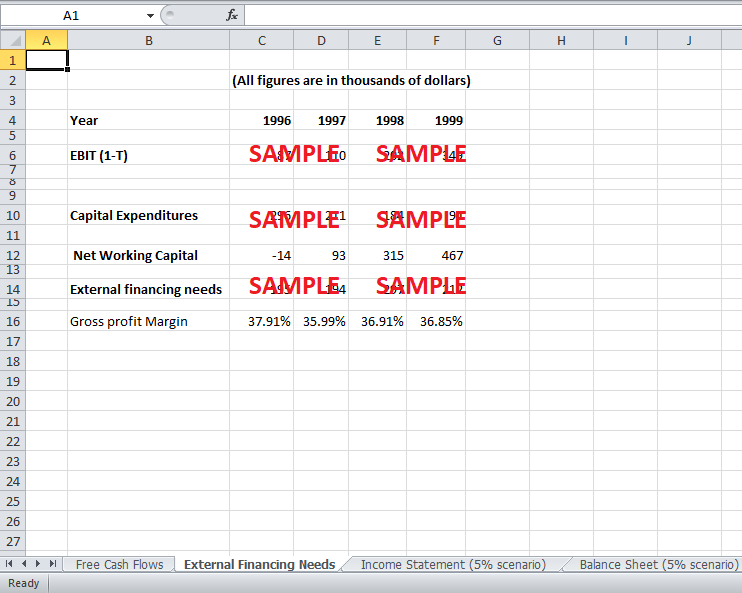

External financing needs can be calculated by subtracting capital expenditure and working capital needs for a year from net income. If the outcome is negative, it means that even if all of the net income is retained and reinvested, it is not sufficient to meet the capital needs of the company and the company has to acquire capital from external sources. Calculations show that the firm’s net income has never been enough to cover the financing needs of the company. External financing needs of the company have remained $195 thousand, $194 thousand, 297 thousand and 212 thousand for years 1996-1999. This is because the nature of the business is such that the company needs extensive investment in working capital. It takes a lot of time to convert the investment in working capital into sales. The profit margin of the company remained almost the same for all these years i.e. around 37%. So, the operational and financial performance of the company has remained exceptional and at the same time very consistent. A profit margin of 37% is extremely good as compared to other players in the same industry. However, since the business is highly capital intensive, the company needs huge external financing because internally generated funds are not sufficient to meet the financing needs. That is why the company borrowed consistently and hence, paid huge interest costs every year. So, apparently the reason behind the consistent need for external financing is that return on capital earned by the operations has remained almost the same as the cost of financing. Furthermore, the company has consistently added new acres to expand the scales of business and take advantage of economies of scale. That is why the company consistently needed external financing to meet growth needs.

3. How have the Stone sisters met their financing needs over the 5 years? Examine all sources and uses of funds and comment on management’s decisions as far as effectiveness. Has Stone Creek’s financial strength increased with its apparent success in the marketplace?

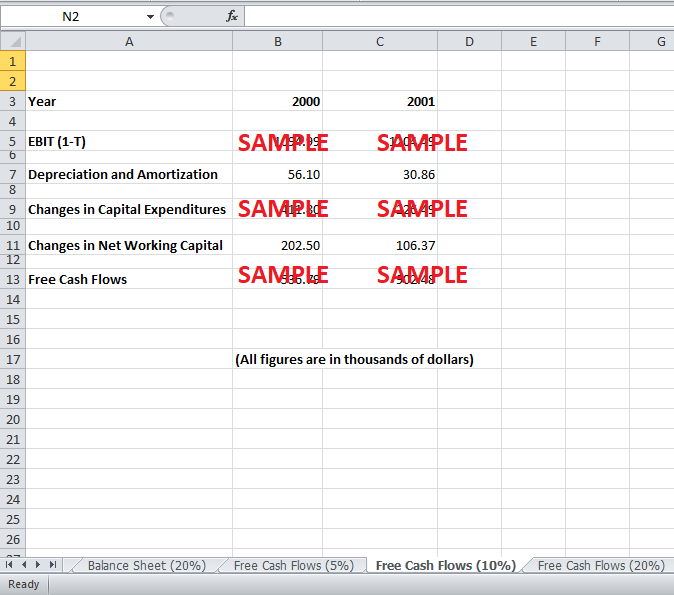

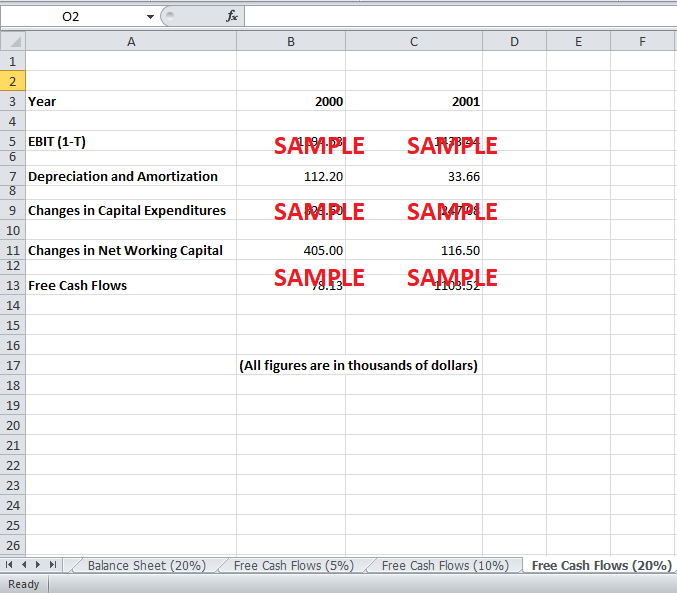

Apart from the net income of the company, two main sources of financing are borrowing from Mr. Wagner and the issued by the local Bank. Free cash flow analysis in the excel sheet shows that the capital expenditures have been decreasing every year, whereas investment in working capital has been increasing tremendously. This is the reason why the company has never been able to become financially independent. A large chunk of cash is always piled up in the working capital, and it takes at least a year to convert investment in working capital into sales. However, management of the company has done very well in utilizing the funds for the growth of the company. Expansion of the company was a very critical phase because without achieving a particular size, the company could not enjoy the benefits of economies of scale. Therefore, although the effects of growth and expansion are still not visible due to weak liquidity position, the benefits of all these efforts will start to appear slowly. In the next years, capital expenditures will decrease further, and the liquidity position of the company will improve. The success in the market of the company will slowly improve the financial position of the company while most of the major expenses like interest cost and capital expenditure will decrease tremendously.

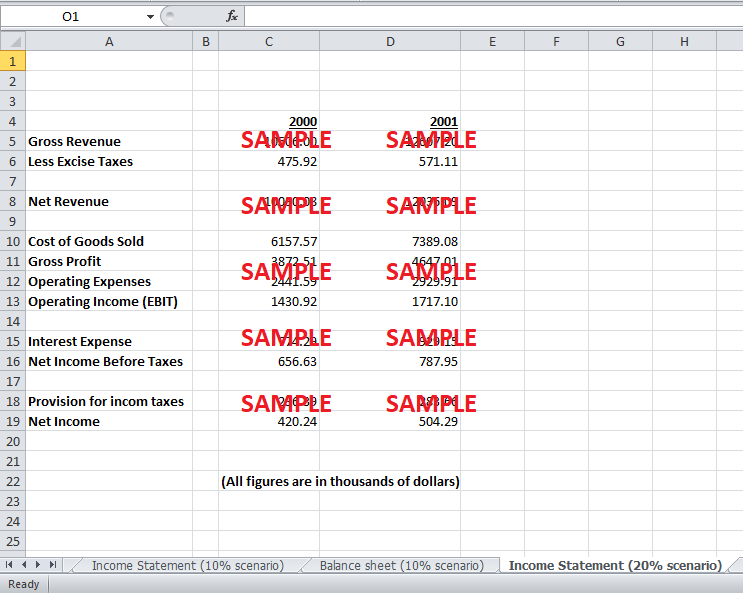

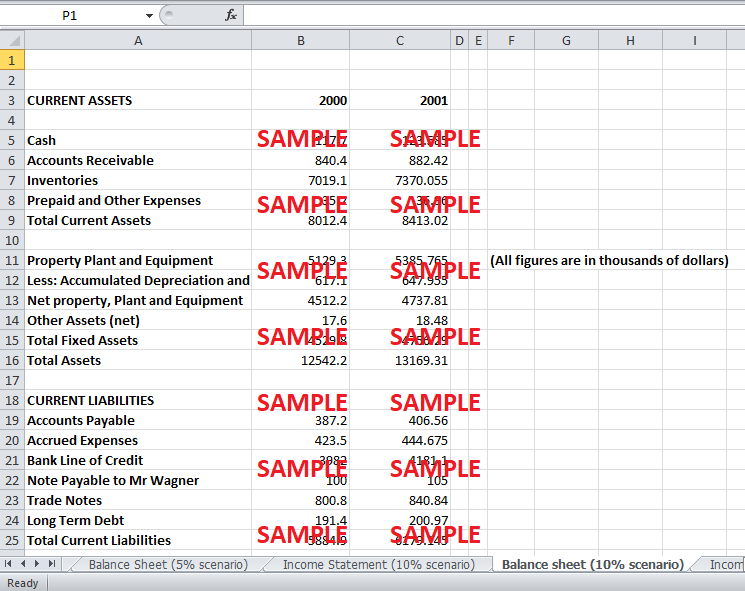

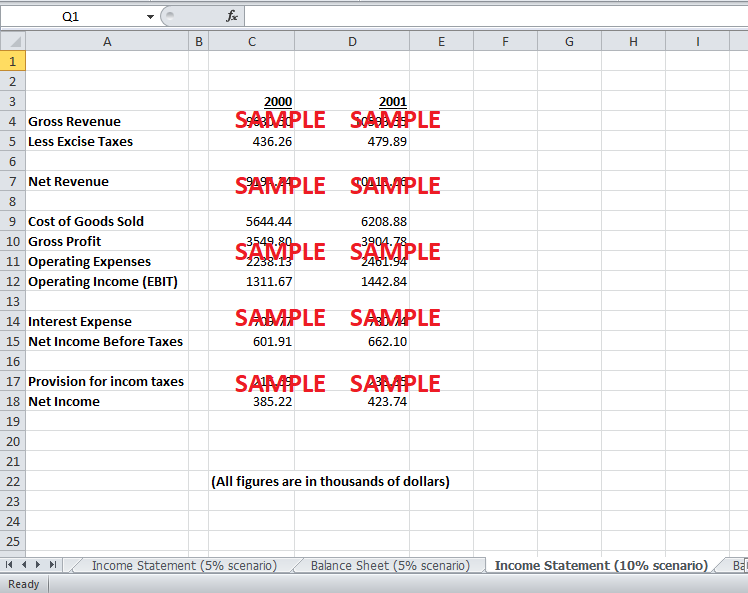

4. Create pro forma Income Statement and Balance Sheets for the next 2 years using.

a. Only internally generated funds (5%).

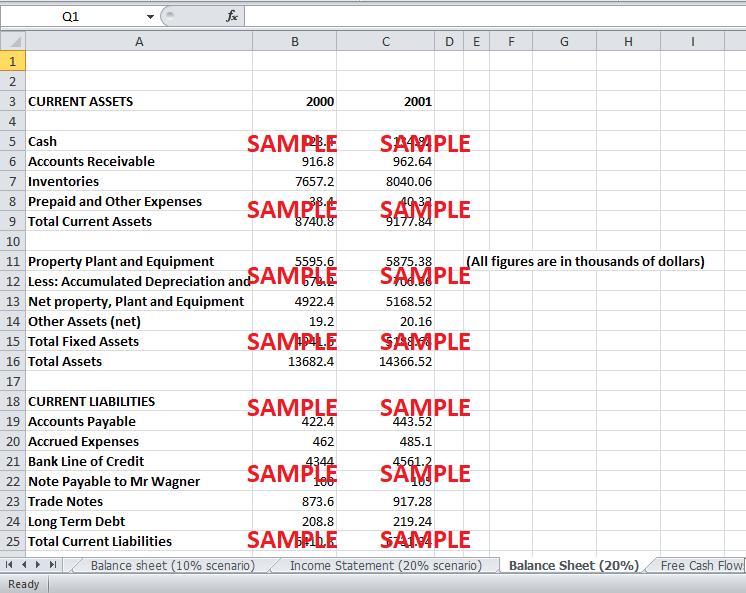

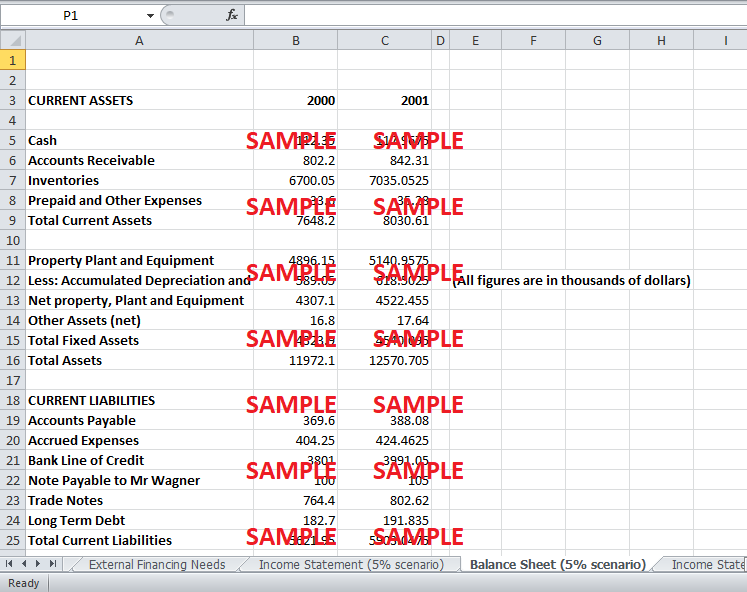

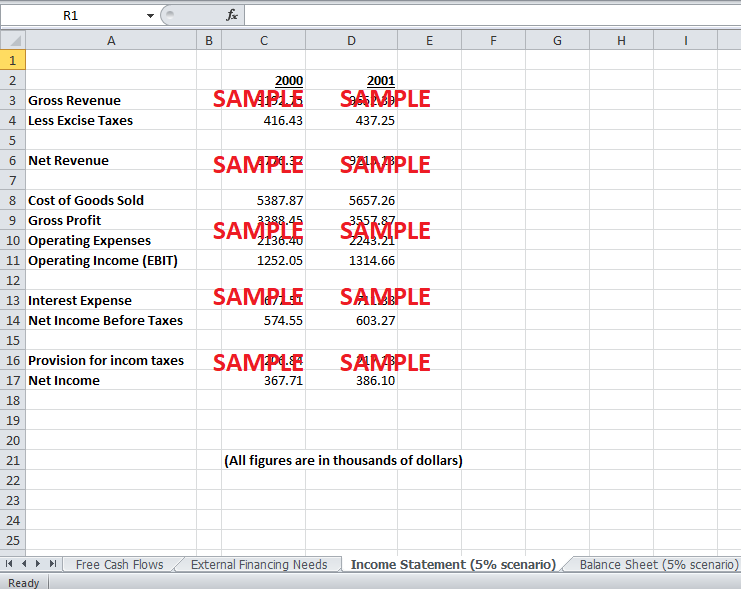

If only internally generated funds are used to maintain a revenue growth rate of 5%, $367,710 and $386,100 are net income values that are obtained for years 2000 and 2001. Total Assets figures come out to be $11972.10 thousand and $12570 thousand for years 2000 and 2001 respectively. Although using just internally generated funds will slow down the growth of the company, profit margin will increase because of lower interest expense as a percentage of revenue.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.