Get instant access to this case solution for only $19

Sun Microsystems Case Solution

The acquisition of Sun Microsystems could be a good strategic fit for the Oracle as it did not have any similar product offerings as Sun Microsystems have. By acquiring leading worldwide providers of industrial-strength hardware, software, and service provider, Oracle can be able to sell the products to existing customers through cross-selling. Oracle can create many applications by utilizing Sun’ Jawa. The whole idea is to provide one-stop shopping for the customer who would reduce the customer’s research cost. By adding diversified products to its portfolio, Sun can mitigate the risk to some extent.

Following questions are answered in this case study solution

-

Is Sun Microsystems a good strategic fit for Oracle?

-

What approaches would you use to place a value on Sun Microsystems?

-

The best approach to the valuation of Sun Microsystems?

-

Assuming a discounted cash flow valuation: What rate of return should Oracle require on the acquisition? What base-case cash flows do you forecast?

-

Identify the synergies and conduct a sensitivity analysis to estimate the effect of synergies on enterprise value.

-

If a competing bidder appears, how high a price should Oracle be willing to offer?

Case Analysis for Sun Microsystems

2. What approaches would you use to place a value on Sun Microsystems?

There are several approaches that can be used to calculate the value of Sun Microsystems. Three approaches which are named as income approach, market approach and cost approach which are mainly used to put a value on the company. The income approach accounts for the future cash flows of the company and converts them to present single cash value. For example, free cash flows method. The market approach uses transactional data to calculate the value of the company. For example, comparative transaction method. The last approach determines the value of the company by identifying the market value of company’s asset.

3. The best approach to valuation of Sun Microsystems?

The best approach to value the Sun Microsystems is income approach because it is directly linked with company’s ability to generate financial benefits in future. The idea is to find the company’s value that is dependent on the future economic benefit. There are various methods under this approach for example discounted cash flows, multiple of discretionary earnings and capitalization of earnings method. The best method among these is discounted cash flows method as it incorporated all the future income volatility by forecasting the cash flows assuming an appropriate growth rate. The present value of cash flows is always appropriate to value some asset.

4. Assuming a discounted cash flow valuation: What rate of return should Oracle require on the acquisition? What base-case cash flows do you forecast?

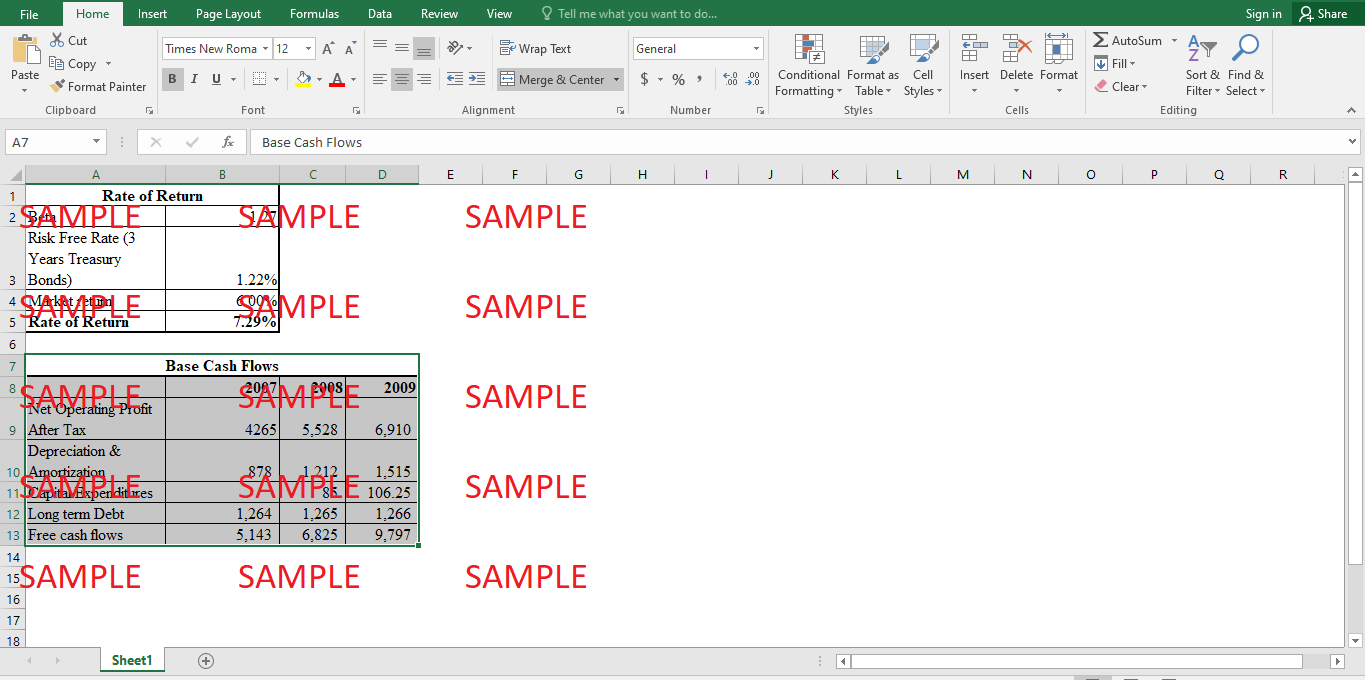

The rate of return required by Oracle can be calculated by capital asset pricing model. The risk free rate of 3 years treasury bonds is used which is 1.22%. The beta for the Oracle is 1.27 as mentioned in the case. The rate of return for the market is 6% which is the rate of S & P 500 at the end of 2008. The market risk premium is calculated by deducting the market return from the risk free rate. The rate of return as shown in Exhibit 1 comes out to be 7.29%.

|

Rate of Return |

|

|

Beta |

1.27 |

|

Risk-Free Rate (3 Years Treasury Bonds) |

1.22% |

|

Market return |

6.00% |

|

Rate of Return |

7.29% |

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Superior Clamps Inc Case Solution

- Supply Chain Partners: Virginia Mason and Owens & Minor (A) (Abridged) Case Solution

- Talent Acquisition Group at HCL Technologies Improving the Quality Of Hire Through Focused Metrics Case Solution

- Scoot Airlines Case Solution

- Surya Tutoring Evaluating a Growth Equity Deal in India Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.