Get instant access to this case solution for only $19

Surya Tutoring Evaluating a Growth Equity Deal in India Case Solution

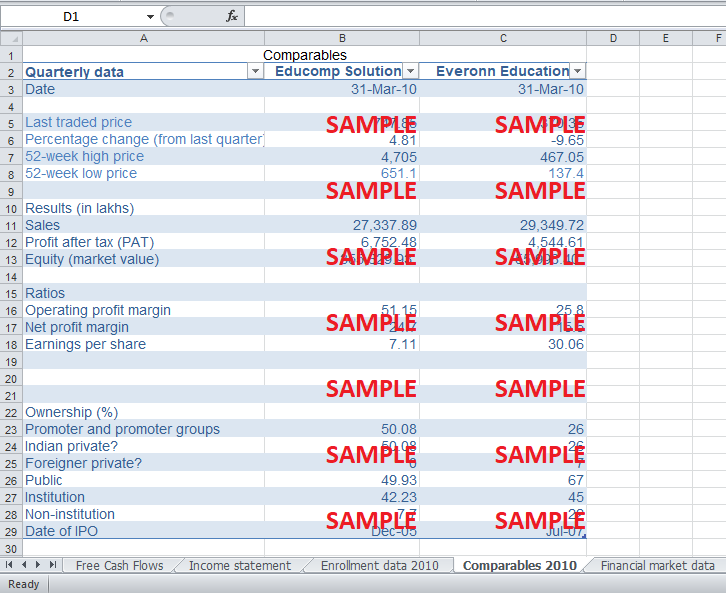

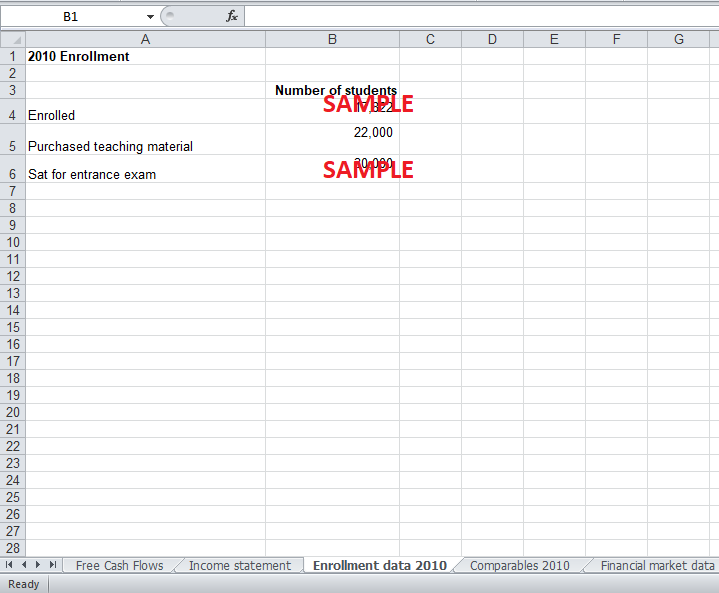

Surya is one of the biggest tuition academies in India where hundreds of students study to get admission in the prestigious Indian Institute of Technology. The tuition industry in India is very competitive. Surya has managed to outperform the competitors and has been able to lead successfully with more than 22,000 students preparing for the admission test. Most professors at the academy are themselves graduates from Indian Institutes of Technology. The whole operation was supervised by young and eager individuals and Sharma was the only shareholder in the business.

Following questions are answered in this case study solution

-

Surya Tutoring Business and the Business Opportunity

-

Valuation Based on Projection

-

Summary of Two Offers

Case Analysis for Surya Tutoring Evaluating a Growth Equity Deal in India

Sharma wanted to expand the network of the Academy and reach the untapped market. He realised that a here is a huge untapped market in the teaming Indian Metropolises of Mumbai, Chennai, Delhi and Bangalore. The foreign countries such as Dubai and Australia were another option to grow. For this plan to execute, he needed financing. Therefore, he received two term sheets from two Indian private equity firms which were agreed to finance the whole expansion project.

2. Valuation Based on Projection

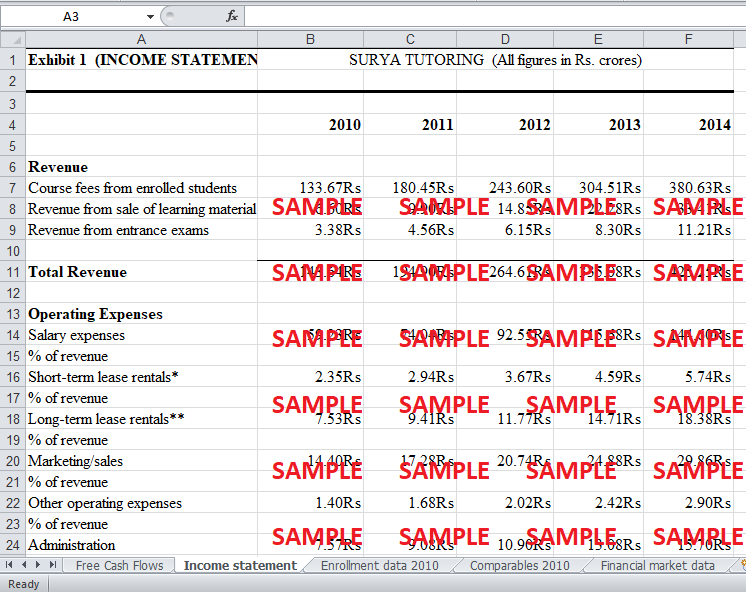

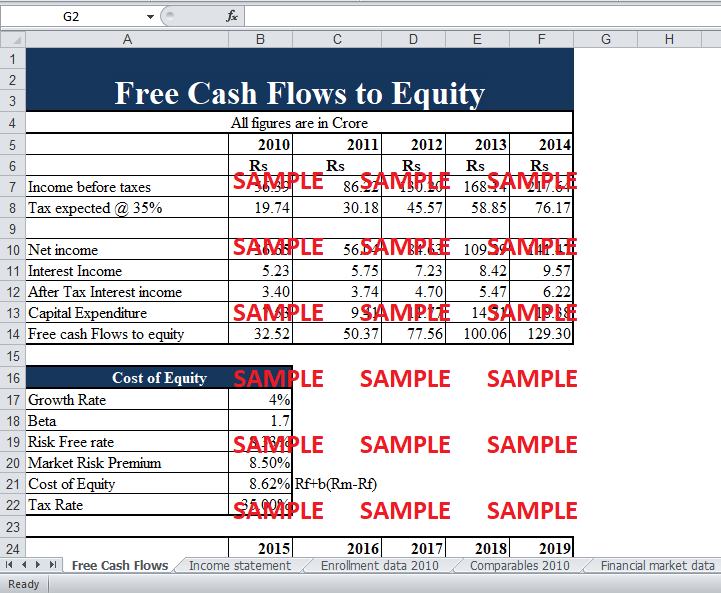

To evaluate the company, the free cash flow to equity approach was used. Free cash flows to equity are calculated by taking the net income after the taxes and adjusting it for non-cash charges such as depreciation. Then capital expenditures are deducted and income from interest is added. Finally, the net borrowings are also added back which gives free cash flows to equity. The Following formula is used:

FCFE = NI + Int x (1 - Tax Rate) – FC – WC + Net Borrowing.

In this case, Surya tutoring has zero interest expense which means they do not have any long term debt. Thus, there is no need to adjust for net borrowings. The free cash flows to equity calculation is shown in Exhibit 1 at the end of the write-up.

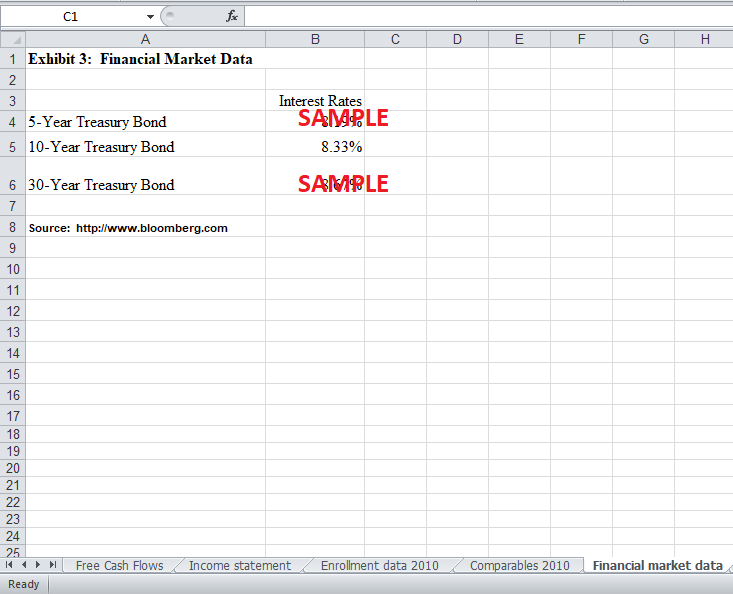

As it was mentioned that, the free cash flows will grow at 4%. Thus, free cash flows are forecasted for the next five years. The cost of equity was calculated using the capital asset pricing model. The cost of equity comes out to be 8.62%. The terminal cash flows at the end of 2019, are calculated by dividing the free cash flows by the cost of equity. These cash flows are then discounted at the cost of equity to find the present value. The sum of the cash flows comes out to be 1815.82 Crore Rs. This shows how much the business is worth. All the calculations are shown in the exhibits at the end of write up.

3. Summary of Two Offers

• Zen Cap Offer

Zen Cap has offered to by 1,30,434 preferred stock in the business which accounts for 8% stake in the company. 10% of the total shares will be issued to the family. Sharma will retain 82% of the stake in the company. According to the terms of this offer, all the new shares issued will be acquired by Zen Cap.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.