Get instant access to this case solution for only $19

Swatch Group And Francogeddon Case Solution

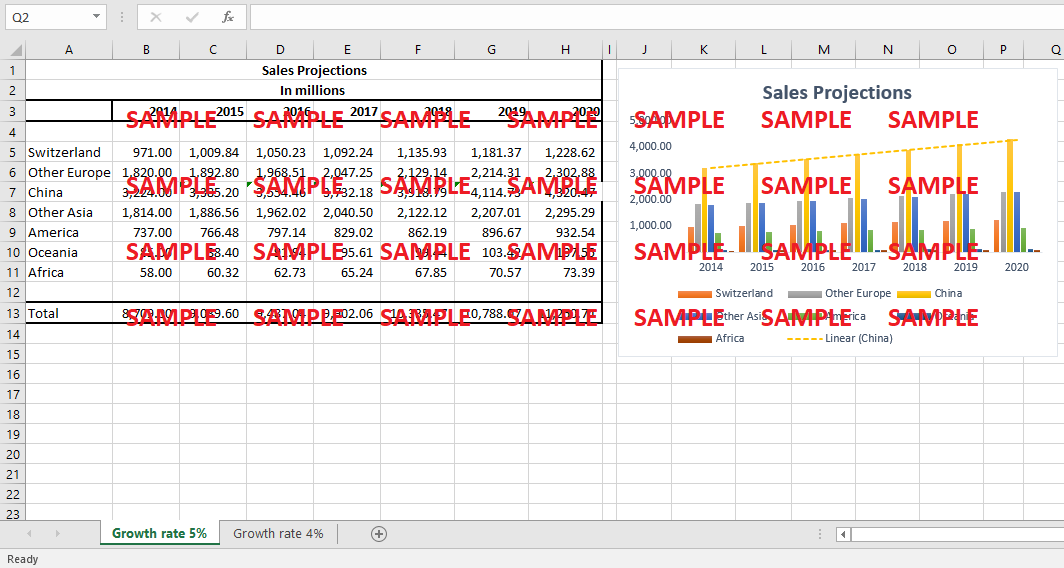

The analysis shows that the company is facing several challenges including competition from lower price similar brands of different countries, declining demands of particular watch, and the currency rate issues. Exhibit 6 of the case shows that sales have been declining in Switzerland but are growing in other regions although the exchange rate appreciation would have a negative impact on the overall revenue growth. Despite declining demand and increasing competition the company has been able to encash brand name and has generated steady revenues with moderate growth (Exhibit 7).

Following questions are answered in this case study solution

-

Analysis

-

Strategy

-

Exhibit A

-

Exhibit B

Case Analysis for Swatch Group And Francogeddon

The income statement and balance sheet analysis reveals that the company has reported a decrease in profits despite high revenue which is complemented by high growth in PPE in the years 2013 and 2014 which represents a strategy of growth supported by the positive outlook of the industry. Swiss brands have witnessed high growth in the industry mainly because of the strong brand image of Swiss companies (Deloitte, 2021). Swatch group can take advantage of its brand positioning and can increase its market share and consumer base significantly in the upcoming years with the right strategy. Another issue is the relationship of the stock price of Swatch with an appreciation of currency which is inverse. The company’s sales growth become slow with lesser revenuers in case of appreciation as it relies more on exports (Exhibit 02). Although the macro-economic indicators are more in favor of the company (Exhibit 1) with positive real GDP growth and optimum levels of inflation and unemployment.

2. Strategy

In line with the given scenario, the most optimum level of growth can be achieved by increasing market share in foreign markets with a focus on high-growth markets such as China. Exhibit A represents the sales growth projections with a steady growth rate of 4% for all markets which can result in significant growth of sales and revenues. With the same level of growth rate, it is obvious that China has the most potential among foreign countries and markets. If a different rate of growth is applied to China for example a more positive 5% then overall revenue growth can be more visible and significant.

In addition to that, the company needs to opt for the strategy of diversification to get the most of its strong brand name.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Pfizer Case Solution

- Performance Management Leadership At Henrys Commercial Sales And Leasing Case Solution

- Colgate Palmolive Canada Fighting For A Share Of The Toothpaste Market Case Solution

- Unilever In Brazil 1997 To 2007 Marketing Strategies For Low Income Consumers Case Solution

- Uber Competing Globally Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.