Get instant access to this case solution for only $19

Sweety ltd Case Solution

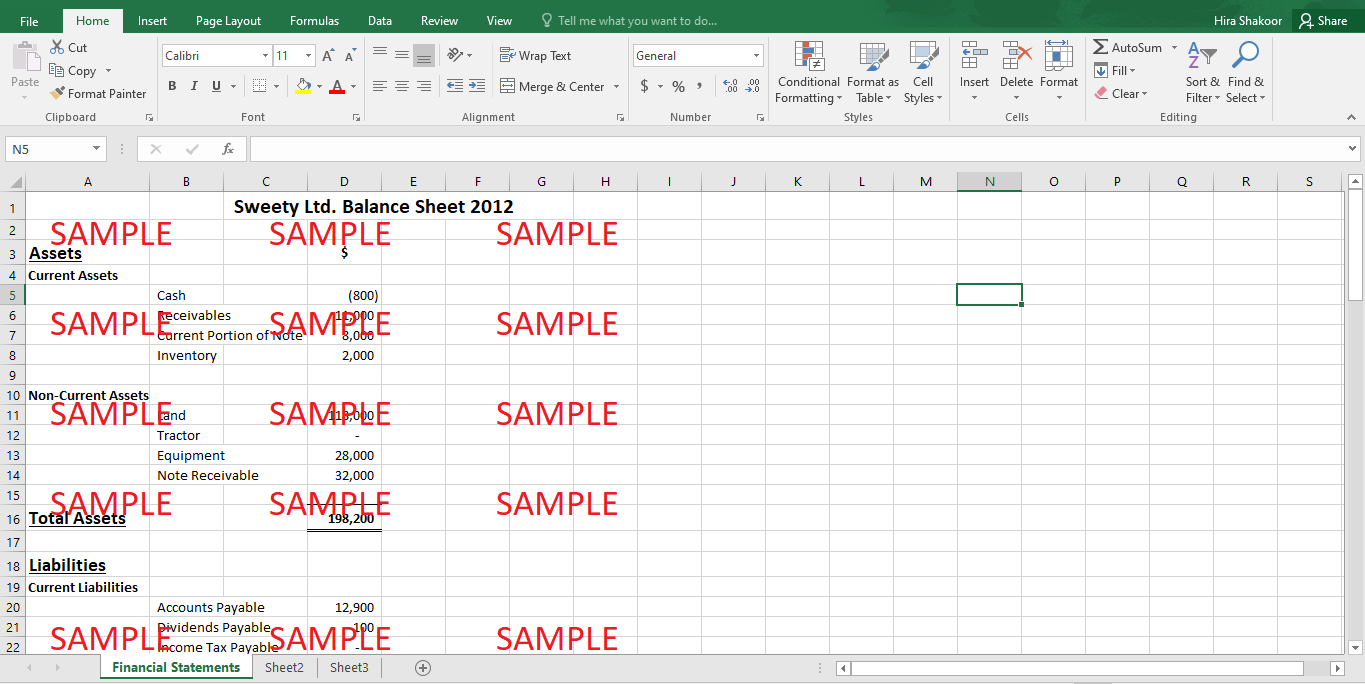

Sweety Ltd. is a maple syrup producer who has had a bad financial year in 2012. Due to climatic conditions, outside the business’ control, the production of maple syrup has been well below average. As a result, the company is experiencing difficulties in meeting its debt and trade credit obligations. There is a need to revise the company’s financial transactions, and its financial statements, in accordance with accounting rules.

Sweety Ltd. is facing difficulty in making payments to its suppliers, many of whom haven’t been paid in several months. It may seem like a business’ going concern assumption may be challenged, given the circumstances, but there is no evidence so conclusively. There have been no legal actions taken, or notice of payments given, by the creditors. This means that there is no immediate threat of bankruptcy. Also, there is no indication that the current operational situation caused by the climate will continue. Therefore, the going concern assumption holds and the financial statements will be made at historical cost as per accounting regulations.

Case Analysis for Sweety ltd

The company had taken out a line of credit from Caisse Populaire Desjardins worth $10,000. The line of credit was a long term agreement on the condition that the company will maintain a current ratio of at least 1.5. In the year 2012, Sweety Ltd.’s unrevised financial statements report current assets of $3,300 and current liabilities of $13,000. This means that the current ratio is 0.25, which is below the minimum required limit. This means that management should reclassify the line credit as a short-term liability keeping in view the accounting concept of prudence until a new agreement is reached.

Since the company only maintains finished goods in the inventory, it has to be valued at the lower of cost and net realizable value. Net realizable value is determined by the sale price of the asset, less any selling expense.

Property, plant, and equipment, used in the regular operations of the business can be valued at either historical cost or fair value. Given the assumption that the business is a going concern, the valuation will be at historical cost. Therefore, the land will be valued at a cost since it not an amortizable asset, while both the tractor and the evaporator will be valued at cost less accumulated depreciation. Depreciation will be calculated using the asset’s estimated useful life and residual value. Since no information is given the residual value of either asset, it can be assumed to be zero. The following depreciation charges will be applicable on a per-year basis:

Tractor = $60,000 / 20 = $3,000

Evaporator = $30,000 / 15 = $2,000

In each case, depreciation will be recorded as:

|

Depreciation Expense |

Dr |

|

Accumulated Depreciation |

Cr |

Sale of an asset, in this case, the tractor, will be recorded using an asset disposal account. This account is used to determine profit or loss on sale, which is transferred to the income statement. The profit, or loss, on sale, is determined using the proceeds from the sale, less the net book value of the asset. The netbook value is the cost of the asset, less its accumulated depreciation. Since the sale has been made against a note receivable, a new long term asset will be generated. The accounting entries will be as follows:

Tractor Disposal a/c Dr ($60,000)

Tractor a/c Cr ($60,000)

Asset wrote off

Accumulated Depreciation Tractor Dr ($33,000)

Tractor Disposal a/c Cr ($33,000)

Asset depreciation is written off

Note Receivable a/c Dr ($40,000)

Tractor Disposal a/c Cr ($40,000)

Sale proceeds

Tractor Disposal a/c Dr ($13,000)

Profit and Loss a/c Cr ($13,000)

Profit on sale of the tractor

As for the customer order received in 2012 for delivery in 2013, the sale cannot be recorded for the purposes of financial statements in 2012. The amount received should be treated as a prepaid income, a current liability, and will be realized in 2013 once the delivery of $500 worth of the product is made. The accounting entries to be made now are as follows:

Sale a/c Dr ($500)

Prepaid Income Cr ($500)

Correction of erroneous entry made in sale account regarding payment received and transfer to prepaid income

Depending on the tax regulations applicable to the firm, the loss will entitle the company for a tax credit or tax reimbursement.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.