Get instant access to this case solution for only $19

Tesla The SolarCity Acquisition Case Solution

Solar City seems a strong strategic fit for Tesla, considering the past collaboration of both the companies on energy initiatives. Having electronic cars, Tesla encouraged its customers to charge their cars using their chargers, which were powered by solar panels. By having Solar city on board, Tesla would be able to reduce its costs and enjoy lower costs, giving it a better edge against its competitive auto manufacturers. Thus, this will be a sort of backward vertical integration for Tesla, aimed at enhancing its operations and improving business efficiency (Monteverde & Teece, 1982).

Case Analysis for Tesla The SolarCity Acquisition

1. The prospects for the Solar city's business are high. This is because the demand and hence the market for the solar system is expected to grow and reach 3,800,000 homes by 2020. Although there were many large players in the industry who had diversified resources, the continuous expansion of solar demand may restrict their capacity, causing the startup companies to bloom and see their markets expanding. This has been further evidenced by the expected profitability of Solar City from 2017 onwards which could be seen growing from $357 million to $1,793 million in 2021. Therefore, as an investor for me, the prospects of Solar City’s business will seem promising.

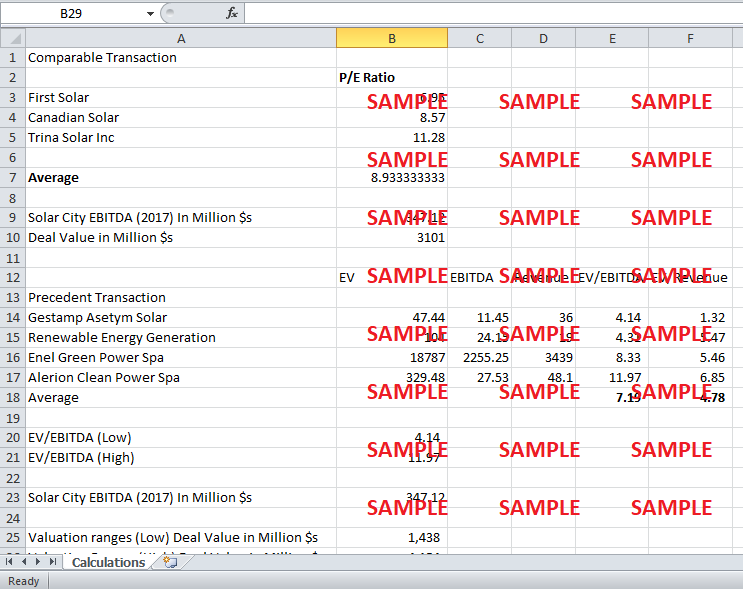

2. The comparable companies that seem to be a good match with the Solar City include Canadian Solar Inc., First Solar and Trina Solar Inc., as these are also involved in solar power products and systems solutions. In the next 10 years, its comparable companies will include Shanghai Aerospace Automobile Mechanical, as it would have likely entered into an acquisition agreement with Tesla. Based on the comparable company analysis, the deal value concerning the acquisition of the Solar City would be $3,100 million.

3. The precedent transaction gives a perception of the industry that the deal value for the five transactions that took place during the period varied considerably. Precedent transaction value is the deal value for similar companies in the industry (Chang, 1998).

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Mobike A Smart Bike Sharing Service Platform Case Solution

- Red Lobster Case Solution

- Pascal Press Crowdfunding A New Coffee Revolution Case Solution

- Netflixs Strategy In 2018 Does The Company Have Sufficient Competitive Strength To Fight Off Aggressive Rivals? Case Solution

- Technology Driven Transformation At Comair Limited Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.