Get instant access to this case solution for only $19

Teuer Furniture A Discounted Cash Flow Valuation Case Solution

Teuer Furniture is a privately held, medium-sized chain of upmarket home furnishings stores based in the United States. The company weathered the economic downturn and had regained its financial footing by the end of 2012. A number of the company's long-term investors have wanted to pay out their shares now that the company is more financially secure. This is the first time Teuer's stock has been repurchased; the company has been paying dividends since 2009. Jennifer Jerabek, the company's chief financial officer, and her team have been tasked with evaluating Teuer using a discounted cash flow technique. Despite the fact that Teuer Furniture was a private company, the investors' interest in the company was a minor part of their overall fortune for all but a few members of management. Teuer calculated its discount rate using the capital asset pricing methodology. Teuer's own beta could not be calculated directly because it is a private company. Instead, the finance team calculated the beta for a few publicly traded home furnishings companies and utilized that as a proxy for Teuer's beta.

Following questions are answered in this case study solution

-

Construct pro forma financials: to value Teuer Furniture you need to construct pro forma income statement and balance sheet. Use the assumptions and data from case.

-

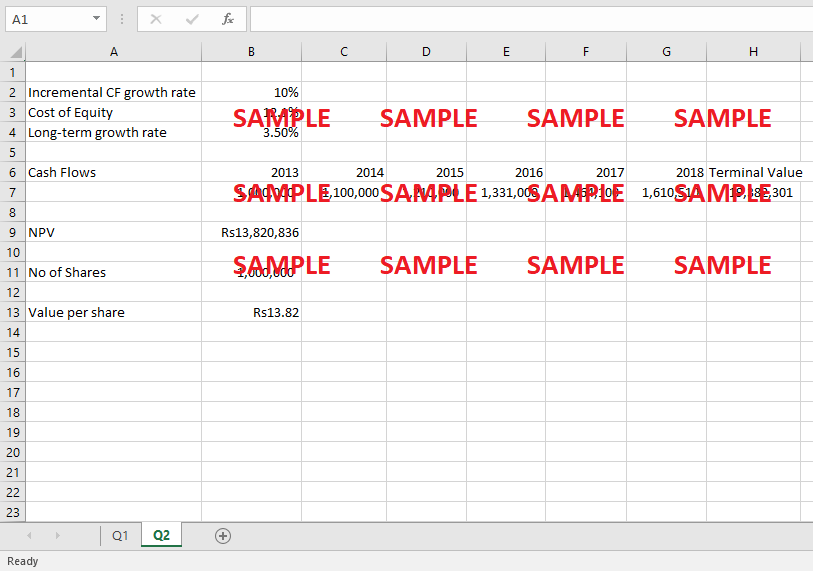

Value the firm using discounted cash flow method by constructing the cash flow from assets for six years (2013 to 2018). You should not include the 2012 cash flows. You will need to include a terminal value in your valuation. Initially, assume that the long-term growth rate of Teuer Furniture’s cash flows is 3.5% and that the firm’s cost of capital is 12.1%. What is the value of Teuer Furniture on a per-share basis?

-

Evaluate the key assumptions. The value of Teuer that you determined is a function of the assumptions made by you. Your base case valuation should be built upon the forecasts of Jerabek’s team. Discounted cash flow analysis depends upon a large number of assumptions. You can change the assumptions where you think it is appropriate. If you do make changes, explain the reasons you did so – especially with the most crucial assumptions/factors. An assumption may be considered crucial when it is both empirically relevant (i.e., your valuation result will change substantially) and cannot be precisely measured

Case Analysis for Teuer Furniture A Discounted Cash Flow Valuation

1. Construct pro forma financials: to value Teuer Furniture you need to construct pro forma income statement and balance sheet. Use the assumptions and data from case.

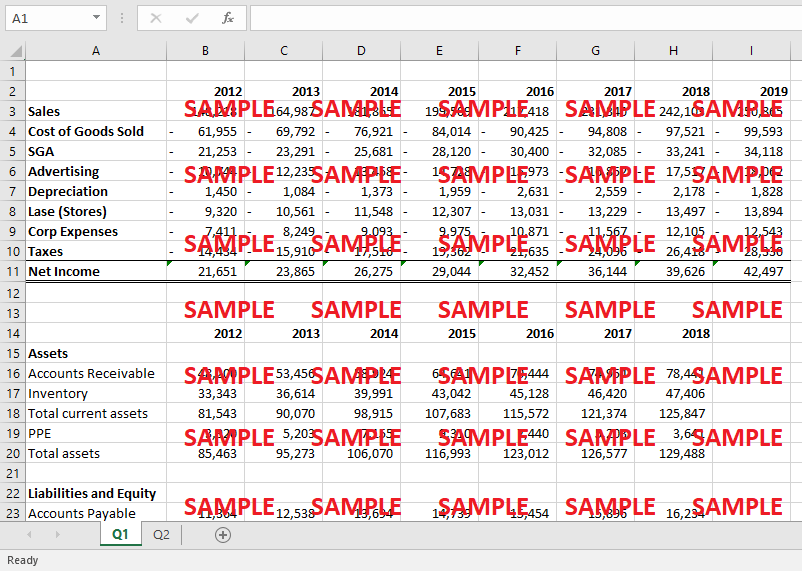

Following is the Pro Forma Income statement for Teuer Furniture:

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Sales |

148,218 |

164,987 |

181,865 |

199,509 |

217,418 |

231,340 |

242,103 |

250,865 |

|

Cost of Goods Sold |

- 61,955 |

- 69,792 |

- 76,921 |

- 84,014 |

- 90,425 |

- 94,808 |

- 97,521 |

- 99,593 |

|

SGA |

- 21,253 |

- 23,291 |

- 25,681 |

- 28,120 |

- 30,400 |

- 32,085 |

- 33,241 |

- 34,118 |

|

Advertising |

- 10,744 |

- 12,235 |

- 13,458 |

- 14,728 |

- 15,973 |

- 16,852 |

- 17,517 |

- 18,062 |

|

Depreciation |

- 1,450 |

- 1,084 |

- 1,373 |

- 1,959 |

- 2,631 |

- 2,559 |

- 2,178 |

- 1,828 |

|

Lase (Stores) |

- 9,320 |

- 10,561 |

- 11,548 |

- 12,307 |

- 13,031 |

- 13,229 |

- 13,497 |

- 13,894 |

|

Corp Expenses |

- 7,411 |

- 8,249 |

- 9,093 |

- 9,975 |

- 10,871 |

- 11,567 |

- 12,105 |

- 12,543 |

|

Taxes |

- 14,434 |

- 15,910 |

- 17,516 |

- 19,362 |

- 21,635 |

- 24,096 |

- 26,418 |

- 28,330 |

|

Net Income |

21,651 |

23,865 |

26,275 |

29,044 |

32,452 |

36,144 |

39,626 |

42,497 |

Teuer's sales growth slows as fewer stores are opened (on a percentage basis), and existing stores' sales growth slows as they mature. The decrease in the rate of sales growth, on the other hand, is not uniform. It drops from 93 percent in 2007 to 15 percent in 2009, then rises to 23 percent in 2010. Another method for forecasting sales is to start with the economy's growth rate and work your way down to the firm's growth rate. Teuer's sales are affected by the business cycle because it sells durable goods (its beta is greater than 1). When the economy is doing well, furniture sales are predicted to climb faster than the economy, and when the economy is doing poorly, furniture sales are likely to fall quicker. As Teuer's stores mature and it opens fewer stores, sales growth is expected to slow; no new stores are expected to open after 2015. Teuer's principal expense is the cost of items sold (e.g., purchasing furniture).

For each store, the cost of goods sold to sales ratio (CGS/sales) was computed. As Teuer's stores mature and it opens fewer stores, sales growth is expected to slow; no new stores are expected to open after 2015. Teuer's principal expense is the cost of items sold (e.g., purchasing furniture). For each store, the cost of goods sold to sales ratio (CGS/sales) was computed. Teuer may begin with low prices to attract clients, then gradually raise prices as customers become more familiar with and loyal to Teuer's goods. As a result, the drop in the CGS/sales ratio is actually a rise in the markup over time (i.e., an increase in the retail price)

Following is the pro forma balance sheet of Teuer Furniture:

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Assets |

|

|

|

|

|

|

|

|

Accounts Receivable |

48,200 |

53,456 |

58,924 |

64,641 |

70,444 |

74,954 |

78,441 |

|

Inventory |

33,343 |

36,614 |

39,991 |

43,042 |

45,128 |

46,420 |

47,406 |

|

Total current assets |

81,543 |

90,070 |

98,915 |

107,683 |

115,572 |

121,374 |

125,847 |

|

PPE |

3,920 |

5,203 |

7,155 |

9,310 |

7,440 |

5,203 |

3,641 |

|

Total assets |

85,463 |

95,273 |

106,070 |

116,993 |

123,012 |

126,577 |

129,488 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

Accounts Payable |

11,364 |

12,538 |

13,694 |

14,739 |

15,454 |

15,896 |

16,234 |

|

Accrued Expenses |

1,682 |

1,879 |

2,057 |

2,226 |

2,349 |

2,436 |

2,505 |

|

Total Current Liabilities |

13,046 |

14,417 |

15,751 |

16,965 |

17,803 |

18,332 |

18,739 |

|

Debt |

- |

- |

- |

- |

- |

- |

- |

|

Equity |

72,417 |

80,856 |

90,319 |

100,028 |

105,209 |

108,245 |

110,751 |

|

Total Liabilities and Equity |

85,463 |

95,273 |

106,070 |

116,993 |

123,012 |

126,577 |

129,490 |

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.