Get instant access to this case solution for only $19

The Boeing 7E7 Case Solution

Boeing Company has remained a market leader in the aircraft manufacturing industry with only Airbus as its chief competitor for decades. The company had successfully launched 777 and 737 aircraft in the past, and both of these projects had been very successful. However, since 1994, after the introduction of Boeing 737, no new commercial jet was introduced by the company until 2003, when the company decided to launch Boeing 7E7, which was subsequently called “Dreamliner”. Boeing 7E7 was capable of carrying 200-250 passengers at a cost that was less than 10% of the costs of a commercial jet of a similar capacity i.e. Airbus A300/200. This case analysis discusses the financial feasibility of the project to see if it is worthwhile for all the stakeholders, particularly shareholders, to take the risk of launching this commercial jet.

Following questions are answered in this case study solution

-

What is an appropriate required rate of return against which to evaluate the prospective IRRs from the Boeing 7E7? Please use the capital asset pricing model to estimate the cost of equity. At the date of the case, the 74-year equity market risk premium (EMRP) was estimated to be. Which beta and the risk-free rate did you use? Why?

-

When you used the capital asset pricing model, which risk-premium and the risk-free rate did you use? Why?

-

Which capital-structure weights did you use? Why?

-

Should the board approve the 7E7?

Case Analysis for The Boeing 7E7

1. What is an appropriate required rate of return against which to evaluate the prospective IRRs from the Boeing 7E7? Please use the capital asset pricing model to estimate the cost of equity. At the date of the case, the 74-year equity market risk premium (EMRP) was estimated to be. Which beta and the risk-free rate did you use? Why?

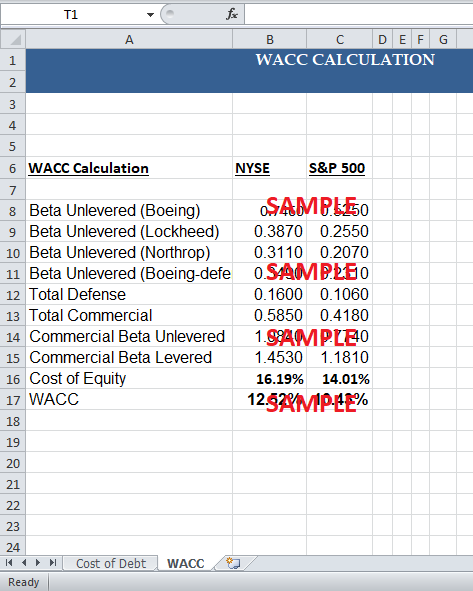

In order to do the feasibility analysis of the project, the first step is the calculation of WACC. With the help of WACC, there can find out the NPV of the project or find out the IRR of the project and see if it is economically feasible for the company to launch the project.

The formula for the calculation of the weighted average cost of capital is as follows:

WACC = weightage of debt * (rd) * (1 - t) + Weightage of equity * (Re)

The cost of debt, Rd, can be calculated using the data given in the exhibit 11 of the case. Exhibit 11 of the case shows the amount of debt, coupon rate, maturity date, price, and YTM. In order to calculate the cost of debt using this information, the weighted average yield to maturity has to be calculated first. Calculations in the excel sheet show that the total market value of debt comes out to be $5,022.12 million. The next step is to divide the market value of each individual debt instrument and then multiply the result with the YTM (yield to maturity) of that instrument. The sum of this weighted average yield to maturity values gives the cost of debt for the company. Calculations carried out in the excel sheet show that the sum of weighted average YTM values comes out to be 5.335%.

Data from exhibit 10 of the case can be used to find out the cost of equity for the firm. It is better to use 60 months of beta values of Boeing and the comparable companies because of the long term nature of the project. Using the NYSE composite index values, the following formula can be used to find out the values of unlevered beta for all the companies using 60 months levered beta data.

Unlevered Beta = Levered Beta / (1 + (1 - t) D / E)

The tax rate for Boeing has been given as 35% while the ratio of debt to equity market values has been given as 52.5%. So,

Unlevered Beta (Boeing) = 1 / (1+ (1 - 35%) 52.5%) = 0.7455

Similarly, effective marginal tax rate for Lockheed Martin has been given as 35% while the ratio of market value of debt to equity has been given as 41%. So,

Unlevered Beta (Lockheed) = 0.49 / (1+ (1 - 35%) 41%) = 0.387

Effective marginal tax rate for Northrop Grumman has been given as 35% while the ratio of market value of debt to equity has been given as 64%. So,

Unlevered Beta (Northrop) = 0.44 / (1+ (1 - 35%) 64%) = 0.311.

The average of these two beta values comes out to be 0.349. This value will be used as a proxy for Unlevered Beta (Boeing-defense) because both the companies, Lockheed and Northrop, operate mainly in the defense market. The unlevered Beta-commercial for the Boeing Company can be calculated using the following formula:

Unlevered Beta (Boeing) = % of commercial business * Unlevered beta commercial + % of defense business * Unlevered beta defense

Exhibit 10 shows that 46% of the sales of the Boeing Company consist of defense supplies while the remaining 54% consist of commercial supplies.

Unlevered Beta-Boeing commercial = (0.7455 – 46% * 0.349) / 54% = 1.084

Levered Beta- Boeing Commercial = 1.084 * (1 + (1 - 0.35) * 52.5%) = 1.453

Risk free rate of return has been given in the case as 4.56% while the risk premium has been given as 8%. So, cost of equity, Re can be given as follows:

Re = 4.56% + 1.453 * (8%) = 16.19%. So based on this cost of equity, WACC can be calculated as follows:

WACC = rd * (1 - t) Weight age of Debt + re * Weight age of equity = 5.335% * 34.4 % * (1 - 0.35) + 65.5% * 16.19% = 12.52%

Similarly, Using the S&P index values, the values of unlevered beta for all the companies using the 60 months levered beta data can be computed using the following equation.

Unlevered Beta = Levered Beta / (1 + (1 - t) D / E)

The tax rate for Boeing has been given as 35% while the ratio of debt to equity market values has been given as 52.5%. So,

Unlevered Beta (Boeing) = 0.8 / (1 + (1 - 35%) 52.5%) = 0.525

Similarly, effective marginal tax rate for Lockheed Martin has been given as 35% while the ratio of market value of debt to equity has been given as 41%. So,

Unlevered Beta (Lockheed) = 0.36 / (1 + (1 - 35%) 41%) = 0.255

Effective marginal tax rate for Northrop Grumman has been given as 35% while the ratio of market value of debt to equity has been given as 64%. So,

Unlevered Beta (Northrop) = 0.34 / (1 + (1 - 35%) 64%) = 0.207

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.