Get instant access to this case solution for only $19

The Super Project Case Solution

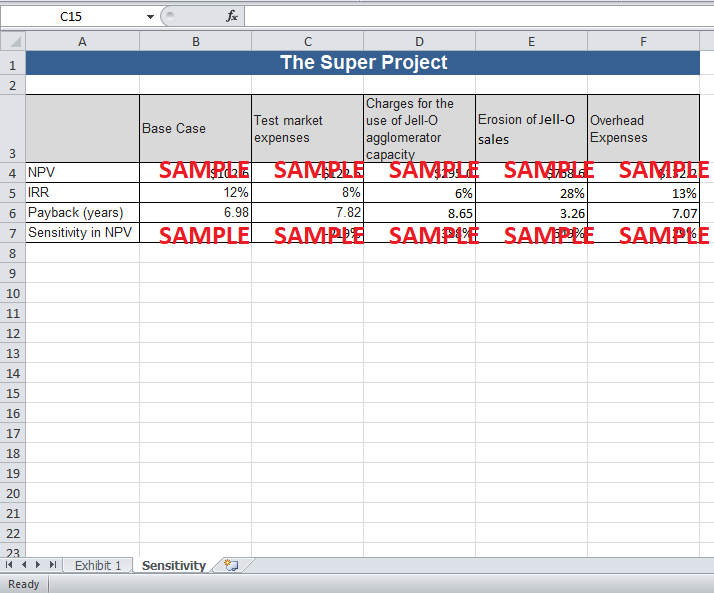

The cash flows prepared by the management of General Foods (Exhibit 6) are not correct due to improper treatment of a certain expenses. Firstly, the tax benefit of depreciation has not been incorporated into the cash flows. Moreover, as indicated in the GF Accounting and Financial Manual, only those incomes and expenses should be included in the incremental analysis that can be directly attributed to the project. In the light of the definition of incremental income and costs, the treatment of the following items has been discussed.

Case Analysis for The Super Project

• Test market expenses

Test market expenses have been incurred before the Super Project has even begun and, hence, is a sunk cost. Incremental cash flow of a project is the difference between the cash flow of the firm with the project and the cash flow of the firm without the project. Since sunk cost has already been incurred, accepting or rejecting the project does not have an impact on its relevance.

• Charges for the use of Jell-O agglomerator capacity

The Super Project will be using the excess capacity of the existing building and agglomerator of the Jell-O project. The management of GF has not included the opportunity cost of the building and agglomerator in the financial evaluation. However, the manager financial analysis, Crosby Sanberg has raised an objection to this treatment. Nevertheless, the excess capacity of the existing Jell-O building and agglomerator represents opportunity cost of future projects of General Foods. Hence, in order to account for the opportunity cost, the pro-rata expenses should be included in the cash flow analysis. NOT RELEVANT

• Erosion of Jell-O sales

The erosion of Jell-O sales represents the loss of existing sales that can be directly attributed to the Super Project. If Super Project is accepted, 20% of the existing Jell-O sales will be lost. Hence, the erosion of existing sales or cannibalization effect is a relevant cost and should be included in the incremental analysis. The evaluation prepared by the management already incorporates the effect of cannibalization.

• Overhead expenses

Overhead expenses should be included in the incremental analysis of the Super Project to the extent that is directly attributable to Super. The management’s analysis includes a vague estimate of the overhead expenses in the financial evaluation. Relevant overhead expenses should be accurately estimated for a fair evaluation of the project.

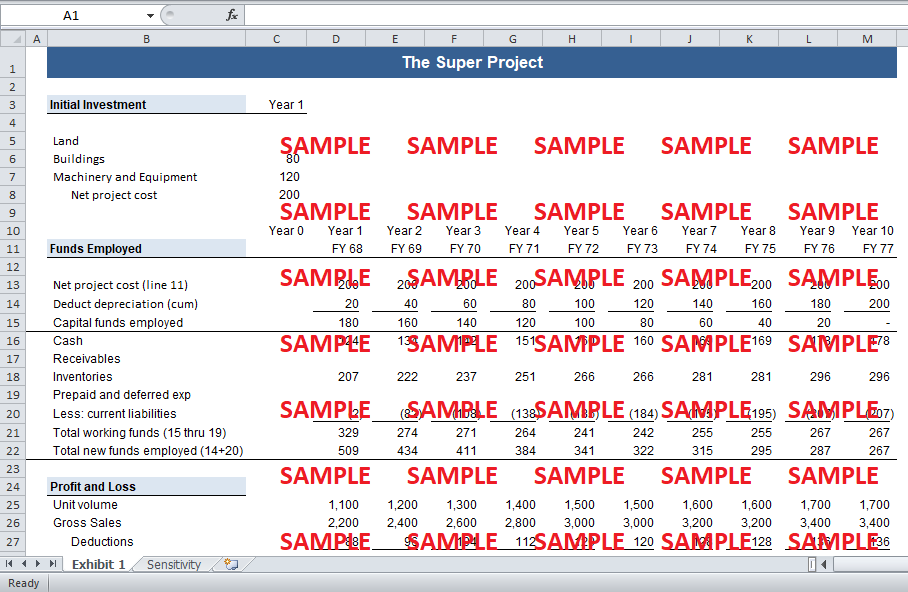

2. In order to obtain a better estimate of the cash flows of the Super Project, a number of changes have been made to the financial valuation done by the management of General Foods. Firstly, the depreciation benefit of the newly acquired assets has been included on a straight-line basis with a useful life of 10 years. Moreover, as mentioned in the discussion above, the irrelevant sunk cost of the market tests has been removed from the expenditures. Furthermore, taxes have been calculated at a rate of 52%. For unprofitable years, the tax expense remains 0 as no actual cash flow occurs in those years. The tax benefit of loss is carried forwarded to profitable years when no tax would have to be paid. The impact of deferred tax asset has been incorporated in the free cash flows. The full allocation alternative proposed by Crosby provides a fair allocation of overhead costs to the Super Project. Hence, the overhead costs of $82 million per year has been subtracted from the sales. Moreover, overhead capital of $40 million has been included in the 5th year of cash flow calculation.

In order to obtain free cash flows (FCF) of the project, depreciation has been added back to the after tax net income. It should be noted that since the project does not have an interest cost, there is no need for risk-adjustment of the net income. The entire project cost of 200 million has been assumed to have been incurred before the start of operations and hence has been moved back to year 0 and treated as initial investment.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- The Tip of the Iceberg JP Morgan Chase and Bear Stearns (A) Case Solution

- The University of Texas MD Anderson Cancer Center Interdisciplinary Cancer Care Case Solution

- The Wm. Wrigley Jr. Company Capital Structure, Valuation and Cost of Capital Case Solution

- How to Motivate Your Problem People Case Solution

- Justice at the Millennium A Meta-Analytic Review of 25 Years of Organizational Justice Research Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.