Get instant access to this case solution for only $19

TriDev Reality Partners Case Solution

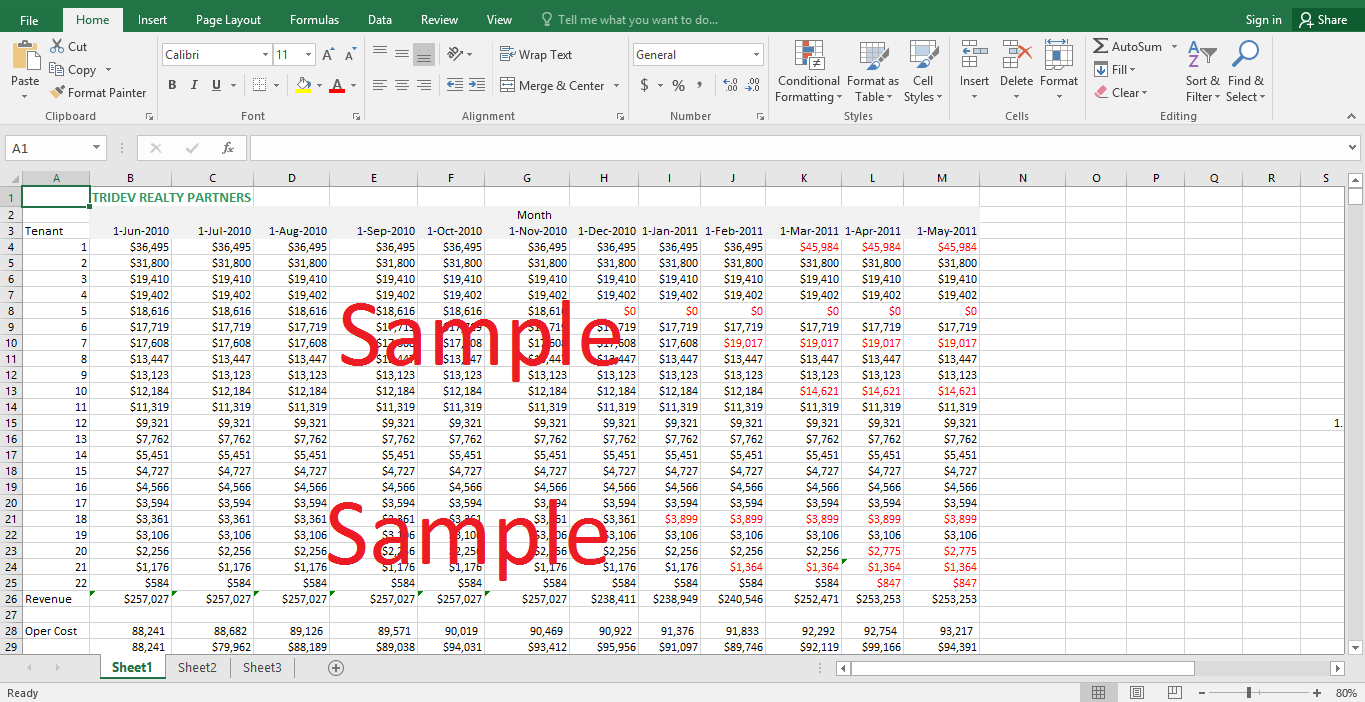

The current bid price of $22.5 million offers a competitive capitalization rate of 9%. In the future, the capitalization rate can be expected to vary between 8% and 10%. A lower capitalization rate is favorable because it implies a higher market value for the property. The expiration of some of the rental leases also present an uncertainty as it is not clear if the company will be able to find a new tenant before May 2011. The company will want to minimize the vacancies in order to attract the best bid. It is reasonable to assume that $22.5 million is the best bid that the company can obtain. Using this assumption, we can estimate the likelihood that the company will be able to obtain a higher bid than $22.5 million. The company expects to earn a 10% hurdle rate on its investment. Therefore, the future expected value of the company will have to be discounted at 10% before comparing it with the present bid.

Case Analysis for TriDev Reality Partners

Due to the uncertainties associated with the future value of the property, it is impossible to estimate the exact value of the property. However, we can estimate the distribution of the possible future property values. The distribution can be constructed by generating a random distribution of the tenant mix after one year. The distribution is based on the estimated probabilities of the lease renewal. The capitalization rate after one year can also be assumed to randomly vary between 8% and 10%. After one thousand iterations of this probability weighted scenario analysis, we can arrive at a range of the possible property prices in the future. The distribution of the present value of these property prices is shown in the histogram below. The distribution of the histogram can be assumed approximately normal. Under such an assumption, the probability of the present value of future sale being greater than $22.5m is calculated to be approximately 75%.

In other words, there is a 75% chance that the company will be able to earn a higher return by opting to sell the property after one year.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- TruEarth Healthy Foods Market Research for a New Product Introduction (Brief Case) Case Solution

- Unauthorized Disclosure Hewlett Packards Secret Surveillance of Directors and Journalists Case Solution

- United Parcel Services IPO Case Solution

- USX Corporation Case Solution

- UnME Jeans Branding in Web 2.0 Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.