Get instant access to this case solution for only $19

TruEarth Healthy Foods Market Research for a New Product Introduction (Brief Case) Case Solution

The case study discusses the case of the company TruEarth that had made a very good name in the industry of semi-cooked “healthy” pastas. The company penetrated at the right time in the industry, serving the demand of people who were searching for pastas that offered high quality, healthy whole wheat option and easy cooking. Now, the company is pondering to enter the pizza industry with the same concept of healthy whole-wheat crust and easy-to-cook product. However, the decision is not as simple as was in pasta’s case. The industry is highly competitive, and pizza is an indulgence where taste preferences are much more important than health consideration. However, the greater awareness regarding health issues is making room for the ‘healthy’ pizzas in industry and the decision to enter with this concept may not be entirely futile.

Following questions are answered in this case study solution

-

Why was Cucina Fresca pasta successful? How would you compare the pizza opportunity to that for pasta? How would you compare the actual product development process for each?

-

Using the forecast model for pasta shown in Exhibit 5, what is your forecast of the demand for pizza?

-

What can the TruEarth team learn from Exhibit 6 about how consumers view pizza?

-

How do the pizza concept test results (Exhibit 7 & 8) compare with the findings for pasta (Exhibits 3 & 4)?

-

Is there a first-mover advantage in pizza similar to fresh pasta?

-

How do you interpret the findings in Exhibits 9 & 10 to evaluate interest in pizza?

Case Analysis for TruEarth Healthy Foods Market Research for a New Product Introduction (Brief Case)

1. Why was Cucina Fresca pasta successful? How would you compare the pizza opportunity to that for pasta? How would you compare the actual product development process for each?

There are several reasons that made Cucina Fresca pasta successful. Late 1900s and early 2000s were the period marked by several shifts in tastes and cooking patterns. People were, by then, more concerned about their health and wanted a replacement that is comparatively healthier than present pasta options. Secondly, changing job patterns did not allow people to engage in full-time cooking. They wanted partial-cooked alternatives that still gave them opportunity to make changes in the cooking according to their tastes, but required less cooking time. Moreover, refrigerated fresh pastas were preferred due to better taste options. TruEarth recognized that option well and introduced Cucina Fresca at the time when there existed no significant competition in the market.

Pizza is also extremely lucrative option as the annual sales for pizza are much greater than pasta. However, there exist certain challenges that were not present in pasta market. Though, considerable number of pizza loving people preferred much healthier pizza option, if available, other view pizza as an ‘indulgence’, and for them, taste matters most. Similarly, pasta market did not have any significant incumbent present at the time Cucina Fresca was introduced, there does exist several big competitors in pizza market.

Product development process of both pasta (BASES I) and pizza (BASES II) comprised of four broad steps: idea generation, concept screening, product development and testing and qualification of volume. In the first step, general idea and patterns were formulated from the trends prevailing in market followed by concept screening where evaluations regarding consumer behavior and willingness to pay were performed. Prototype products were test among focused group in product development and testing stage followed by eventual study where sale and response estimations were carried out by market research companies. The BASES II study was more extensive than BASES I study in that it also included taste test that measured response and views after the potential product is tasted. Moreover, the study also gauged the response about introduction of pizza from those people who were already using the other products of TruEarth such as pasta.

2. Using the forecast model for pasta shown in Exhibit 5, what is your forecast of the demand for pizza?

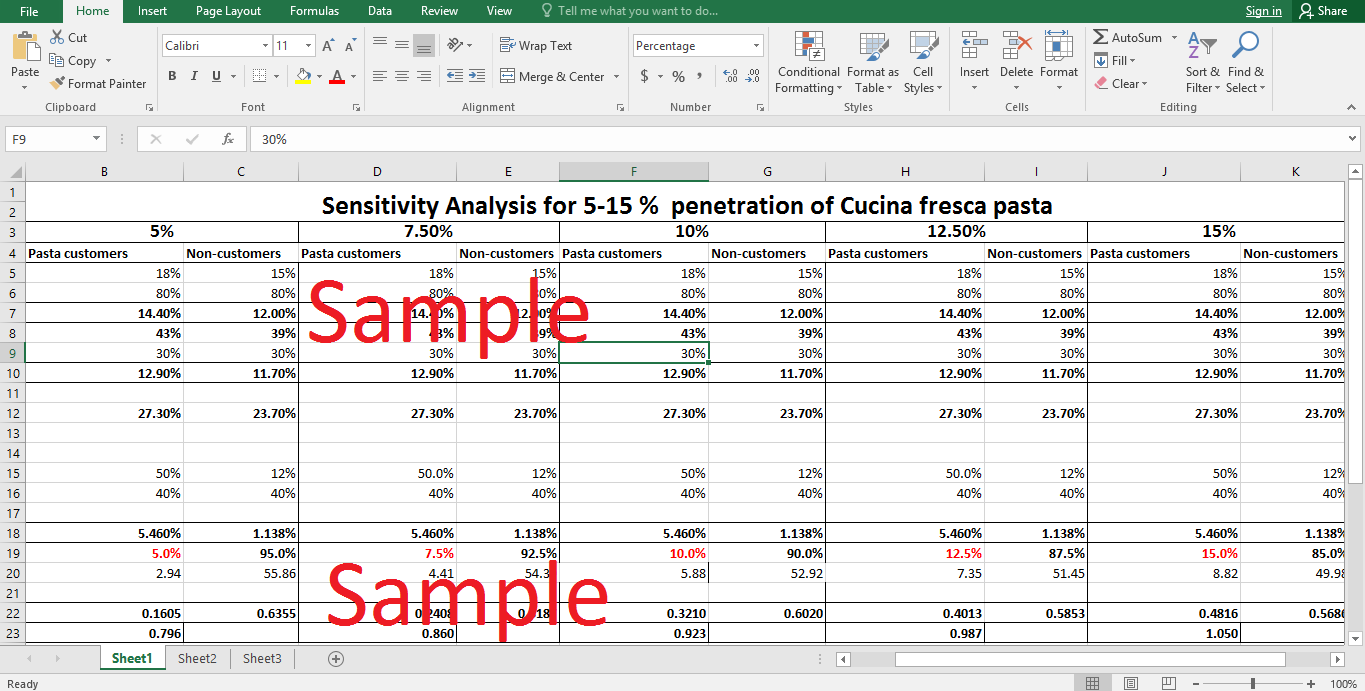

The results have been calculated in excel sheet attached. The expected demand under different scenario is different. From our calculations, it can be seen that it ranges between 1.38 to 2.54 MM units.

3. What can the TruEarth team learn from Exhibit 6 about how consumers view pizza?

Exhibit 6 dissects the ratings regarding different attributes of pizza on the basis of different options such as takeout pizza, refrigerated pizza and the ‘potential’ TruEarth pizza concept. Each option can be evaluated on the scale of 1-10 where 1 is selected when one strongly disagrees with the statement and option 10 depicts strongest degree of agreement with the question. It can be inferred from the table that pizza is regarded as a ‘family product’ among all three classes. However, takeout pizza has strongest rating of 8.9 out of 10 followed by TruEarth pizza concept with the rating of 8.6. So, it is a wise decision on the part of the company to supply pizza for 2-3 persons serving instead of 1 as people mostly sees it as a family product. On the other hand, TruEarth concept has got a lower score in convenience scale compare to takeout pizza. It is obvious as in case of takeout pizza you do not need to do anything whereas TruEarth pizza concept requires some preparation before eating. However, respondents believe that TruEarth pizza concept is easier to prepare than other standard refrigerator pizza that is surely good news for the company. When it comes to taste attributes, TruEarth concept has performed poorly compared to other two options. Respondents are not satisfied with the varieties that TruEarth concept has offered them giving them an average rating of 6.7 compared to takeout pizza that has got a score of 9.1. So, TruEarth has to work rigorously in this area to remain competitive in the market. However, it is performing well than refrigerated pizza that can be considered as a bigger competitor for it than the takeout pizza. When responses regarding quality attributes are considered, TruEarth pizza surpasses significantly compared to other two types, especially, in the case of ‘heath considerations’. So, the health issues can be a most significant selling point for TruEarth whole grain pizza. The second part of exhibit shows that 17% people are willing to buy TruEarth pizza in their next 10 pizza purchases.

4. How do the pizza concept test results (Exhibit 7 & 8) compare with the findings for pasta (Exhibits 3 & 4)?

Exhibit 3 and Exhibit 7 depict the purchase intent measures for pasta and pizza respectively. It can be inferred that about 79% of respondents were willing to buy Cucina Fresco pasta if offered. 79% comprises of 27% who will definitely buy the pasta and 49% who will probably buy the pasta. On the other hand, 18% of respondents will definitely want to buy the new pizza if introduced, and 43% will probably buy the new pizza making a total of 60% respondents that show interest in buying the pizza. It can be seen that ‘top two boxes’ proportion of 60% for pizza is less than purchase intent of 79% for pasta. Similarly, the mean likeability and mean price/value rating for pasta is also significantly higher than pizza, hence, making future aspirations for pizza less favorable than pasta.

Exhibit 4 and 8 summarize the likes and dislike of pasta and pizza concept respectively. General comparison of two tables shows the better performance of pasta in both concept’s likes and dislikes. For example, only 19% of total respondents like the whole grain concept in pizza compared to 32% in case of pasta. So, the TruEarth specialty of whole grain is not as widely appreciated in pizza concept as it was in pasta concept. On the other hand, greater number of people had concerned with price of pizza as compared to pasta, labeling the price ‘too high’. Moreover, 23% of respondents believe that pizza offered limited selection compared to only 20% signaling lesser variety perception in case of pasta.

5. Is there a first-mover advantage in pizza similar to fresh pasta?

No, the first mover advantage in case of pizza is not similar to the pasta experience. It is due to the fact that when pasta was introduced no significant competitor was present in the market. Moreover, the case for pizza is different as health factor is not given as much importance as with the pasta case. Big names like Kraft and Nestle have already established mark in the pizza industry, in addition to other suppliers, who deal with whole grain pizza crusts. So, the concept of whole grain pizza would not be completely new and neither, the health factor specialty would be as penetrative as in pasta’s case.

6. How do you interpret the findings in Exhibits 9 & 10 to evaluate interest in pizza?

Exhibit 9 lists the major reasons for liking and disliking the pizza concept. The good taste of sauce was the major reason for desirable purchase intent chosen by about 22% of people who were favorable to product. Other than the sauce, the freshness of ingredients and easiness to prepare were other reasons for desirable purchase intent. On the other hand, the major reason for not favoring the product was price. About 45% of the respondents who dislike the product labeled the product ‘too expensive’. Other major reasons for the unsavoriness of the pizza were relative expensiveness in comparison to competitors and dislike of the crust. The major suggestions for the improvement of the pizza included lowering of the price and improving the crust and taste of the pizza. The study also asked the respondents about the suggested price of pizza. The statistics are represented in exhibit 10.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.