Get instant access to this case solution for only $19

Vanguard Security Corporation Foreign Exchange Hedging Dilemma Case Solution

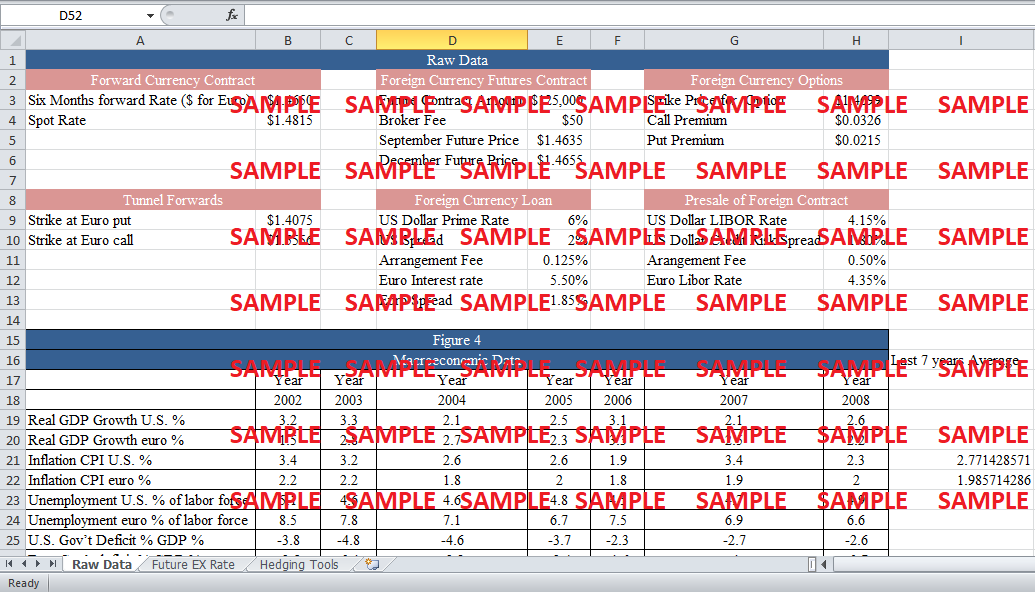

Vanguard Security Corporation is planning to receive $127.27 million six months from now. However, as the home currency for the corporation is Euro, therefore, the accounts receivable amount is susceptible to changes in the exchange rate. Whenever an international company deals with customers that are outside the domains of their home country, the risk of ‘exchange rate fluctuation’ is always the prime concern. In the case of VSC, as the customer contract specifies the amount in dollars; hence, the company is at a risk of exposing its receivables to euro-dollar exchange rate. However, to gauge the factors that affect the risk and exposure to exchange rate, you need to get a full picture of the determinants of exchange rate. First of all, the relative interest rates of two countries are crucial in establishing the currency value. Secondly, the prevalent inflation rates also affect the nominal interest rates; hence, they also play a key role in determining the currency appreciation or depreciation percentage. Finally, on a broader perspective, any nation’s current and financial account balances also affect the exchange rate. For this reason, the above mentioned four factors are decisive in marking the level of exposure to currency exchange rate fluctuation.

Following questions are answered in this case study solution

-

What are the risks or exposures faced by VSC?

-

Forecast the exchange rate for the contract period using the four techniques (Interest Rate Parity, Purchasing Power Parity, and International Fischer Effect & Balance of Payments).

-

Which hedging tool should VSC use and why? Justify your answer.

Case Analysis for Vanguard Security Corporation Foreign Exchange Hedging Dilemma

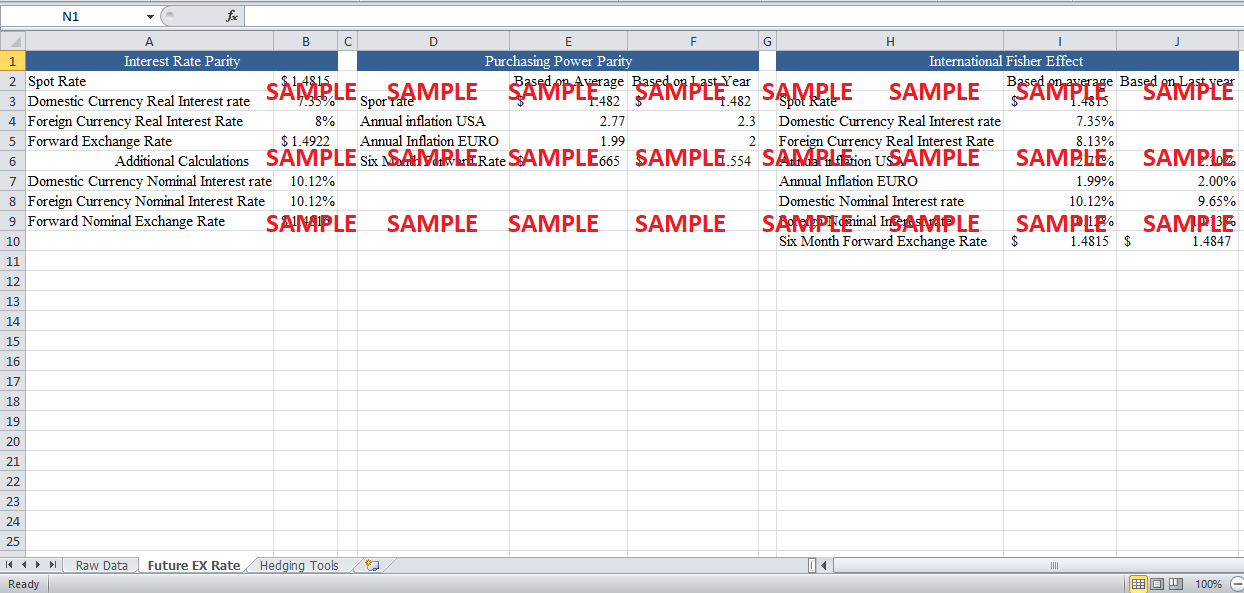

1. Forecast the exchange rate for the contract period using the four techniques (Interest Rate Parity, Purchasing Power Parity, and International Fischer Effect & Balance of Payments).

Interest rate parity

The ‘interest rate parity’ theory suggests that the future spot exchange rate between two currencies will be a function of the prevalent interest rate between them. Therefore, according to IRP theory, the decisive factors of future exchange rate are the interest rates of the two countries. The logic behind the calculation of the 'forward spot rate' backs its roots in the ‘no arbitrage’ principle. If the interest rate differential of two countries is not equal to the differential of the future and spot rate, then, investors can benefit by making riskless profit by borrowing money from the low interest rate country and utilizing the proceeds to develop instruments that offer on the spot profit. As more and more investors try to attain arbitrage, the exchange rate is adjusted in such a way that no profit seeking opportunity is available. The formula for calculating future spot exchange rate is as follows.

Future Spot Exchange rate = Spot Exchange rate * (1 + Foreign country interest rate) / (1 + Home country interest rate)

By utilizing the above formula, the future spot rate for VSC comes out to be $1.4922/euro.

Purchasing Power Parity

The purchasing power parity, hereafter to be referred as PPP, relies on the same concept of interest rate parity. The only difference arises when PPP postulates that the fraction of future spot rate and the current spot rate will be equal to the inflation rate differential of two countries. The expected inflation rate for the specific period is not explicitly mentioned. Therefore, for the purpose of calculating the future spot rate in accordance with PPP theory, total dependence would be relied upon the historical inflation rate. Furthermore, either the average or the most recent inflation rates can be used. The formula for calculating the future spot exchange rate can be written as,

Future Spot Exchange rate = Spot Exchange rate * ((1 + Foreign country annual inflation rate) / (1 + Home country annual inflation rate))^0.5

On average historical basis, the exchange rate comes out to be $1.665/euro. While, on the basis of last year inflation, the future exchange rate is $1.554/euro.

International Fisher effect

The international fisher effect is based on the concept of ‘Fisher equation’. Fisher equation states that,

Nominal Interest Rate = Real Interest Rate + Inflation Rate

Borrowing from the same concept, international fisher effect proposes that the future current appreciation or depreciation rate is proportional to the differential of the nominal interest rates. Therefore, the international Fisher effect accounts for both the PPP and interest rate parity. The formula for calculating future exchange rate is as follows.

Future Spot Exchange rate = Spot Exchange rate * ((1 + Foreign country Nominal interest rate) / (1 + Home country Nominal interest rate))

Taking into account the average inflation rate, the exchange rate comes out to be $1.4815/euro. However, performing the calculations by utilizing last year’s inflation rate, the six month forward rate comes out to be $1.4847/euro.

Balance of payments

The exact increase or decrease in the currency rate cannot be calculated. However, the trend in the current account balances of both the countries shows that there are chances that the dollar will appreciate in relation to the euro.

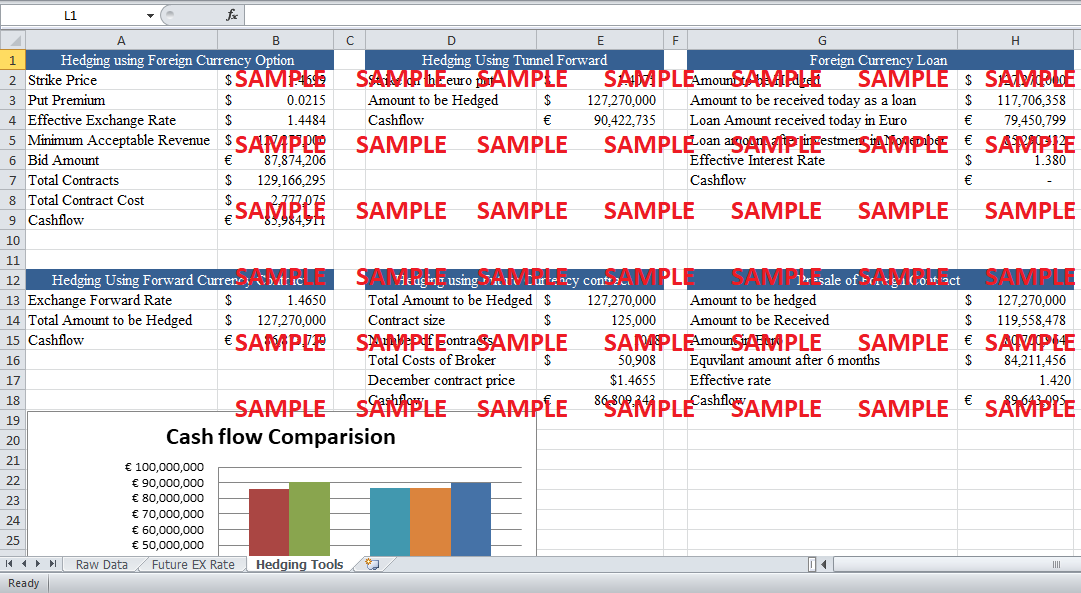

2. Which hedging tool should VSC use and why? Justify your answer.

Let’s define broad criteria for selection of an appropriate tool. Firstly, the cost associated with each tool should be compared. It will give an idea of the relative outlay.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.