Get instant access to this case solution for only $19

Well Fargo Convertible Bonds Case Solution

Wells Fargo is amongst the largest financial firms in the United States. Although experts contend that convertible bonds are not a prime source of financing for a company of Wells Fargo’s stature, the company believes that it represents an attractive market opportunity. Throughout its history, Wells Fargo has followed a strategy of catering to the market demands. Currently, in 2003, there is a huge demand for convertible bonds. Therefore, the issuance of convertible bonds incommensurate with the company’s market-oriented strategy. The company believes that it has been able to structure an appropriate deal by involving three different investment banks. However, the deal is quite complex in nature and poses quite significant risks. These risks include the risk of stock dilution from a potential conversion of bonds (accounting treatment), failure to meet capital adequacy requirements, and the tax implications of the deal. The case involves very complex issues and the suitability of the convertible debt issue can only be determined after accounting for all of the relevant concerns. However, the focus of this essay is to talk about the tax considerations resulting from the convertible debt issue. For the purpose of this analysis, all of the other considerations are ignored.

Following questions are answered in this case study solution

-

Introduction

-

Tax Treatment of Convertible Debt

-

Analysis

-

Conclusion

Case Analysis for Well Fargo Convertible Bonds

2. Tax Treatment of Convertible Debt

Wells Fargo might be able to benefit from a recent change in tax laws that allow companies to deduct potentially higher interest payments for tax purposes. It can be said that the convertible debt proposed to be issued by Wells Fargo has an economically important contingency feature. Such a contingency feature allows the company to make tax deductions at their long-term fixed-rate debt. The current long-term rate debt of the company is 5.8%. This means that the company has the option to calculate interest at an annual interest rate of 5.8% on their outstanding convertible debt and use that amount as a tax-deductible expense. This fixed-rate interest rate will be applicable even if the actual coupon interest of the convertible debt is lower than 5.8%. It is believed that any differences the taxes due at the long-term fixed rate of 5.8% and the taxes due on the lower actual convertible debt rate will be treated as a deferred tax liability. The company might be required to reverse the differed tax liability in the future. It is not clear how the liability will reverse, but it is indicated that the liability will be expected to reverse at the maturity of the convertible debt.

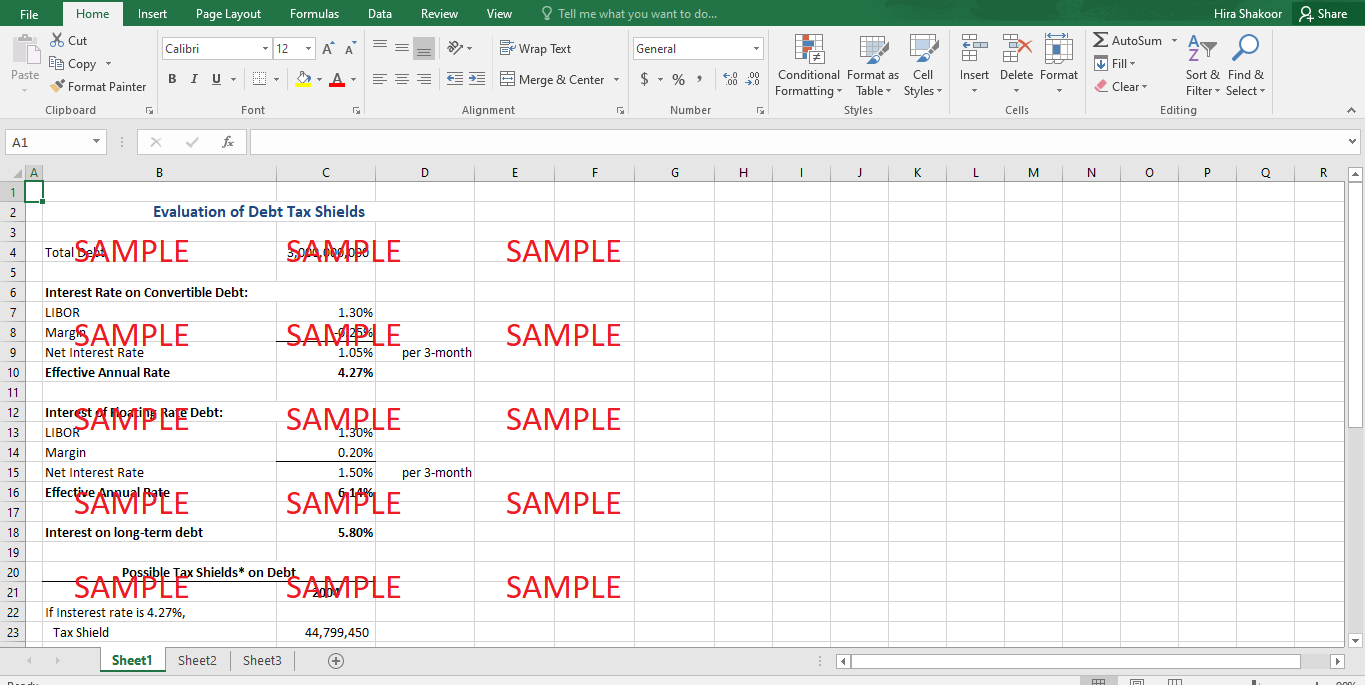

3. Analysis

It is important to analyze the value that the deferred tax might generate for Wells Fargo. The deferred tax liability means that instead of paying the taxes during the current period, the company will pay the taxes in a future period. Since the amount of taxes remains the same, the delay in taxes decreases the present value of taxes payable. This is because deferred tax liability results in an outflow of resources in the future years. The future outflow is worthless in present value terms. This scenario can be quantified using the data presented in the case study. The attached spreadsheet contains the calculations of taxes payable by Wells Fargo under different interest rates. The interest payable on the convertible debt of Wells Fargo is 3-month LIBOR minus 25 basis points. This translates into an annual rate of about 4.27%. On the other hand, the interest on floating rate security would have been the 3-month LIBOR plus 20 basis points. This translates into an annual rate of 6.14%. Therefore, by issuing convertible debt security, Wells Fargo is able to decrease its annual interest rate from 6.14% to 4.27%. Although, this represents an attractive scenario as far as the interest payable is concerned. The decrease in interest rate is actually a compensation for the risk of conversion embodying the convertible debt securities.

On the other hand, the company loses some of the tax shield associated with paying an interest rates on debt, which is a tax-deductible expense. However, as explained earlier, the company is allowed to use 5.8% for tax deductions. This rate is much closer to the floating interest rate of 6.14%. Thereby, much of the lost tax shield from using a lower interest rate is mitigated. The spreadsheet shows the debt tax shield under the three different interest rates. The maximum possible tax shields, under the floating interest rate, are about $64 million for the first year. These tax shields are calculated on the debt issue of $3 billion, assuming a tax rate of 35%. Under the absence of any tax laws, the tax shields on the convertible debt would have dropped to about $44 million. This is a drop of $20 million only in the first year. Although the interest portion of the debt will start getting lower as the debt approaches maturity, there is no doubt that the drop in tax shields would be significant. However, the tax provisions allow Wells Fargo to record interest rates at higher amounts for tax deductibility. Thereby, the tax shields increase to almost $60 million in the first year. The loss in tax shields is reduced drastically from $20 million to about $4million.

The reduction of $16 million is actually a deferred tax liability that is expected to reverse in the future. Therefore, it could be argued that an increased debt tax shield is only temporary and is likely to reverse in the future – that is the company will have to pay this $16 million in the future. However, the present value of this $16 million should be much lower when paid in the future. At one extreme, it is possible that the conversion option of the debt is not exercised and the investors continue to hold the debt security until its maturity.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.