Get instant access to this case solution for only $19

Wilkerson Company Case Solution

Wilkerson Company, a supplier of products to manufacturers of water purification equipment, is facing an apprehension because competitors had been reducing prices on one of the company’s main product line, pumps. In order to address this situation, the president of Wilkerson Company, Robert Parker was discussing operating results of the previous month with controller and manufacturing manager. Wilkerson Company operates three different product lines, which includes valves, pumps and flow controllers. The manufacturing process of valves and pumps are quite similar. Company had recently started with a unique design of valves that were better than any valves in the industry. Flow controllers are the devices that control the rate and direction of flow of chemicals, and their manufacturing process requires more labor and components costs than pumps and valves require, for each finished units. The cost allocation method used by the company is straight forward, and in order to evaluate operating results reasonably modification is required in this technique.

Following questions are answered in this case study solution

-

What is the competitive situation faced by Wilkerson?

-

Given some of the apparent problems with Wilkerson's cost system, should executives abandon overhead assignment to producer entirely by adopting a contribution margin approach in which manufacturing overhead is treated as a period expense? Why or why not?

-

How does Wilkerson's existing cost system operate? Develop a diagram to show how costs flow from factory expense accounts to products.

-

Develop and diagram an activity -based cost model using the information in the case. Provide your best estimates about the cost and profitability of Wilkerson's three product lines. What difference does your cost assignment have on reported product costs and profitability? What causes any shifts in cost and profitability?

-

Based on the results of your activity-based cost model, what actions might Wilkerson's management team consider to improve the company's profitability?

-

What concerns, if any, do you have with the cost estimates you prepared in the answer to Question 4? What other information or analysis would you want for better cost and profitability estimates?

-

Wilkerson has been compensating salespersons with commissions on their gross sales volumes (less returns). Parker wonders whether the company should change this incentive system.

Case Analysis for Wilkerson Company

1. What is the competitive situation faced by Wilkerson?

Wilkerson is operating in a highly competitive market, in the industry of valves and pumps, where no company can control its supply and price level. In a competitive firm, each firm has to sell its products at a market price; otherwise it would lose its market share. Similarly, Wilkerson has no alternative but to sell its products at given market price to maintain sales volume. The company’s competitors had been reducing the price on company’s leading product line, pumps. This reduction in price had led to declining profits for Wilkerson in pump line, and Wilkerson gross margin ratio has fallen below 20 percent, way below the company expected gross margin ratio of 35%. Conversely, the thirst of the highest market share by the competitors is not seen in the market of valves. According to manufacturer controller, several companies have now matched the Wilkerson’s quality of valves, but due to no change in the market price, company had been operating at more than 35% gross margin ratio as per expected. The market for flow controllers is not so competitive; hence, 10% increase in the selling price by the company has no apparent effect on demand.

2. Given some of the apparent problems with Wilkerson's cost system, should executives abandon overhead assignment to produce entirely by adopting a contribution margin approach in which manufacturing overhead is treated as a period expense? Why or why not?

Some of the competitors companies are not allocating any of the overhead cost to the products, treating them as a period expense instead of product expense. Contribution margin approach is used by the companies, which is calculated by subtracting all variable costs from sales revenues. In this scenario, variable costs only include direct materials and direct labor costs; hence, all products would be generating substantial contribution to overheads. Using this approach for the pricing of the products is flawed, as pricing would mean only to cover the variable costs. Moreover, treatment of manufacturing overhead entirely as a period expense is flawed. The overheads which have cost drivers, like machine hours, production runs, production units and hours of engineering work, should be considered as product costs. Allocating these overheads as period expense would result in high margin as most of the product costs and variable costs are considered period costs. Moreover, pricing of the products on this contribution margin approach would result in lower sales price of the products, negatively affecting the profits of the company.

3. How does Wilkerson's existing cost system operate? Develop a diagram to show how costs flow from factory expense accounts to products.

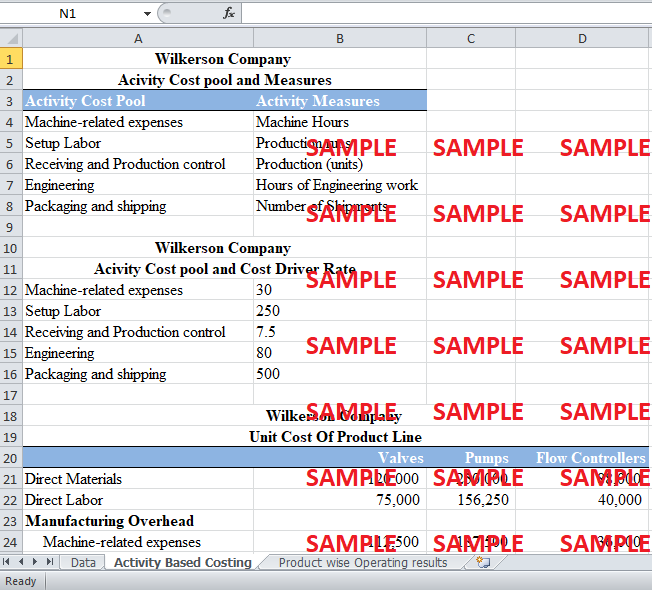

The accounting approach used by Wilkerson is very simple. Components, used for the manufacturing of different products are purchased on annual purchasing agreements. Costs related to direct materials are based on the cost of these components purchased under such agreements. Allocation of direct labor costs to the products, $25 per hour, was based on the number of direct labor hours per unit. The assembling and machining of all the products into the finished products is done in only one producing department. Company is using an inexpensive way of allocating overhead costs in this department to the product since direct labor cost had to be recorded to prepare department payroll. Three times of the production-run direct labor cost is allocated to the products as an overhead costs.

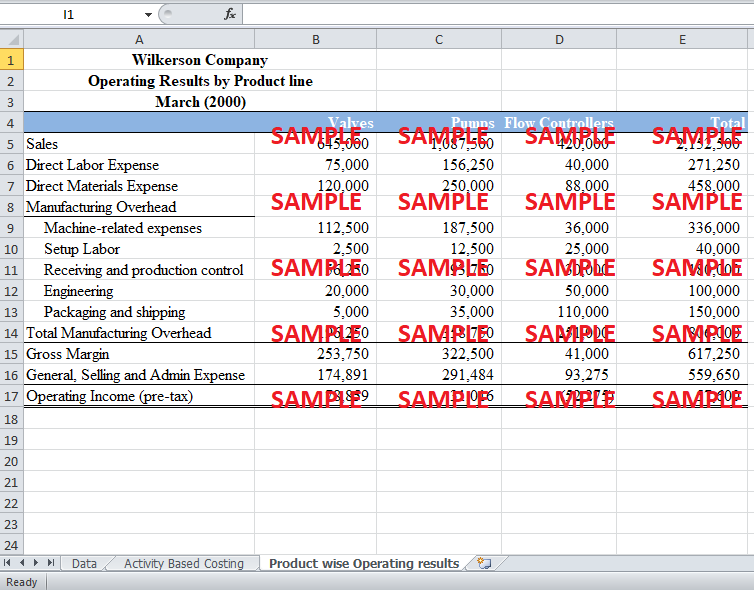

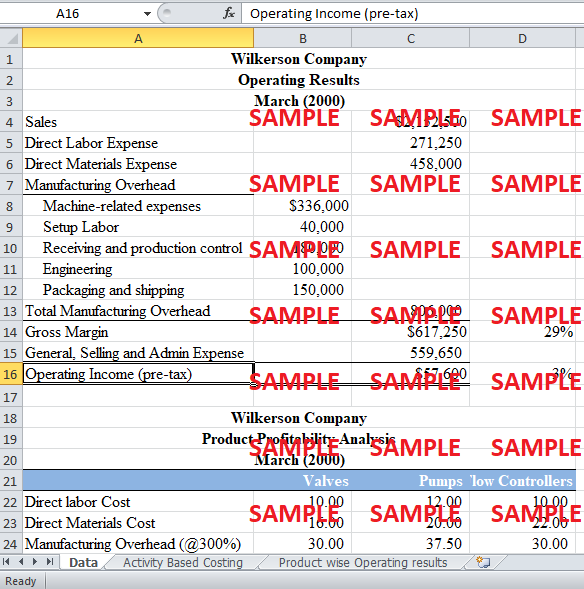

4. Develop and diagram an activity -based cost model using the information in the case. Provide your best estimates about the cost and profitability of Wilkerson's three product lines. What difference does your cost assignment have on reported product costs and profitability? What causes any shifts in cost and profitability?

The product wise cost and profitability of each product line of Wilkerson is given below. Direct labor cost is calculated by multiplying direct labor cost per unit with the number of production units. Material cost per unit is multiplied with the number of units to estimate direct materials expense. To develop an activity-based cost models, costs are assigned to each product by allocating cost drivers to each activity. On the basis of these cost drivers, overhead expenses are allocated to each product. General sales and administration expenses are allocated on the products on the basis of units produced and sold. Product wise profitability is calculated, which shows that the most profitable product line are valves and flow controllers are the least profitable. The overall profitability of the firm remains the same using cost assignment, but the cost breakdown into different product lines helped to identify the profitable and non-profitable product line. Shifts in profitability would be caused by changing sale price per unit. Moreover, change in direct costs per units and any overhead cost per unit would result in shifts, not only in cost but also in profitability.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.