Get instant access to this case solution for only $19

Workbrain Corp A Case in Exit Strategy Case Solution

Workbrain Corp. is a high growth company with high potential for creating value in the near future. Being incorporated in 1999, Workbrain Corp. has been operating on capital from venture capitals’ money and personal equity. However, soon the company will need to raise more money in order to achieve its growth targets. Moreover, Workbrain’s investors, especially venture capitalists, would soon want to exit from the investment. If Workbrain is able to provide a decent return to its venture capitalists, not only would the investors benefit, this will pave the way for future financing for Workbrain.

Following questions are answered in this case study solution

-

Discuss whether Workbrain should prepare for an IPO.

-

Determine if now is the right time for an IPO.

-

Determine which exchange would serve the company better (TSX or NASDAQ) and why.

-

Determine if the shareholders would be better off if the company pursued potential acquirers rather than an IPO.

-

Discuss what other financing alternatives are available.

-

Discuss if the company even needs to raise money.

Case Analysis for Workbrain Corp A Case in Exit Strategy

Workbrain should prepare for an IPO (Initial Public Offering) in order to address the above-mentioned financing needs. By going public, Workbrain will gain access to additional funds needed for the growth of the company’s operations. Since Workbrain is quite a young company, it has the potential for expansion in more than one dimension. Going public will enable Workbrain to build credibility in the capital market as well as the consumer market. Along with proving itself in front of potential investors, Workbrain will gain credibility in front of its clients since an average client of Workbrain is quite big in size.

Determine if now is the right time for an IPO.

Although Workbrain Corp. should go public in the near future in order to achieve its growth targets, one needs to be pretty careful in making the relevant decisions related to the timings of the IPO. An Initial Public Offering (IPO) or the act of going public comes with many costs and risks while providing the company access to the public capital. Firstly, public funding is one of the most expensive ways of financing. Moreover, the process of IPO is extremely time-consuming and costly. Another downside of going public is that it increases financial and managerial reporting costs tremendously. As compared to a few private investors, the company needs to prove itself in front of a large number of public investors and the overall capital market. Even the smallest discrepancy in sales and profitability targets needs to be justified in front of investors and can lead to a huge fall in the share price. Finally, owing to the additional accountability, the company loses managerial flexibility, and all of the managerial decisions need to be justified in front of the shareholders first.

Workbrain Corp. passes a number of criteria for going public. The earnings and growth for the next few years are significantly predictable and reliable. The company expects its revenue to grow by 101% in the current year while 69% in the subsequent year. Most of the comparable companies have a revenue growth rate of 20 – 30%. Hence, such a high growth potential will be attractive to institutional investors. Since Workbrain’s IPO is going to be the first in the technology industry, in the past few years, high growth rates and predictable revenue stream will help revive investors’ faith in the industry. Nevertheless, Workbrain does not have the right management available currently.

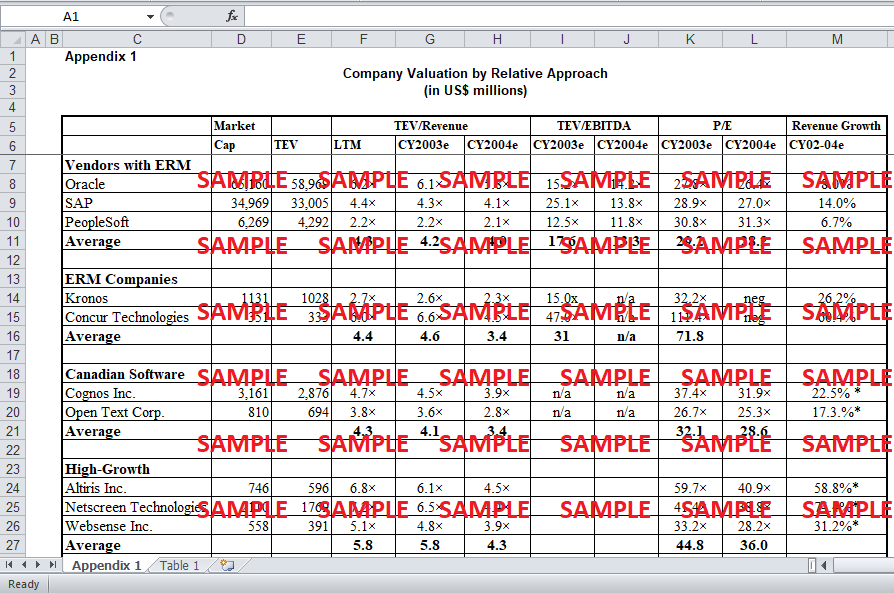

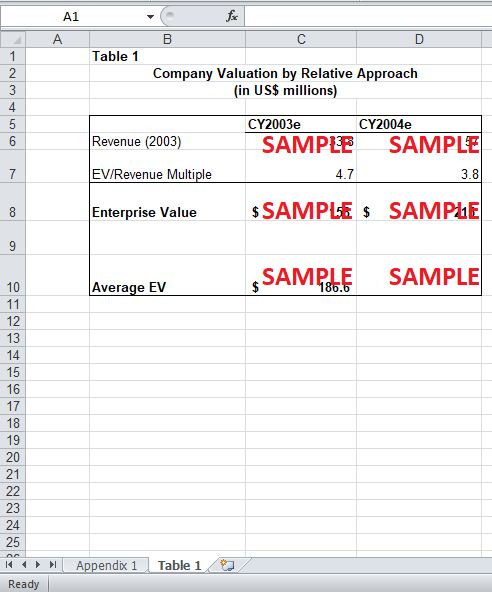

Table 1

The enterprise value of Workbrain is estimated at $ 186.6 million through the relative's approach (See Table 1). Though the company seems to be small as compared to other public companies, the high growth potential and unique value proposition will soon enable the company to compete with the existing players on an equal level. As mentioned below, the revenues of Workbrain are expected to reach $ 85 million by 2005 which will enable Workbrain to go for NASDAQ. Meanwhile, Workbrain should gain the requisite expertise for the execution of IPO since IPO is a lengthy process.

Determine which exchange would serve the company better (TSX or NASDAQ) and why.

NASDAQ would serve the financing needs of the company in a better way. Workbrain Corp. aims to be one of the dominating players in the workforce management industry. NASDAQ holds a respectable reputation in the technology industry for public companies since most of the big technology companies have gone through NASDAQ. Going public through NASDAQ will provide Workbrain with the credibility of high growth, stable IT company. This will also help Workbrain attract potential clients since its average clients are also large in size, i.e. 4500-5000 employees.

Determine if the shareholders would be better off if the company pursued potential acquirers rather than an IPO.

The current shareholders of Workbrain Corp. constitute three different venture capitalists ABS, Accenture, and Edgestone, who collectively own 34% of the company.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.