Get instant access to this case solution for only $19

Xavier Case Solution

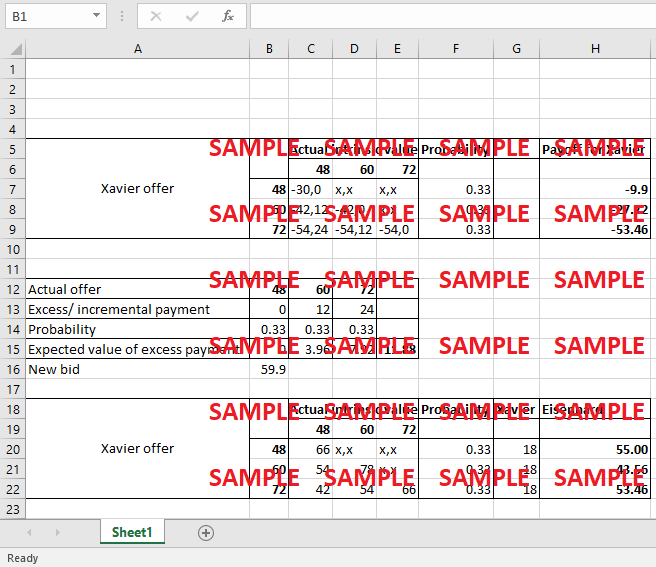

Xavier’s offer to buy Eisenhard depends on the expected payoff from the deal. The payoff will vary on account of Xavier’s offer and actual intrinsic value of Eisenhard. For example, with reference to table 1, if Xavier offers to buy Eisenhard for $48M and if the actual value of Eisenhard is $48M, in this case Xavier will have a net cash flow of -$30M which is (-$48M payment + $18M synergies benefit). On the other, in this case Eisenhard will not have any incremental cash flows. If Xavier offer to buy for $48M and actual value is either $60M or $72M no deal will take place therefore (x,x).

Following questions are answered in this case study solution

-

What should you offer as Xavier to buy Eisenhardt's components division? What is Xavier's expected profit?

-

Suppose now that Wagner Consulting offers to find out for you how much Eisenhardt values its components division. What will your bid be (as a function of Wagner's report)? What would you be willing to pay to hire Wagner Consulting for this job?

-

Instead of offering the fixed price contract of part 1 to Eisenhardt, you instead decide to offer a contract under which Eisenhardt receives five sixths of the value of the joint enterprise (which you will find out once the acquisition is complete).' Calculate your and Eisenhardt's expected profits from this take-it-or-leave-it offer. Why are both you and Eisenhardt better off ( in expectation) after this offer than the offer in Question #1?

Case Analysis for Xavier

Similarly, if Xavier offers to buy at $60M and actual value is $48M, thereby making a positive net cash flow for Eisenhard of $12M since its actual value ($48M) is $12M ($60M - $48M) less than the offered value ($60M). In this regards, the payoff matrix has been established. Since, each outcome has a chance one in three (probability of 1/3=0.33) thereby expected payoff for Xavier is calculated. Since, payment of $48M result in higher payoff (-9.9M) thereby Xavier will always offer -48M and expected profit will be -$9.9M.

Table 1

|

Xavier offer |

|

Actual intrinsic value |

Probability |

Payoff for Xavier |

||

|

48 |

60 |

72 |

|

|

||

|

48 |

-30,0 |

x,x |

x,x |

0.33 |

-9.9 |

|

|

60 |

-42,12 |

-42,0 |

x,x |

0.33 |

-27.72 |

|

|

72 |

-54,24 |

-54,12 |

-54,0 |

0.33 |

-53.46 |

|

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.