Get instant access to this case solution for only $19

Yanzhou Bids for Felix Resources Case Solution

The Chinese economy is growing day by day and China consumed 43% of the global coal resources in 2008 as compared to 7% of global resources in the year 2007. In the year, 2008 the demand for thermal or steam coal and coking coal rose drastically. Steam coal or thermal coal is used for the generation of electricity. In China, 80% of electricity is generated by coal. Coking coal is used for the production of steel. As per a survey, the demand for Thermal coal was expected to grow at a rate of 3.5% per annum till 2035 and coking coal demand to rise at a rate of 2% per annum.

Following questions are answered in this case study solution

-

What economic and political forces are driving Chinese coal companies to look outside China for new resources?

-

Is Felix Resources an attractive target? How so?

-

Is this a friendly or hostile acquisition?

-

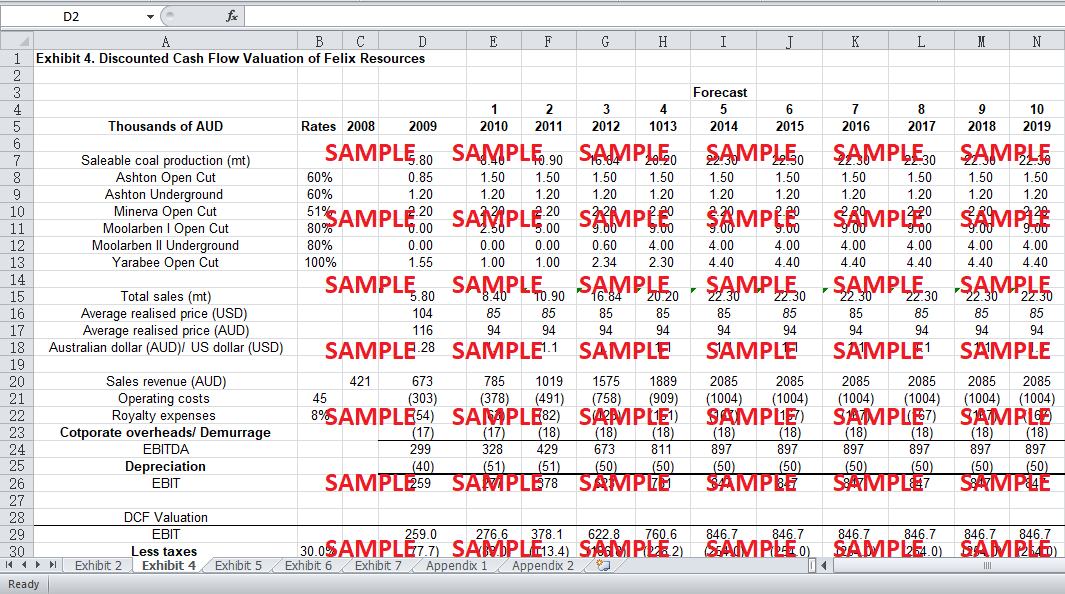

What is Felix worth? What is the company worth according to various valuation methods commonly used in the coal industry?

Case Analysis for Yanzhou Bids for Felix Resources

During the same time as the demand for coal rose the government but a ban on the export of coal .In February 2008, an export tax of 13% was levied on existing commitments to export coal. Meanwhile, the Chinese government had ordered people to close 15000 small coal mines as a huge amount of deaths had occurred due to the unsafe working conditions. China itself produced 14% of the global coal and the remaining coal deposits were extreme north or west of China which were not easily accessible.

Apart from strict conditions to export coal and taxes on exporting and closing down of many coal mines demand continued to rise which led Chinese producers to move towards new markets for coal.

2. Is Felix Resources an attractive target? How so?

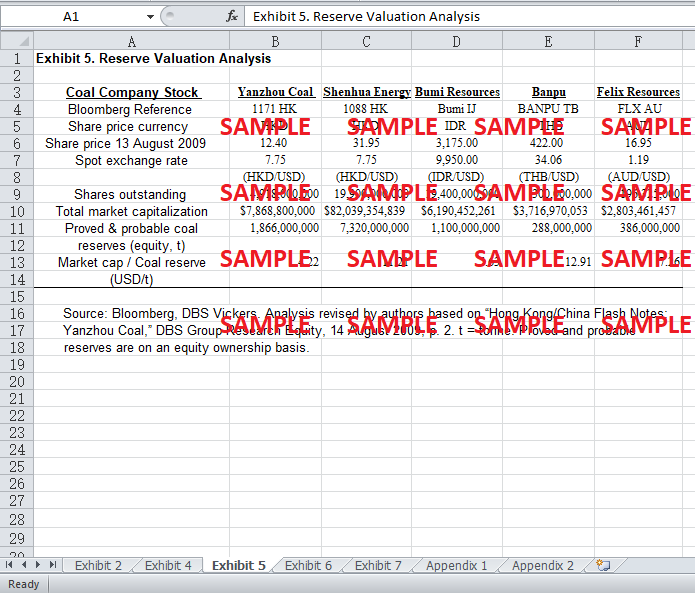

Felix Resources Limited of Austalia (FLX.AU) was the 12th largest coal mining firm in 2009.Felix was expected to earn a profit of AUD 260 Million and total sales were expected to be approximately AUD 680 Million. As Australia has an excess of production of coal that it requires most companies like Felix had sold their production to export markets like South Korea, Japan and now ,China.

|

Exhibit 2. Felix Resources Coal Reserves |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reserves (million tonnes) Remaining |

|

|

|

|

Mines Under Operation |

Interest |

Proved |

Probable |

Total |

(years) |

Coal Products |

|

|

Ashton open-cut coal mine |

60% |

29.2 |

19.9 |

49.1 |

17 |

semi-soft coking coal |

|

|

Ashton underground coal mine |

60% |

23.5 |

23.9 |

47.4 |

14 |

semi-soft coking coal |

|

|

Minerva open-cut coal mine |

51% |

13.6 |

15.2 |

28.8 |

11 |

thermal coal |

|

|

Yarrabee open-cut coal mine |

100% |

26.1 |

1.4 |

27.5 |

10 |

pulverized coal inject, thermal |

|

|

|

|

|

|

|

|

|

|

|

Mines Under Development |

|

|

|

|

|

|

|

|

Moolarben open-cut coal mine |

80% |

40.4 |

237.3 |

277.7 |

20+ |

thermal coal |

|

|

Moolarben underground coal mine |

80% |

44.1 |

35 |

79.1 |

20+ |

thermal coal |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

176.9 |

332.7 |

509.6 |

|

|

|

|

Equity Volume |

|

132.3 |

253.3 |

385.5 |

|

|

|

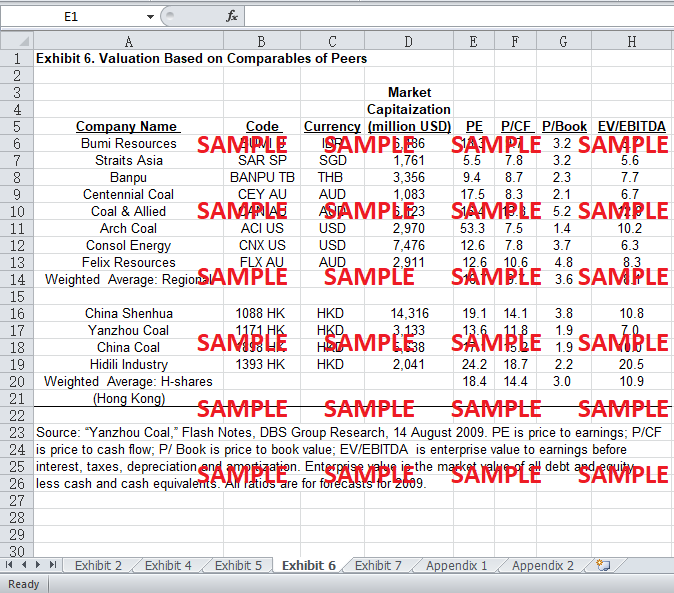

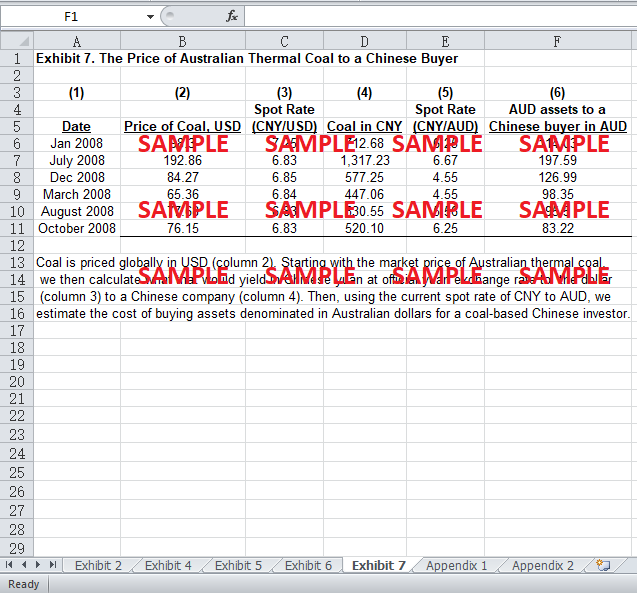

Exhibit 2 above shows that most coal in the Felix coal mines is coking coal and thermal coal that is highly in demand in China .Apart from that the coal from Felix has a low content of sulphur that will help to reach the goal of reducing carbon emissions in China by 40% till the year 2020.

|

Appendix 1. Felix Resources Limited, Income Statements |

|

|

|

|

|

|

|

For the year ended 30 June (000s AUD) |

2008 |

2009 |

|

|

|

|

|

Revenue |

451,870 |

755,548 |

|

Other income |

124,331 |

18,269 |

|

Changes in coal inventory |

8,372 |

10,654 |

|

Raw materials and consumables used |

(67,031) |

(83,533) |

|

Employee benefits expense |

(45,366) |

(67,568) |

|

Depreciation and amortisation expense |

(28,639) |

(31,374) |

|

Transportation expense |

(63,289) |

(64,171) |

|

Contractual services and plant hire expense |

(88,966) |

(104,376) |

|

Government royalites expense |

(25,277) |

(56,646) |

|

Changes in overburden in advance |

7,521 |

5,074 |

|

All other operating expenses |

(10,709) |

(8,755) |

|

Finance costs |

(8,521) |

(4,303) |

|

Share of net profits/(losses) of associates |

(17) |

21 |

|

Profit/(loss) before income tax |

254,279 |

368,840 |

|

|

|

|

|

Income tax (expense)/revenue |

(65,819) |

(101,222) |

|

Profit for the year from continuing operations |

188,460 |

267,618 |

|

|

|

|

|

Profit is attributable to: |

|

|

|

Members of Felix Resources Limited |

188,261 |

267,428 |

|

Minority interest |

199 |

190 |

|

|

|

|

|

|

Cents |

Cents |

|

Basic earnings per share |

95.92 |

136.18 |

|

Diluted earnings per share |

95.85 |

136.01 |

|

Dividends paid per share |

9.00 |

73.00 |

|

|

|

|

|

Source: Felix Resources, Ltd., Annual Report, 2008, 2009. |

||

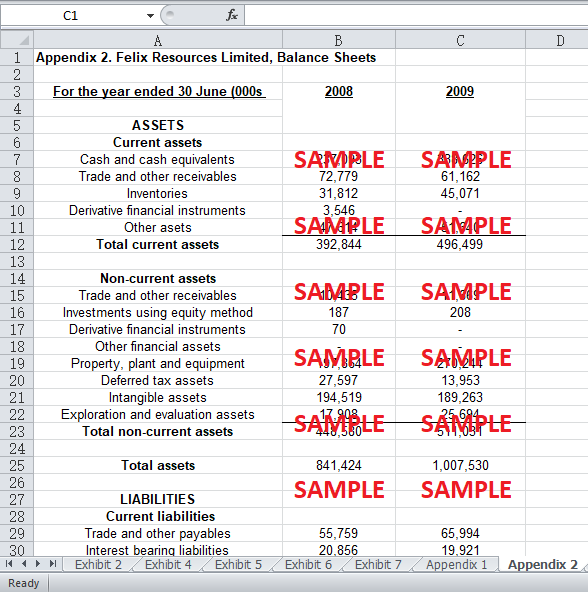

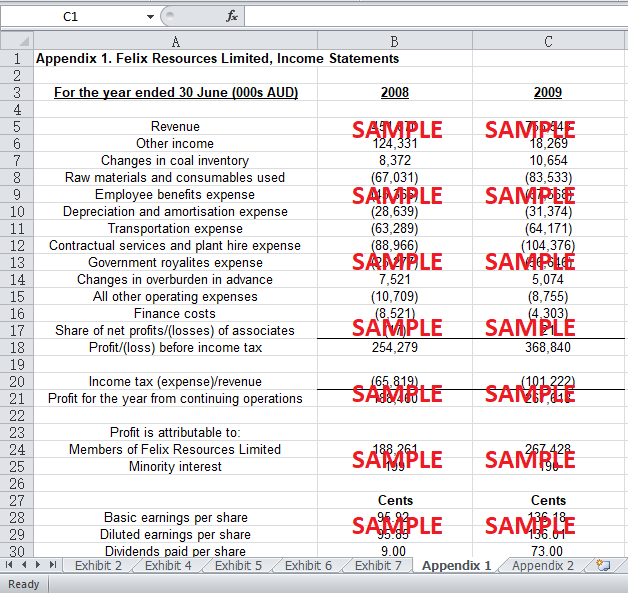

In Appendix, 1 attached above you can compare the performance of Felix from 2008 to 2009 .If you see the revenue increased from 451,870 in 2008 to 755,548 in 2009 which is a growth of 69% .The profit has also increased to 267,618 from 188,460 by 42% from the previous year.

The balance sheet also shows a positive outlook on the business where investments in derivates have been taken out and liquidity position has also improved .Moreover, the retained profit amount has also improved which can help in investing further.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.