Get instant access to this case solution for only $19

A New Financial Policy At Swedish Match Case Solution

Swedish Match was the worldwide in the smokeless tobacco market with products like snuff, snus and the chewing tobacco. The company served a large segment of the cigar and the smokeless products segment of United States and other Scandinavian countries. Due to good operational performance and a very healthy liquidity position, the company had paid off most of its past debt and the outstanding debt had become very low. In comparison to the competitors, the company enjoyed a very good credit rating of A- and hence, the CFO of the company suggested that it is a good time to increase the leverage of the company and repurchase some of the equity. This proposal for leveraged recapitalization was presented before the board in September 2005, and the board had to analyze the effects of the leverage recapitalization on the balance sheet of the company. The board also wanted to conduct the scenario analysis to see if the company would be able to maintain the liquidity strength even of earnings of the company decline in the near future. Other than the ability to maintain the liquidity strength of the company, the board also wants to assess if it can achieve BBB+ credit rating after the leverage recapitalization.

Following questions are answered in this case study solution

-

Assume Swedish Match faces a 28% tax rate on income and can issue bonds at a fixed krona yield of 4.5%, how much will the company save in taxes for a SEK4 billion recapitalization? What is the value of this interest tax shield?

-

What will Swedish Match’s book value balance sheet look like after it completes the debt issuance and share repurchase?

-

What will Swedish Match’s book value market value balance sheet look like:

a. Right after it announces the leveraged recap?

b. When it completes the issuance of the SEK 4 billion in debt?

c. When it completes the share repurchase?

-

Can Swedish Match afford to borrow this much money? What are the risks? Is it realistic to expect a BBB + rating? Should the company go ahead with a leveraged recap? If so, would you approve a larger recapitalization?

Case Analysis for A New Financial Policy At Swedish Match

1. Assume Swedish Match faces a 28% tax rate on income and can issue bonds at a fixed krona yield of 4.5%, how much will the company save in taxes for a SEK4 billion recapitalization? What is the value of this interest tax shield?

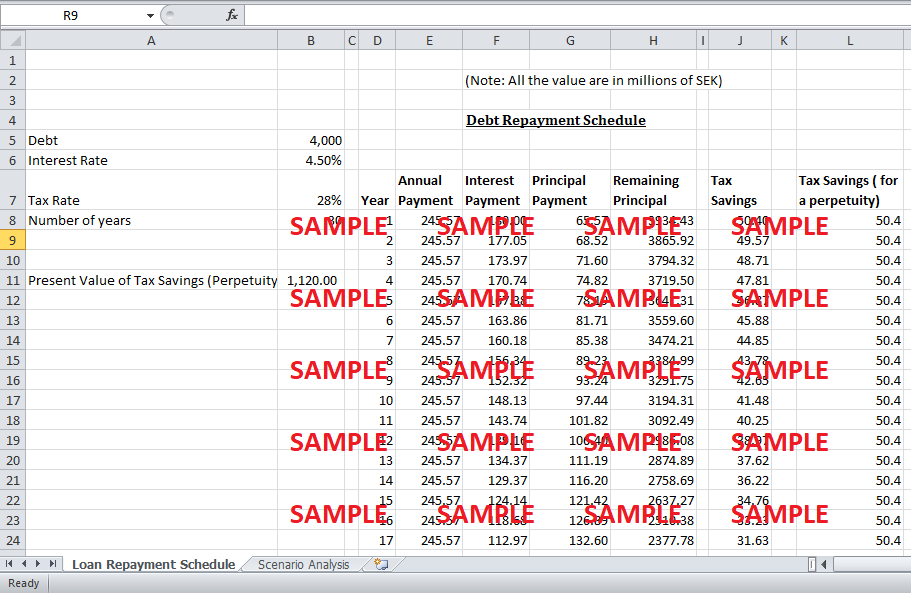

If Swedish Match borrows SEK 4 Billion at an interest rate of 4.5% and the total repayment period of the debt remains 30 years, the annual debt repayments can be calculated using the debt repayment schedule. For the calculations of the annual debt repayments, it is assumed that payments occur at the end of each year and hence, a total 30 payments will be paid by the company in lieu of the loan. As shown in the calculations, the annual debt repayments using 4.5% as interest rate, 4000 SEK million as debt and 30 years as maturity period, come out to be around 245.57 SEK million per annum. Out of this payment, interest rate is paid out on the outstanding principal every year, and the remaining amount is adjusted for the repayment of principal. Therefore, after calculating the amount of interest payments for the next 30 years, the interest tax shield can be calculated by multiplying the interest expense with the tax rate of 28%. Based on these calculations, tax savings for the first year come out to be around 50.40 SEK million, and the tax savings for the 30th year come out to be around 2.96 SEK million. Therefore, the annual savings of the company due to the tax shield of the interest payments continue to decrease every year as the interest payment on the outstanding principal decreases.

If on the other hand, it is assumed that the debt of SEK 4,000 million is raised as perpetuity and the entire principal is to be repaid at the end of the maturity period, the annual interest payments and the corresponding interest tax shield will be constant for all the years to come. In this case, the annual tax shield will remain constant for all the years to come i.e. 50.4 million SEK. Using 4.5% as the discount rate, the present value of the tax savings can be calculated using the following perpetuity formula:

Present Value = Interest Tax Shield / Discount rate = 50.4 million SEK / 4.5% = 1,120 million SEK.

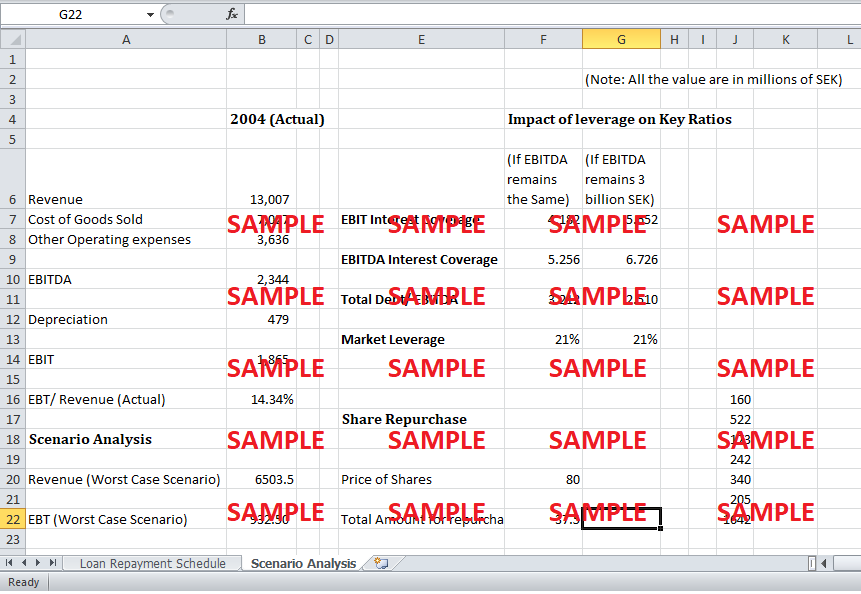

2. What will Swedish Match’s book value balance sheet look like after it completes the debt issuance and share repurchase?

The company is planning to buy back shares of worth 9-12 million SEK in next three years until the end of year 2007. Therefore, in the first year, shares of worth 3 million SEK will be bought back at the end of the year by the company. The current market value per share on which the company wants to repurchase the stock is approximately 80 SEK on the stock exchange. The journal entries to record the acquisition of debt and the corresponding repurchase of the shares are as follows.

-

Cash 4,000 (Debit)

Debt 4,000 (credit)

-

Cash 3,000 (credit)

Shares Repurchase 3,000 (debit)

After the repurchase, the total interest bearing debt of the company will increase from 3,529 SEK million to 7,529 SEK million and hence, the total liabilities figure in the balance sheet will also increase by 4,000 EK million. On the other hand, since shares worth 3,000 SEK million will be repurchased, the equity figure in the balance sheet will decrease from 5,060 SEK million to 3,060 SEK million. So, the net impact on the liability side of the leveraged recapitalization will be an increase of 1,000 SEK million. On the other hand, Cash and Cash equivalents will increase by 1,000 SEK million because out of the 4,000 SEK millions of borrowings; 3,000 SEK million will be spent on the shares repurchase and hence, the total assets figure on the balance sheet will also increase by 1,000 SEK million.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.