Get instant access to this case solution for only $19

Beauregard Textile Company Case Solution

Beauregard Textile Company is evaluating pricing strategy for its product T-30 whether it should charge $3 or $4 per yard. Its competitor is continuously charging the $3 despite making losses and difficult financial condition. If Beauregard continues charging $4, it will have the market share of only 33% while $3, Calhoun and Pritchard has the market share of around 66%. If Beauregard decreases its price to $3, it will gain its customers back because of its location advantage, but it will not be profitable at this price. This whole case represents a situation of Prisoner Dilemma where both would be better off only in case if Beauregard continues its price of $4 while Calhoun and Pritchard also increase its price to $4. In this situation, market size would be reduced by around 20%, but both these companies would make profits.

Following questions are answered in this case study solution:

-

What are the financial results for Beauregard Textile Company that Beal and Calloway should be looking at with respect to the present pricing arrangement?

-

What is the contribution per yard, and what is the total contribution, at the $4 price? How would the numbers look if Beauregard Textile dropped its price to $3.00?( Note that you must determine the relevant costs that should be included in computing the contribution per yard.)

-

Calhoun and Pritchard presumably is showing a loss at $3.00. Why then is it not raising its price? (Assume similar costs).

-

What happens to Calhoun and Pritchard if Beauregard Textile drops its price to $3.00?

-

What price should Beauregard charge? Why?

-

How might Beauregard Textile persuade Calhoun and Pritchard to rise its price WITHOUT violating the antitrust laws which prohibit collusion on pricing between competitors?

Beauregard Textile Company Case Analysis

1. What are the financial results for Beauregard Textile Company that Beal and Calloway should be looking at with respect to the present pricing arrangement?

Beauregard lost its markets share about 40% when it raised the price of Triaxx-30 from $3 to $4. Total market for T-30 has been remained quite stable which indicates that customers switch to low cost suppliers when prices are increased. Calhoun and Pritchard kept its prices at $3 and hence its market share increased by 50%. Now the Calhoun and Pritchard has the market share of around 66%. Beal and Calloway must look at the current contribution margins and profits at the price of $4. If it decides to drop the price to $3, what would be the effects on the contribution margin and profits? What options are available for reducing the costs if it decided to drop its prices to increase its market share? What might be the response of the Calhoun and Pritchard when Beauregard decreases the price? How much would be the loss in the market share after this decision? If the company continues at the prices of $4, what must be done to increase the market share through differentiated products or through additional value added products? So, after considering the all these financial results, Beauregard must decide the price which gives it a maximum advantage in the market.

2. What is the contribution per yard, and what is the total contribution, at the $4 price? How would the numbers look if Beauregard Textile dropped its price to $3.00? (Note that you must determine the relevant costs that should be included in computing the contribution per yard.)

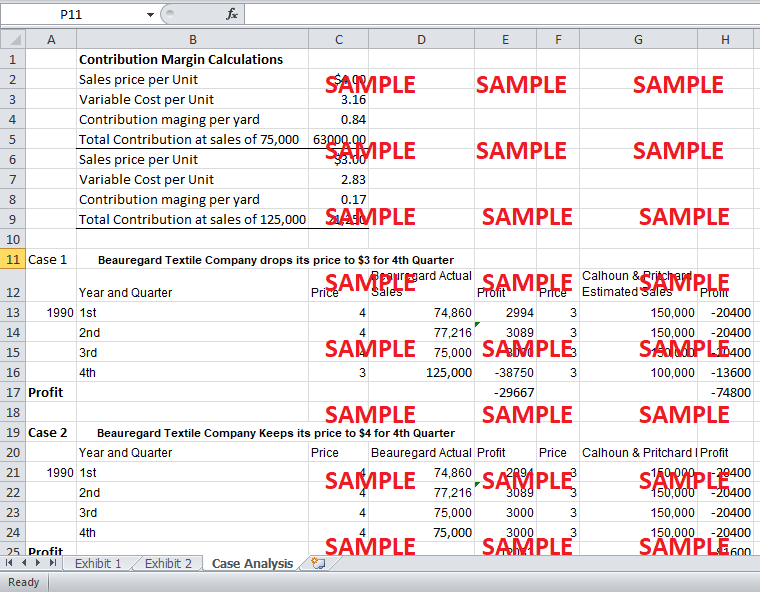

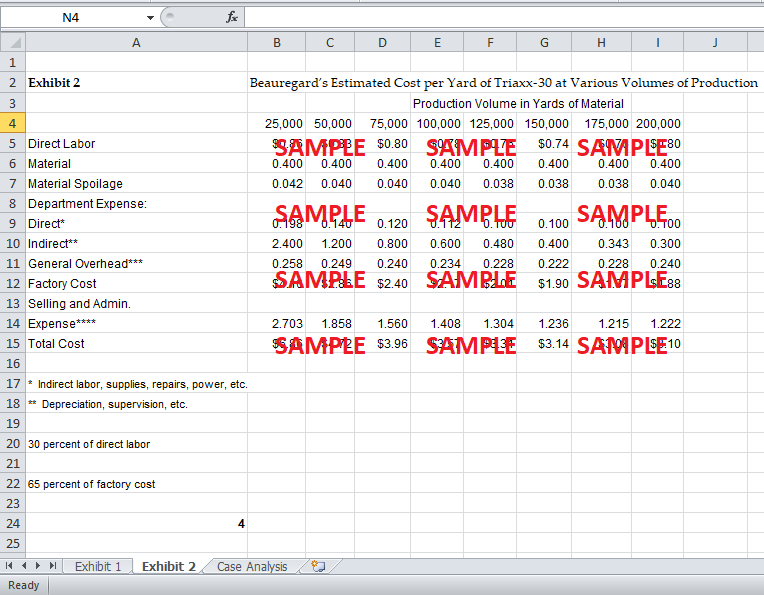

For the calculation of the contribution margin, the fixed costs of depreciation and supervision would be excluded for the calculation of the cost per yard while other costs can be considered as variable as they are directly linked to the production. At the $4 price, at the volume of 75,000, variable cost per unit is $3.16 per yard. Hence, contribution margin is $0.84 or 84 cents. Total contribution would be $63,000 while total fixed costs would be around $60,000 and hence profit would be around $3,000.

If Beauregard Textile dropped its price to $3.00, it will be able to gain its market share back to more than 125,000. Here, we assume that Calhoun and Pritchard will not decrease its price more as the costs are quite similar. With sales above 125,000, variable costs would be around $2.83 per yard and hence the contribution margin would be around $0.17 per yard which will not be able to cover the fixed costs of around $0.48 per yard. Total contribution would be $21,250 while fixed costs would be around $60,000 making it total losses of around $38,750. Hence, in this case Beauregard Textile would be incurring losses. However, losses can be increased if Calhoun and Pritchard cut its prices under $3 due to its competitive nature if Beauregard Textile drops the price to $3. However, as it is expected that Calhoun and Pritchard is already facing financial problems, it can be expected that it will not further cut its prices, and it will make the situation worse for Calhoun and Pritchard due to more losses. Only incentive would be increasing market share, but now it would be difficult for Calhoun and Pritchard to face the extra losses and sustain for the long term.

3. Calhoun and Pritchard presumably is showing a loss at $3.00. Why then is it not raising its price? (Assume similar costs).

Calhoun and Pritchard is showing a loss at $3.00, but it has gained a huge market share of around 66% by staying at the prices of $3. It is competing against Beauregard Textile Company through the reduced price. This strategy can be understood as earlier Beauregard Textile was the market leader with the highest market share when both were selling at the price of $3. Hence, the Calhoun and Pritchard now have a market share of 66% with price at $3, and Beauregard Textile has lost its market share. Calhoun and Pritchard, after becoming a low price market leader, can increase their prices slightly to reduce their losses and to breakeven. However, this strategy is still not helping the Calhoun and Pritchard to make profits. Calhoun and Pritchard fears that if it raises the price to $4, and Beauregard Textile decreases its price to $3, Calhoun and Pritchard would not only lose its market share but also it would make huge losses. This dilemma is also causing Calhoun and Pritchard not to increase their prices.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.