Get instant access to this case solution for only $19

Ben Walter Case Solution

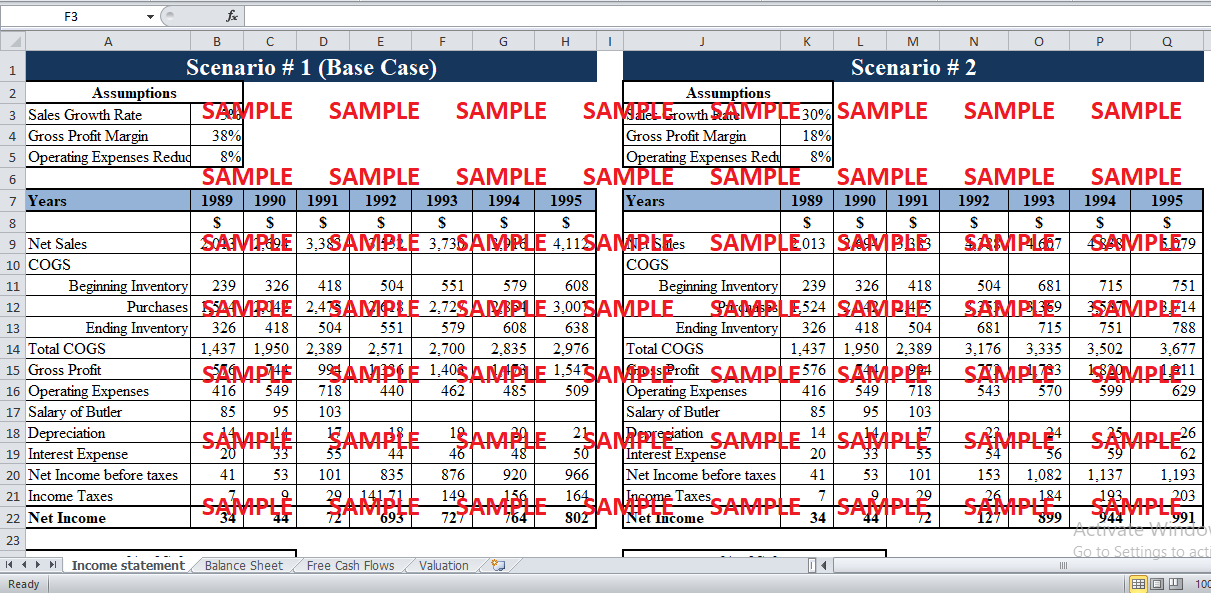

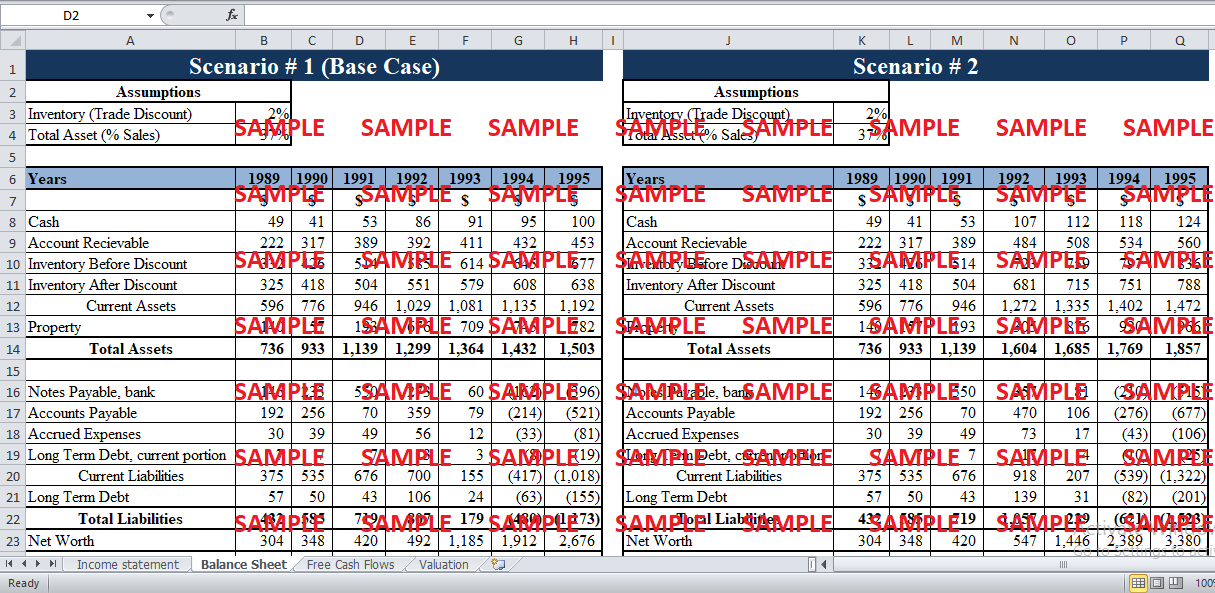

In order to calculate the Performa income statements, the expenses as a % of sales were calculated first. Similarly, the asset as a % of total assets and liabilities as a % of total liabilities were calculated. The average growth of sales for the years 1990 and 1991 was calculated as 29.7%. As given in the instruction the two scenarios were assumed. In the first scenario, the gross margin was increased and sales growth was decreased. In the second scenario, the sales growth rate was increased and the gross margin was decreased. Free cash flows and valuation of equity were performed for both scenarios.

Following questions are answered in this case study solution

-

Performa Statements

-

Scenario # 1 (Base Case)

-

Scenario # 1 2

Case Analysis for Ben Walter

2. Scenario # 1 (Base Case)

Assumptions

In this scenario, the growth rate of sales was assumed to be 5% as given in the case as the lowest growth rate. The gross profit margin was assumed to be relatively high. The average gross profit margin was 28%. By adding 10%, the gross margin was assumed to be 38%. The operating cash flows were reduced by 8% during the forecast period in order to generate positive free cash flows.

Also for the forecast of total assets, the assumption was made that the total assets would be a proportion of sales.

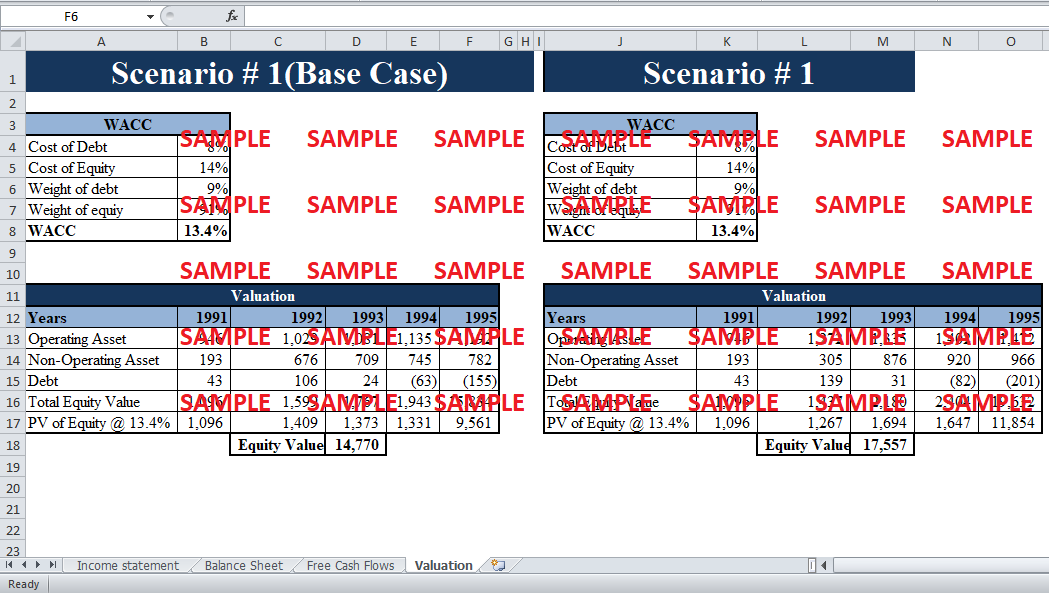

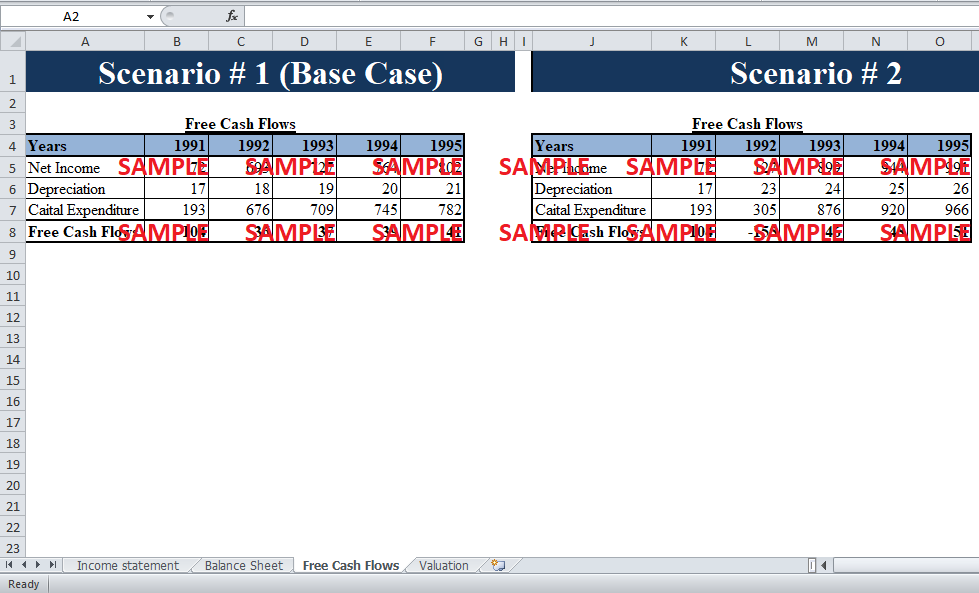

Free Cash Flows & Valuation

The free cash flows for the base case were calculated using cash flow from operations. The cash flow from operation comes from the sum of net income and depreciation. The capital expenditure was deducted from cash flow from operation. In this case, the capital expenditure was only property expense.

In order to calculate, the WACC for the store, the weights of debt and equity were calculated first. The book value of debt and equity was used to calculate the weight. The cost of debt was 8% (provided in the requirements) and the cost of equity was 14% as this is the minimum rate that Walter requires on his investment. The weighted average cost of capital comes out to be 13.4%.

In order to value the equity, the corporate value was calculated and then the total debt was deducted from it. The corporate value is the sum of operating and no operating assets. The value of perpetuity at last year was also calculated. The present value of equity for each year is calculated by discounting it with the WACC. The Equity value for the base case is 14,770,000.

3. Scenario # 1 2

Assumptions

In the second, scenario high sales growth rate of 30% was assumed. At the same, time the gross margin was assumed to be lower than the base case. In this scenario, the gross margin was 28% which calculated by reducing the average gross margin of 28% by 10%.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.