Get instant access to this case solution for only $19

Bidding for Hertz: Leveraged Buyout Case Solution

The Ford motor group has put its wholly owned subsidiary Hertz up for sale in June 2005. Hertz had two main operating units namely, rent a car and equipment rentals. This sale is based on a dual track process which would result in an IPO if all other sales opportunities fail. The Carlyle Group is up against a consortium which is also interested in the LBO. From the projections of cash flows and growth, the Carlyle group should access the return on equity and other important relevant factors to make sure that Hertz was a feasible leverage buyout target. Meanwhile, the bidding group has to beat the rival consortium and the possible IPO bid to carry out this LBO successfully. Also at the same time, the Carlyle group has to take into consideration the possible risks of the buyout and the effect of synergies due to this transaction.

Following questions are answered in this case study solution:

-

How does the dual-track process used by Ford to initiate “consideration of strategic alternatives” affect the bidding process for Hertz?

-

In what ways does Hertz conform or not conform to the definition of an “ideal LBO target”? Do you believe Hertz is an appropriate buyout target?

-

Strategically, what value-creating opportunities can the sponsors exploit in this transaction?

-

How realistic are the key assumptions that underlie the Bidding Group’s projections in case Exhibits 8, 9, and 10? Which assumptions are most likely to have the largest impact on returns?

-

Based on the base-case estimates in case Exhibits 8, 9, and 10 and your estimate(s) of terminal value if the sponsors put up $2.3 billion in equity, what return can they expect to earn?

-

If Carlyle desires a 20% target return on its equity investment, does your analysis suggest that $2.3 billion is too much to pay, or can it afford to pay more—in either case, by how much?

-

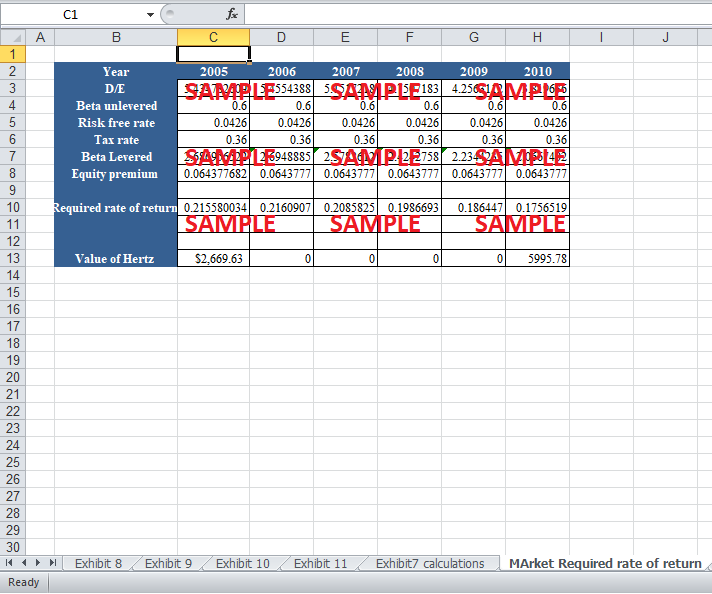

What is the market-required rate of return for this investment, and why might this differ from the sponsors’ target return?

-

What is the value of Hertz using the equity residual method of valuation?

-

Assess the amount Ford is likely to receive if it pursues its IPO alternative versus being bought by a private equity group.

-

What factors would be considered in assessing whether the consortium’s bid is likely to beat that of a rival group?

Case Analysis for Bidding for Hertz: Leveraged Buyout

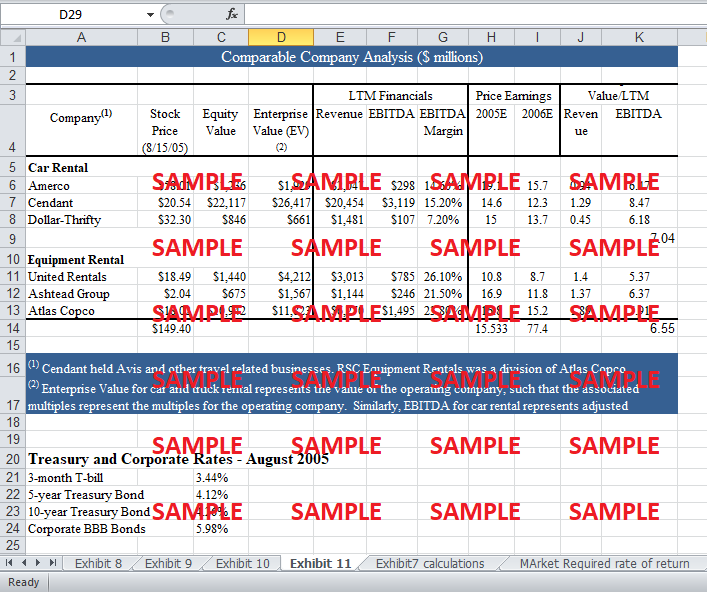

1. How does the dual-track process used by Ford to initiate “consideration of strategic alternatives” affect the bidding process for Hertz?

The dual track process assumes the fact that ford will be able to avail IPO facility if the LBO options are not viable. First of all this process will lead to a reduction in the risk of Ford as it will have a dual option in terms of share offering. Secondly, it will lead to a possible increase in the price of LBO because of competitive pressure pressed by the IPO. Thirdly, it can provide Ford with negotiation leverage. Most importantly, apart from all these factors, this process will provide Ford with a true and fair value of their selling company owing to the ‘due diligence’ factor of the bidders.

2. In what ways does Hertz conform or not conform to the definition of an “ideal LBO target”? Do you believe Hertz is an appropriate buyout target?

For a LBO to be ideal, there are many factors to be considered.

1. Well-established Business and Products

In terms of car rentals, undoubtedly Hertz was the market leader and it had the enough expertise in the business. Rent a car captured 68% of the overall industry revenues in USA, which makes Hertz the undisputed market leader. In the equipment rental market, Hertz was ‘industry revenue’ wise on the third position. Both businesses have well established brand names and products.

2. Strong Management Team

Hertz management team had loads of industry experience and certainly was strong in terms of their management style and philosophy. However, Ford had never expected the Hertz management to increase their performance and productivity. Nevertheless, at the current moment, Ford should realize that for this LBO to be attractive it has to force or probe the Hertz management to perform better.

3. Strong and Predictable Operating Cash Flows

Historically, Hertz financial performance in terms of OCF has been superb. Hertz was a market leader with diversified operation all over the world. 34% of revenues were coming outside of US. Revenues in both the rent a car and equipment market were stable and had experienced growth in the last couple of years and are expected to grow steadily. Equipment market was a little shallow; however, this trend was about to diminish with time.

4. Seller is Motivated to Cash out of his/her Investment or Divest Non-core Subsidiaries

In the case of hertz, Ford was surely motivated to sell it and divest this part of the business.

5. Strong Tangible Asset Coverage, Heavy Asset Base, Divestiture Assets

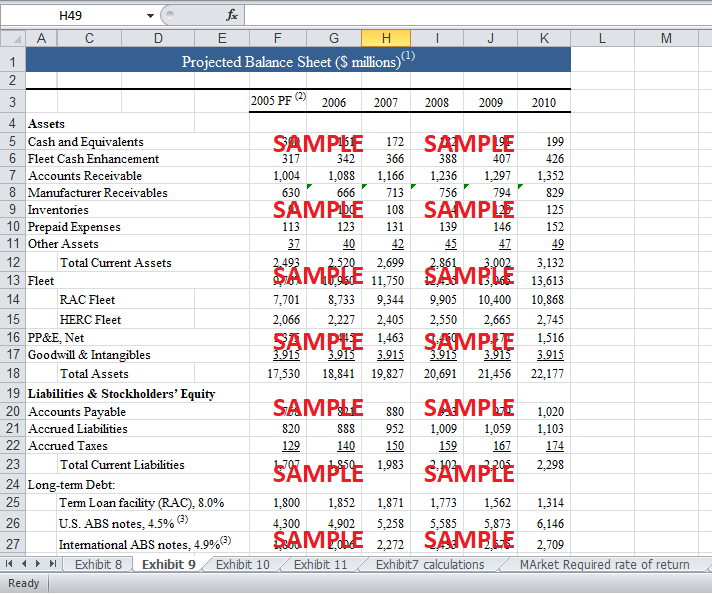

Hertz had a very strong asset base both in rent a car and equipment business. On a consolidated basis, Hertz tangible assets were almost 76% of overall assets. Also, the assets of the two units were very separate in the mode of business and revenue generation.

6. An Exit Strategy

The company should approve different modes to resell the company in order to create an attractive exit strategy for the buyer.

Considering the above mentioned factors, the company would be a feasible LBO target on condition of enhanced performance on the part of management to generate boosted revenues.

3. Strategically, what value-creating opportunities can the sponsors exploit in this transaction?

There are two types of value-creating opportunities the seller can cater to. In terms of operating synergies, value is created by refining the operational effectiveness of the company. The units, rent car and equipment, present to the seller huge prospects of improving the performance by employing different options like:

-

Increasing the revenue per rental day

-

Length of the rental and

-

Fleet utilization

In terms of financial synergies, you examine the incremental effects of financial benefits that arise in LBO. Both the units display enormous value creating opportunities to the bidding group such as:

-

$ 400-600 million in savings in the adjusted EBDITA margins.

-

By controlling non fleet related expenses (as they have a growth rate of 38%).

-

RAC’s CAPEX in the US were higher than the Avis one.

-

RAC’s CAPEX in the Europe was also higher than the US one.

-

The most important financial savings can arise by issuing Asset backed debt. The loan can be backed by the huge fleet size. This securitized loan can reduce the cost of debt to a great extent. This agreement could be the most financially feasible agreement the bidding group can get.

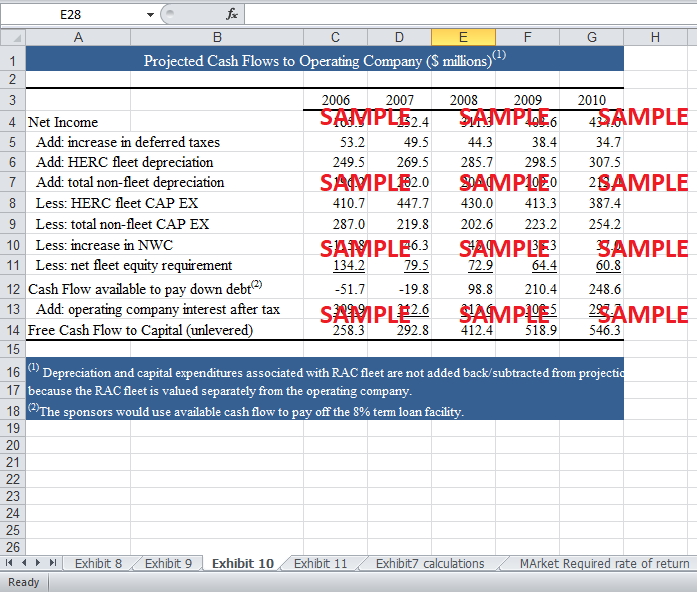

4. How realistic are the key assumptions that underlie the Bidding Group’s projections in case Exhibits 8, 9, and 10? Which assumptions are most likely to have the largest impact on returns?

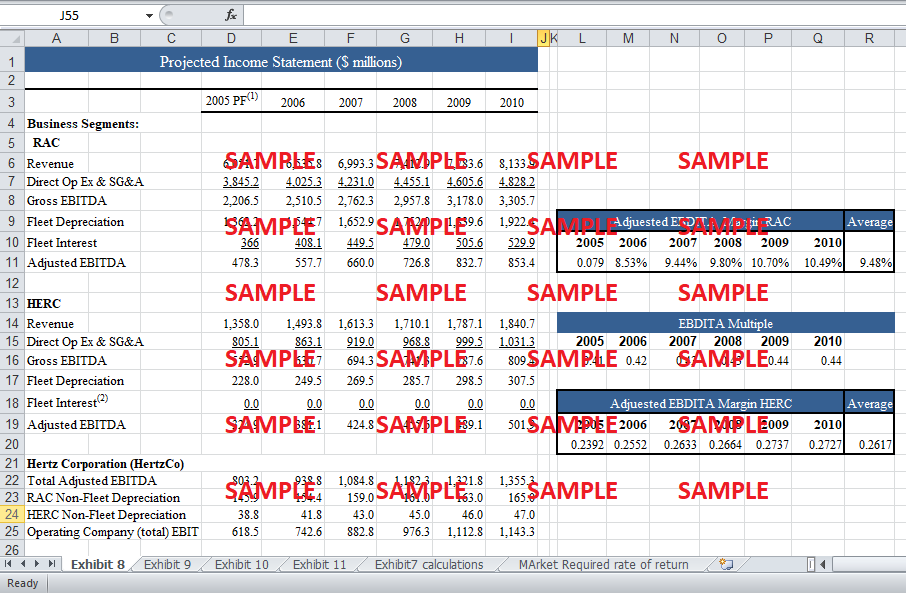

In exhibit 8, the major assumptions underline the growth rate, in both the cases of RAC and HERC. Both units’ revenues were projected to grow at a positive rate till 2010, averaging 6.1% and 6% in RAC and HERC respectively. After 2010, the rate is supposed to be equal to 4.5% and 3% in RAC and HERC respectively. The revenues of RAC were positively correlated to the airport traffic, which in turn is supposed to grow at 3.7% till 2010. The HERC revenue growth had observed a boon in recent years, but the future growth is supposed to be stable. Both the average growth rate and the terminal stable growth rate seem realistic.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.