Get instant access to this case solution for only $14

Bonnie Road Case Solution

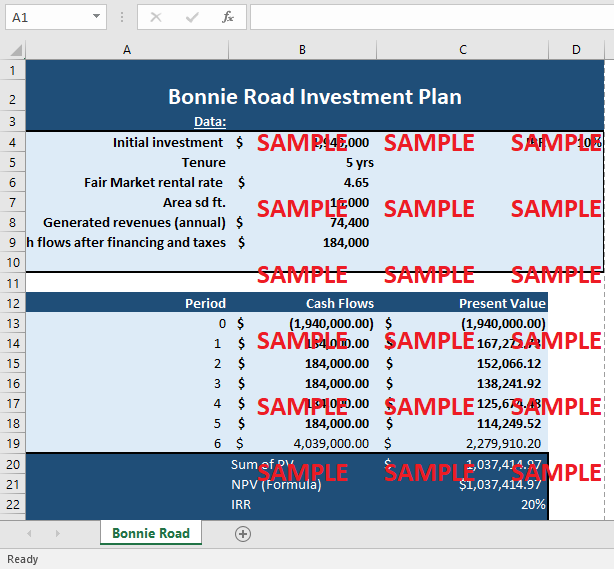

It is obvious from the calculations that the NPV and IRR both are negative for the given case for the tenure of five years. Even if Alexander use financing and the projected net cash flows seem feasible for the five years the net impact of the investment is negative and not sufficient for qualifying as the profitable investment in the long run.

Case Analysis for Bonnie Road

Although the calculated IRR is optimum as per the investor’s demanded rate of 10% but in terms of NPV the value is lower as compared to the initial investment therefore the investment is not desirable for the monetary perspective. It might become profitable after some value addition or with a longer pay back period but for the given tenure it is not a profitable investment and the project seems risky from a financial perspective.

Get instant access to this case solution for only $14

Get Instant Access to This Case Solution for Only $14

Standard Price

$25

Save $11 on your purchase

-$11

Amount to Pay

$14

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.