Get instant access to this case solution for only $19

Burlington Northern Railroad Company: Equipment Leasing Case Solution

The lease should be regarded as a financing decision because it is an operating lease. At the end of the lease, BNRR has the option to buy the equipment back. If, it was an investing decision, lease payments could be capitalized instead of treating them as an expense.

Following questions are answered in this case study solution

-

Should the lease be regarded as an investment or financing decision?

-

What are the after-tax cash flows relevant to Paul Weyandt if Burlington purchases the auto racks?

-

What are the after-tax cash flows directly attributable to the leasing decision, and what discount rate should be used for those cash flows?

-

What is the net present value of leasing?

-

How important is BNRR’s tax status to your analysis?

-

How important is your estimate of the residual value to your analysis?

Case Analysis for Burlington Northern Railroad Company: Equipment Leasing

2. What are the after-tax cash flows relevant to Paul Weyandt if Burlington purchases the auto racks?

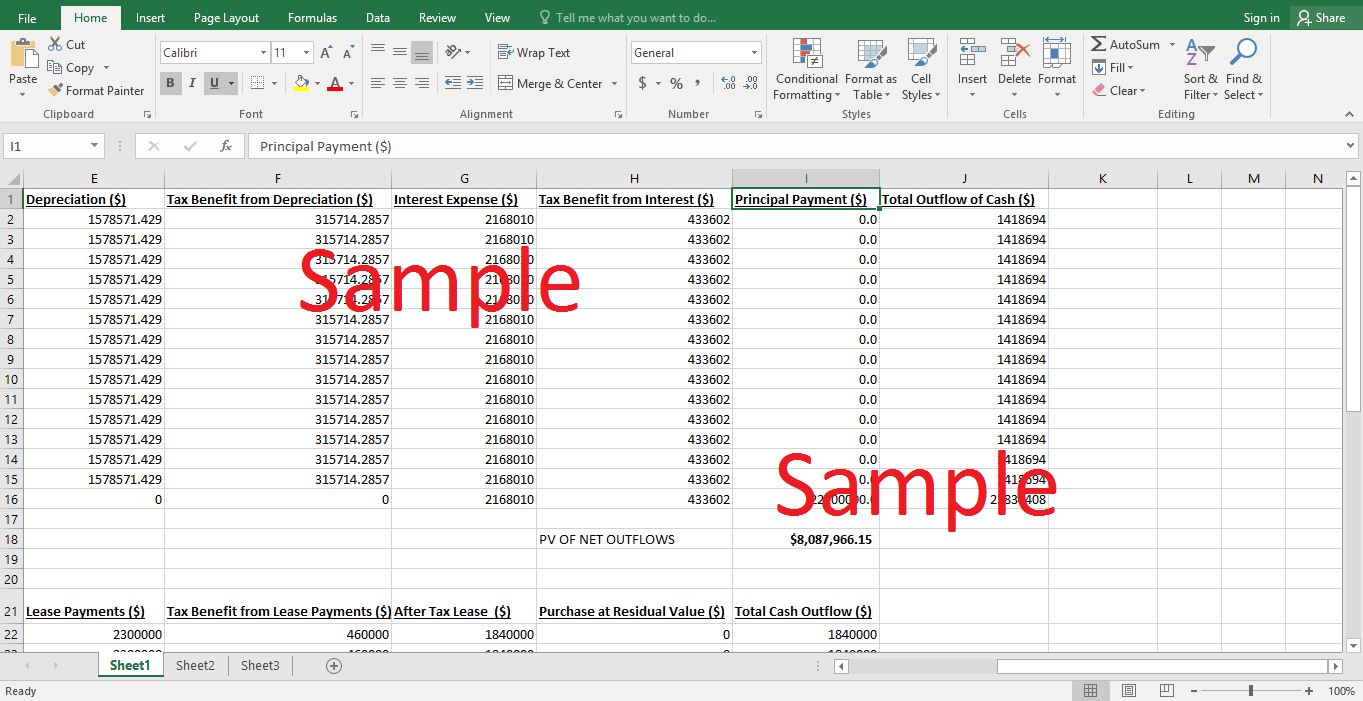

The after tax cash flows relevant to Paul Wayedt, in case the company chooses to buy the auto racks, can be calculated by subtracting the tax benefit from the interest and depreciation expenses from the Interest and principle payments. Since, the company is buying the asset; the amount spent in this regard will be capitalized. Depreciation will be recorded through straight line depreciation method for 14 consecutive years. Following are the net cash outflows for 15 years, if the company chooses to buy the auto racks through debt financing. For example, Interest Expense for the first year is $ 2,168,010. So, the tax advantage can be calculated as 20% of the Interest expense (0.2*2,168,010). This amount comes out to be $ 433,602. Similarly, 20% of depreciation expense for the first year comes out to be $ 315,714 (0.2*1,578,751). This pattern goes on for every year, except for the last year; there is a principal payment of $ 22,100,000.

|

Year |

Total Cash Outflow |

|

1 |

1,418,694 |

|

2 |

1,418,694 |

|

3 |

1,418,694 |

|

4 |

1,418,694 |

|

5 |

1,418,694 |

|

6 |

1,418,694 |

|

7 |

1,418,694 |

|

8 |

1,418,694 |

|

9 |

1,418,694 |

|

10 |

1,418,694 |

|

11 |

1,418,694 |

|

12 |

1,418,694 |

|

13 |

1,418,694 |

|

14 |

1,418,694 |

|

15 |

$ 23,834,408 |

3. What are the after-tax cash flows directly attributable to the leasing decision, and what discount rate should be used for those cash flows?

If, the leasing decision is opted instead of financing, then in that case, International Accounting Standard for Leases does not permit to capitalize the asset if it falls in the category of Operating lease. However, lease payments will be deductible as expenses. Hence, company will be able to enjoy the tax benefit from lease payments. Net Cash outflow for each year can be calculated by subtracting the tax benefit from the lease payments. For example, for the first year, lease payment is $ 2.3 million. So, assuming 20% tax rates, the tax benefit comes out to be $ 460,000. Hence, the net outflow relevant to the lease or buy analysis comes out to be $ 1,840,000. This pattern goes on for the rest of the years except in the last year where cash outflow total also includes the purchase of auto racks at the predetermined price of $ 9.2 million.

|

Year |

Total Cash Outflow |

|

1 |

1,840,000 |

|

2 |

1,840,000 |

|

3 |

1,840,000 |

|

4 |

1,840,000 |

|

5 |

1,840,000 |

|

6 |

1,840,000 |

|

7 |

1,840,000 |

|

8 |

2,240,000 |

|

9 |

2,240,000 |

|

10 |

2,240,000 |

|

11 |

2,240,000 |

|

12 |

2,240,000 |

|

13 |

2,240,000 |

|

14 |

2,240,000 |

|

15 |

$ 11,496,302.29 |

The discount rate relevant to computing the present value of these cash flows should be 20%. This is essentially the hurdle rate mentioned in the case study. This rate signifies the minimum rate of return that has to be earned for any investment in capital. In other words, 20% is the benchmark rate of return, set by the management of the company that has to be earned for all the capital investment purposes.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.