Get instant access to this case solution for only $19

Ceres Gardening Company Funding Growth In Organic Products Case Solution

Ceres Company, with its innovative GetCeres program, is aiming to increase its outreach by penetrating the retail market for the organic gardening business. Ceres is offering relaxed credit terms to its retailers in a bid to capture a new consumer segment - the causal gardeners. Their new marketing strategy, however, is putting additional strain on their working capital position. The company is stripped of cash and can’t borrow additional money because of its restrictive debt covenants. The burgeoning sales are, therefore, not sustainable in the future. The company is left with two options: they can either raise more equity capital to support their growth or they can withdraw from their aggressive growth policy and expand at a sustainable rate

Following questions are answered in this case study solution:

-

Abstract

-

Introduction

-

Risks and Implication of the New Strategy

-

Projected Cash Flows

-

Conclusion

Ceres Gardening Company Case Analysis

2. Introduction

Ceres Gardening Company was founded to promote sustainable organic gardens and landscape. It started as a small venture but grew rapidly in the 90s before it went public in 1999. In the early years, the company had grown primarily through a mail order catalogue. During recent years, the focus had, however, shifted to retail sales. They based this decision on industry research, which suggested a shift towards organic seeds and farming due to the greater growth opportunities. The company hired a new VP of marketing and under her leadership, more independent sales reps were hired to implement the Get Ceres program. The objective of the program was to seek a bigger presence in the retail distribution channel. The main idea behind the program was to keep large amount of inventory in retail outlets so that the opportunity of sale to the casual shopper is not missed. Ceres increased their presence at the retail outlets by offering 15% discounts on all sales new retailers, and the same discount for any increase in sales for existing retailers. The company also allowed qualifying retailers a higher 120 days to pay the company’s receivables.

3. Risks and Implication of the New Strategy

The main motivation behind allowing the discount and extra credit to retailer was to encourage them to hold more inventories. The additional inventories were meant to guarantee that the average retailer in not of stock when the casual seed shopper visit his outlet. The strategy probably worked in 2006 because the sales increased by 21% to 42.6 million – 80% of these sales were through the retail channel. However, the inventory levels of the retailer also increased. In 2005, the ending inventory of the retailer was $10 million, while it was projected to be $23 million at the end of 2006. The attached excel file shows the calculations of the dealer’s sell-through – the amount sold by the retailer to the end customer. The sell-through is calculated by the following formula:

Beginning Inventories + Dealer’s Sell-in – Dealer’s Sell-Through = Ending Inventories

The dealer’s sell-in – amount sold by Ceres to the retailers – is estimated to be 80% of total sales for 2006. Once we calculate the sell-in, the sell-through is the only unknown and can be easily calculated as shown in the spreadsheet. For 2006, the sell-through is estimated to be approximately $24 million, which is only marginally higher than the ending inventory of $23 million. In other words, out of the total goods available for sale with the retailers, they were only able to sell half of it.

This should surely create problems in the future as dealers already have sufficient inventory to meet most of the sales for next year. If Ceres does not realize this and keeps on producing with the assumption that dealers will buy it, the company might be left with a huge pile of unsold inventory at their hands. Moreover, the relaxed terms of the receivable might also be putting a strain on the working capital. Their position is further worsened by the fact that they cannot postpone the payable by more than 90 days without incurring significant additional fees. The operating line of credit cannot be used perpetually either as the company is required to be debt-free for at least 2 months in order to obey their debt covenants.

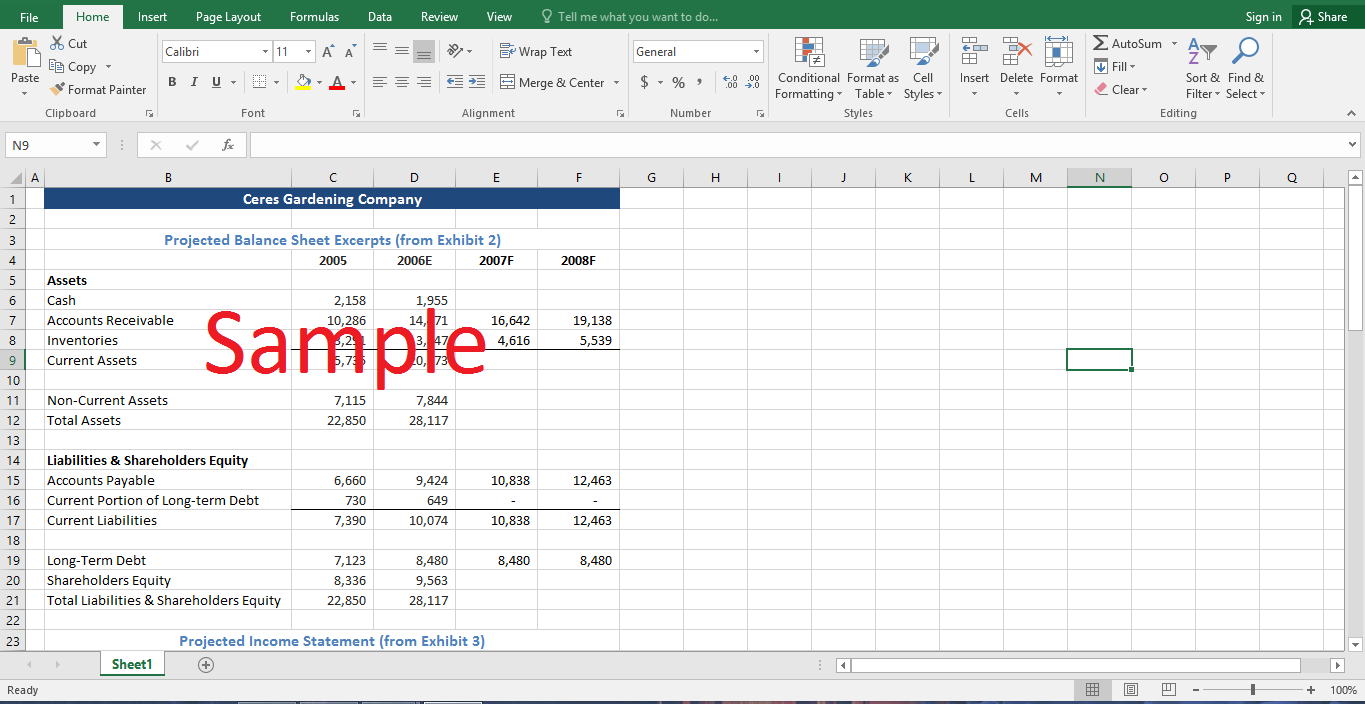

4. Projected Cash Flows

Since the working capital is seen to be worsening, it is clear that the new strategy might be having a negative impact on the cash position of the company. Therefore, it is important to project the future cash flows under the new strategy. The excel file reveals a projected income statement for the following two years (2007 and 2008). The projections are based on a pro-forma statement that assumes a stated level growth in each component of the income statement. The company has seen a growth of over 20% during the year following the strategy. However, it is clear from the analysis of dealer’s pass-through that Ceres will not be able to sustain that growth. The appendix of the case reveals that the organic garden industry is expected to grow at around 10% in the following two year. Since Ceres is looking to capture the market share, it is reasonable to assume that it will able to grow at more than 10%. It is, therefore, assumed that the company will be able to increase its sales by 15% in the following two years. However, the increase in sales should also be adjusted for the 15% discount offered to retailers. Since retail sales contributed to 80% of the total sales in the last year, a discount of 15% has been deducted from 80% of the projected increase in sales for 2007 and 2008. The cost of sales is also expected to increase in accordance with the revenue at 15%. In the absence of any information to the contrary, each of the non-operating expenses has been increase at their average growth rate over the past five years of operations. These calculations give us the projected earnings before interest and taxes for 2007 and 2008.

One of the debt covenants states that the principal portion of the debt cannot be repaid if the revolving credit is outstanding. The revolving credit is likely to be outstanding because of the adverse working capital condition associated with the new strategy. Therefore, the debt level is likely to remain constant in the next two years, and the interest expense will remain the same. Adjusting the earnings for interest and taxes gives us the projected net income, which can be used to calculate the cash flow from operations. The projected working capital needs to be ascertained in order to calculate the operating cash flow. The changes to receivable due to more relaxed credit terms and the changes to payables due to the new 90 days payment terms have already been accounted for in the 2006 balance sheet. Hence, the receivable and payables only need to be adjusted for the higher level of sales in the future years. It is reasonable to assume that the receivables are expected to grow at the same rate as sales, and payables are expected to grow as the same rate as cost of sales. The inventories, however, might grow at a higher rate than sales if Ceres does not account for the adverse effects of dealers’ pass-through. Even if they do account for it, they might be content with keeping a higher inventory so that they do not lose any customers from insufficient inventories. Thereby, the inventories are assumed to grow at 20% - a slightly higher growth rate than the growth rate of sales.

Adjusting the net income for working capital and depreciation gives us the projected cash flow from operating activities. As it can be seen in the attached excel file, the projected cash flow is quite low, especially when it is compared to the cash flow from a few years back. In fact, there is a decreasing trend in the net cash position of the company. This may be a worsening sign for the company as it is faced by restrictive debt covenants that limit its financing possibilities for expansion and capital expenditures.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.