Get instant access to this case solution for only $19

Chase Manhattan Corporation: The Making of America's Largest Bank Case Solution

In August 1995, Walter Shipley, the CEO of Chemical Banking Corporation, considered a decision regarding the merger of its corporation with Chase Manhattan Corporation. Although, this merger could produce “the largest commercial bank” in the United States, it had certain risks and costs associated with it.

Chemical Banking Corporation, since 1840s, has been growing prosperously by acquisitions, introducing a variety of products and expanding in other geographical markets, both domestically and internationally. Its objective was to maximize earnings and become an innovative firm. On the other hand, Chase Manhattan Corporation had been in operation since 1955. This corporation was formed by a merger of two banks; Bank of Manhattan and Chase national bank. Both of these banks were profitable and well reputed and had grown through acquisition and product development. In times of crisis, both Chase and Chemical had taken steps to reduce costs and close down branches.

Following questions are answered in this case study solution:

-

Overview

-

Benefits of formation of Chase Manhattan Bank

-

Risks

-

Quantitative Factors

-

Conclusion

-

Appendix

Chase Manhattan Corporation The Making of America s Largest Bank Case Analysis

In 1994, the US banking industry became extremely competitive. There was a wave of mergers between financial intermediaries across US due to the deregulation of the financial industry. There was also the competition from the non-financial institutions like mutual funds and insurance companies. This caused Chemical’s position to fall from the second largest to the fourth largest bank in the US. It was an era of rapid consolidation, new product innovations and advancing technology. Hence, if Chase or Chemical is not able to cope up with these rapid changes, they will be doomed to bankruptcy.

Shipley is facing a dilemma. Though he knows that the merger is a highly favorable proposition for Chemical, he still has his concerns regarding this venture being a success. These concerns are based on the struggle Chemical faced when it acquired Manufactures Hanover Corporation in 1991. It took four years for the company to make this enormous acquisition a success. Now, if it enters into another merger, it would again take a number of years to restructure the bank and make the merger pay off. This might over the year damage the competitiveness of the bank in a rapidly progressing financial services industry.

2. Benefits of formation of Chase Manhattan Bank

This merger would have a lot of qualitative benefits which would reflect in the profits of years after the merger. The most significant effect this merger would have is the creation of the largest commercial bank in the United States. This would undoubtedly gain market leadership for the merged firm. Exhibit 3 in the case clearly show that Chemical is ranked first in the relationship and lead share in Downstate new York middle market as well as deposit share in new York 9 County Consumer share. Nevertheless, Chase has either second or third rank in market share in these products. A merger would most certainly establish the merged bank’s long term stable position as a market leader in the US with distinct competitive advantage. Consequently, Chase Manhattan Bank will become the world’s 4th largest bank. As the competition is intense in the national and international markets, this move will increase the barriers to entry for new firms in the industry and equip the bank to compete effectively with other firms.

The merger would be both a market extension and in-market merger. In market mergers included both the banks being in same geographical areas. After merger, these excess overlapping activities can be eliminated. the cost saving will also occur This will reduce the management burden as well as the management cost of the new firms when over a 100 unwanted branches are closed down. There will also be a reduction in the number of employees to manage and pay due to overlapping of banks’ business activities. After 12000 job reduction, the overall operating costs will fall substantially. For market extension merger in non-overlapping markets, these are growth opportunities in potential markets. The size of the firm after the merger will lead to large savings due to economies of scale of large scale operations. The most obvious effect of this merger would, thus, be the reduction in the operating and overhead costs.

From marketing view point, this merger will assist in upholding and capitalizing on the “globally recognized brand name” of Chase Manhattan Corporation. Thus, Chemical-Chase would have significantly larger revenue growth when it enters new markets and develop new products. The crux of marketing is to attract and retain customers by satisfying their needs. This merger will facilitate the bank in better catering to the complicated needs of large corporate clients. This will give the firm the comparative advantage in attracting new businesses and clients. The increased expenditure in new technology will further provide a positive perception of Chemical-Chase bank for its customers.

There will be other cost advantages to the mergers. For instance, after the merger both banks would share the growing technology investment costs which were required to make sure that the financial services firm is up to date in technology (mainly in ATMs and net banking). In 1995, it was obvious that Chase was undervalued. Despite the high returns, the share stock prices were low. This was because of the lack of new business opportunities pursued by Chase. After the merger, the firm can take advantage of economies of scope. This merger can help boost the share price of the merged bank as now it would be able to invest in new business opportunities.

Additionally, Chase was an attractive merger partner. It, not only, had strong wholesale businesses, but also, some competitive strength in private banking, credit cards and mortgage banking. Chase even provided foreign exchange products and international money transfer. Hence, this proposition can help Chemical diversify and create a certain niche in the market. It, further, reduce the risks of bankruptcy in case of a drastic change in the economic environment. In early 1990s, Chemical had suffered a reduction in financial performance during the financial crisis. This could happen again in the future if Chemical does not take a step to prevent this. Merging with Chase will improve the credit rating of the bank as both the firms are attractive for one another.

Finally, the impact of deregulation over the last few years should not be taken lightly. Rigorous deregulations led to easy access of non-financial intermediaries into the financial sector. Moreover, Banks received the right to underwrite certain corporate securities. This provided banks with an opportunity to provide innovative products. Additionally, the declining cost of information technology gave non-banking firms a chance to specialize. Thus, banks were in direct competition with the non-financial firms. With this merger, both banks could capitalize on their respective expertise, offer more products to the combined customer base and compete effectively. This merger, hence, seems critical for the banks to protect their market share and sustain their profitability.

3. Risks

Chemical Banking Corporation is fairly profitable with a net income of $1,294 million. It has just become profitable after massive amount of restructuring done because of its merger with Manufactures Hanover Corporation. Chemical is, therefore, in a relatively stable position. It does not have a dire need to step into another merger and take up risks associated with it. Merger with such a large multiple-line bank is itself a risk. During this era of specialization, it might not be wise to expand in a number of banks rather than focusing on certain selected businesses individually.

The integration of these complex organizations will pose a problem for the firm in the short term. Moreover, there will be disruptions which could inconvenience the customer and the bank might end up losing its valued customers. Consequently, this will have the negative effect on revenue in the short term.

The stock market may not show the expected rise in prices of shares, if the stock price does not reflect the new value of the bank. The valuation would be difficult for the Wall Street analysts due to massive restructuring taking place in the merged bank.

Furthermore, much has to be decided and considered before this merger is complete. One crucial consideration would be the exchange ratio in the acquisition i.e. “the number of shares exchanged during transaction. The positions given to top management of Chase and Chemical in the combined bank would have to be decided. If this merger goes through, a lot of decision has to be made regarding the which distinct systems and technologies to retain, how to plan branch closing, plan lay outs, asset disposals, etc. Moreover, as this is not the merger of equals one bank may want to dominate the other which might create agency problems. The firms will also become more interdependent on each other which might not be that favorable in the long run.

The laying off of workers and closing branches is profitable for the firm, however, the redundant workers suffer tremendously. This will eventually create moral problems within the organization. It is also mentioned in the case that both organizations have a different corporate culture and thus integration will be a serious problem if the merger takes place.

4. Quantitative Factors

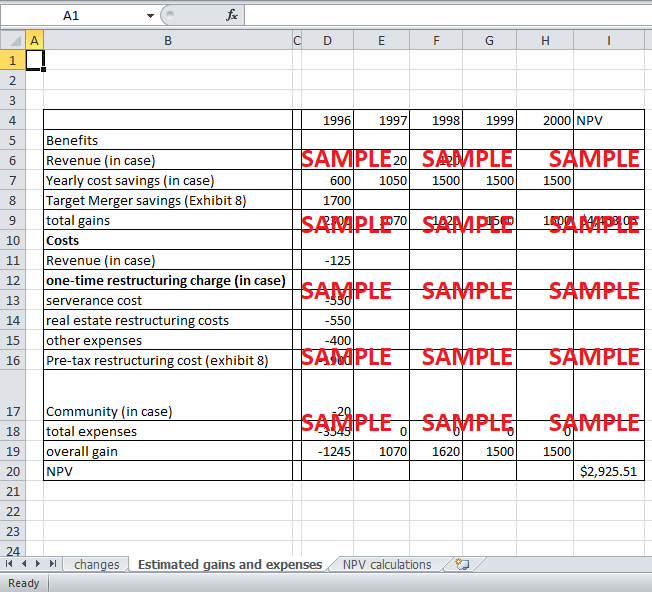

The total assets of the two firms combined are nearly $300 billion with over 74000 employees. Cost saving of up to $1.5 billion is anticipated. Revenue too will increase in later years. However, in the beginning the costs of restructuring will be high and, due to disruptions, the revenue will fall. This is clearly shown in exhibit 1.

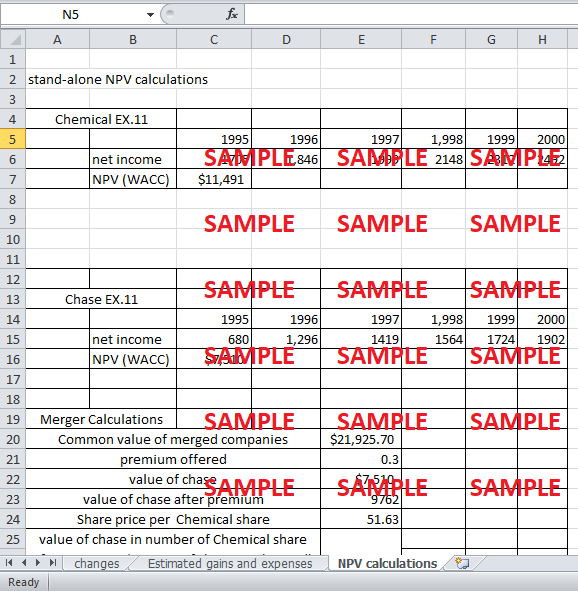

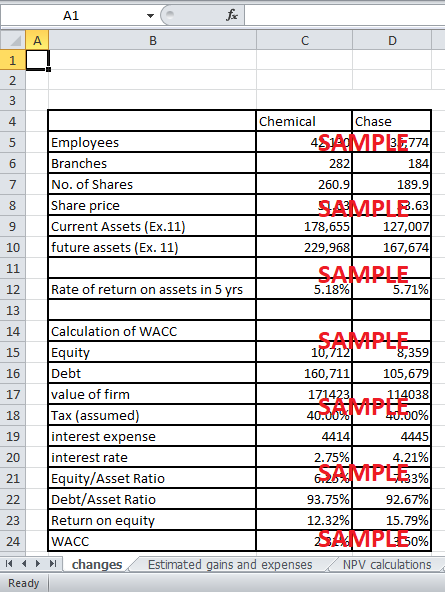

The Weighted Average Cost of Capital (WACC) calculated in Exhibit 2 shows that the rate of return required by both firms to remain afloat is relatively low. Thus, there is a lot of safety margin for the firms. In Exhibit 3, we calculated the exchange ratio using the WACC. It shows that it is highly probable that the share prices will fall, in the beginning at least. The NPV of Chase and Chemical stand alone is also calculated using WACC and both turn out to be positive. We deduce that, for the next five years, both Chase and Chemical have positive projected cash flows. Also, the value of the merged firm is positive and higher than values of the firm standing alone. We can, therefore, safely say that this merger will produce positive cash flow.

We also deduced that 189 shares of chemicals will be given to Chase management in order to merge the company. The merger is not a merger between equals because for mergers between equals the premium is as low as 5% whereas premium charged for this merger is 30%. Chase was undoubtedly undervalued. Despite the high net income, the share price of Chase was relatively low. Thus, Chase was at a risk of takeover.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.