Get instant access to this case solution for only $19

Compass Records Case Solution

Compass Records was an artist-run record company founded in 1995. It was jointly owned and managed by Alison Brown and Gerry West. By 2005, the firm was known for its folk and root music production. In June 2005, Brown was faced with a decision of whether to give the record contract to Adair Roscommon, a talented upcoming singer. She also contemplated whether to produce and own the artist’s recording or to license the music for a limited period. By producing and owning, Compass can exploit the sales of the album and additional albums that Roscommon records in the long run. By licensing the sales can only exploit the sales in the short run. The probability of success of Roscommon’s album determines which option is better for the firm.

Following questions are answered in this case study solution:

-

Please assess the economic benefits of owning and producing an album versus licensing an artist’s recording. What are the initial outlays under either scenario? What are the benefits over time? Do the NPV and IRR results suggest that one scenario is superior to the other?

-

What uncertainties or qualitative considerations might influence your recommendation? How do variations in the forecasted sales affect the decision? Please estimate the impact on NPV from a change in your estimate of future sales for Adair Roscommon’s album.

-

What should Alison Brown do? Prepare a recommendation as to whether Compass Records should license Adair Roscommon’s next recording, or produce and own it.

Compass Records Case Analysis

1. Please assess the economic benefits of owning and producing an album versus licensing an artist’s recording. What are the initial outlays under either scenario? What are the benefits over time? Do the NPV and IRR results suggest that one scenario is superior to the other?

There are two types of recording contracts; own and produce and license. In “own and produce” contract, the firm can exploit the music any way it wills in the long run. Conversely, in the licensed contract, the recording had already been recorded and packaged. The rights to exploit foe this contract is a short term.

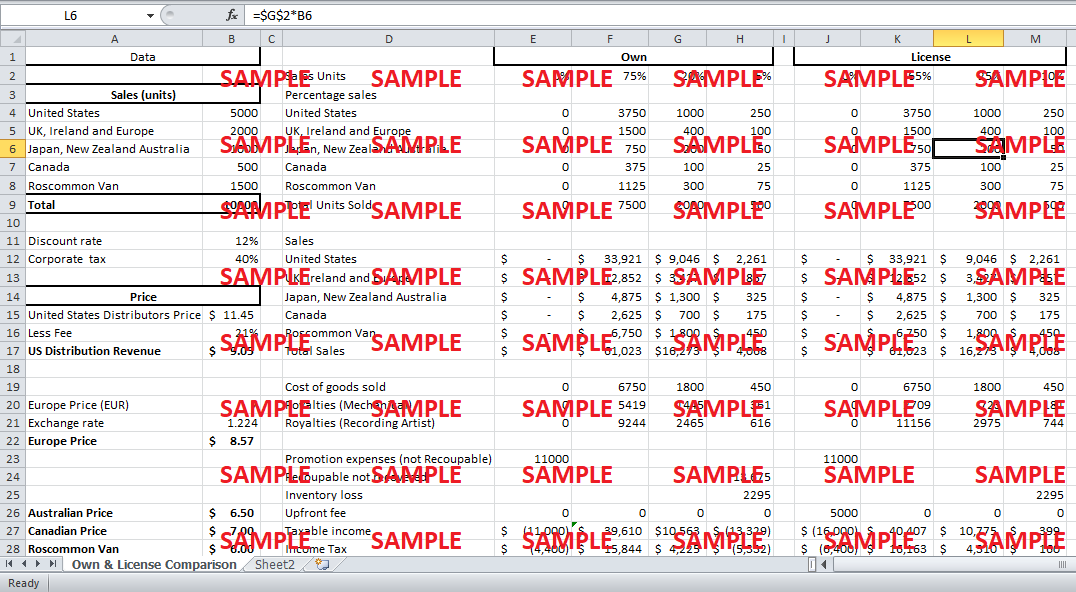

The Licensing the recordings would be cheaper for the firm as only an upfront payment of $3,000 to $5,000 have to be made. However, licensing would reduce the firms profit potential if the Roscommon album becomes a hit and makes high sales. This is because the contract is for a short period of time. In contrast, the benefits of owning and producing an album would be the large due to the ability to gain higher profits, but the cost of owning is as high. The cost is high because though there is no upfront payment, but there is about $20,000 payment plus the royalties for the album and additional three albums. Therefore, in purchasing the master recording, Brown would be taking a massive risk. This is because, if the album is not successful, the firm will lose a large investment.

The total initial outlay is $41,071 for owning the master recording. In case of licensing the recording, the initial outlay is $27, 571. This is because the recoupable expenses for purchasing master recording are significantly higher than those of licensing the recording.

Over time, the benefits of licensing the recording are higher than those of owning and producing. This is because the cash flow is positive for three years after production for the licensing option, but it is not positive throughout for owning and producing option. The net present value (NPV) of licensing is positive and higher than that of owning. The NPV is $13,197. For owning, the NPV is negative $4520. The IRR for licensing is also high and positive at 41% but negative for owning at -12%. So Brown would be losing money by owning the master recording as shown by the calculations. Hence, for Brown, licensing is a superior scenario.

2. What uncertainties or qualitative considerations might influence your recommendation? How do variations in the forecasted sales affect the decision? Please estimate the impact on NPV from a change in your estimate of future sales for Adair Roscommon’s album.

It is important to point out that, over the ten years of existence, Compass has found its niche of producing folk and musical genre. As Roscommon is a talented folk singer, she would fit the company’s image perfectly. Furthermore, both Brown and West believed in Adair’s potential to as an investment; therefore, in order to reap the maximum profits they should own and produce rather than just licensing the artist’s recording. Furthermore, based on their decision regarding their previous albums, Brown and West have been able to make profits on 80% of the album. If they believe that Roscommon has enough potential they must follow their instincts as they have done for their previous albums.

Another important thing to consider is that Compass Records is only a small player in the global music business. It cannot take an enormous risk. If the firm purchases the master recording and the album does not do well, the firm will not be able to recover the high investment. This blow might be too risky for the firm. Moreover, the industry has shown no growth since 1995. The shrinking market increased competition among the firms. Hence, taking the risk at this point will not be prudent for Compass.

The future sales of Roscommon’s album are very uncertain. In the worst scenario, fewer than 5000 albums will be sold worldwide. This will cause a huge drop in sales and lead to negative cash flows and the initial outlay would not be recoupable. This may also cause the NPV and IRR of licensing to become negative. The firm will lose less money if it licensed the recording rather than owning it. Hence, due to the high risk of losing money, licensing would seem like a better option.

On the other hand, the best scenario would be when Roscommon’s album is a grand slam. This means that the album will sale more than 20,000 units worldwide. The high sales will cause the NPV and IRR of both owning and licensing to increase and be positive. However, if Compass owned the recording it will reap the cash flow for more than 3 years, but if Compass licensed it, the firm will not profit more than three years.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.