Get instant access to this case solution for only $19

Coronet Savings and Loan Case Solution

As Burke sits in his office looking for a solution to the problem raised during the meeting, he has to decide two things; firstly is what kind of securities should the company deal in, and secondly, what should be the best way to deal with the company’s financial risk without compromising too much on the profits. He conducted a thorough ratio analysis of the company’s financials and compared them to the industry to get an idea of how the market is behaving, and where the company stands in comparison. He then used the results of these analyses to get a clear picture of the whole situation. He then, using the industry as a benchmark, condensed all the information into meaningful recommendations.

Following questions are answered in this case study solution:

-

Use ratio analysis to compare Coronet to the industry. Identify Coronet's strengths and weaknesses.

-

Prepare a gap analysis.

-

Recommend Policy

Coronet Savings and Loan Case Analysis

1. Use ratio analysis to compare Coronet to the industry. Identify Coronet's strengths and weaknesses.

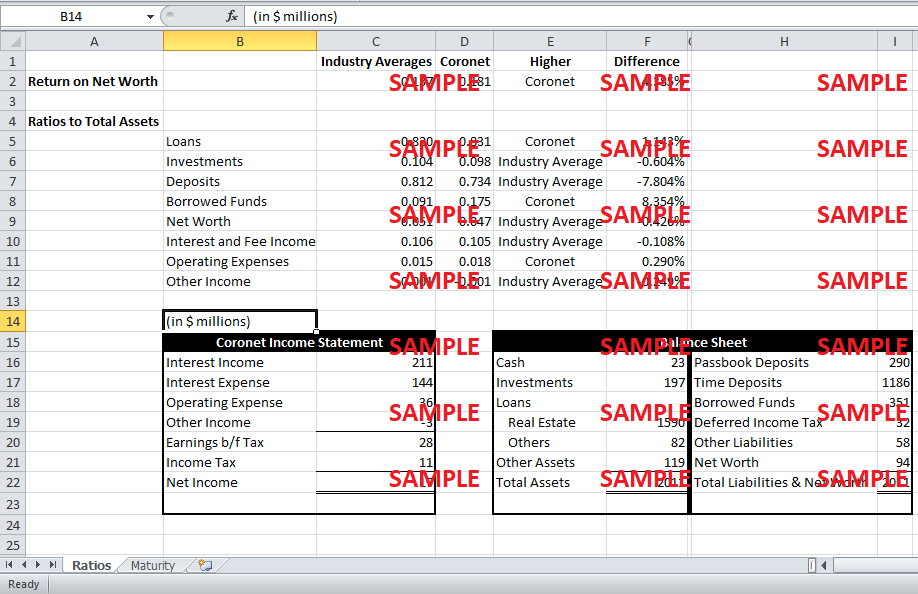

Ratio comparisons can give any analyst a picture of where the company stands, in terms of financial strengths, in its industry. This is an important step to devising an appropriate strategy to deal with current market conditions. In this case, as already noted in the case study passage, the return on net worth of the company is 4.4 percentage points higher than the market average, standing at 18.1%.

Coronet has issued loans, borrowed funds, and operating expenses as a greater percentage of its total assets as compared to the industry average. On the other end, it has investments, deposits, net worth, interest and fee income, and other income as a percentage of total assets, lowers than the industry average.

This shows that Coronet has a comparative advantage when it comes to generating returns on total investments. It also seems to have better credit worthiness in front of lenders, compared to the industry average, since it able to operate with higher borrowings, as well as, lower net worth as a percentage of total assets.

On the down side, Coronet’s higher borrowings expose it to higher interest rate risk. The company is also especially weak when it comes to realizing interest and fee income, and other income groups. Coronet’s other income is a net negative, which shows the company lacks the ability to make profitable investments, which are outside the company’s actual business process. The company is also unable to attract as many deposits as the average in the industry, which can be one of the reasons why the company is borrowing-focused on its financing side.

2. Prepare a gap analysis.

Given the results of the financial ratio analysis one thing is clear. The company is carrying more liabilities than the industry average, which exposes it to unwarranted financial risk. The company has an above average return on net worth mainly because of lower than average net worth as a percentage of total assets. The less than the market average of income in the form of interest earned, fees, and non-business revenues provides further evidence of this fact.

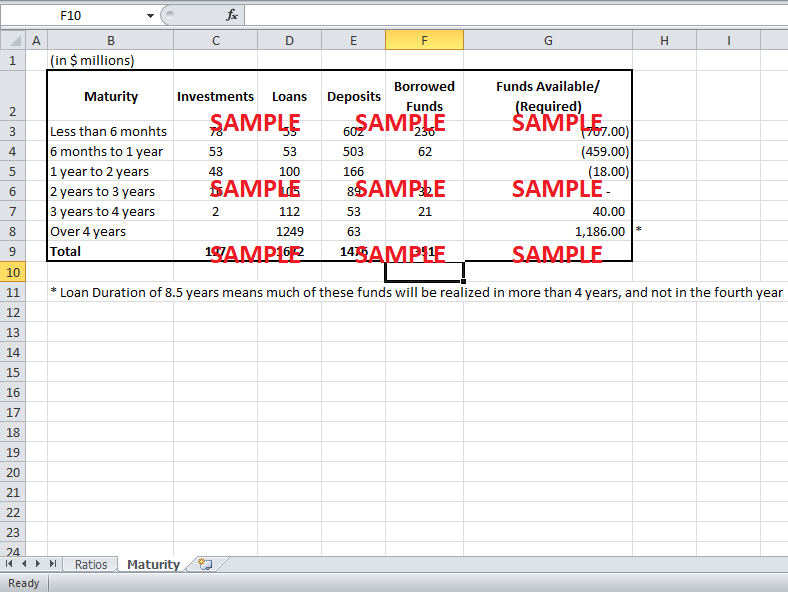

Another troubling aspect of Coronet’s financial composition is the way its assets and liabilities are set to mature. As can be seen in exhibit 3, the current yield curve is of the normal upward sloping shape. This means that financial instruments with shorter durations will have lesser interest rates while those with longer durations will have higher interest rates. This creates an incentive for financial firms to borrow short-term and lend long-term in order to maximize their interest income. However, this results in a maturity mismatch. Based on an analysis of the expected flow of cash, it is evident that the company is bound to run into financial difficulties in the coming two year period when most of its liabilities will mature. The inflows generated by maturing assets will be completely insufficient to cover the maturing liabilities.

Loans, which constitute the majority of all of Coronet’s financial assets, have duration of 8.5 years as mentioned in exhibit 4. This means that these loans will be maturing and completely converting into inflows of cash in eight and a half years, which is far beyond the longest maturity liabilities that the company has. This further strengthens the argument of the severe maturity mismatch that Coronet now faces.

Additionally, since the company has a significantly higher debt to equity ratio as compared to the industry average, about 8.35 percentage points higher, any financial risk is expected to be worsened. The financial position of the company stands on precarious grounds considering the fact most of this borrowed debt will have to be returned within six months, according to exhibit 4. This is bound to create cash flow problems for Coronet.

Another thing that came out during the ratio analysis was the firm’s operating expenses. The operating expenses as a percentage of total assets are higher than the industry average. This eats into the company’s profits putting extra pressure on the managers to adopt riskier strategies.

Now looking at all this information one thing is absolutely clear, as soon as the economy takes a downturn, and the interest yield curve flips, the company will be in dire straits, as was the case the previous year, when Coronet’s returns fell far below the industry average. With a bank run for any short duration securities, and loss in the value of long-term securities, the firm will be left unable to fulfill its obligations towards its liabilities. Therefore, it should be the top priority of the current management to take steps in order to ensure that the firm’s financial risk is kept at bay.

3. Recommend Policy

Considering all the facts, there two things that need to be taken into consideration; one, the company needs to rethink its financial structure, and two, the company needs to match maturities of its assets and liabilities in order to ensure availability of funds to pay off its liabilities.

Coronet’s financial structure is tilted towards financing using more debt rather than equity as compared to the industry. One possible reason for this is the desire to not allow the dilution of earnings as a percentage of net worth. Otherwise known as return on equity, this ratio is commonly used to determine a company’s profitability.

In this case; however, this desire is exasperating the problem. The firms focus should instead be on controlling their operating expenses which are a higher percentage of their total assets as well as their earnings as compared to the average in the industry. The company should also attempt to raise their revenues, which are below the industry average.

Improving the company’s operations, will improve Coronet’s ability to generate profits by cutting costs. It will also reduce the business’ operational risk, which is a separate branch of the total risk that the company faces.

Now Coronet’s revenues, in terms of interest earnings, fees and other income are below the industry average. In order to compensate, the company finances itself by taking short maturity; therefore less interest rate bearing, instruments. It then uses these finances to lend using long-term securities, as they bear higher, interest rates. The difference between the two rates is the company’s margin. However, this creates the problem of maturity mismatch as already discussed.

Since the company is operating at a higher debt to equity ratio it can try financing its lending by using equity based financial instruments. This will improve the company’s financial structure as well as ease up the use of very short-term instruments. Dilution should not be an issue considering sufficient cost savings are achieved through improved operations.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Corporate Governance at Martha Stewart Living Omnimedia Case Solution

- Cost of Capital at Ameritrade Case Solution

- Country Risk Analysis and Managing Crises Tower Associates Case Solution

- Country Risk Analysis and Managing Crises Tower Associates Case Solution

- Creating a Process-oriented enterprise at Pinnacle West Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.