Get instant access to this case solution for only $9

Dogloo And Opportunity Capital Partners Case Solution

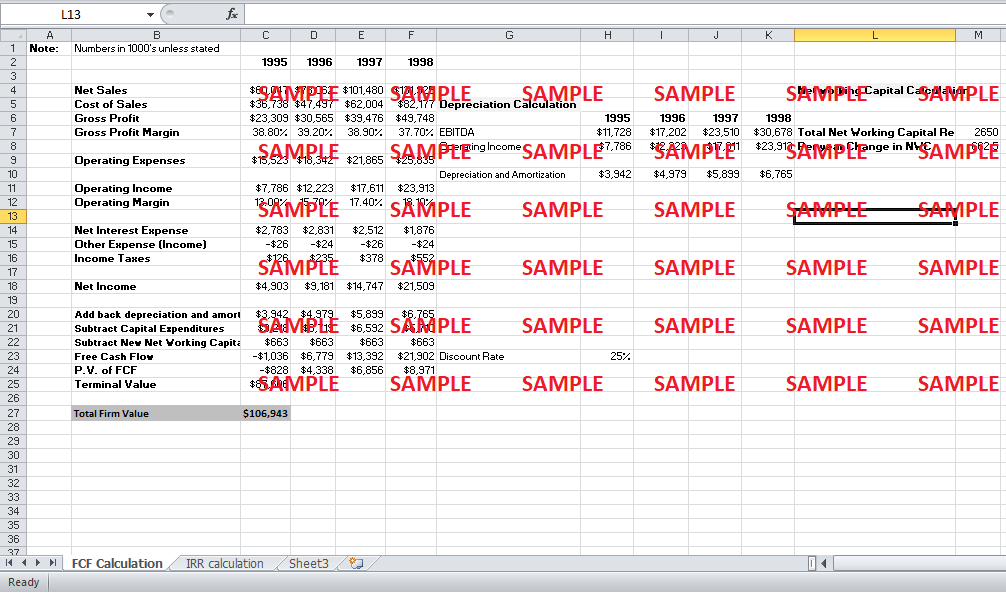

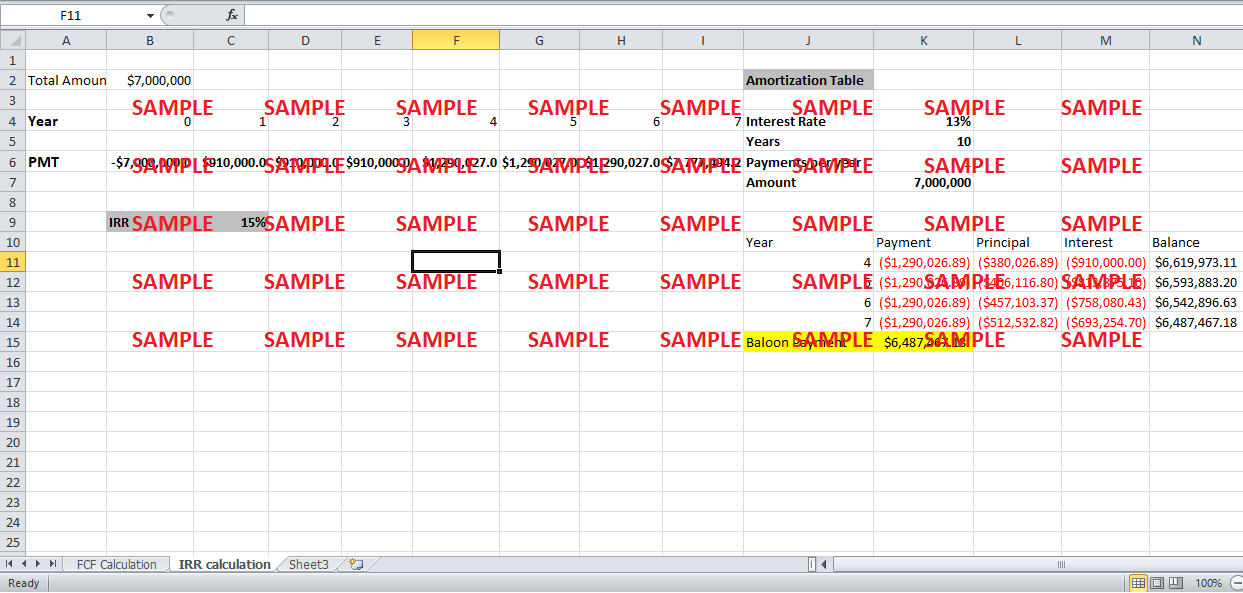

OCP has calculated an IRR based on exiting in 3-5 years from the initial investment. It has calculated 25% by calculating a rate such that the present value of the interest payments from the first 3 years, the amortization payments from year 3 onwards ($1,290,027) and the liquation value (in year 4 or 5) equal 700,000.

Case Analysis for Dogloo And Opportunity Capital Partners

1. There are some issues that Dogloo currently faces. First of all, Dogloo's current CEO, Aureilo Baretto, is much more concerned about marketing and product development as compared to financial needs of the company. Secondly, Doskocil's lawsuit has consumed more cash and resources than expected. Thirdly, Dogloo is facing an explosive demand, due to which the capacity limitations of their out sourced manufactures are being exposed.

A possible solution to the excess demand issue is to shift production in-house, which would require a lot of resources. Additionally, Dogloo needs to replace its current CEO with a more seasoned and experienced CEO who could manage Dogloo's financial resources better.

2. The value of the Dogloo is 106 million, based on free cash flow model. Free cash flow can be determined by subtracting change in net working capital and capital expenditures from net income and then adding depreciation. Then a terminal value (87 million) is calculated by dividing 1998's free cash flow by the discount rate. Finally, the present value of free cash flows from the year 1995-1998, and the present value of terminal value is added together to find the value of the firm.

3. The investment structure has two crucial benefits. Firstly, the debentures of OCC and OCP can be converted to common equity of the firm.

Get instant access to this case solution for only $9

Get Instant Access to This Case Solution for Only $9

Standard Price

$25

Save $16 on your purchase

-$16

Amount to Pay

$9

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.