Get instant access to this case solution for only $19

Financial Reporting Problems at Molex, Inc. (A) Case Solution

Molex Inc. has faced a grave issue of accounting misstatement in their current financial statements. The company’s current external auditors have demanded the removal of both CEO and CFO. For the audit of financial statements, Molex had to hire the external auditors as the Sarbanes-Oxley Act of 2002 demands it. Currently, Molex has three available options. Upon analysis, it is found that the management decision of not talking up the misstatement issue to the auditors was linked to their EPS, share price and immateriality of the issue. The concerns of mistrust raised by the auditors are valid and are based on realistic assumptions. The one and only feasible option for Molex is that it should honor the request of auditors by removing the CEO and the CFO.

Following questions are answered in this case study solution:

-

Why does Molex have to hire an external auditor?

-

What was the financial reporting problem at Molex? How would the correction of the problem be recorded in Molex's financial statements?

-

What factors do you think influenced management's decision not to raise the issue with the auditors?

-

Why were Molex's auditors so concerned about the reporting problem at Molex? If you were a member of the board, would you agree with their concerns?

-

As a member of Molex's board, what would you do to respond to the auditor's request that the CFO (and possibly the CEO) be replaced?

Financial Reporting Problems at Molex Inc A Case Analysis

1. Why does Molex have to hire an external auditor?

Following the year 2000, many renowned international companies went into bankruptcy. Many of these companies had hired the best auditing firms of the world. The fact that even the top auditing firms of the world were not able to detect fraud and misstatements on the financial statements was a pressing issue for the lawmakers. Following the crash of Enron and other leading companies, a special act was passed and implemented. This act was termed as “Sarbanes-Oxley Act of 2002”. This law changed the way companies used to hire auditors. The act was geared to make the financial statements more accurate and trustworthy; therefore, it required an external auditor for the review accounting policies and financial statement. This law also separated the duties of external and internal auditors. Before the implementation of this law, companies could use the same auditing firm for both the internal and external audit. This law prohibited external auditors from offering any sort of services to the concerned firm. Therefore, Molex has to hire an external auditor that was in no way related to the internal audit department. The Sarbanes-Oxley Act allowed the audit committee to appoint external and internal auditors. The duties of the external auditor are prescribed in ‘Section 404’ of this act.

2. What was the financial reporting problem at Molex? How would the correction of the problem be recorded in Molex's financial statements?

The basic and foremost rule of consolidation accentuates the fact that profit from the inter-subsidiary sale is recognized when this sale is rendered to a 3rd party. Therefore, essentially no profit should be recorded from any inter-subsidiary sale. In the case of Molex, more than one subsidiary had carried out business with each other. Therefore, in consolidated financial statements, the unrealized profit that results from left over inventory should not have been included. As a result, there was a portion of unrealized profit in the subsidiary accounts. Due to this reason, the consolidated accounts of Molex were overstated as the unrealized profit has been realized. All of the concerned accounts including revenue, cost of sales, profits and ‘retained earnings’ have to be adjusted. In consolidated financial statements, Molex needs to introduce an elimination entry. As a result of this journal entry, sales and inventory will be reduced. Furthermore, the decreased sales will also decline the profit and hence subsequently the earnings of the subsidiary would be lessened. This elimination entry would reduce the sales, inventory and ‘retained earnings’ of the relevant subsidiary. The elimination entry is as follows:

|

Elimination entry for Unrealized profits |

||

|

|

Dr |

Cr |

|

Intercompany Sales |

xxxx |

|

|

Cost of sales |

|

xx |

|

Inventory |

|

xx |

As the financial statements of the subsidiary are combined with the financials of Molex, this decrease in sales will consequently decrease the overall revenue for Molex. At the end, Molex will end up having less amount in its ‘retained earnings’ account.

3. What factors do you think influenced management's decision not to raise the issue with the auditors?

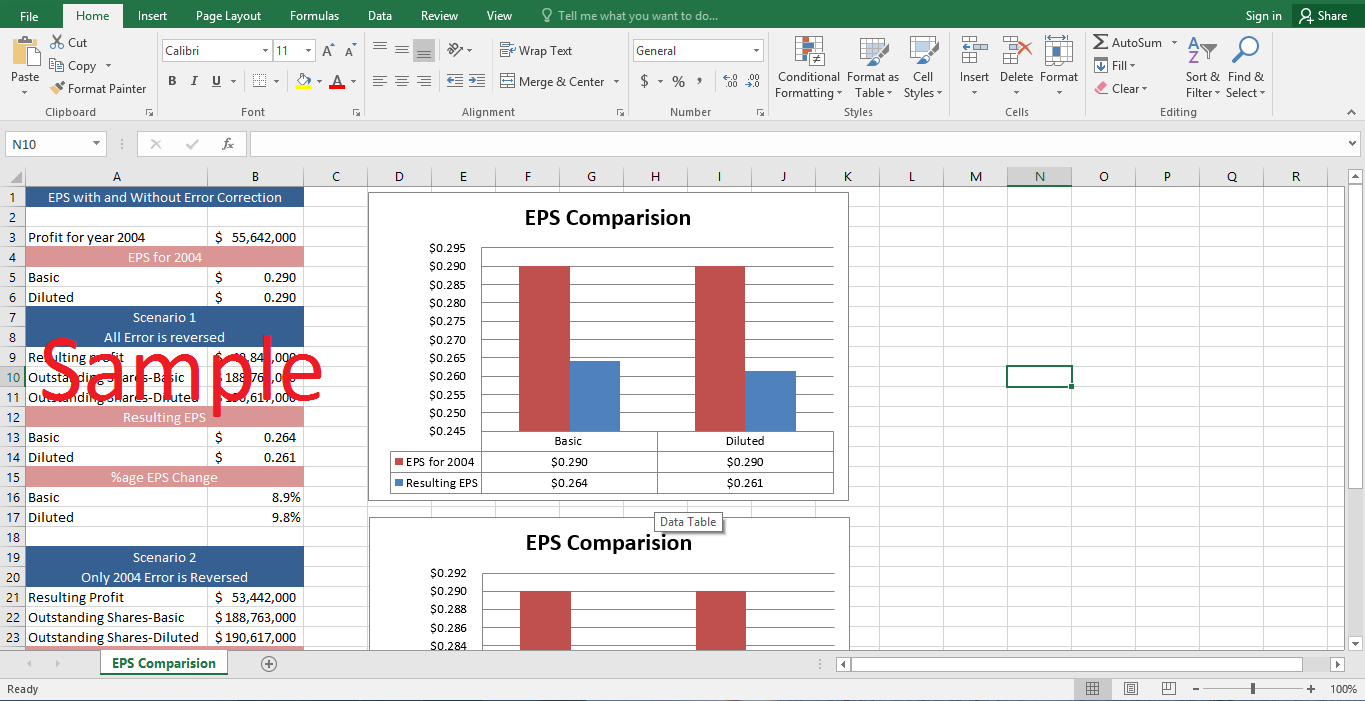

In the adjustment of annual financial statements, any company first considers the marginal effects of not carrying out this adjustment. In the case of Molex, the accounting error was bound to decrease its earnings. Also, the error was discovered at such a time when the stock price of Molex was not performing very well. The stock price was on a decreasing trend, and additionally it was performing worse than NASDAQ index. In order to find out the influential factors for this decision, the whole scenario has to be analyzed completely. If Molex decides to post the adjusting entry and reverse the entire unrealized profit, the profit at 30th September 2004 would decrease by 10%. Consequently, both the diluted and basic EPS would change. The following graph depicts the EPS figure for both before and after error correction.

It is evident from the graph that if Molex incorporates the adjusting entry for the full amount the EPS would decrease to $0.26. This is disturbing for Molex as this EPS is below the estimated mark. This act of Molex can render the already fluctuating share price of Molex downwards. However, if Molex posts the adjusting entry just for the correction of last year’s error, the EPS will not decrease that much. The following graph shows the comparison. In this case, the EPS will attain the estimated mark.

This fact should also be kept in mind that for an error to be persuasive, it should be ‘material’. The concept of ‘materiality’ exercises intense judgment. The fact the top management, after exercising its judgment, concludes that the adjusting entry is immaterial, is of extreme importance. This fact when coupled with the above scenario clearly dictates that it is not advisable to recognize the error. Therefore, these two underlying factors restricted management from raising the issue with the auditors.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.