Get instant access to this case solution for only $19

Groupe Ariel S A Parity Conditions And Cross Border Valuation Case Solution

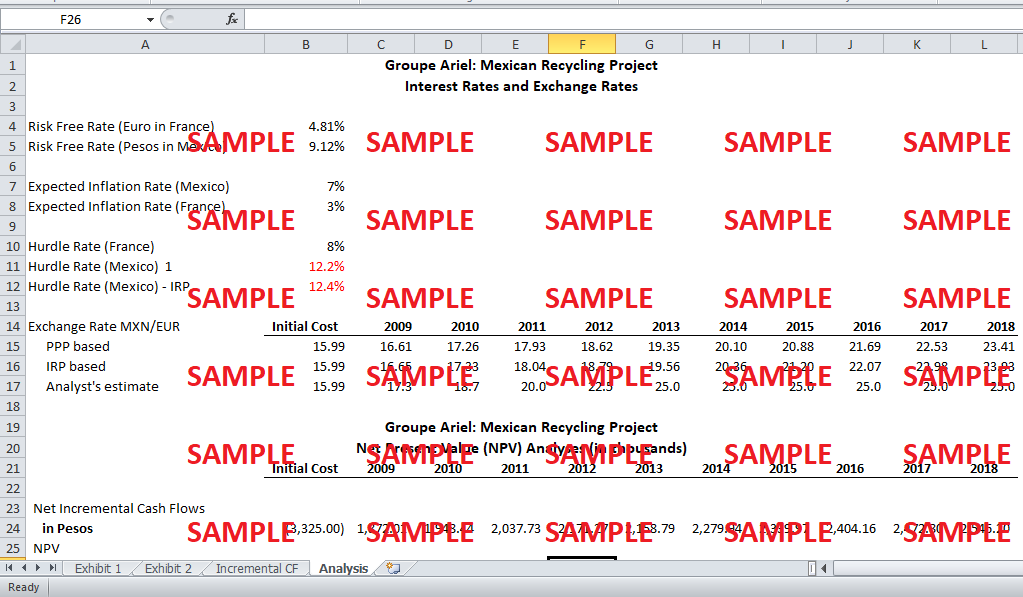

The net present value (NPV) for the Mexican recycling project using the cash flows obtained by using IRP based estimates of exchange rates has been calculated. See Exhibit 3 for reference. The IRP based Euro cash flows and the Euro discount rate of 8% give a net present value (NPV) of 539.19 thousand Euros. The IRP based Euro net present value (NPV) for the Mexican recycling project of 539.19 thousand Euros is clearly related to the IRP based Peso net present value (NPV) of 8,621.64 thousand pesos. By dividing the Peso NPV by the Euro NPV, 15.99 is obtained which is the spot exchange rate for both the economies on 23 June, 2008. This implies that if the purchasing power parity is followed properly, the NPV in Euro is nothing other than the converted value of the Peso NPV using the current spot rate.

Following questions are answered in this case study solution

-

Estimate the cash flows of Groupe Ariel’s Mexican recycling project. These cash flows should be denominated in Pesos.

-

The expected inflation rate for the foreseeable future is 7% (as given in Exhibit 2 of the case). Assuming that the expected inflation in France over the same future period is 3%, then what is Groupe Ariel’s discount rate in Pesos? (We should not use the inflation rates provided in Exhibits 3 and 4 because those are past rates; we need future / expected rates for our calculation.)

-

Using answers from #1 and #2, what is the NPV of this project in Pesos?

-

How would the estimate for Peso discount rate be different if we used interest rates (instead of inflation rates) to convert the Euro discount rate into Pesos? (I.e., how would the discount rate change if we used IRP instead of PPP?) Use 9.12% and 4.81% as the risk-free rates for Mexico and France, respectively. (For convenience, I picked them from Exhibits 3 and 4.)

-

What is the Peso-based NPV using this IRP-based estimate of discount rate?

-

Now let’s calculate the Euro-based NPV of this project. First, convert the cash flows from #1 into Euros using PPP-based estimates of future Spot rates.

-

Discount these at the Euro discount rate and find the NPV. How is it different from the Peso-NPV in #3 – is there an obvious relationship between the two?

-

What if we convert the cash flows into Euros using the IRP-based estimate of future Spot rates? Write down these new cash flows.

-

Discount these at the Euro discount rate and find the NPV. How is it different from the Peso-NPV in #5 – is there an obvious relationship between the two?

-

What is the NPV in Euros if we were to use the analysts’ estimates of future Spot rates (as given in the last paragraph of the case on pg. 4)? We are given that the MXN / EUR rate is 15.99 in 2008, expected to be 20.00 by 2011 and, say, 25.00 over 2013–2018. Let’s assume that this means that the rates are as follows:

|

YEAR |

RATE |

|

2008 |

15.99 |

|

2009 |

17.3 |

|

2010 |

18.7 |

|

2011 |

20.0 |

|

2012 |

22.5 |

|

2013 |

25.0 |

|

2014 |

25.0 |

|

2015 |

25.0 |

|

2016 |

25.0 |

|

2017 |

25.0 |

|

2018 |

25.0 |

11. In your conclusion (also worth 10 points), comment on whether the project is profitable in: Mexican Pesos and Euros. Finally, how would using the analysts’ forecasts change your answer – does it make the project look less profitable or unprofitable? What does this imply for your decision on the project – is it realistically profitable? And, which rates should we pick – IRP-based, PPP-based, or the analysts’ forecasts? Based on all this, should the firm invest in this project?

Case Analysis for Groupe Ariel S A Parity Conditions And Cross Border Valuation

1. Estimate the cash flows of Groupe Ariel’s Mexican recycling project. These cash flows should be denominated in Pesos.

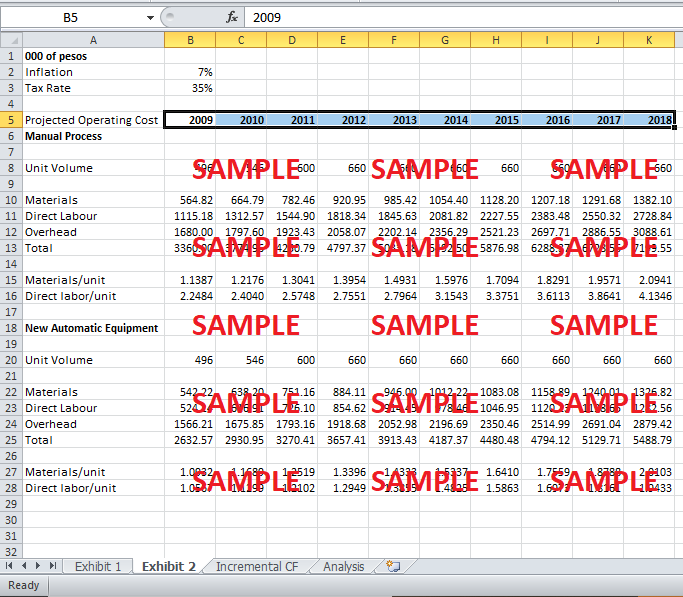

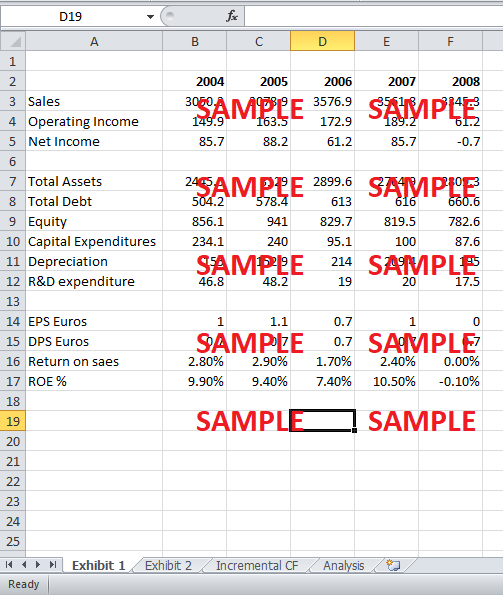

Arnaud Martin, at Groupe Ariel, has received an investment proposal from a wholly owned subsidiary in Mexico, Ariel-Mexico; the new investment proposals for the purchase and installation of new automated machinery for the recycling and remanufacturing of toner and printer cartridges. Martin has the responsibility of evaluating the proposal while keeping in mind the difference between currencies, Euro, and Pesos. Exhibit 1 below shows the estimate of the incremental cash flows for the Mexican recycling project.

The estimates for the incremental cash flows shown in Exhibit 1 have been reached at after making certain assumptions. Firstly, the change in revenue for both the projects is assumed to be zero, i.e. taking the project does not affect the demand side. However, it must be noted that the automation of recycling process will reduce human errors as mentioned in the case study. This might lead to greater satisfaction of consumers. Nevertheless, this effect has been assumed to be negligent due to lack of relevant information. This brings our focus to cost reduction.

The change in expected cost for materials, direct labor and overhead has been calculated from the projected costs given in Exhibit 2 of the case study. Moreover, the depreciation for the old equipment, i.e. 83,333.33 pesos, has been obtained by dividing its remaining book value by three. The depreciation for new equipment is 350,000 pesos that have been calculated by dividing the total cost of 3.5 million pesos with a useful life of 10 years. Resultantly, the increase in due to new project is shown in Exhibit 1.

Using a tax rate of 35%, after-tax EBIT has been obtained to calculate the free cash flows of the project. Depreciation is added back into the after-tax EBIT. The change in net working capital (NWC) is assumed to be zero as given in the case. Finally, there is no capital expenditure except for the first year. The initial investment for the project is a cost of purchase and installation of 3.5 million pesos for the new equipment less the market value of the current equipment. By adding the capital expenditures into the above, net incremental cash flows for the Mexican recycling project has been obtained.

2. The expected inflation rate for the foreseeable future is 7% (as given in Exhibit 2 of the case). Assuming that the expected inflation in France over the same future period is 3%, then what is Groupe Ariel’s discount rate in Pesos? (We should not use the inflation rates provided in Exhibits 3 and 4 because those are past rates; we need future / expected rates for our calculation.)

After getting an estimate for the yearly cash flows for the project, an estimate of the discount rate is essential in order to find the net present value of the project. We are given Groupe Ariel’s discount rate in Euros that is 8%. Moreover, the expected inflation rate in Mexico, for the foreseeable future, is given as 7%. The expected inflation rate in France over the same future period is given to be 3%. Using these expected rates of inflation and the discount rate for Groupe Ariel in France, the discount rate for Groupe Ariel in Mexico has been estimated.

According to Brealey, Myers and Allen (2011), the relationship between inflation rates and interest rates can be formalized as follows:

r_Euro = ((1+ π_peso)) / ((1+ π_Euro)) x (1 + r_Euro )-1 (1)

Using the above relation, the hurdle rate of Groupe Ariel in Mexico came out to be 12.2%. See Exhibit 2 for calculations.

3. Using answers from #1 and #2, what is the NPV of this project in Pesos

The net incremental cash flows for Groupe Ariel have been obtained in question 1, are shown in Exhibit 1. Similarly, the estimate for the appropriate discount rate, i.e. 12.2%, is taken from Exhibit 2. The net present value (NPV) for the Mexican recycling project has been calculated by using the following formula:

NPV = Initial investment + PV (Expected Cash flows) (2)

The net present value of Mexican recycling project using the purchasing power parity-based estimate of hurdle rate is 8,749.26 thousand pesos.

4. How would the estimate for Peso discount rate be different if we used interest rates (instead of inflation rates) to convert the Euro discount rate into Pesos? (I.e., how would the discount rate change if we used IRP instead of PPP?) Use 9.12% and 4.81% as the risk-free rates for Mexico and France, respectively. (For convenience, I picked them from Exhibits 3 and 4.)

According to interest rate parity (IRP), the difference in interest rates between two countries should be equal to the difference between forward and spot exchange rates (Brealey, Myers, & Allen, 2011). The interest rate parity gives the relation between interest rates and forward and spot exchange rates of any two countries.

The forward rate is the no arbitrage exchange rate obtained by using the risk free rates of both countries to eliminate any chances of cross-border risk-free returns (Brealey, Myers, & Allen, 2011). The risk free rate in France is 4.81% while that in Mexico is 9.12%, as given in exhibit 3 and 4. The forward rate is obtained by multiplying the difference in risk free rates with the spot exchange rate i.e. 15.99MXN/EUR. The forward exchange rate, as shown in Exhibit 2, is 16.61MXN/EUR.

Finally, the hurdle rate for Groupe Ariel based on interest rate parity (IRP) is 12.4%, as shown in Exhibit 2. It can be seen that the IRP based estimate for the peso discount rate is higher than the PPP based estimate of 12.2%.

5. What is the Peso-based NPV using this IRP-based estimate of discount rate?

The net present value of Mexican recycling project using the purchasing power parity based estimate of hurdle rate is 8,621.64 thousand pesos. As obvious, a higher discount rate from IRP approach gave a lower NPV for the project. Nevertheless, the difference does not appear to be very large.

6. Now let’s calculate the Euro-based NPV of this project. First, convert the cash flows from #1 into Euros using PPP-based estimates of future Spot rates.

According to the purchasing power parity, the difference in the expected inflation for any two countries should be equal to the difference between the expected spot exchange rates for the respective currencies (Brealey, Myers, & Allen, 2011). The above mentioned relation can be represented in the form of an equation as follows:

〖ES〗(Peso / Euro) /S (Peso/Euro) = (E(1+ π_peso)) / (E(1+ π_Euro))

Using the purchasing power parity, the exchange rate between Mexican currency and Euro has been calculated for each year. The expected exchange rate increases from 15.99 MXN/EUR spot rates to 23.41 MXN/EUR in 2018.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.