Get instant access to this case solution for only $19

Gulf Oil Corp.--Takeover Case Solution

The decision to sell the Gulf Oil was due to the takeover attempts by Boone Picken’s, the chief executive officer of Mesa Petroleum Company. In August 1983, a group of investors and Boone started to buy shares in the company at an average price of $39. After two months, the ownership in the company increased to 9% and the share price was $43.

Following questions are answered in this case study solution

-

Why was Gulf attacked? Who is the villain in this transaction?

-

What is the source of value bidders hope to reap from the Gulf transaction?

-

Assess the performance of Gulf's management in running the company. How has Gulf's exploration program performed? What is the value of the program?

-

How much is Gulf worth per share to Socal? How much are competing bidders likely to bid? How much should Mr. Keller bid?

Case Analysis for Gulf Oil Corp.--Takeover

Gulf Management was aware of the situation and started to prepare themselves for a response. Meanwhile, the investor group bought 13.2% of the ownership in the company. Pickens had intentions of putting himself to the board of directors and change the policy of the company. Gulf was able to win the proxy battle. They felt that reincorporation is the only way that could limit the capital at their disposal and their means of access to the boardroom. Therefore, Gulf decided to liquidate, and many firms were offered to purchase.

2. What is the source of value bidders hope to reap from the Gulf transaction?

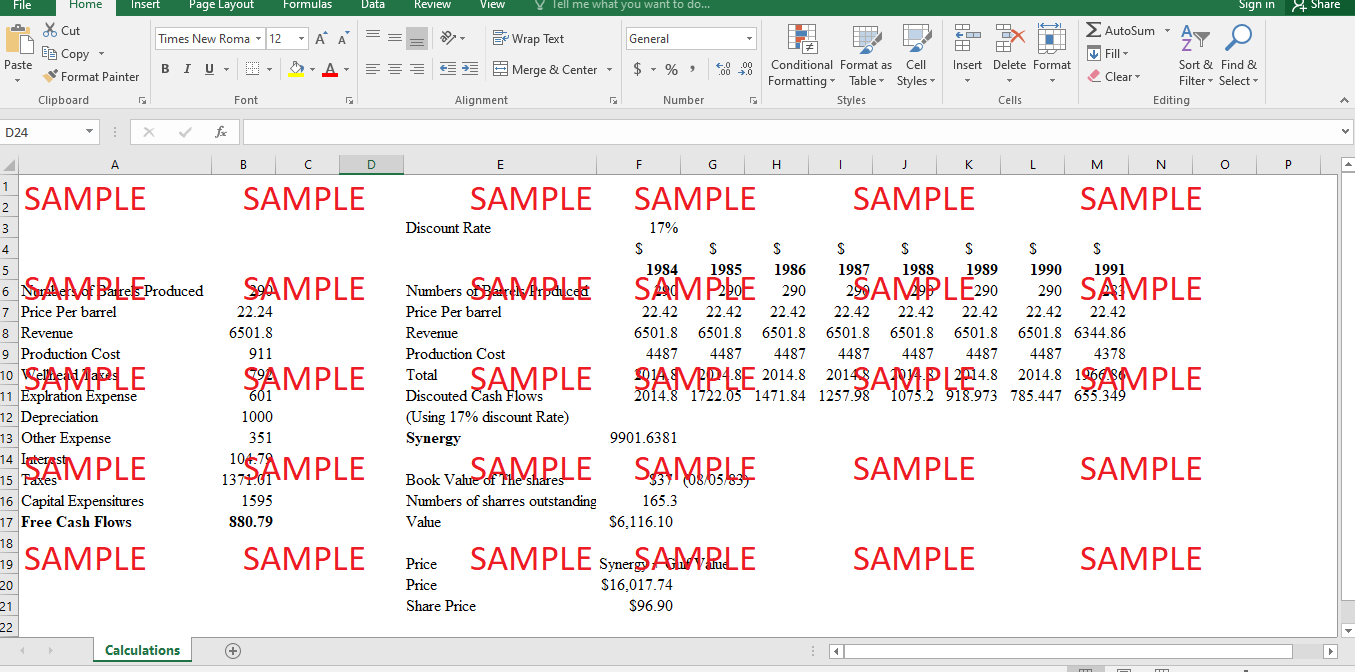

The bidders would reap value regarding the access to high quality light oil. The bidding company would be able to double its reserves. Moreover, the value of Gulf's Oil and reserves is another added benefit. A production was estimated from 1983, predicting the oil production until all of the reserves were exhausted. In 1983, the total production was 290 million barrel. In 1991, the same amount of production will be followed.

The value will be generated by the production cost which is held to be constant about amount produced. This will include depreciation as well because the units of production method is being used by Gulf. The company would get intense tax benefits as the inventory method used by Gulf is LIFO, which means that the resources that would be discovered later are used to price the current stock. Therefore, the tax charges will be lowered.

3. Assess the performance of Gulf's management in running the company. How has Gulf's exploration program performed? What is the value of the program?

The Gulf management has made serous improvements in the financial performance of the company. The return on equity has been very volatile in the past, and the company always remain below the industry benchmark. But from the last two years, the company has been able to show an upward trend in the return on equity.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.