Get instant access to this case solution for only $19

High Mountain Technologies Case Solution

The value of a firm is highly dependent on the cash flows it generates. There is a subtle distinction between income and cash flow. Income is reported using the accrual principle of accounting. That means any outlay is recorded irrespective of the fact whether the cash is paid or not. Free cash flow takes into consideration this accrual nature of transactions by making various important and pertinent adjustments in the income. The free cash flow can be defined as:

“The amount of funds available to all investors in a firm after the firm pays taxes and meets investment needs.”

To calculate 'FCF', there is a need to find the sources and uses of funds in a project. The FCF formula is written as:

FCF = (1-T) EBIT+ Depreciation – Capital expenditures - ∆Net working capital

Following questions are answered in this case study solution:

-

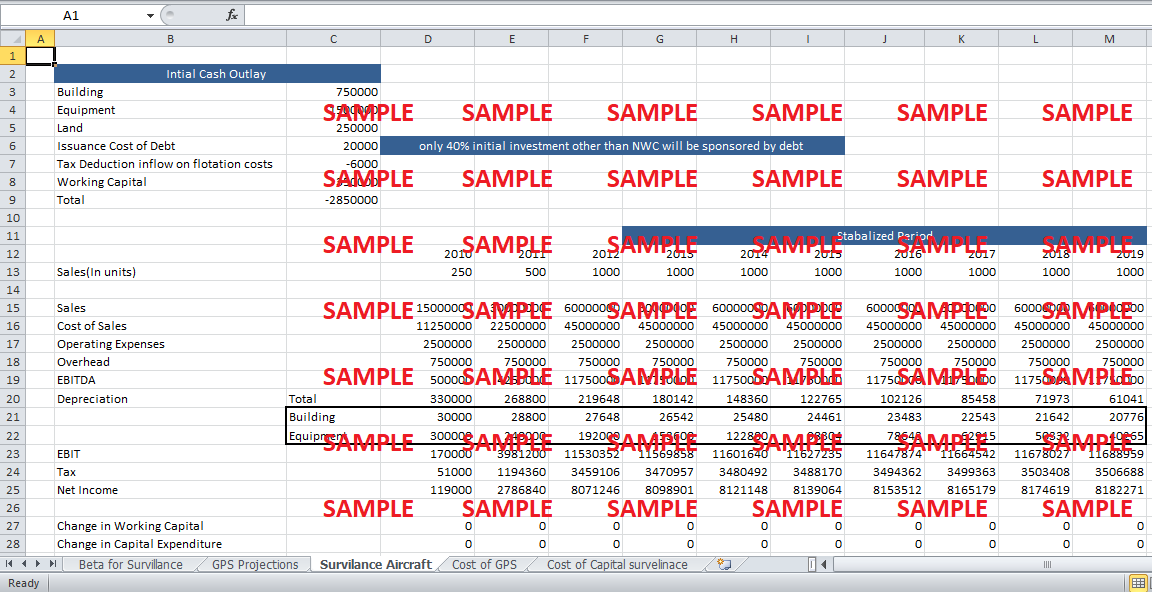

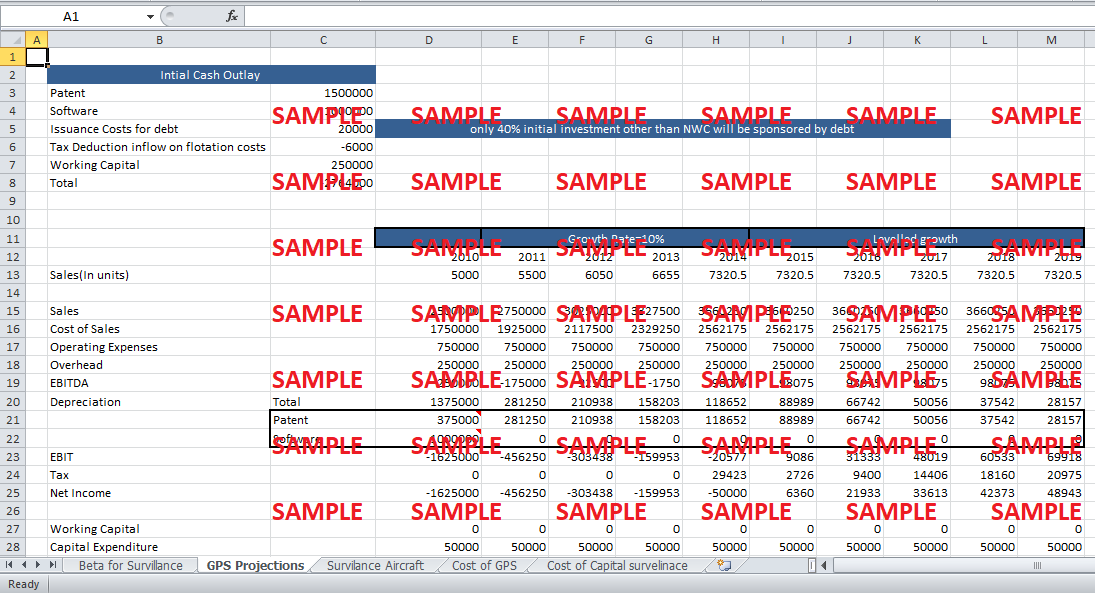

Discuss the rationale of how free cash flows are estimated. Based on the information provided in the case, estimate both projects free cash flows over the 10 years investment period.

-

Estimate the appropriate costs of capital for the GPS transmitter and surveillance aircraft projects.

-

Perform a capital budgeting analysis by applying various project ranking techniques to both projects. As well, address advantages and disadvantages of each ranking technique applied in analysis.

-

Conduct a risk analysis by applying appropriate techniques and identify critical financial or economic factors in this project. Discuss and suggest how HMT manages these critical factors.

-

If GPS transmitter project were to be considered by the firm, how can this project be modified to become financially feasible? Discuss potential real options pertinent to this project.

-

Which project is worthwhile to HMT, and how would you justify the decision?

High Mountain Technologies Case Analysis

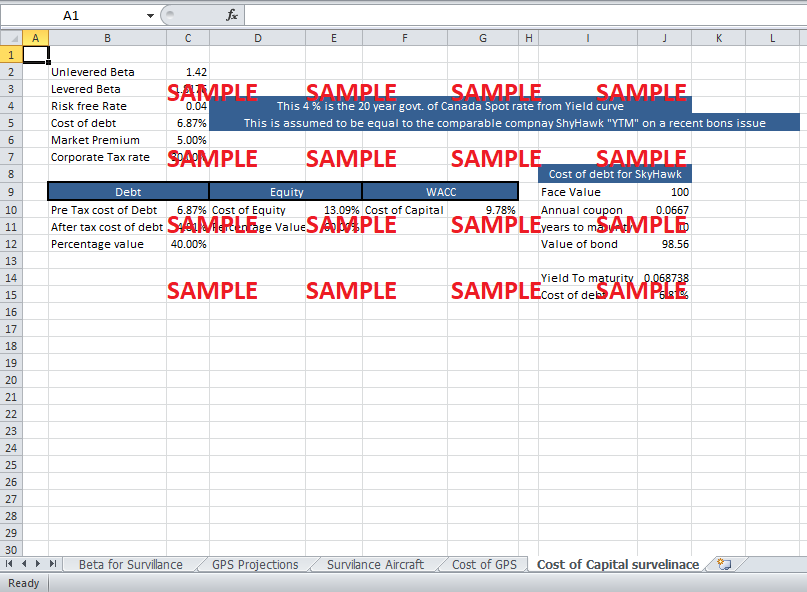

2. Estimate the appropriate costs of capital for the GPS transmitter and surveillance aircraft projects.

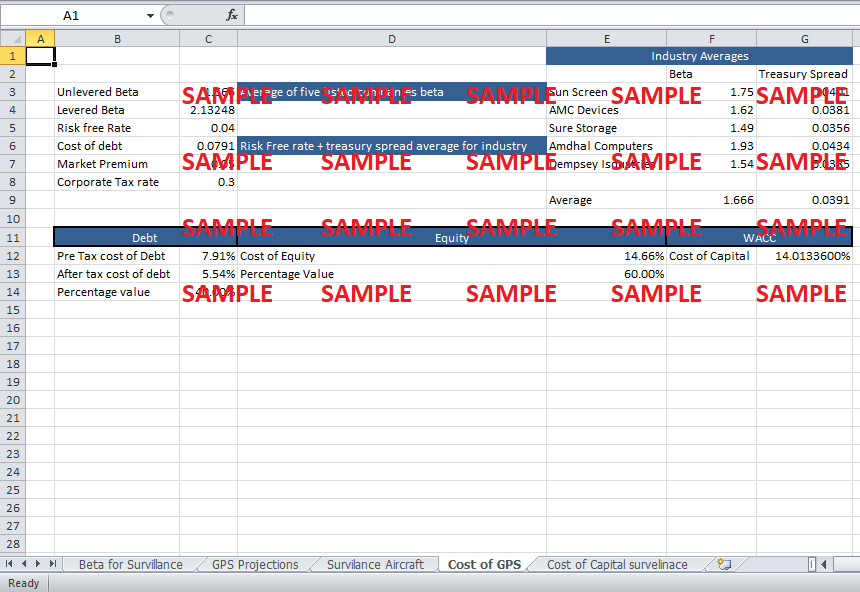

For calculating cost of capital for GPS transmission unit, the betas of similar debt capacity firms were considered. The GPS project beta is taken to be the average of all the industry betas. The risk free rate is estimated to be 4%, which is derived from the yield curve information. In the case of GPS transmission, the treasury spread is also given. This value depicts the rate debt holders demand in excess of risk free rate. Adding it to risk free rate will yield the cost of debt. CAPM is used to calculate the cost of equity. However, before applying the CAPM calculations the beta is levered. Finally, the 40:60 ‘debt to equity’ ratio is applied in the WACC formula listed below:

WACC = D/V (1-T) (Cost of Debt) + E/V (cost of equity)

After adding the desired 3% risk adjusted rate to WACC, the cost of capital for GPS transmission comes out to be 14.01%

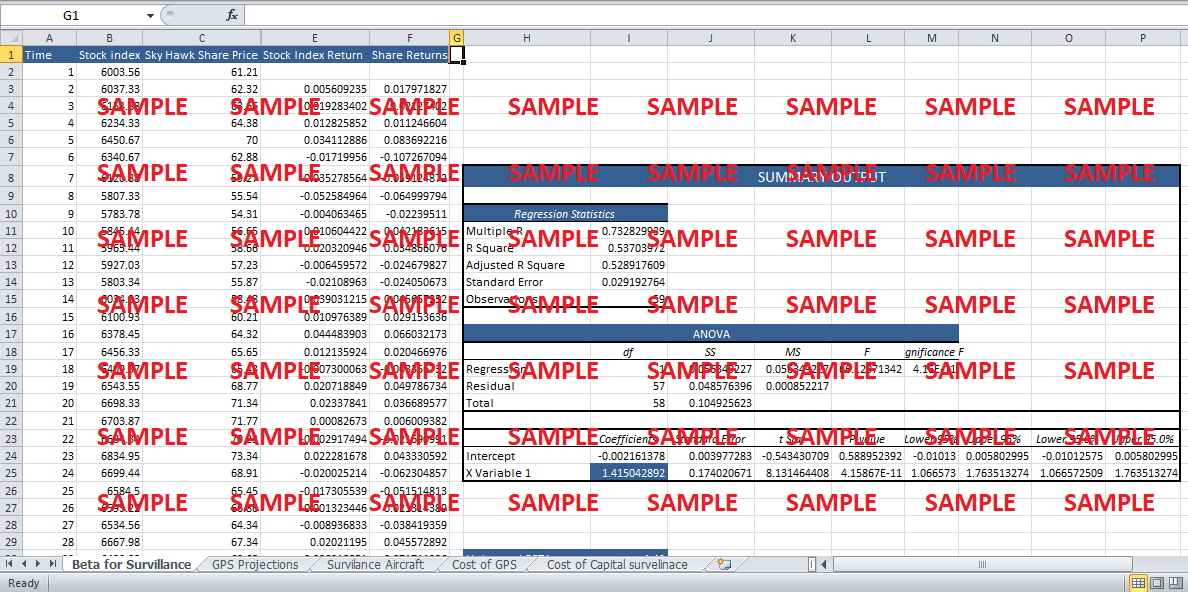

Similar steps are taken for calculating the cost of capital for surveillance unit. The beta in this case is calculated using the regression model. Beta is the x variable coefficient in the regression. It comes out to be 1.41. This unlevered beta is levered to account for leverage. Cost of debt for the project is assumed to be equal to the cost of debt for Sky Hawk. Applying the same above mentioned formula the cost of capital comes out to be 9.78%.

3. Perform a capital budgeting analysis by applying various project ranking techniques to both projects. As well, address advantages and disadvantages of each ranking technique applied in the analysis.

For GPS transmission project, following figure shows the results of three important capital budgeting techniques.

|

Technique |

Value |

|

Payback period |

12 Years |

|

NPV |

($2,120,953.55) |

|

IRR |

-15% |

|

|

|

|

|

In this case, Payback period is longer than the life of the project. Payback period is important as it shows the number of years needed to generate the initial investment back. However, as it does not take into consideration the scale of the project, another scale related tool is to be used. NPV takes into consideration the scale and an adjusted cost of capital. NPV in this case comes out to be $ -2,130,361. The NPV figure is not attractive at all considering the extreme negative value it bears. It is also important to find the internal rate at which the project will deliver returns. This internal rate or IRR equals -15.2%.

The flowing figure shows the relevant values for Surveillance project.

|

Technique |

Value |

|

Payback period |

1.77 years |

|

NPV |

$34,254,576.01 |

|

IRR |

104.7% |

|

|

The payback period rounds about to 1.77 years and looks very reasonable. This implies, at 17.7% of the project life from its start, it will break even, and after that period every inflow is sheer profit. IRR comes out to be 104%, which is a little strange and also highly acceptable. NPV amounts to $34,254,576.01. Initial investment comes out to be 8.32% of the NPV. Hence, the Surveillance aircraft project seems to be very beneficial in monetary terms.

4. Conduct a risk analysis by applying appropriate techniques and identify critical financial or economic factors in this project. Discuss and suggest how HMT manages these critical factors.

For the purpose of risk analysis, the first tool to be used is the sensitivity analysis.

-

Sensitivity analysis: For GPS transmission unit, let’s assume that the price per unit can vary from 400 to 700. The corresponding NPVs are $-4,176,367 and $1,989,973 respectively. Let’s assume again that the levelled growth after 5th year is actually 3%. In this case, the NPV comes out to be $-2,111,046. In the circumstance of tax rate change from 30% to 40%, the NPV value equals $-1,944,181. If the additional 3% risk adjusted cost of capital is not added, the NPV is $-2,130,361.55. For surveillance project, a $5000 unit price change will generate a NPV of $17,976,389.99. Incremental 10% tax rate will decrease the NPV value to $29,217,397.23.

-

Risk adjusted discount rate method: In this method the discount rates are adjusted for additional risks a project takes. In case of GPS transmissions, an additional 3% is already built into the project. Nevertheless, as the project is very risky and HMT for the first time has carried out such a project, a supplementary 2% would be more feasible. By changing the risk adjusted rate from 3% to 5% NPV equals $-2,109,402.91. In the 2nd case, the surveillance project is stable in its output, so no adjustment is required. Other firms are carrying out such projects, and their cost of debt would be ideal to replicate in NPV calculations.

In the case of GPS project, two critical factors need special attention.

-

The 3 % addition in GPS cost of Capital

-

The unit price of GPS.

Both these factors have magnificent effects on the NPV. The unit price should be increased to transform this project to a higher NPV value. Cost of capital should be further adjusted for added risk.

5. If GPS transmitter project were to be considered by the firm, how can this project be modified to become financially feasible? Discuss potential real options pertinent to this project.

Two relevant real options for GPS project are the growth and abandonment option. If GPS project is carried out beyond 10 years, can the company break even? Considering the cash inflow at year 10 and its subsequent rate of change it is really hard for the company to break even in the next 10 years. Moreover, as the company would be stuck in the project, it won’t cater to additional profitable opportunities efficiently. On the other hand, if the company abandons the project, it can have extra resources to spend elsewhere. Even without investing the money anywhere, the company is going to be in a net benefit as it will abandon a negative NPV Project. The only way this project can turn feasible is by raising the unit price and decreasing the overhead and other S&A costs. It is, however, advisable for the firm to abandon this negative NPV Project from the beginning.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.