Get instant access to this case solution for only $19

Humana Inc. Managing in a Changing Industry Case Solution

Intensifying competition and change in the U.S. health care industry force a large integrated health care provider to reassess its strategy of operating both hospitals and health insurance plans (HMOs). In an attempt to increase its stock price and operating performance, the company considers a number of restructuring strategies for separating the two businesses, including a corporate spinoff. Alternative options include issuing targeted stock, selling assets, establishing an ESOP, doing a leveraged buyout, and repurchasing stock. The case illustrates how a company under financial stress can use a corporate spinoff to increase its stock market value and effect real improvements in its business. The case also highlights the importance of choosing a financial restructuring strategy to fit the firm's underlying business or strategic problems.

Following questions are answered in this case study solution:

-

What corporate structure would you recommend for Humana?

-

Assume that the spin-off alternative is chosen.

i. How would you have it be financially structured?

ii. What should the resulting financial structures of the separate firms look like?

-

What price should you expect to get for the spin-off?

Humana Inc Managing in a Changing Industry Case Analysis

1. What corporate structure would you recommend for Humana?

i. The diverging objectives

The company is currently hanging in a dilemma where its businesses are moving in different directions. It has two businesses; the hospital business and the health care business. Both the businesses are moving divergently with respect to financial as well as strategic objectives. The healthcare business is showing good profitability, which is even better than that of the industry. This profitability can be assessed by looking at the enrollment figures. The company has been able to increase its enrollment by four times within a period of ten years.

It is also important to note that the recent increase in the enrolment has been immense. It is also quite interesting to note that the increase in this enrollment is expected to continue for at least five years in the future. This is probably because of the change in the laws recently which have shifted strategic winds in favor of the health care business and away from the hospital business.

The hospitals are facing tough times as the laws only give a fixed reimbursement for treating the patients and do not compensate for any extended treatment. This new law has given the out-patient trend a new swing and the in-patient trend has started fading out. For most of the hospitals, the in –the patient system is the major source of revenue. As a result of this new law, the major source of revenue has seen a major decline in the past few years and therefore, many companies are thinking of restructuring their health business in an attempt to balance the revenue and costs.

It is also important to note that the administrative and other costs are really high for the health industry. This means that these costs comprise a major chunk of the total cash as well as non-cash outflow doe the health industry. Due to the very high costs associated with this industry the profit margins are shrinking down, and companies are trying to find newer ways to address to the problem.

It seems to be obvious that the healthcare business is better in terms of profitability than the hospital business. This is because of the increase in enrollment and the hope of improving this enrolment in the future. However, it is also important to note thatthe business is facing other problems, in addition to the above mentioned ones.

The company’s strategic as well as administrative systems have not been able to control the increase in enrollment efficiently. This means that the cost have kept on rising as a result of this increase in enrollment. This increase in the costs has pulled the profitability down to un-controllable levels. The administrative cost is too high to be called controllable. It is currently at 16.1%. Although it has fallen down from 22%, but the management considers it too high to be good.

The medical loss ratio of the company has also been rising and has been seen as a danger to the company’s financial health. In fact, the company’ medical loss ratio has been the worst in the industry. It is also important to note that the company’s strategic relationships with the physicians have been worsening over time. The physicians have been blaming the company of controlling he costs by taking dangerous moves.

ii. The Solution

As a result of the different natures of both the businesses, it is time for the company to decide whether to keep on going with the integrated strategy of keeping both the businesses under one head. These businesses have not been under financial constraints, but strategic winds seem to be against the integrated strategy and demand something different from the company.

The solution seems to be lying adopting a differentiated strategy rather than an integrated one. The company has considered various solutions to the problems which are aimed at either improving the integrated strategy or replacing it with a new differentiated strategy. However, every solution has its own blessings as well as harms, and the company has to be very careful while adopting any path way as the financial, as well as strategic future of the company is dependent upon the strategic move.

• The First Option

The first option is to keep the company in tact but to effect the division between the two businesses. This does not mean that the company would be dividing itself into two distinctive strategic business units. However, the two different subsidiaries of the business will be created, and the parent company would remain the same under this new system. This purpose could also be achieved by issuing new stock for both the business. Such a strategy would help the company to control the cost of the overall business while developing a new strategy under the previous integrated one.

• The Second Option

The second option is to keep the hospitals and the healthcare operations together but to adopt a different pricing strategy for both businesses. This strategy would allow the company to control cost of boththe businesses separately while keeping the company structure intact. This would also allow the company to control theadministrative costs while maintaining he integrated strategy of keeping both the businesses under one head.

However, the company has earlier on implemented a decrease in the overall prices of the treatment being offered in the hospitals. The result of this strategic move had not been seen by the company, and therefore, such a strategy seemed to be in serious doubts.

• The Third Option

Another option was to sell those hospitals which were cannibalizing the healthcare business or which were facing the greatest financial, operational as well strategic losses. This option was considered a good one as the company would be able to improve its liquidity position and to improve the EBITDA multiple aspects of the company.

However, this option had a serious drawback. If the hospital was sold for more than the depreciated book value, the government applied the medical re capture to the company, and it would have to pay a lot to the government for the sale of the asset. So, this option could not be considered as the payout to the government would have crossed all benefits to the company.

• The Fourth Option

By looking at the industry trends, the company felt that the leveraged buyout option was also a viable one and could pull the company out of the massacre. Earlier on HCA did that and received a fairly good price for the leveraged buyout. Therefore, the management of Humana considered it a viable option. However, the company could not do that, as it was required by law to keep a large percentage of its assets in the form of marketable securities. If the company goes through a leverage buyout, it could lose many of its securities resulting in violation of the law. Therefore, this option could not be considered by the company.

• The Fifth Option

The company could retain the capital structure and still avail the benefits by going through a stock buyout. Such an option is never viable for those companies which adopt an aggressive capital structure and rely a lot upon debt financing. However, in the case of Humana, the company has not really relied a lot upon debt and has adopted a conservative strategy. Under such conditions, the stock buyout option seemed to be a viable one for the company.

• The Sixth Option

The company also considered that it should consider the employee stock ownership plan. Such a plan would allow that company to model itself as HCA did to avoid the catastrophe.

• The Corporate Spinoff Option

After considering all the above mentioned options, the company felt that it should no longer go on with the integrated strategy of keeping both the businesses under one head. It felt that it was time to put a boundary line between the two businesses and to create separate strategic businesses units. Such an option could be implemented by issuing one share for an already issued and outstanding share. Both the businesses would have a separate identity under the new system, and the names would also be different.

The chief executive officer of the healthcare business would be David Jones while the president of Humana would become the chief executive officer of the hospitals business. It is also important to note that under the spinoff strategy, the board of directors of both the companies would be different and therefore would be no overlap of them. This would allow both the businesses to work according to their own strategies and to avoid any strategic confusion.

However, many important issues had to be resolved before such a strategy could be implemented. Whenever such a strategy is adopted, it is very important for the management to allocate the cost to the businesses. This is because before the segregation, both the businesses were operating under one head and the cost allocated was considered the cost of one parent company.

If the company decides to create strategic business units, it will have to allocate costs to both the units in such a way that the costs do not become a burden for both businesses. This is especially true for the overhead costs which have to be applied and therefore, it I very difficult to determine these costs with great accuracy their application to both the strategic units would be another difficulty.

Currently, both companies are sharing the same administrative as well as strategic facilities. Both the companies also share many physical assets which are treated under one parent company. Assets such as offices, computers and many others are being shared by both the businesses. If the division takes place, it would be very difficult for the management to divide the assets between both companies in an optimal manner.

It is also important to note that both the companies also depend upon each other for many operations. If the division takes place, cannibalization might occur, and the management might not be able to create a shared platform for both companies. The cost allocation problem is especially very important because it would be directly affect the financial as well as operational performance of the company. The company has faced an issue of unallocated cost in the past, and therefore, needs to be careful while taking such mega decisions.

It is also important to note that it would also be difficult for both the businesses to share the outstanding debt. Despite of the conservative financial strategy adopted by the company, there is a certain figure of the debt which it has to pay. If the division takes place and both the businesses attain the status of separate businesses, it would be very difficult for them to divide the debt in such a way that it does not become a burden on both the businesses.

It would also be important for the parent company to specify future businesses ties between both the divisions. At one extreme, both the companies would be free to select their own customer, competitors and other stakeholders so as to avoid any strategic mismatch. At the other extreme, both the businesses will have to set the strategic maneuvering in order to create strategic ties. This means that they will have to give prior preference to each other. For example, the hospitals would be required to provide service to the healthcare customers at rates before the spinoff.

Many other technical issues also had to be addressed before the spinoff could take place. These issues were of strategic, operational, and financial as well legal consideration.

2. Assume that the spin-off alternative is chosen.

-

How would you have it be financially structured?

-

What should the resulting financial structures of the separate firms look like?

i. The Financial Status of the Corporation

Before the spinoff is done, it is really important to observe the financial strength of the parent company. The company is conservatively financed with low reliance upon debt.

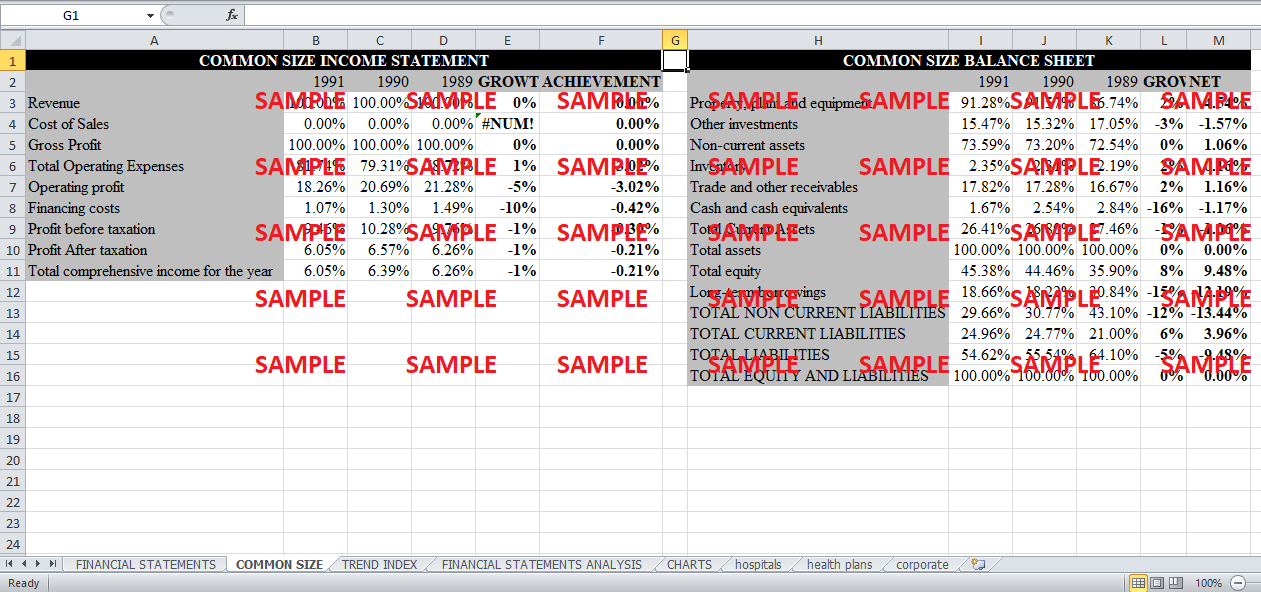

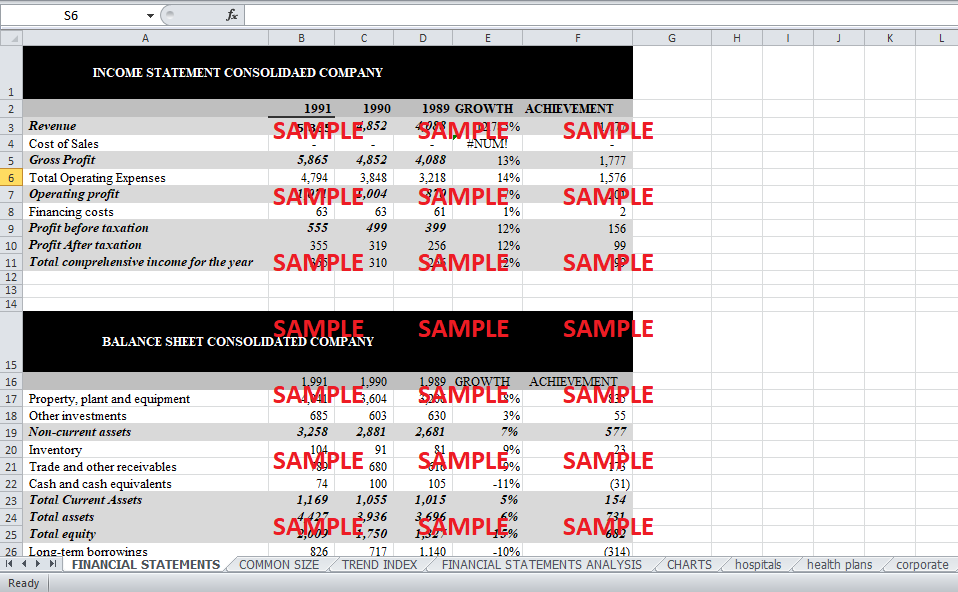

• The Common Size Analysis

As the (Table 3, Appendix 1) shows, the operating expenses comprise more than 80% of the total revenue of the company. This leaves a profit margin of less than 20% for the company. Similarly, the table 4 shows that the non-current assets comprise more than 73% of the total assets. The current assets comprise less than 25% of the total assets. This is mainly because the company has relied a lot upon fixe assetswhich comprise 91% of the total assets.

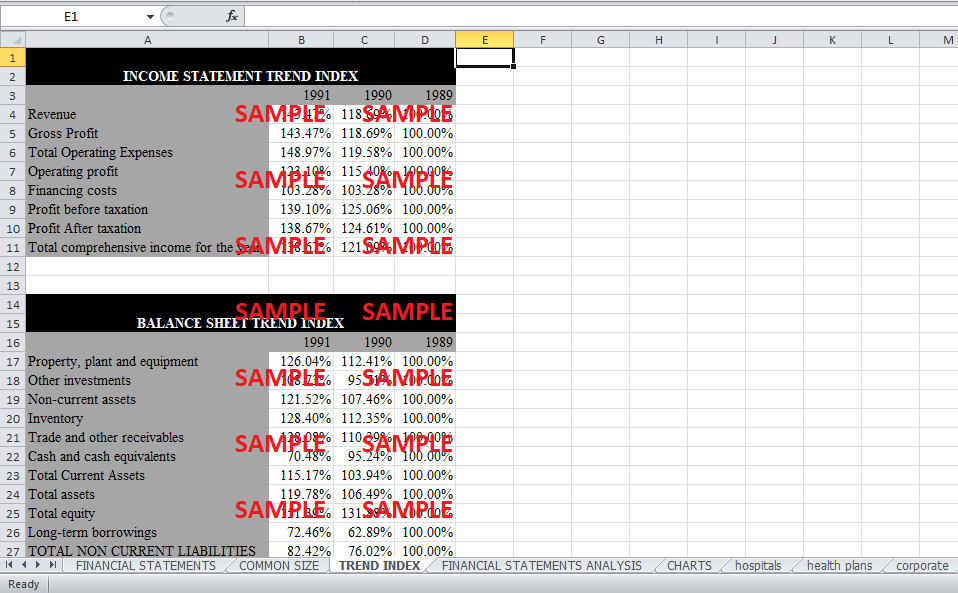

• The Trend Index Analysis

(Table 5, Appendix 1) shows that the revenue of the company has increased by 43% over the years which is a great achievement if seen comparatively. It also shows an increase in the operating expenses which is a matter of deep concern for the company. This increase in the operating expenses is has pulled the margin down for the company. The total comprehensive income has gone up by more than 35% for the company over the years.

(Table 6, Appendix 1) shows that the company has tried to rely more upon equity over the years and has in fact, increased the total equity by 51%. This indicates that the company had been following a conservative financing strategy over the years. It also shows that the currently have gone up by more than 40% over the three years. It is also interesting to note that the cash position of the company has deteriorated over time.

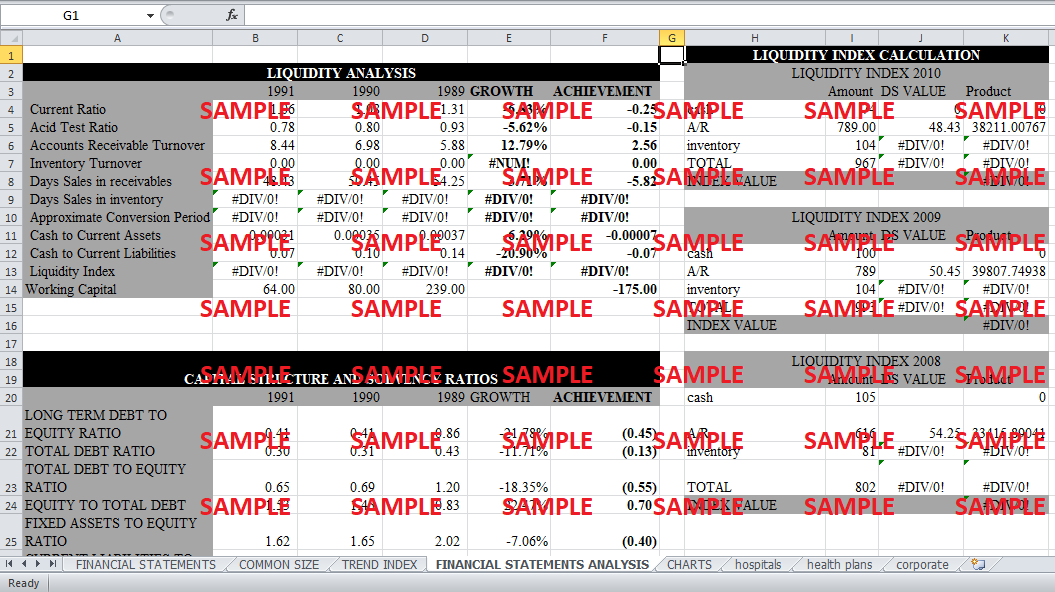

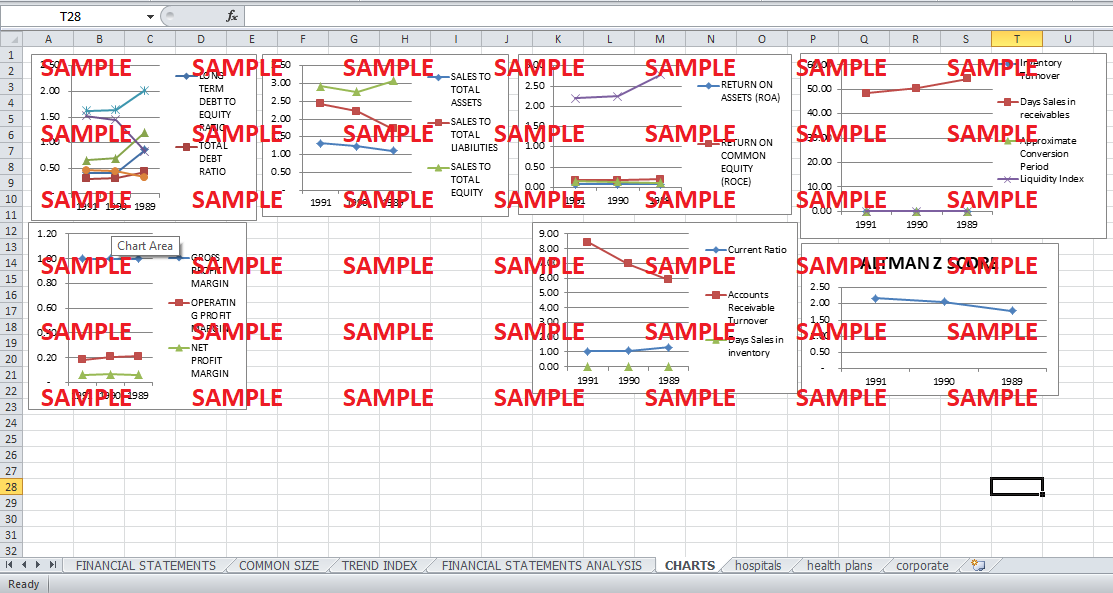

• Liquidity Analysis

(Table 7, Appendix 1) shows that the liquidity position of the company has deteriorated over time. This is what the current ration shows which has gone down by 0.25% over the years. The acid test ratio also confirms this trend. The working capital has also gone down over the years for the company.

• Capital Structure Analysis

(Table 8, Appendix 1) shows that the capital structure of the company and confirms the conservative trend. The reliance upon total debt has gone down over the years. On the other hand, the reliance upon total equity has gone up over the years. (Table 9, Appendix 1) shows that there turn on total assets has gone up over the years while the return on total equity has gone down over the years. This contrast exists because the increase in equity has surpassed the increase in net income. The leverage index also shows that the company is relying more on equity than on debt.

• Asset Utilization

(Table 10, Appendix 1) shows that the asset utilization of the company has improved over the years. However, the increase in total equity has even surpassed the increase in total sales. (Table 11, Appendix 1) shows that the company seems to be far away from the bankruptcy status. Its Z score has gone up over the years.

ii. Structuring Options

By looking at the financial capital structure of the consolidated company, it seems obvious that planning the capital structure of the new strategic business units would be a matter of deep concern for the company. The company has three broad options in order to financially structure its subsidiaries. The first option is that it can go with the previous conservative strategy and can keep on relying more upon equity than on debt. This would allow both the new companies to take benefit from the new leverage.

The second option is to allow both the strategic units to choose from an available mix of financial structures. This would allow both the units to rely upon equity or debt according to their own financial, as well as strategic plans.

The above mentioned options have their own benefits and harms from a strategic point of view. Another option exist which would base the financial structure upon the previous and track records of the company financially as well as strategically. Such a division would allow the company to create divisional justice so that no one would have objections upon the new divisional scheme.

• The Innovative Division

(Table 12, Appendix 1) shows a relative assessment of both the businesses. This relative assessment would serve as the DNA for new division. The table shows that out of the total asserts, the hospital business uses 83% while the assets used by the healthcare business constitute only 17% of the total assets. This tells the management about the ways the assets would be divided between the two companies.

The table also shows that the hospitals have to pay 82% of the long term debt while the healthcare business has to pay only 18% of the total debt. This tells the management that it would be unfair to divide the debt equally among the two businesses. Debt should be divided according to the ratio of the debt incurred i.e. 82% to hospitals and 18% to the healthcare business. Allocating otherwise would be unfair as hospitals would also get 83% of the total assets. However, if the management decides to allocate assets differently, the debt division should be modified accordingly.

The table also shows that hospitals have earned 76% of the total revenue while the healthcare business has earned only 24% of the total revenue. This shows that the management should divide the assets so as to facilitate both companies in generating revenues. The table also shows that the hospitals incur interest expenses while the healthcare actually earns interest. Therefore, dividing the debt in any fashion other than the above mentioned would generate difficulties in debt servicing. The table also shows that 78% of property, plant and equipment have been added for the hospitals while only 22% have been added for the healthcare business. This division should also be transferred in the same ratio so that the hospital business does not face a lack of facilities.

So, the hospital business should be dresses with 83% of the total assets, 82% of the long term debt and 78% of property, plant and equipment. Similarly, the healthcare business should be dressed with 17% of the total assets, 18% of the total debt and 22% of property, plant and equipment.

• Strategic Maneuvering

However, it is important to note that the above mentioned strategy is based upon the financial as well as accounting results obtained by analyzing historical data. These can only be implemented if the parent company wants to keep going with the same business with two different strategic business units in action. If the company sees some future problems with any of the business, it should strategically change the division of the assets so as to give greater value to that business which has the minimal risk and which also has the ability to flourish in the future.

As mentioned in case, the hospital business is expected to face some new restriction as a result of the budget cut policy which the federal government is likely to impose in the near future. On the other hand, the healthcare business is expected to grow rapidly in the near future. Under such strategic winds, the company should try to allocate greater assets to the healthcare business and fewer assets to the hospital business. The debt should also be divided accordingly because the healthcare business has greater earning potential to pay off the debt.

3. What price should you expect to get for the spin-off?

i. Significance

The spinoff would only be beneficial if it generates extra value or adds value to the existing one. In order to assess the value addition which would incur as a result of the spinoff, a corporate valuation technique has to be applied. The corporate valuation technique would assess the corporation on the basis of revenue and cash flows generated in the history. These flows would then be used to assess the future inflows. These future inflows would then be used to assess the enterprise value and the terminal value of the free cash flows generated. It is important to note that the free cash flows would be at first unlevered in order to assess the real financial strength of the company. The financial statements of the company would be used to assess the unlevered free cash flows.

In order to predict the cash flows and revenues of the company in the future, certain assumptions have to be made about the growth rate and the weighted average cost of capital. This is because the growth rate would assess the growth of cash flows in the future while the weighted average cost of capital would be used to discount the flows back to the present value.

ii. The Assessment of WACC and Growth Rate

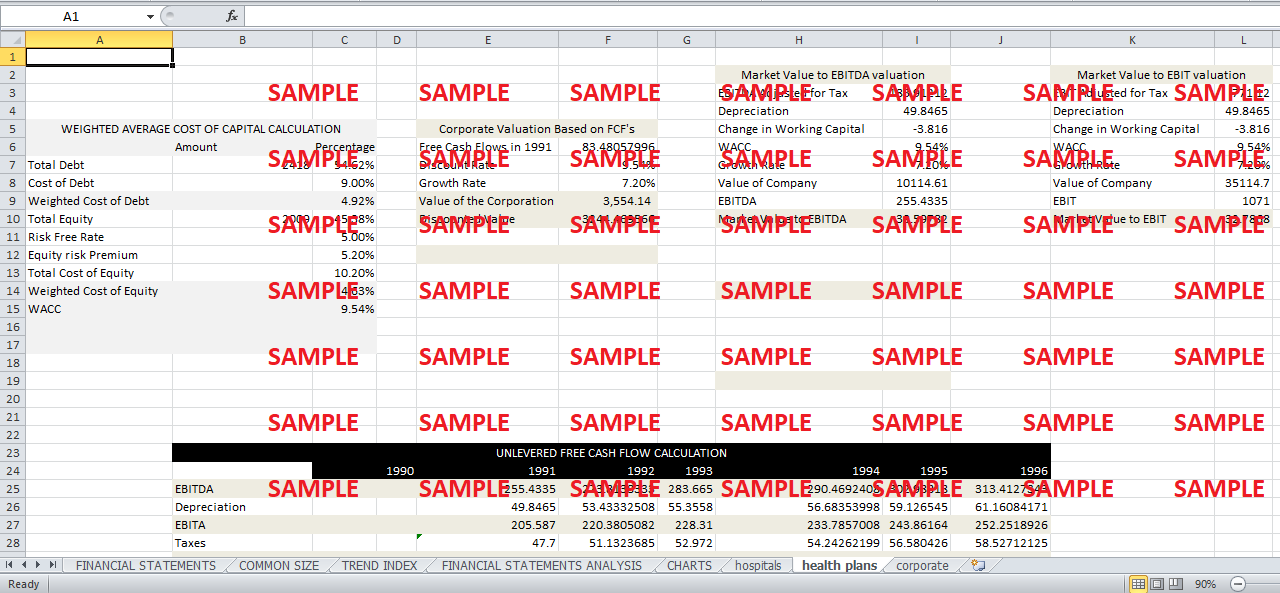

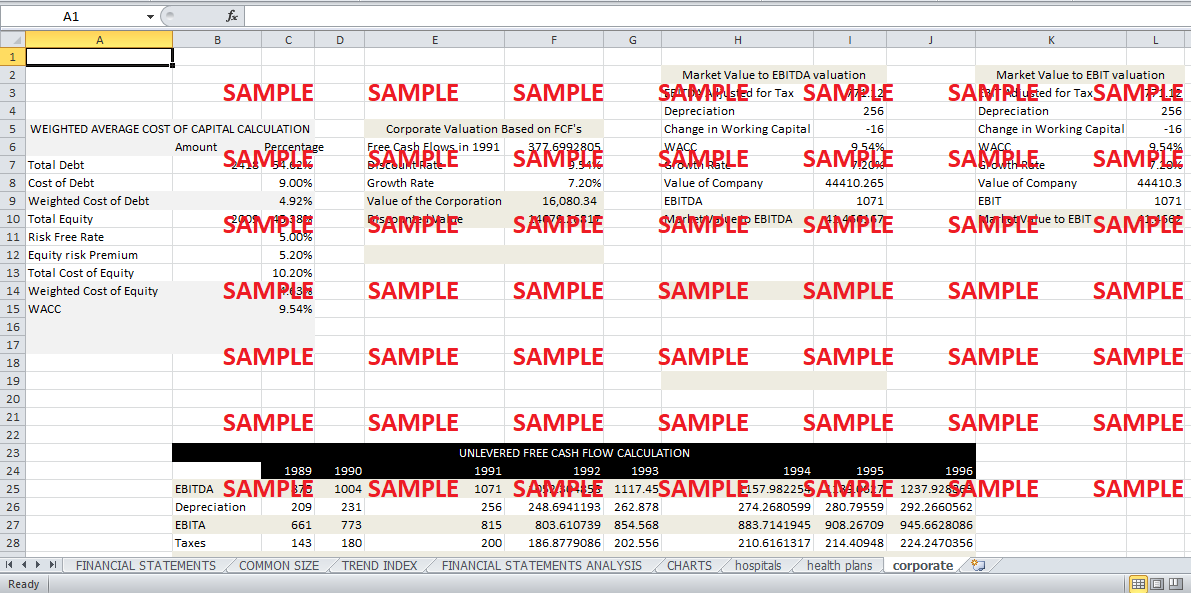

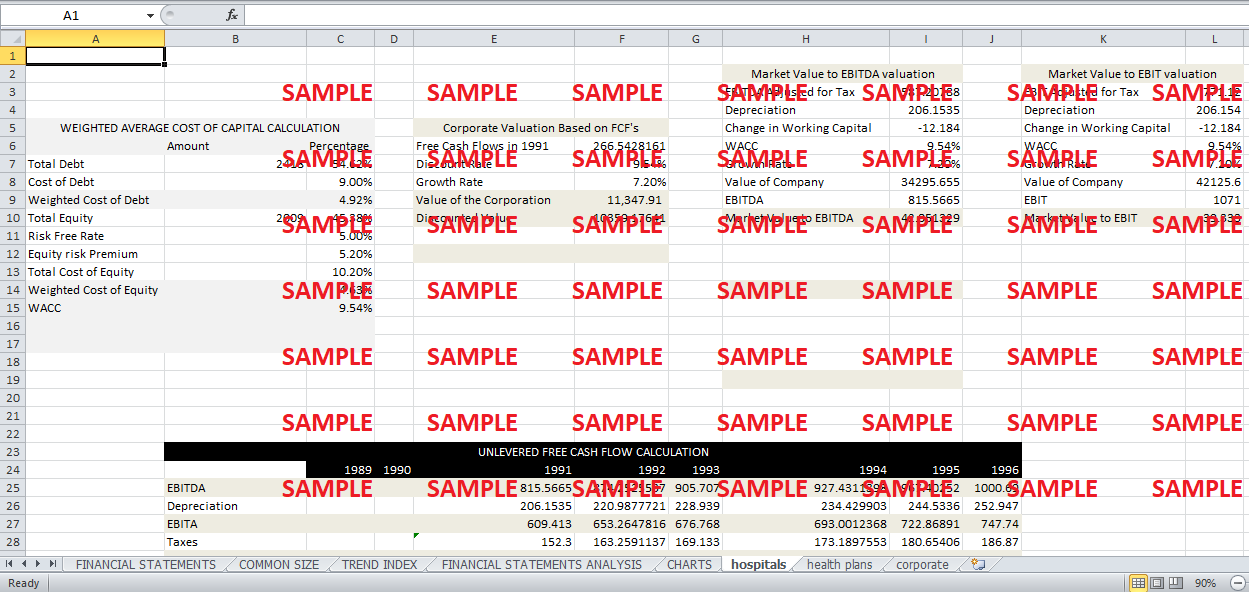

• The WACC Assessment

(Table 1, Appendix 2) shows the way the weighted average cost of capital has been assessed. The assets of the company have been financed by equity and liabilities. The equity comprises common stocks. The liabilities comprise long term as well as current liabilities with long term debt being the major chunk. The debt makes up 54.62% of the total financing. The cost of debt which the company incurs is actually the interest which it pays. This interest rate comprises two aspects; the risk free rate and the inflation premium. These two figures add up together to make 9%. The total weighted cost of debt comes out to be 4.92%.

45.38% of the total capital has been financed by equity. The cost of equity consists of risk free rate and the equity risk premium. These two add up to make 10.2%. The weighted average cost of equity comes out to be 4.63%. The total weighted average cost of capital comes out to be 9.5%. This is the rate at which the cash flows of the company would be discounted back to determine the present enterprise value.

• The Growth Rate Assessment

Another rate needs to be determined in order to assess the corporate value. That is the growth rate which has been calculated by assessing the revenues across three years. This growth rate would then be used to predict the future unlevered free cash flows.(Table 3, Appendix 2) shows the calculated growth rate. This growth rate has been assessed by analyzing the rate at which the revenue has grown across three years. This growth rate has been used to assess the future cash flows and the terminal value of the corporation.

ii. The Intrinsic Value of the Businesses

• Intrinsic Value of the Entire Corporation

In order to calculate the price of both the units separately (if spinoff is done), the expected cash flows from the two business units will have to be assesses separately. (Table 2, Appendix 1) shows the way the intrinsic value of the corporation has been assessed.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.