Get instant access to this case solution for only $14

Intellectual Asset Valuation Case Solution

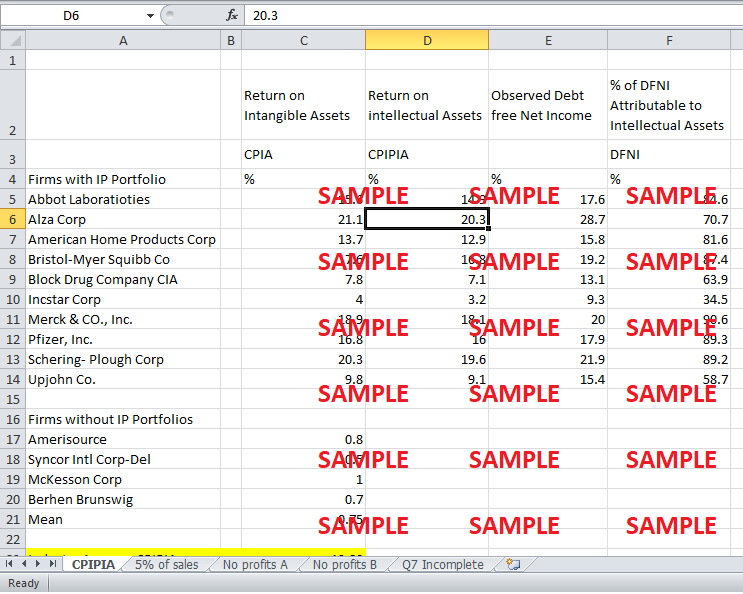

The CPIA is the contribution to profits by intangible assets except Intellectual property and intellectual assets (IPIA). Exhibit 6 in the case study gives the CPIA of both the firms with IP portfolio and those without it in the pharmaceutical industry.

Following questions are answered in this case study solution

-

What is the industry average for CPIPIA? (Determine from Exhibit 6.)

-

From the licensor's perspective, what is an acceptable range of royalty rates? (Determine from Exhibit 6.)

-

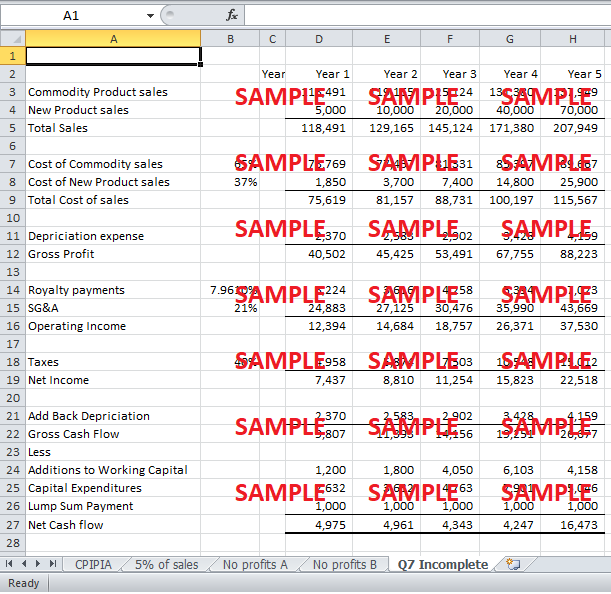

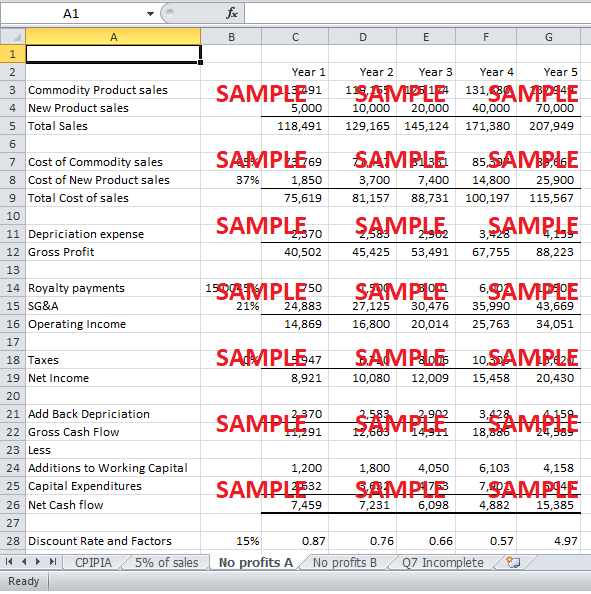

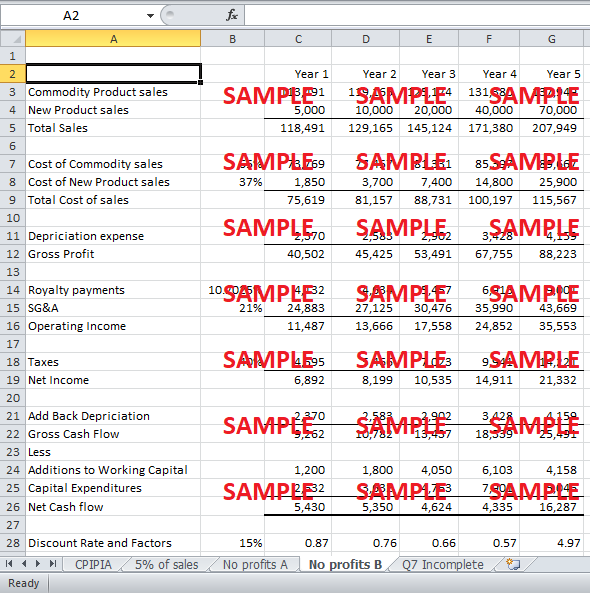

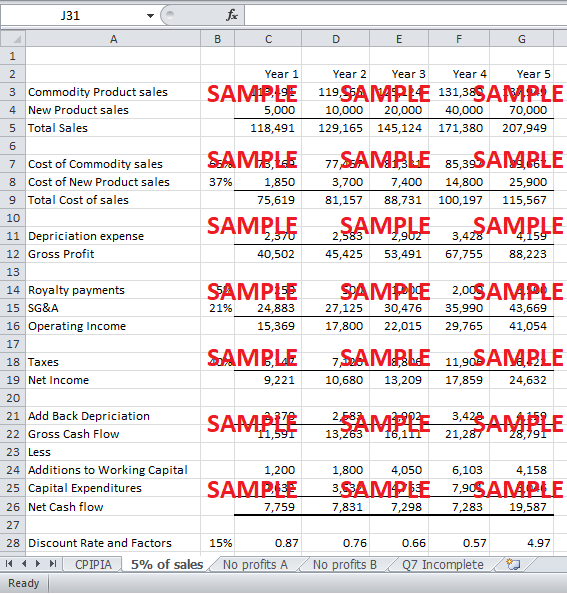

Having established that 25% of gross profits is economically unacceptable to the licensee, does the licensor leave money on the table if the parties use the other "rule of thumb," namely 5% of sales of the new product? If so, how much? If not is 5% of sales economically acceptable to the licensee?

-

At 'what royalty rate is aIl of the value of the new product extracted in the fornl of royalties? (Calculate rates for both gross profits and sales revenues for the new product.)

Case Analysis for Intellectual Asset Valuation

CPIPIA, on the other hand, is the contribution to profits by only IPIA. In Exhibit 6 CPIPIA is the return on Intellectual asset. CPIPIA is calculated by subtracting the industry mean of firms without IP portfolio from the CPIA values of firms with IP portfolio. The industry average of the CPIPIA turns out to be 13.8%. This means that, on average, the IPIA contribution is 13.8% of the total return generated by the firms with IP portfolio.

2. From the licensor's perspective, what is an acceptable range of royalty rates? (Determine from Exhibit 6.)

Considering Exhibit 6 given in the case, we see that the lowest CPIPIA is 7.1% while the highest CPIPIA is 19.6%. Therefore, this should be an acceptable royalty range for the licensor if it wants to extracts the maximum value of the new product. However, the average is 13.8%. Hence the royalty rate should be around this value.

Get instant access to this case solution for only $14

Get Instant Access to This Case Solution for Only $14

Standard Price

$25

Save $11 on your purchase

-$11

Amount to Pay

$14

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.