Get instant access to this case solution for only $19

Lab International Inc Case Solution

LAB International Inc. is a Canadian health-care company currently operating two separate divisions, LAB Pharma, and LAB Research. LAB Pharma was primarily focused on developing drug therapies while LAB Research has been providing preclinical contract research services to the pharmaceutical industry. The CEO of LAB International Inc. believes that the share price is undervalued. According to analysts, the share price of LAB International Inc. represents only LAB Pharma’s operations and LAB Research pulls the true share price down.

As a solution, the CEO seeks to spin off the LAB Research Division. This report provides an estimate for the IPO share price for the new company. The share price of LAB Research has been estimated by the following two methods.

Following questions are answered in this case study solution

-

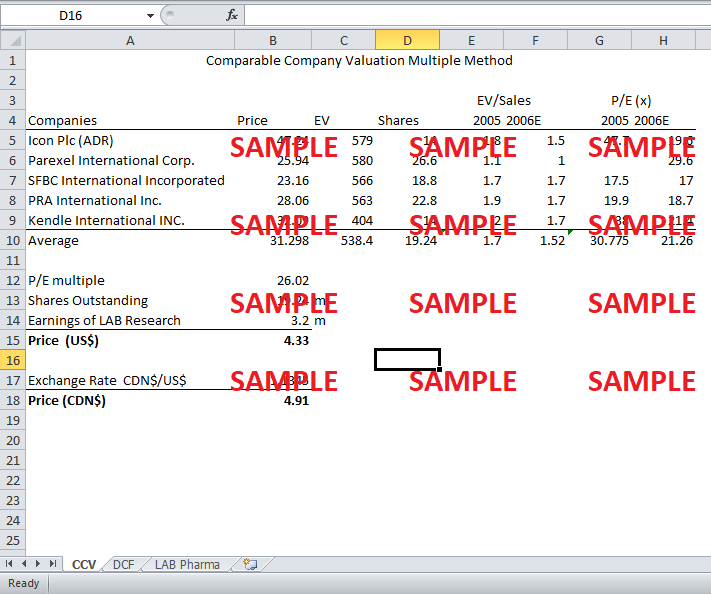

Comparable Company Valuation Multiple Method

-

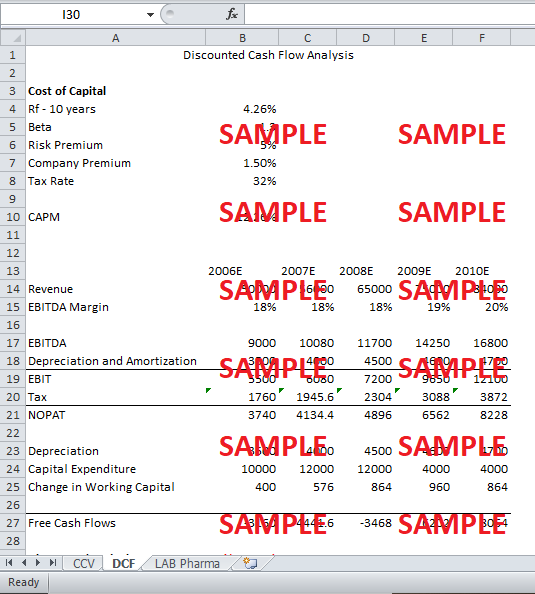

Discounted Cash Flow Method

-

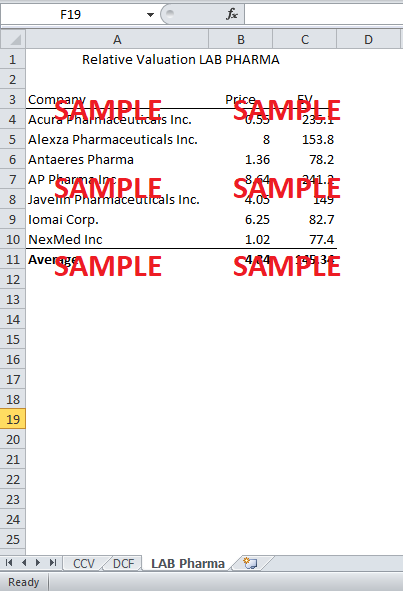

LAB Pharma Valuation

-

Conclusion

Case Analysis for Lab International Inc

1. Comparable Company Valuation Multiple Method

The first method used to measure the share price for the initial price offering (IPO) is the comparable company valuation method. Under this approach, a number of comparable companies in the CRO industry have been identified as given in Exhibit 8 of the case study. Moreover, in order to further get a better comparable company, the companies with extremely high market capitalization and enterprise value have been excluded from analysis. Furthermore, the price to earnings multiple has been used to estimate the IPO price of LAB Research Division. The price to earnings (P/E) multiple is 26.02 which is the average P/E of the identified comparable companies. Moreover, the average number of shares outstanding for the same comparable companies has been used i.e. 19.24 million shares. Finally, the earnings for LAB Research Division as give in Exhibit 8 of the case study are US$ 3.2 million.

The estimate for the IPO share price of LAB Research has been obtained by multiplying the P/E multiple with earnings per share (earnings divided by an average number of shares outstanding). The price of the share in US$ came out to be US$ 4.33. Moreover, by using the CDN$/US$ exchange rate of 1.1345, as given in Exhibit 8, the price in Canadian dollars is CDN$ 4.91. See exhibit 1 for reference.

2. Discounted Cash Flow Method

The second method used to estimate the IPO share price of LAB Research is the Discounted Cash Flow method. Firstly, the free cash flows have been estimated by using the estimates given in Exhibit 10 of the case study. The operating profits (EBIT) have been obtained by multiplying EBITDA margin with the revenue for each year and subtracting the depreciation and amortization expense from the earnings before taxes, interest, depreciation and amortization (EBITDA). Furthermore, after-tax operating profits (NOPAT) have been obtained by subtracting tax from the EBIT according to a tax rate of 32%. Moreover, the capital expenditures and changes in working capital have been subtracted while depreciation and amortization have been added back to the NOPAT to get an estimate for the free cash flows. Finally, in order to estimate the terminal cash flows, a growth rate of 5% has been assumed.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Sales Force Integration At FedEx (A) Case Solution

- Claude Grunitzky Case Solution

- A&D High Tech A Managing Projects For Success Case Solution

- The Agnellis And Fiat Family Business Governance In A Crisis A Case Solution

- Talent Acquisition Group At HCL Technologies Improving The Quality Of Hire Through Focused Metrics Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.