Get instant access to this case solution for only $19

Lake Champlain Sporting Goods Company Case Solution

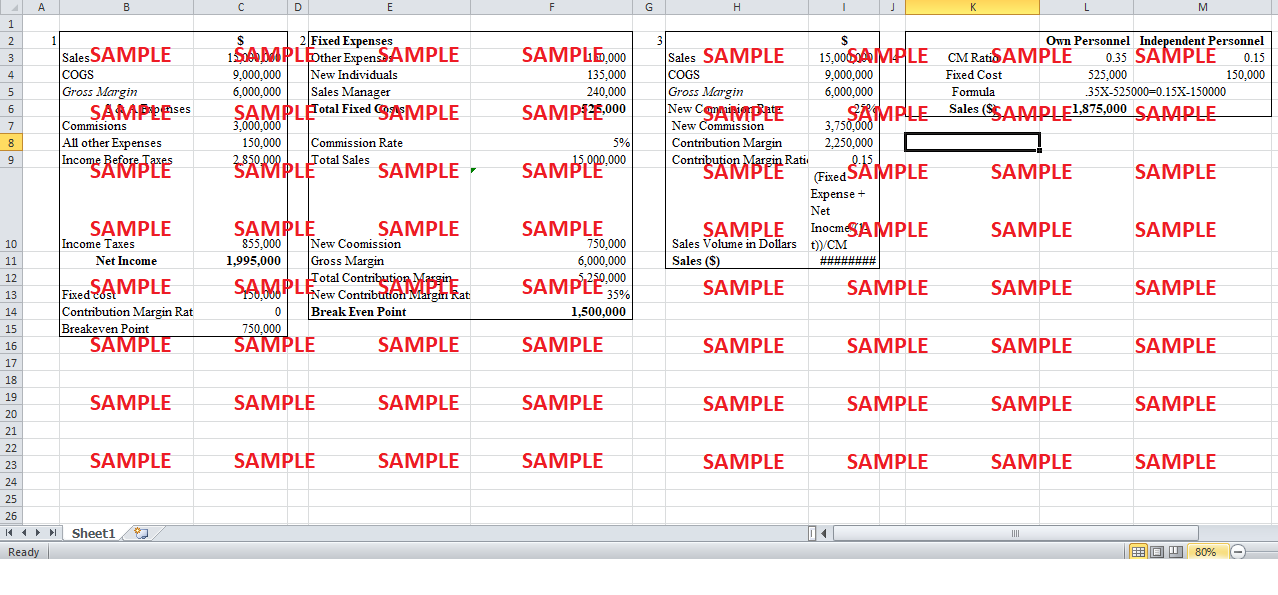

The desired level of sales at which the company will be indifferent between keeping the independent sales personnel with an increase in commission and hiring its personnel is calculated by comparing the before tax income in both cases. As Tax will be the same in both cases, so deducting the fixed cost in each case from the contribution will give sales volume.

Following questions are answered in this case study solution

-

Compute lake Champlain sporting goods estimated break-even point in sales dollars for the year ending December 31, 20x4, based on the budgeted income statement prepared by the controller.

-

Compute the estimated break-even point in sales dollars for the year ending December 31,20x4, if the company employs its own sales personnels.

-

Compute the estimated volume in sales dollars that would be required for the years ending December 31, 20x4, to yield the same net income as projected in the budgeted income statement, is management continues to use the independent sales agents and agrees to their demand for a 25 percent sales commission.

-

Compute the estimated volume in sales dollars that would generate an identical net income for the year ending December 31, 20x4, regardless of whether lake Champlain Sporting Goods Company employs its own sales personnels or continues to use the independent sales agents and pays them a 25 percent commission.

Case Analysis for Lake Champlain Sporting Goods Company

Question 1

The breakeven point in $ is calculated by dividing the fixed cost of the company with the contribution margin. Exhibit 1 shows that the contribution margin ratio is 20% which is calculated by deducting the commission from gross margin and dividing it with the sales. The breakeven point comes out to be $1,995,000.

Question 2

The new alternative for sales personnel involves hiring three individuals and two sales manager on fixed salary and 5% commission. The new fixed cost as shown in Exhibit 2 is $525,000. The new sales commission would be 5% of total sales. The new commission comes out to be $750,000. The breakeven point is again calculated by dividing the new fixed cost with the new contribution margin. The new contribution margin now deducts $750,000 from the gross margin. The breakeven point through the compensation method comes out to be $1,500,000.

Question 3

The increase in commission of independent sales personnel from 20% to 25% would increase the commission by 5%. The new commission would be $3,750,000 that is used to calculate the new contribution margin. As shown in Exhibit 3, the new contribution margin rate comes out to be 0.15. The following formula is used to calculate the sales volume required to earn the same amount of net income which is $1,995,000.

Sales Volume ($) = (Fixed Expense + Net Income/ (1-t)) / Contribution Margin Ratio

Exhibit 3 shows that the sales level that is required for the company to be indifferent between the 20% commission and increasing it to 25%.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.